Will Nelson Peltzâs Disney proxy campaign prove to be a costly distraction?

The latest fight over the future of Walt Disney Co. is headed into its home stretch, with the companyâs April 3 shareholder meeting fast approaching. This is the moment when investors will decide whether to shake up the Disney board by voting to replace one or more of the Burbank entertainment giantâs directors with someone dissatisfied with its performance.

A recent recovery in Disneyâs share price seemed to sew up a likely victory for Disney Chief Executive Bob Iger and the companyâs nominees, with analysts speculating that it would deflate the proxy campaign waged by billionaire Nelson Peltz, whose New York-based Trian Fund Management holds $3.5 billion in Disney stock. But if Disney were certain that Peltzâs quest is purely a quixotic one, itâs not acting like it. Instead, the company is doing everything it can to undermine Peltzâs efforts.

Itâs easy enough to understand why Iger would bristle at the thought of an outsider coming in to criticize his strategy as he tries to turn the company around. Igerâs first 15-year run as CEO made Disney the envy of the entertainment industry, with killer brands and unrivaled box-office success. Now heâs back after the botched transfer of power to Bob Chapek, and the company has been struggling, as Peltz has repeatedly pointed out. Igerâs legacy is at stake.

Making matters worse and personal for Iger, Peltz is joined by former Disney chief financial officer Jay Rasulo and ex-Marvel Entertainment chief Ike Perlmutter, both of whom left the company on bad terms.

Disney, naturally, wants a decisive victory, and itâs not taking any chances in communications with investors, highlighting the strides it has made to improve performance while also hitting hard against its opponents. Working in Igerâs favor is the fact that Disneyâs prospects have improved lately, as The Timesâ Meg James has reported.

Iger has received public support from JPMorgan Chase CEO Jamie Dimon and the heirs of Walt and Roy Disney, including Abigail Disney, Waltâs grand niece and a frequent critic of the companyâs executive compensation practices. On Monday, Disney issued a statement summarizing a report from corporate governance advisory firm Glass, Lewis & Co., which endorsed Disneyâs nominees. âWe struggle to see many of Trianâs intentions as representing a likely net gain for investors,â Glass Lewis said.

Last week, Disney unveiled a political-style attack ad aimed at Peltz and his co-nominee, Rasulo, which blasted the formerâs credentials and accomplishments on the boards of other companies and characterized the latter as a bitter ex-employee who left after being âpassed over for a promotion nearly a decade ago.â The video also made sure to hammer home the association with Perlmutter, who was ousted last year and whose rivalry with Iger is well documented. Perlmutter owns the majority of the Disney shares held by Trian.

Quoth the ominous voice-over, âNelson Peltz has a long history of attacking companies to the ultimate detriment of shareholder value.â

Peltz and his allies bristled at the adâs characterization, describing it as hyperbolic mudslinging. âIn our view, this charged and disingenuous rhetoric seems calculated to distract shareholders from Disneyâs poor track record and sidestep accountability,â Trian said in a statement. Peltz and Rasulo are not looking to replace or oust Iger, but rather are vying to topple board members Michael B.G. Froman and Maria Elena Lagomasino.

â[T]he cold truth is that neither of them has helped Disney retain its leadership position in the media landscape,â Trian said in a letter to Disney shareholders.

Further, Trian says Disney has mischaracterized its performance history, which has included investments in DuPont, Heinz and Wendyâs. Citing a lengthy white paper, Trian has said that for the 11 of the firmâs investments in which Peltz joined the boards, these companies delivered 17% average annualized returns through the end of 2023.

Letâs put forth the steel-man version of Peltzâs case. As my colleague Stacy Perman wrote recently, Peltz isnât the type of investor to get in for a quick flip. Heâs known, instead, for taking long-term positions in companies. And some corporate leaders who fought to avoid Peltz joining their boards ended up praising him after he succeeded. Trianâs website includes testimonials from former Heinz CEO Bill Johnson and Mondelez International boss Dirk Van de Put.

âHeâs not a corporate raider like Carl Icahn,â Los Angeles investor and deal-maker Lloyd Greif told The Times last month. âI think heâs much more experienced in running companies. A lot of these guys were financial engineers, and they would come into a company and immediately look at, how do we break this company up to maximize value.â

Looking at Disney from a long-term perspective, itâs clear that the company has disappointed in recent years. Sure, the stock is up more than 35% from six months ago. But itâs still down from the same time in 2022, the year the bloom was coming off the streaming rose. Compared with five years ago, the stock is essentially flat. The company has underperformed the S&P 500 over the last five years.

Trianâs diagnoses of Disneyâs ailments are varied, and some are difficult to dispute. For example, Peltzâs missives frequently note that Disney has had a poor track record of succession planning, and even the companyâs staunchest defenders would be hard pressed to argue with that assertion.

Other critiques are less clear cut, but defensible. Trian, for example, contends that Disneyâs $71 billion acquisition of 21st Century Fox was âstrategically flawed,â in part because it represented a doubling down on linear networks at time when the industry was getting walloped by cord-cutting.

Although Disney can say that Igerâs deal with Rupert Murdoch got it prized assets, including âAvatar,â âThe Simpsonsâ and control of Hulu, the purchase has certainly been a mixed bag . For example, Disney has now effectively exited the Indian media business it acquired with the Fox deal by merging it into a Reliance Industries-controlled joint venture, taking a write-down on Star India.

Peltz & Co. argue that Disney was late in recognizing the threat of streaming, though Iger was ahead of the curve among legacy media CEOs in candidly acknowledging the impact of changing audience behavior on linear networks, particularly ESPN. Trian says Disney pursued streaming subscribers with an overly aggressive pricing scheme ($7 a month was too low), a point that Iger himself has admitted. Peltz claims that recent initiatives â the $1.5-billion partnership with Epic Games; the unnamed sports streaming joint venture with Warner Bros. Discovery and Fox Corp. â are half-baked.

But even assuming that Peltzâs analysis is accurate, how fully formed is his prescription? Trianâs 133-page document on Disney spends much ink on the companyâs problems, but is short on specific remedies. The paper suggests that Disney should consider combining Hulu and Disney+ into one entity, evaluate the viability of Huluâs live TV product and improve theatrical film performance. Which are surely ideas that the current leadership group has thought of already.

As far as succession planning goes, the Glass Lewis report gives Disney the edge over Trianâs plan. âNotwithstanding faults in Disneyâs prior succession initiative, Trianâs intent to launch a new process is not clearly superior to, and may be heavily duplicative of, Disneyâs ongoing effort, which is already tied to a special board committee composed of members we believe to be credible,â the report says.

Anyway, much of Peltzâs campaign seems aimed at holding Igerâs and the rest of the Disney boardâs feet to the fire. For example, Trian suggested that the board âinsistâ on a direct-to-consumer strategy to achieve âNetflix-likeâ profit margins of 15% to 20% by fiscal 2027. How such a goal would be realized is not explained in great detail. âInsistâ may be the key word.

Iger will most likely prevail with the board Disney wants, without Peltz, Rasulo or any of the three nominees put forth by another shareholder, Blackwells Capital. To Disney, this whole episode may seem like a nuisance, an expensive distraction. But regardless of how the boardroom skirmish turns out, Iger still has a lot to prove before we can judge his second term.

Youâre reading the Wide Shot

Ryan Faughnder delivers the latest news, analysis and insights on everything from streaming wars to production â and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

Stuff we wrote

UTA battle: Lawsuits, $950,000 expense account fuel fight between Hollywood agency and ex-partner. United Talent Agency partner Michael Kassan, who joined the firm in 2021 following the purchase of his company MediaLink, filed legal action against the talent agency last week. UTA hit back with its own lawsuit, alleging that Kassan fraudulently wasted millions of dollars to fund his lavish lifestyle.

Why your favorite streaming shows are showing up on traditional TV. With series like Huluâs âOnly Murders in the Buildingâ showing up on Walt Disney Co.âs ABC, legacy media companies are finding that exposure on TV networks can help expand the audience for their streaming series â and avoid leaving money on the table.

Elon Muskâs X cancels partnership with Don Lemon before his new show even begins. In a move that should surprise no one, the social media platform parted ways with Lemon after his interview with its billionaire owner, now published on YouTube.

Sports Illustrated gets a new publisher that will keep it in print. Minute Media, which publishes the Playersâ Tribune and FanSided, will take over operation of the legendary but troubled title.

The docket:

- Roman Polanski civil trial set for August 2025 in child rape case.

- Alec Baldwin asks judge to dismiss charges in fatal âRustâ shooting.

- Fox News sued by family of Ukrainian producer who died covering Russian invasion.

Number of the week

ABCâs telecast of the 96th Academy Awards drew an average of 19.5 million viewers, a 4% increase from the 2023 ceremony, according to Nielsen data. Some observers seemed to be expecting a bigger bump because of the âBarbenheimerâ presence (it was also a pretty good show, by most accounts), but awards broadcasts canât escape the realities of audience behavior.

A lot of people, especially younger folks, are just not going to watch a 3 1/2 hour show that doesnât involve a football. Theyâre watching the clips of Ryan Gosling, John Mulaney and nearly naked John Cena online and sharing them on Instagram and X, but theyâre not watching live. Of the Oscars viewers:

- 11.1% were 18-to-34

- 22.1% were 35-to-54

- 62.7% were 55 or over

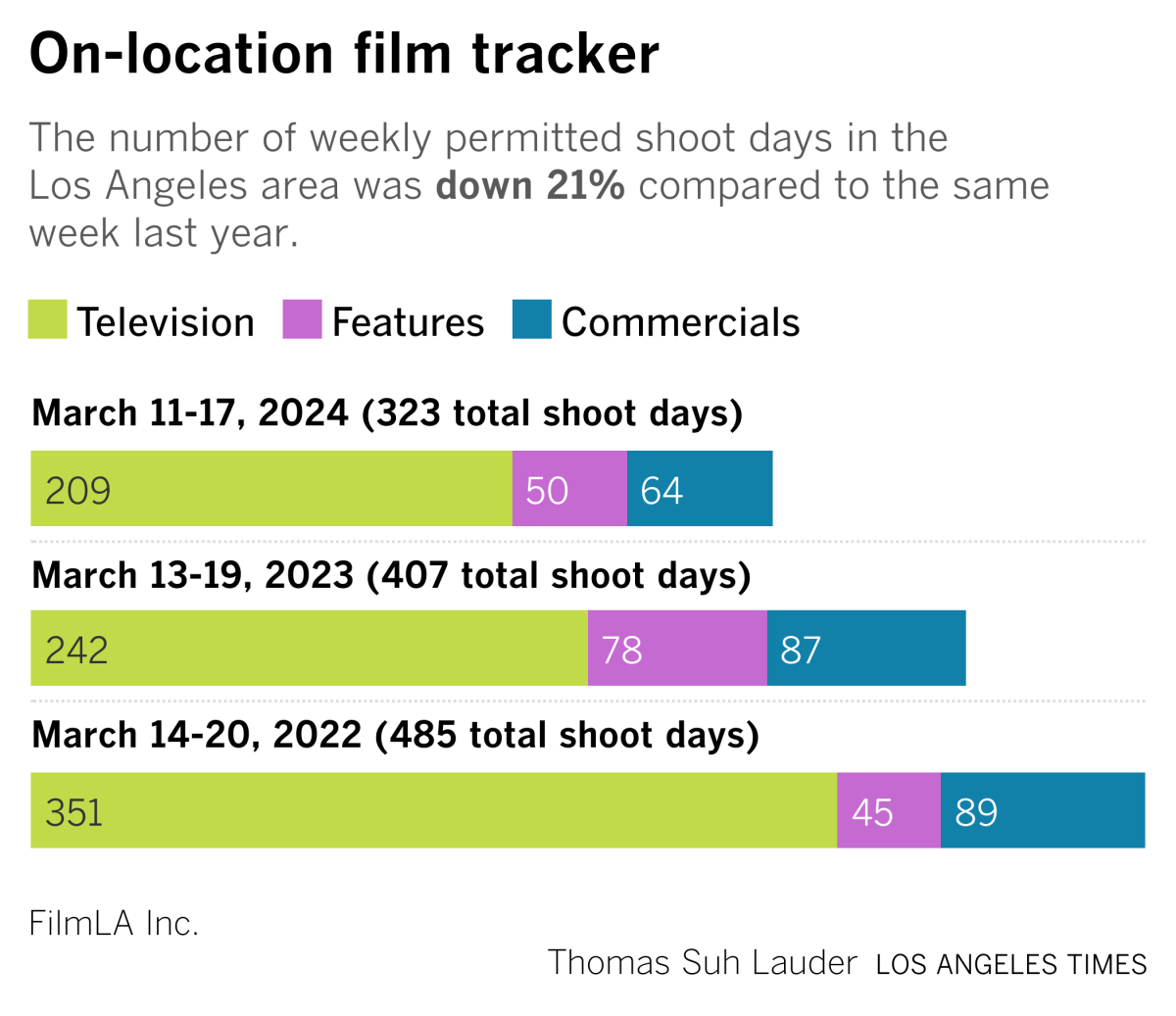

Film shoots

Latest local film permitting data from FilmLA.

Best of the web

â The terrible costs of a phone-based childhood. (The Atlantic)

â Why âeconomic headwindsâ are suddenly to blame for everything. (LAT)

â Why CBS thinks it can win the streaming wars. (Vulture)

â How American news lost its nerve. (Semafor)

Finally ...

Our guitar hero moment of the week comes from blues rocker Gary Clark Jr., whose new song âHabitsâ is beautiful and is also nine minutes long.

The Wide Shot is going to Sundance!

Weâre sending daily dispatches from Park City throughout the festivalâs first weekend. Sign up here for all things Sundance, plus a regular diet of news, analysis and insights on the business of Hollywood, from streaming wars to production.

You may occasionally receive promotional content from the Los Angeles Times.