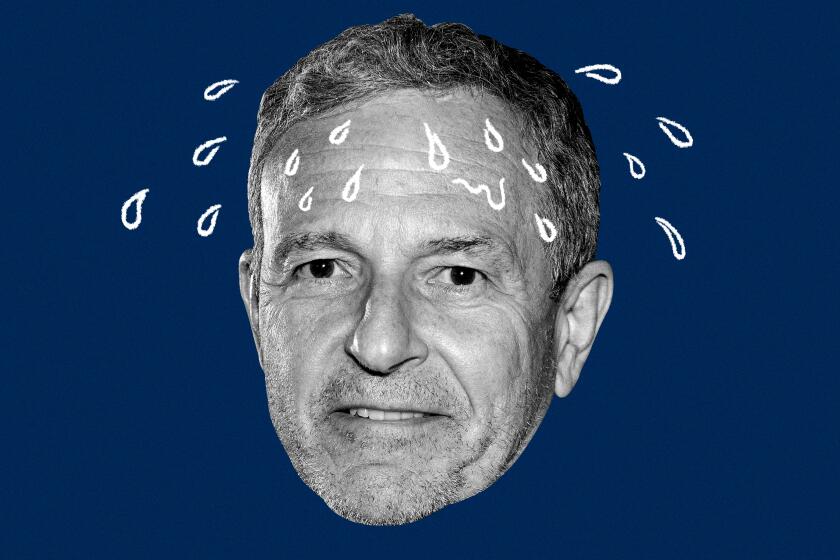

Why Bob Iger’s second act at Disney is looking brighter after a rough start

- Share via

After a bruising year of Hollywood strikes, wrenching job cuts and stock setbacks, Disney Chief Executive Bob Iger finally is racking up some wins.

While delivering stronger-than-expected earnings last week, Iger made several announcements designed to keep the Burbank giant firmly ensconced in pop culture: ESPN will anchor a new sports streaming service launching next fall. Disney+ will be the streaming home for Taylor Swift’s concert tour movie. And Captain America and Baby Yoda could soon infiltrate the hit online game “Fortnite,” thanks to Disney paying $1.5 billion for a minority stake in Epic Games.

Investors who’ve been fretting over Disney’s troubles are beginning to see some relief. The company’s stock is up 20% since the start of the year. Disney had its best day since 2021 on Wall Street following the earnings report. On Monday, shares gained nearly 1% to $109.29.

The strong showing could help thwart activist investor Nelson Peltz’s Trian Fund Management and a second shareholder, Blackwells Capital Group, which both are trying to stage a boardroom shakeup at Disney’s annual shareholder meeting April 3.

“Whatever chance of success these activist investors had is being buried by 100,000 tons of Disney carbonite,” TD Cowen media analyst Doug Creutz said in an interview after the earnings. “The market likes what it sees.”

The Burbank company has a hangover from its big streaming push. The stock has struggled, investors are restive and its key studios have been stretched.

On Monday, Disney sent a letter to shareholders touting the “significant steps Disney is taking as it successfully executes a strategic transformation of the Company.”

However, analysts said Iger still has his work cut out to get the Mouse House back in order.

“They aren’t out of the woods yet,” Creutz said. “The question is: Will they be able to show sustained growth on the entertainment and sports side of the business?”

Still, Disney is demonstrating that, among Hollywood’s legacy film and TV studios, it appears well positioned to weather the disruption wrought by the shift to streaming.

Traditional rivals — including Paramount Global and Warner Bros. Discovery — have been struggling to maintain their standing in the wake of Netflix’s takeover of the television industry and the arrival of global behemoths Apple and Amazon into the streaming arena.

Disney’s stock rebound had more to do with business fundamentals than Iger’s announced initiatives, including teaming up with Fox Corp. and Warner Bros. Discovery to introduce a new streaming service with more than a dozen sports-centric legacy cable channels, ESPN and TNT, among others, analysts said.

Iger’s yearlong cost-cutting efforts — including eliminating 8,000 positions — drove the stronger earnings.

Financial losses in the streaming service businesses shrank to $216 million during the most recent quarter from losing more than $1 billion during the same period a year prior. Disney reiterated that its streaming business would show profits by September.

“Looking at our results this quarter, we can say with confidence our strategy is working,” Iger said during last week’s first-quarter earnings call.

The concert film will hit the Walt Disney Co. streaming service in March after grossing more than $260 million at the global box office.

Disney also revealed that it has secured the streaming rights to an extended version of Swift’s Eras tour concert movie, which will debut March 15 on Disney+. That should help to plug gaps in the company’s programming release pipeline, brought in large part by last year’s writers’ and actors’ strikes. Disney+ has 111 million subscribers worldwide (down slightly from the previous quarter).

But the strength came from Disney’s workhorses: the vaunted theme parks, cruise line and consumer products division, which generated a record profit of $9.1 billion in the quarter, thanks in part to improving economic conditions. The division’s operating income increased 8% to $3.1 billion. International parks, including those in Shanghai and Hong Kong, and the Disney Cruise Line, led the way. Domestic parks, which have raised prices, posted slightly lower results.

Chief Financial Officer Hugh Johnston, who joined the company in November from PepsiCo, and Iger pleased Wall Street with news that the company planned to spend $3 billion repurchasing shares.

The 2023 WGA strike lasted 148 days, making it one of the longest work stoppages in Hollywood history. Why did it last so long?

“It finally feels like the company has some financial control, in a way that Disney hasn’t felt in a number of years,” Michael Nathanson of the MoffettNathanson research firm said, adding that activist shareholders are also due some credit.

Disney hopes the market’s reaction will blunt calls by Peltz and Blackwells to shake up the board.

Peltz wants to dump two board members — Michael B.G. Froman, president of the Council on Foreign Relations, and Maria Elena Lagomasino, CEO of WE Family Offices, which serves high-net-worth families — to make room for him and Jay Rasulo, a former Disney chief financial officer. Trian beneficially owns $3 billion of Disney common stock, amassed in large part by longtime Marvel Entertainment chairman Ike Perlmutter, who was ousted from Disney last year.

Disney blasted the activist investor’s agitation, calling it an agenda driven by former Marvel CEO Ike Perlmutter, who was ousted from the company earlier this year.

Blackwells, for its part, called Trian’s slate “uninspiring.” The firm wants to break up Disney, and it nominated three board candidates of its own: media veteran Jessica Schell, real estate expert Craig Hatkoff and TaskRabbit founder Leah Solivan.

Disney has called on shareholders to ignore both activist groups and support its slate of 12 board members, including Iger, during its annual meeting. The company enlisted Donald Duck’s scatterbrained cartoon uncle, Prof. Ludwig Von Drake, in a video on votedisney.com to make its case that Disney’s current board members are up to the job.

Peltz, for his part, isn’t backing down. “It’s deja vu all over again,” Peltz’s firm said in a statement. “We saw this movie last year, and we didn’t like the ending.”

Disney released its earnings report for the first quarter of 2024 as Bob Iger seeks to quell a proxy battle waged by investor Nelson Peltz.

Last week’s earnings gave Disney a welcomed win in the wake of a recent legal setback. A federal judge in Tallahassee, Fla., last month tossed the 1st Amendment lawsuit the company brought against its nemesis in the culture wars — Florida’s Republican Gov. Ron DeSantis.

Disney has tried to argue that DeSantis-led changes to Florida land-use laws were retaliation against the entertainment giant for publicly criticizing Florida’s so-called “Don’t Say Gay” law two years ago. (Disney swiftly appealed the judge’s ruling.)

Disney faces challenges on other fronts too.

The company continues to confront the ravages of audience declines in linear television, which have hammered the ABC network and longtime cash cow ESPN.

Disney is attempting to walk a fine line by preserving the lucrative pay-TV bundle while separately offering products with fewer channels to sports fans who don’t want to pay more than $100 a month.

Disney is planning to release the flagship ESPN channels directly to consumers in the fall of 2025. And this coming fall, the company will contribute its linear sports channels to the yet-unnamed streaming service that Disney will co-own with Fox and Warner Bros. Discovery. The companies haven’t announced a price point, but some analysts believe that it might top $50 a month in an attempt to draw cord-cutters and “cord-nevers.”

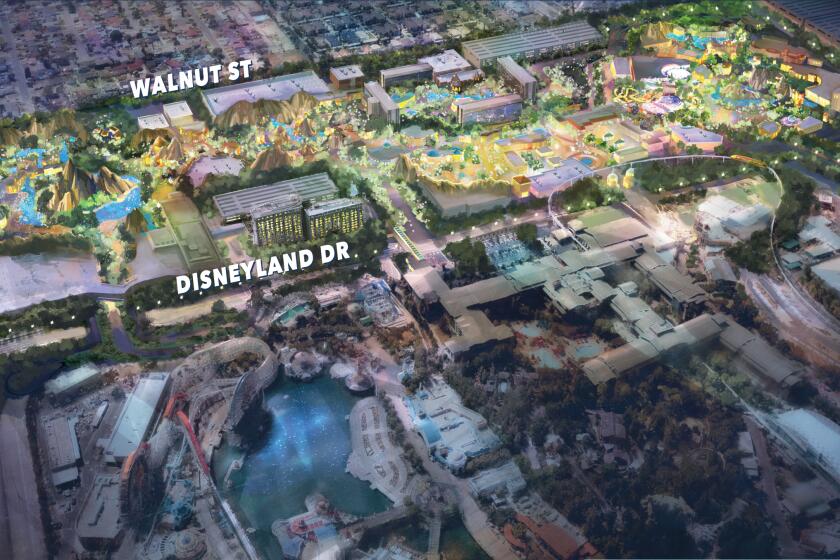

Disneyland’s plan to reimagine the theme park into a more “immersive” experience may require up to $2.5 billion and a plan to privatize some Anaheim streets.

Of particular concern still is that Disney’s movie side has struggled, leading Iger to acknowledge late last year that the company had lost focus in the rush to crank out content for its streaming services.

“There is an overhang of poorer-performing films, but the company has said it will concentrate more on quality than quantity,” said Jeffrey Sonnenfeld, a senior associate dean of the Yale School of Management. “That focus is really important.”

The company during its earnings call announced that a sequel to “Moana” — the 2016 animated film that, according to Iger, was the most-streamed movie of 2023 in the United States — is coming to theaters in November. It was originally conceived as a series to be streamed on Disney+, but the company changed tack and decided to release the sequel as a feature in theaters. Several other Disney sequels are also on the way, following strike-related delays.

Raymond James analyst Ric Prentiss pointed to the partnership between Disney and Epic Games as another way to draw advertisers who are clamoring to reach the younger demographic.

“If you’re going to be a relevant, growing player, you better have gaming in your kit bag,” Prentiss said, adding that Disney’s play is “not just to create a game, but to create an environment where people spend a lot of time.”

Improving the film slate, guiding ESPN into streaming and reducing the streaming losses are key.

“Iger’s doing well to have this stock bounce after just one year back on the job,” Sonnenfeld said. “A turnaround usually takes three years.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.