Column: The Child Tax Credit is our greatest antipoverty program. Why is Congress letting it wither?

Here are some documented truths about the federal Child Tax Credit:

â The enhanced credit, enacted in March 2021 as part of the American Rescue Plan, the governmentâs pandemic relief package, reduced the child poverty rate by about 30%, keeping as many as 3.7 million children out of poverty by the end of that year.

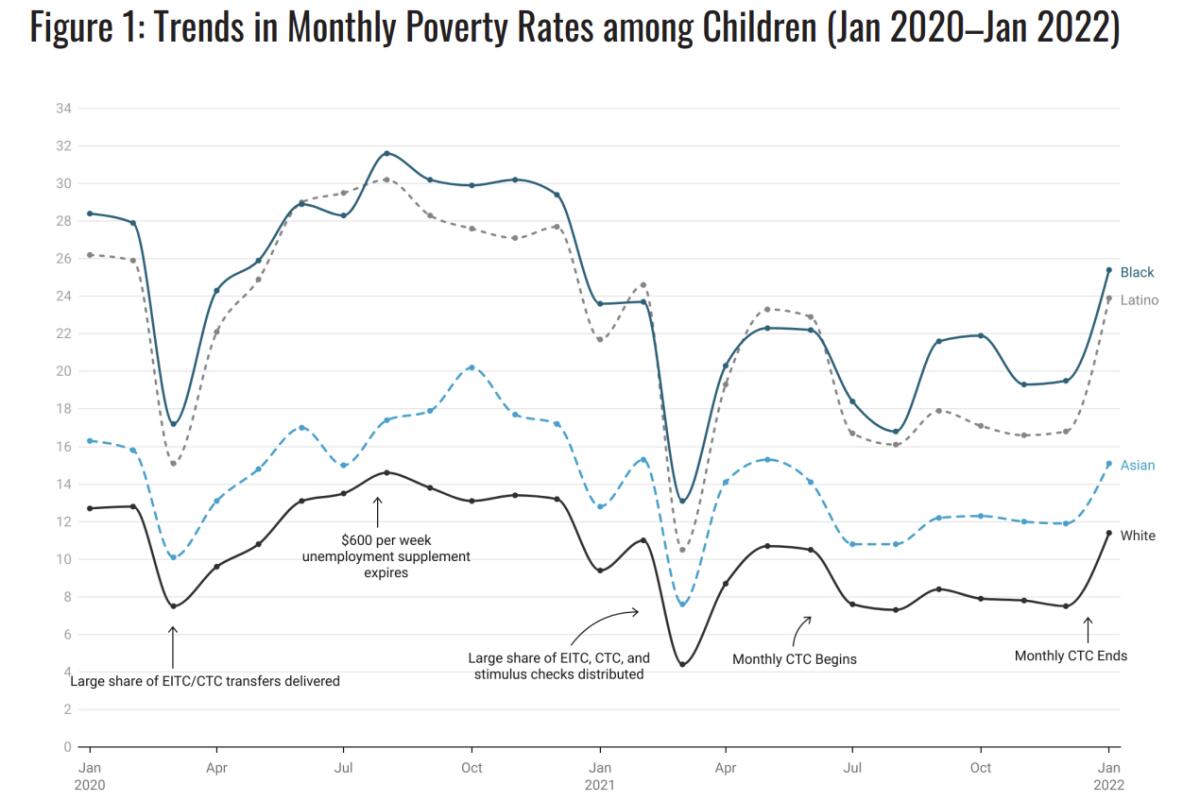

â When the enhancements expired in January, the child poverty rate spiked to 17% from 12.1%, plunging 3.7 million children back under the poverty line. The impact was much worse on Black, Latino and Asian children than on white ones.

In the richest country in the world, there should not be a single child who cannot eat in the morning or who is living in a car.

— Economist Claudia Sahm

â The credit, which was paid out in monthly installments from July through December 2021 with the balance paid out as tax refunds in early 2022, had no detectable effect on the inflation rate.

â The vast majority of families used the payments to benefit their children, to build savings and to pay down debt. A vanishingly small proportion spent it on frivolities or on drugs or alcohol.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

â The chances that the lame duck Congress will restore the Child Tax Credit to its 2021 level are virtually nil. Next year, when Republicans control the House? Less than nil.

Something doesnât compute here. The Child Tax Credit worked superbly well to fulfill its goals, yet it gets no love from Congress. Someone needs to explain this. I will, but be forewarned: The explanation tells an ugly story about Americaâs political leadership and our economyâs embedded inequality.

âIn the richest country in the world, there should not be a single child who cannot eat in the morning or who is living in a car,â says Claudia Sahm, former Federal Reserve economist, the founder of a consulting firm bearing her name and a close follower of economic inequality trends.

The expiration of the Child Tax Credit means 3.7 million more children in poverty. Is this the America we want?

Letâs take a brief detour to examine how the American Rescue Act improved the Child Tax Credit, which was originally established in 1997.

To begin with, the credit was increased to an annual $3,000 per child ($3,600 for children under age 6), from $2,000 per child. It raised the maximum age of children eligible for the credit to 17 from 16.

Even more important, the credit was made fully refundable, meaning that it went to families regardless of whether or how much they paid in federal income taxes. The ARP eliminated the preexisting programâs work incentives, which reduced the credit for lower-income families.

In 2021, half of the annual credit was paid at the rate of up to $300 monthly per child up to age 6, and $250 monthly for children age 6 to 17. The rest was paid out when families filed their income tax returns.

The old provisions were restored when the ARP enhancements expired at the end of 2021. The maximum credit fell back to $2,000 per child, paid annually, and the payout was again tied to family income.

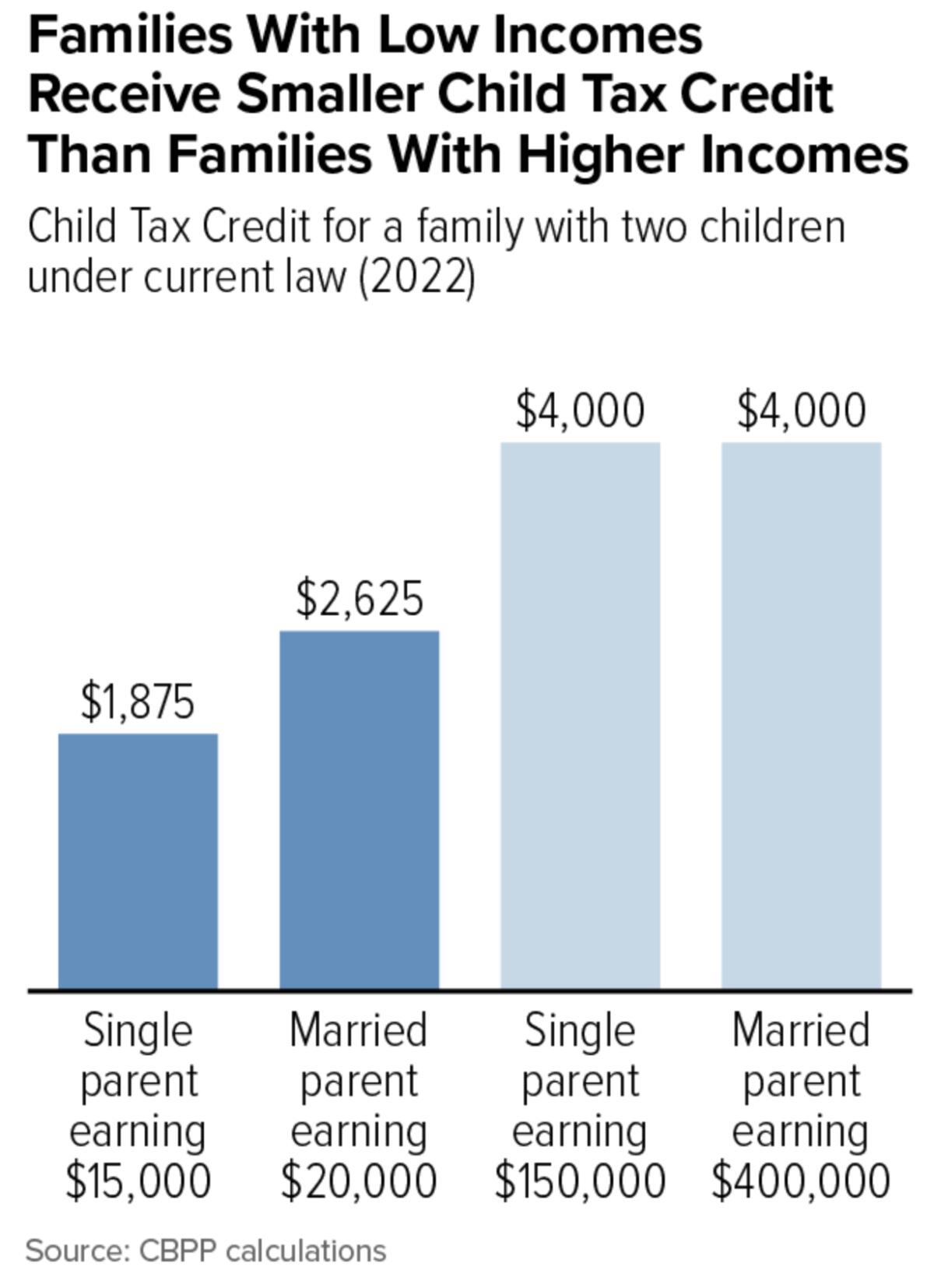

That turned the programâs benefits on their head by denying the neediest families the most help and rewarding the richest (up to the income limits of $400,000 for couples and $200,000 for single parents).

Under the current rules, for example, married parents with two children and earnings of $400,000 receive the full $4,000 in annual benefits; a single parent with two children and earnings of $15,000 will receive only $1,875, and a family with income so low they donât have income tax liability get nothing.

About 19 million children under age 17 receive a reduced credit or no credit at all because of the income phase-in.

As the Center on Budget and Policy Priorities reckons, this effect falls especially hard on Black children, 45% of whom fall into the reduced or zeroed-out category; Latino children (39%); and American Indian or Alaskan native children (38%), but only 17% of white children â âlong standing inequitiesâ that were temporarily redressed by the ARP.

As Sahm has pointed out, the enhanced credits were a proof-of-concept that cash benefits are best at fighting poverty. Theyâre flexible, leaving it up to families to determine their most pressing needs and decide how best to deploy the financial assistance.

The new child tax credit being paid out to American parents will prove the virtues of universal basic income.

Opposition to continuing the 2021 Child Tax Credit is generally based on ancient conservative shibboleths and misconceptions about poverty.

One is the notion that assistance recipients canât be trusted to spend their money wisely.

The claim that recipients left to their own devices will spend their benefits on drugs and drink or crab legs or tattoos has always been a fantasy of ignorant conservatives, tied closely to racism and the denigration of the poor as morally bankrupt (or they wouldnât be poor, you see).

Studies of how low-income households actually spend their assistance checks consistently show that the money goes to rent, home-cooked food, transportation and clothing. In fact, households receiving assistance generally spend larger portions of their total income on those essentials than households that donât need financial help.

Another is the assertion that cash assistance discourages work. This tenet motivated red states to impose work requirements on enrollees in expanded Medicaid programs under the Affordable Care Act. One would have hoped that the record of those provisions put the idea in the grave that work requirements increase employment. Sadly, it hasnât.

The record showed that work requirements didnât help employment trends at all, made the Medicaid programs more expensive, not less, and forced thousands of people off the Medicaid rolls, threatening their health. Nevertheless, politicians still think theyâre some sort of a panacea, though for what isnât clear.

Sen. Mitt Romney (R-Utah) declared earlier this year that he would endorse restoring the higher benefits of the Child Tax Credit, but only if work requirements were part of the package, eliminating benefits for families with caregivers at home. (The chances that Romney, with an estimated $250-million net worth, understands the economic position of low-income families are almost nonexistent.)

Sen. Joe Manchin III (D-W. Va.) refused last year to accept an extension of the Child Tax Credit enhancements unless they came with work requirements. âDonât you think, if weâre going to help the children, that the people should make some effort?â Manchin said on CNN, displaying his conviction that recipients of the credit were layabouts and malingerers.

As I pointed out earlier this year, Manchin had some nerve blocking the extension, since his home state boasted the fourth-worst rate of child poverty in the nation and fifth-worst in extreme child poverty. Who does Manchin represent, again?

The Republican project to turn Medicaid from a healthcare program into an obstacle course for the most vulnerable members of society has passed its first proof-of-concept test: Arkansas has reported that 4,574 residents, or more than half of those subject to new work requirements, lost their coverage as of last Saturday.

Other arguments against expanding the credit draw heavily from the traditional far-right textbook. Just a few days ago, the Heritage Foundation contended that extending the credit would âundermine the economy, self-support, social well-being, and upward mobility.â

The Heritage screed asserted that cash aid âweakens marriage and increases abortion,â a claim for which no evidence exists whatsoever. It also cited a paper from the University of Chicago finding that removing the work requirements from the Child Tax Credit would lead to 1.5 million workers exiting the labor force. Heritage noted that the departing workers accounted for 2.6% of working parents, but not that it represented less than 1% of all civilian workers.

All these objections, including the unsupported claim that the credit drove inflation, overlook the fundamental misconception about the program â itâs typically treated as a government expenditure. But thatâs wrong: Itâs manifestly an investment in the next generation and the nationâs future, with an immense long-term return.

Itâs not only about the moral imperative to keep todayâs children out of poverty.

âWeâre leaving money on the table,â Sahm told me. âIf they have the opportunity to flourish, to be healthy, to have a childhood, these children are going to be much more productive. They will be workers someday, and by making the Child Tax Credit a workforce program for adults now, we are undermining the workforce of the future.â

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.