Column: The blockade of Build Back Better means millions more children condemned to poverty

When it comes to anti-poverty programs, the U.S. seems to have developed the unique skill of cutting off benefits just as theyâve shown their value.

The latest example is the Child Tax Credit. Part of the American Rescue Plan, the $1.9-trillion pandemic relief package signed by President Biden last March, the credit had the capacity to truly transform the economics of family life in America.

The program was designed to deliver $3,000 per child ($3,600 for children 5 and under) to the vast majority of families over the following year. Half the amount was paid in monthly installments from July through December at the rate of up to $250 per child ages 6 to 17 and up to $300 per child under age 6.

In its first six months, the expanded Child Tax Credit has shored up family finances amidst the continuing crisis, reduced child poverty and food insufficiency, [and] increased familiesâ ability to meet their basic needs.

— Columbia University

The credit is fully refundable, meaning that households are entitled to it even if they owe no federal income tax. The credit phases out for high-income families.

The payments reached more than 61 million children in more than 36 million households, according to calculations by Columbia Universityâs Center on Poverty and Social Policy. The balance of the credit is to be paid as tax refunds when families file their federal income tax returns between now and April 18.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

The payments had a rapid and material effect on the child poverty rate, which fell from about 16% in June to about 12% in December. Then the monthly payments ceased, and the child poverty rate rebounded to 17% in January, its highest mark since January 2020.

That increase translates to 3.7 million children added to the poverty rolls in just a single month.

âThe weight of the evidence is clear,â the Columbia researchers observed in a December roundup of pandemic anti-poverty measures: âIn its first six months, the expanded Child Tax Credit has shored up family finances amidst the continuing crisis, reduced child poverty and food insufficiency, increased familiesâ ability to meet their basic needs, and has had no discernible negative effects on parental employment.â

As I reported last July, the entire rescue plan, which included enhanced food stamp benefits and other safety-net features, was projected to help cut the child poverty rate in the U.S. nearly in half, to 7.5% from 13.6%, according to an analysis by Columbia University. The Child Tax Credit was its biggest component.

The Biden administration has been trying to convert the one-year Child Tax Credit into a permanent program, but that goal has been thwarted by Congress â specifically, by Sen. Joe Manchin III (D-W.Va.).

Manchin has bizarrely drawn a line in the sand against the child credit, even though his state is a leading member of the child poverty hall of shame: In 2018, West Virginia boasted the fourth-worst rate of child poverty in the nation and fifth worst in extreme child poverty.

(The rankings apply to children under 16; the poverty line is defined as household income of about $26,500 for a family of four; âextremeâ poverty sets in at half that amount.)

The new child tax credit being paid out to American parents will prove the virtues of universal basic income.

A failure to reenact the planâs Child Tax Credit wouldnât reduce it to zero; it would simply revert to the $2,000 credit per child in place before 2021. Unlike the rescue plan credit, however, the old benefit was not fully refundable.

Manchin isnât the only skinflint in American politics. The Republican Party has made stinginess a governing principle. Consider the âRescue Americaâ agenda offered the other day by Sen. Rick Scott (R-Fla.), a member of the Senate GOPâs leadership caucus.

Buried within its red-meat culture-warrior points (all schoolchildren required to say the Pledge of Allegiance and salute the flag, âmen are men, women are women,â no to a âpolitically correct... new religion of wokeness,â etc., etc.), the Scott plan called for all Americans to âpay some income tax to have skin in the game.â

Scott in his agenda groused that half of all Americans pay no income tax, though he also advocated cutting the IRS budget in half, so itâs unclear how he would enforce the rule.

The problem is that the poorest 50% of Americans have a negative federal tax bill, thanks to refundable programs such as the Child Tax Credit and Earned Income Tax Credit, which are paid out to households even if the benefits come to more than their taxes.

In other words, Scott, whose net worth of about $220 million makes him one of the richest senators, called for a tax increase on poor families of as much as $2,500 a year.

By the way, just to demonstrate how ignorant Scott is about federal taxes, almost everyone pays them; the lowest-income 50%, who pay no federal income taxes or have negative income tax bills, are billed for federal payroll taxes to fund Social Security and part of Medicare.

In fact, the lowest-income 50%, whose federal income tax bills were negative $128 billion, paid out $178.9 billion in payroll taxes, according to the IRS. In other words, their total net federal tax bill actually came to about $50 billion.

Scottâs tax agenda is so politically embarrassing that it earned an explicit rebuke from Senate Minority Leader Mitch McConnell (R-Ky.), who may not relish trying to restore his partyâs Senate majority by raising taxes on poor people and cutting them for rich people.

Even Sen. Mitt Romney (R-Utah), who is sometimes regarded as a moderate Republican, says he would extend the child tax credit only with one condition â the imposition of a work requirement.

Thatâs a cynical folly. Work requirements for Medicaid, the federal healthcare program for indigent Americans, were a popular Republican policy initiative during the Trump years, even though they were repeatedly shown to cost more money than they saved and failed utterly to place more Americans in jobs. The programs approved by Trumpâs healthcare officials are all being canceled under Biden.

The Biden administration informs two states that their Medicaid work requirements are dead.

By applying work requirements to the Child Tax Credit, Romneyâs proposal would render stay-at-home caregivers ineligible, harming the households most in need. (Romneyâs net worth of about $250 million makes him the richest senator.)

The Child Tax Credit isnât the only element of the American Rescue Plan destined to prove its value by its impending expiration. The plan also restructured premium subsidies offered to buyers of health plans in the Affordable Care Act marketplace by increasing the credits and making millions more Americans eligible.

The rescue plan increased subsidies across the board. Perhaps more important, it eliminated the âsubsidy cliffâ that cut off the premium assistance entirely for those whose household income exceeded 400% of the federal poverty limit.

That system capped ACA premiums at 9.83% of income â but only for those earning less than the ceiling ($111,000 for a family of four this year); earn even a dime more than the ceiling, and the subsidy dropped to zero. Under the new system, no buyers would have to pay more than 8.5% of their income for a benchmark silver plan, regardless of their income.

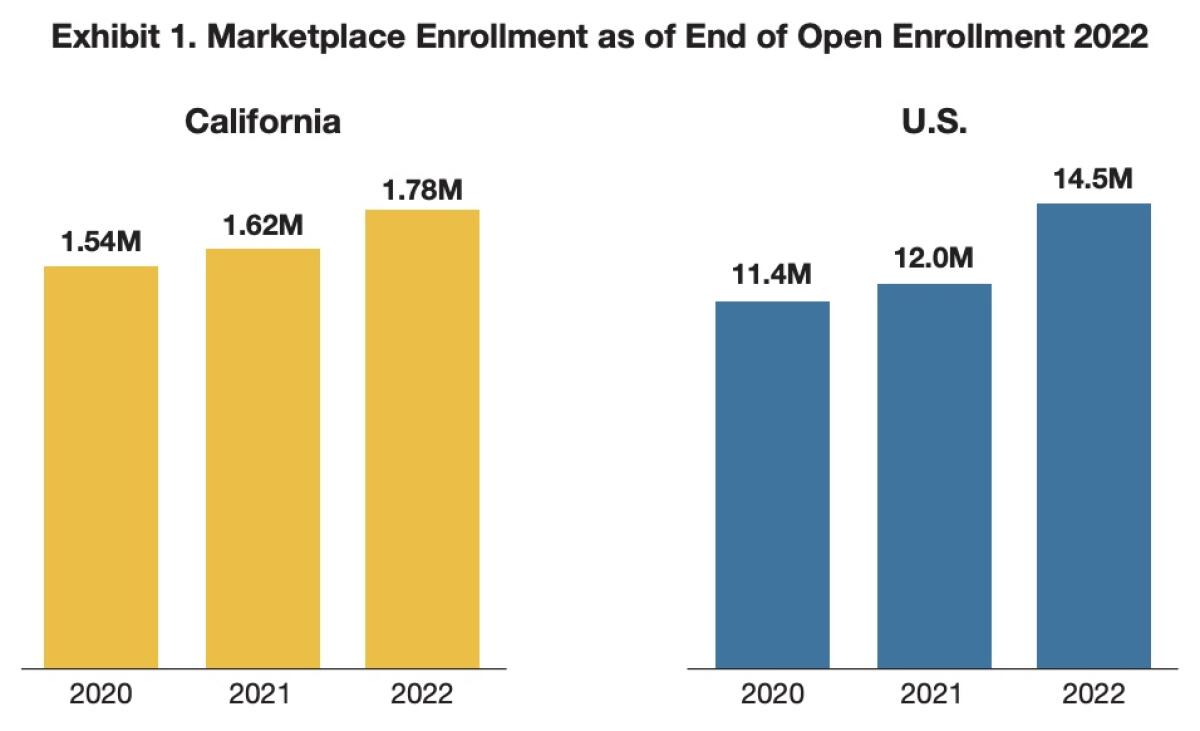

The new structure helped drive ACA plan enrollments to their highest level ever in the current year â 14.5 million Americans enrolled or renewed coverage for 2022, an increase of more than 20% over the 12 million enrollment for 2021. California, like many other states, also experienced record sign-ups, to 1.78 million for this year from 1.62 million in 2021.

Because of the higher subsidies and an inflow of younger, healthier enrollees, average premiums (after subsidies) fell by 23% nationwide and 20% in California, according to Covered California, the stateâs ACA marketplace.

If the subsidy structure isnât renewed this year, premiums will soar, as Covered California Executive Director Peter V. Lee outlined during a webcast Wednesday.

âFourteen million Americans will experience premium shock,â Lee said in his last public appearance as the exchangeâs boss before he steps down this month. Two million consumers might drop coverage because of its higher cost.

âThe impact would be ongoing,â Lee added, because the risk profile of the ACA enrollment pool would deteriorate. âWhen you price people out of coverage, the people who drop coverage first are healthy people.... Everyoneâs going to pay the price for that.â

Covered California estimated that if the subsidies are returned to their previous levels, premiums for lower-income buyers would rise to $74 a month from zero. A middle-income couple in their early 60s âwould lose all help and pay $1,720 more each month,â potentially an insurmountable obstacle to maintaining coverage.

Failure to maintain the current subsidy structure would be just another example of policy-makers ignoring the evidence in front of their eyes that these government programs work.

Generally speaking, Americaâs approach to the pandemic crisis brought the U.S. a stronger recovery than any other developed country. That was mostly because it was the most generous as a proportion of gross domestic product in the developed world â a record-shattering 25% of GDP, according to Moodyâs Analytics.

But the job isnât finished. The Child Tax Credit lifted millions of children out of poverty. The ACA subsidies brought health coverage to millions more. Anti-poverty programs meet their goals. Why canât Americaâs political leaders learn these simple lessons?

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.