Many of the uber-rich pay next to no income tax, report says

- Share via

WASHINGTON — The rich really are different from you and me: They’re better at dodging the tax man.

Amazon founder Jeff Bezos paid no income tax in 2007 and 2011. Tesla founder Elon Musk’s income tax bill was zero in 2018. And financier George Soros went three straight years without paying federal income tax, according to a report Tuesday from the nonprofit investigative journalism organization ProPublica.

Overall, the richest 25 Americans pay less in tax — an average of 15.8% of adjusted gross income — than many ordinary workers do, once you include taxes for Social Security and Medicare, ProPublica found. Its findings are likely to heighten a national debate over the vast and widening inequality between the very wealthiest Americans and everyone else.

An anonymous source delivered to ProPublica reams of Internal Revenue Service data on the country’s wealthiest people, including Warren Buffett, Bill Gates, Rupert Murdoch and Mark Zuckerberg. ProPublica compared the tax data it received with information available from other sources. It reported that “in every instance we were able to check — involving tax filings by more than 50 separate people — the details provided to ProPublica matched the information from other sources.’’

Using perfectly legal tax strategies, many of the uber-rich are able to shrink their federal tax bills to nothing or close to it.

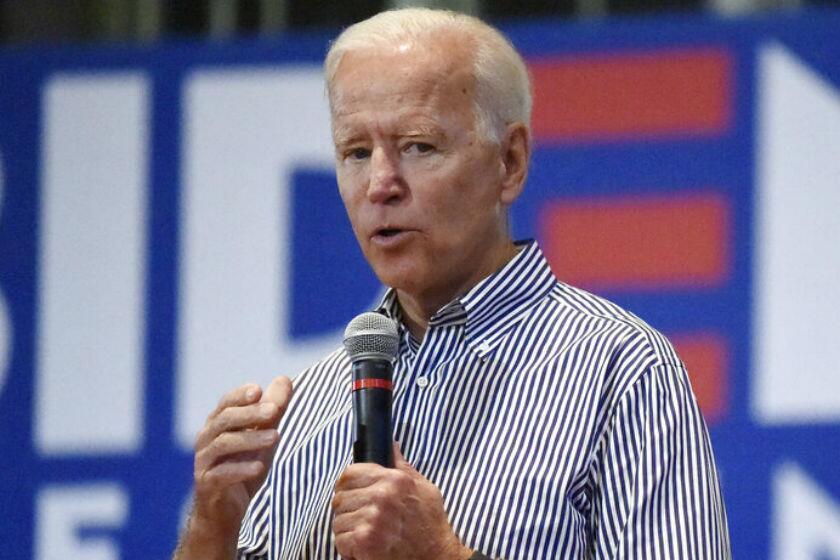

President Biden acknowledges he’s unlikely to get support from Republican lawmakers for any type of tax hike but said he would get Democratic votes.

A spokesman for Soros, who has supported higher taxes on the rich, told ProPublica that the billionaire had lost money on his investments from 2016 to 2018 and so did not owe federal income tax for those years. Musk responded to ProPublica’s initial request for comment with a punctuation mark — “?” — and did not answer detailed follow-up questions.

The federal tax code is meant to be progressive — that is, the rich pay a steadily higher tax rate on their income as it rises. And ProPublica found, in fact, that people earning between $2 million and $5 million a year paid an average of 27.5%, the highest of any group of taxpayers.

Above $5 million in income, though, tax rates fell: The top .001% of taxpayers — 1,400 people who reported income above $69 million — paid 23%. And the 25 very richest people paid still less.

The wealthy can reduce their tax bills through the use of charitable donations or by avoiding wage income (which can be taxed at up to 37%) and benefiting instead mainly from investment income (usually taxed at 20%).

President Biden, in seeking revenue to finance his spending plans, has proposed higher taxes on the wealthy. Biden wants to raise the top tax rate to 39.6% for people earning $400,000 a year or more in taxable income, estimated to be fewer than 2% of U.S. households. The top tax rate that workers pay on salaries and wages now is 37%.

Biden is proposing to nearly double the tax rate that high-earning Americans pay on profits from stocks and other investments. In addition, under his proposals, inherited capital gains would no longer be tax-free.

The president, whose proposals must be approved by Congress, would also raise taxes on corporations, which would affect wealthy investors who own corporate stocks.

ProPublica reported that the tax bills of the rich are especially low when compared with their soaring wealth — the value of their investment portfolios, real estate and other assets. Using calculations by Forbes magazine, ProPublica noted that the wealth of the 25 richest Americans collectively jumped by $401 billion from 2014 to 2018. They paid $13.6 billion in federal income taxes over those years — equal to just 3.4% of the increase in their wealth.

Biden’s ambitious child tax credit, putting cash in families’ bank accounts soon, could cut child poverty in half. But a lot has to go right on a tight deadline.

Chuck Marr, a senior director at the left-leaning Center on Budget and Policy Priorities, suggested that Biden’s proposals, which face fierce opposition from Republicans in Congress and from businesses, are “modest” given how much the wealthy have benefited in recent years and how comparatively little tax many of them pay.

“It always seems like the solutions are cast as radical when there’s less focus on the current situation being radical,” Marr said.

Sens. Elizabeth Warren and Bernie Sanders, among others, have proposed taxing the wealth of the richest Americans, not just their income.

On Tuesday, Warren tweeted in response to the ProPublica report:

“Our tax system is rigged for billionaires who don’t make their fortunes through income, like working families do. The evidence is abundantly clear: it is time for a #WealthTax in America to make the ultra-rich finally pay their fair share.″

ProPublica’s data “reveals that the country’s wealthiest, who have profited handsomely during the pandemic, have not been paying their fair share of taxes,” Sen. Ron Wyden (D-Ore.) who leads the tax-writing Senate Finance Committee, said at the start of a hearing Tuesday on the IRS budget with Commissioner Charles Rettig.

Wyden has proposed legislation that would tighten enforcement of tax collection against wealthy individuals and corporations that use artifices and loopholes to skirt paying taxes.

For his part, Rettig said that the IRS is investigating the leak of the tax data to ProPublica and that any violations of law would be prosecuted. (ProPublica reported that it doesn’t know the identity of the source who provided the data.)

“We will find out about the ProPublica article,” Rettig said. “We have turned it over to the appropriate investigators, both external and internal.”

Now controlling the White House and Congress, Democrats are focusing on the tax gap — the hundreds of billions of dollars’ difference between what Americans owe the government in taxes and what they pay — and its connection to economic inequality. The top 10% of earners have accounted for most of that gap, experts say, by underreporting their liabilities, intentionally or not, as tax avoidance or as outright evasion.

The tax gap is under a spotlight as a potential source for recouping some revenue to help pay for Biden’s proposed spending on infrastructure, families and education. Democrats have been pushing the IRS to invigorate its enforcement of tax collection and make it fairer, by pursuing the big corporations and wealthy individuals who manage to game the system.

At Tuesday’s hearing, Wyden told Rettig that it’s wrong “how the wealthy always seem to skip out on their obligations.”

“You have a better chance of being struck by lightning than being audited if you’re a partner in a partnership,” Wyden said.

Rettig responded, “We are outgunned.”

Biden is proposing to nearly double the tax rate that the highest-earning Americans pay on profits made from stocks and other investments.

Democrats have argued that the tax gap has widened mainly because big U.S. corporations have parked revenue overseas and wealthy individuals have failed to pay their fair share. They assert that the IRS, long understaffed and underfunded, has tended to pursue taxpayers of modest means more aggressively than high-powered businesspeople and corporations.

Taxpayers with annual incomes under $25,000 are audited at a higher rate (0.69%) than those with incomes up to $500,000 (0.53%), according to IRS data. Taxpayers who receive the earned-income tax credit, which applies mainly to low-income workers with children, are audited at a higher rate than all but the very wealthiest tax filers. The audit rate for millionaires fell from 8.4% in 2010 to 2.4% in 2019.

The agency’s funding has been slashed about 20% since 2010. Biden’s new spending proposals include an extra $80 billion over 10 years to bolster IRS audits of upper-income individuals and corporations, with an eye toward recovering an estimated $700 billion.

Much of the gap comes from the use of overseas havens. The government loses an estimated $40 billion to $120 billion a year from offshore tax evasion. Biden’s tax plan includes measures to stop corporations from stashing profits in countries with low tax rates. Last weekend, the Group of Seven wealthy democracies, which includes the United States, agreed to support a global minimum corporate tax of at least 15% to deter multinational companies from avoiding taxes by stashing profits in low-rate countries.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.