GameStop’s fourth-quarter earnings and sales fall short of Wall Street’s expectations

A hefty tax benefit helped drive GameStop’s fiscal fourth-quarter profit sharply higher, but the video-game retailer’s sales declined despite a surge in its online business. The company’s latest results fell short of Wall Street’s expectations.

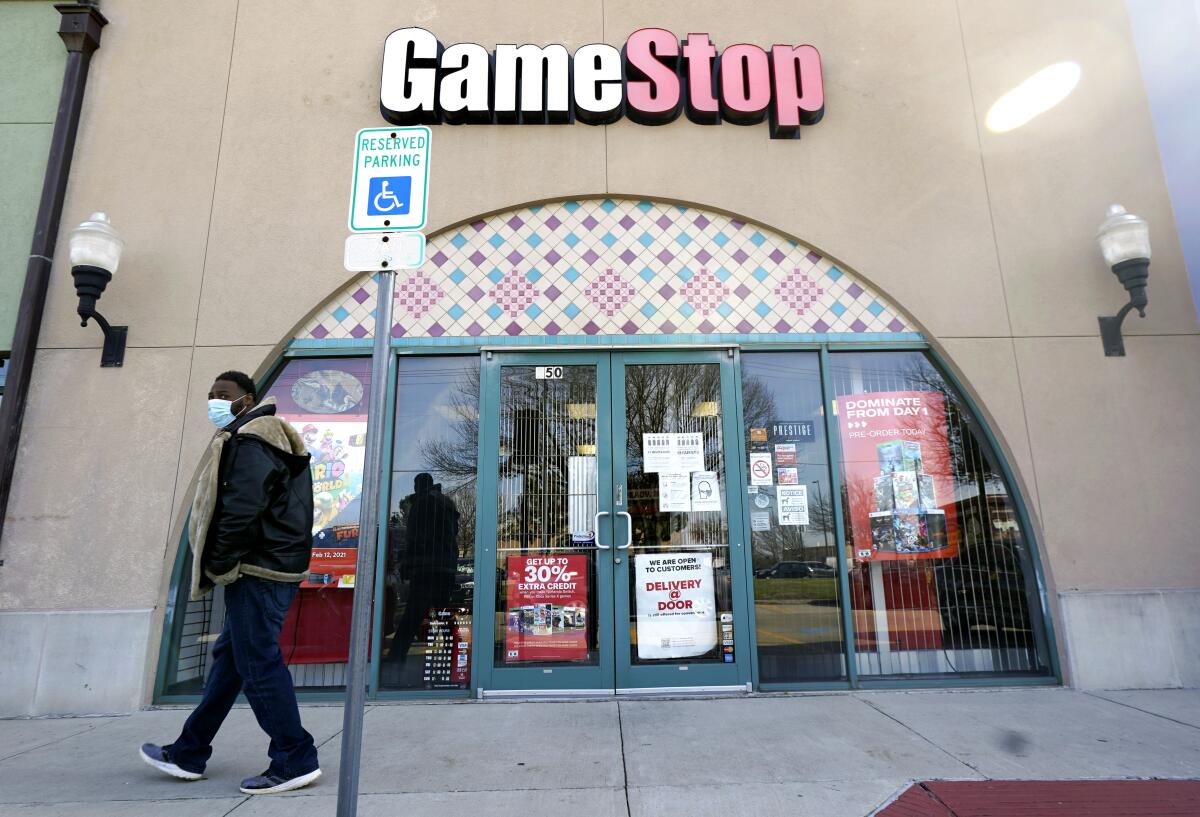

The company, whose stock price soared in January after a social media-fueled frenzy, said Tuesday that its would suspend providing earnings guidance as it focuses on an effort to transform into a more online-focused retailer.

The Grapevine, Texas, company reported net income of $80.5 million, or $1.19 per share, for the three months that ended Jan. 30. That compares with net income of $21 million, or 32 cents a share, a year earlier.

The latest results include a nearly $70-million tax benefit. Adjusted for that and other one-time items, the company’s earnings amounted to $1.34 a share, versus $1.27 a year earlier.

GameStop theories are about a dime a dozen, and that’s what they’re worth.

Revenue fell to $2.12 billion, from $2.19 billion. Analysts were expecting adjusted earnings of $1.35 a share on $2.21 billion in revenue, according to FactSet.

The company said global e-commerce sales made up 34% of net sales in the fourth quarter compared with 12% in the year-ago quarter. As GameStop attempts to transition more of its business online, the company recently named board member Ryan Cohen to spearhead that transition.

GameStop shares were little changed in after-hours trading. They fell 6.6% to $181.75 in the regular trading session.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.