- Share via

There is an old saying in business that you need to have money to make money.

The Dodgers are one of baseball’s richest teams, and thanks to the highly unusual structure of their contract with Shohei Ohtani, they are about to have, and potentially make, a whole lot more than they already do.

In the week since Ohtani inked his heavily-deferred, 10-year, $700-million deal with the Dodgers, the unprecedented pact has been viewed around Major League Baseball in a number of ways.

As a record-breaking contract with the biggest guarantee in sports history. As the selfless act of a superstar player hellbent on winning. As a relative steal for the Dodgers, keeping payroll free for other impact acquisitions.

“You get the player, and you’ve got the freedom to do whatever you want around him,” said one person with knowledge of the situation, who was granted anonymity to speak freely. “The upside is endless. Because this has never been done.”

Shohei Ohtani, baseball’s top free agent, agrees to a $700-million deal with the Dodgers. Here’s everything you need to know about Ohtani joining the Dodgers.

Like Ohtani, MLB’s only two-way star, his contract is unique as an unprecedented business opportunity for the Dodgers, according to industry and financial experts.

He easily could net the club $50 million annually in additional marketing and advertising revenues. He already is making himself a reported $50 million in endorsements, contributing to his apparent indifference to maximizing his Dodgers salary.

Most of all, he is giving the Dodgers and their owners the ultimate financial gifts: 1) the ability to save money in the short term by deferring $680 million of his salary until the contract is complete; and 2) the potential to profit off the income that money will generate in the meantime, a dynamic that could transform an already big-spending franchise into MLB’s biggest financial behemoth.

“They’re getting a huge financial windfall for this contract [when compared to the $460-million present value disclosed],” said finance expert Morrie Aaron, founder and president of MCA Financial Group. “They’ll make a lot of money — a lot of money — on this thing.”

One rival agent offered up a jaw-dropping estimate.

“This may be close to an $800 million to $1 billion gain for the Dodgers over a decade,” the agent said, noting that if the team were to simply take the $680 million in deferrals and invest it — say, with an asset management firm like Guggenheim Partners, which is run by Dodgers owner Mark Walter — then the money could more than double in a decade’s time.

“They may be able to make $1 billion extra,” the agent reiterated.

How much the Dodgers will capitalize off their arrangement with Ohtani — one that the player presented to the team — remains to be seen. For the next two years, the club’s only obligations will be to pay Ohtani $2 million annually in salary. Starting in 2026, the Dodgers will have to start setting aside at least $46 million per year to fund Ohtani’s deferral payments, a stipulation under MLB’s collective bargaining agreement.

Club officials have been adamant about their intentions to make good on their promise to Ohtani and invest in the team.

“This was about making our team better,” Dodgers president Stan Kasten told The Times. “Both on the field, and for our fans off the field. This accomplished both.”

Still, what has become clear since Ohtani’s signing: He offered the Dodgers an exceedingly club-friendly structure, one that could present a money-making opportunity even with its record-breaking price tag.

The Dodgers have a variety of ways they could commercially capitalize on Shohei Ohtani, from jersey patches to Dodger Stadium field naming rights.

“Cash in hand, this is a huge benefit for the Dodgers,” said Pepperdine law professor Maureen Arellano Weston, who is the director of the school’s entertainment, media and sports dispute resolution project. “Deion Sanders paid for his contract at Colorado in the first couple of games [thanks to revenue increases driven by his celebrity] … There may be some similar effects that can happen here.”

Said Aaron: “What he’s really doing is financing the ballclub, and providing a cheap and very inexpensive loan.”

The question now?

“Are [the Dodgers] going to take the money and invest it in players?” Aaron added. “Or are they going to take the money and invest it in their own pockets?”

Depending on the team’s actions this winter, the answer might soon become clear.

Ironically, the Dodgers’ greatest concern entering the Ohtani sweepstakes was that signing him would strain their payroll.

While ownership had signaled a commitment to spend lavishly on the Japanese star, the threat of another club effectively offering a blank check still loomed. Even someone like Walter, whose Guggenheim Partners manages $325 billion in assets, had limits for how much could be spent on Ohtani.

That’s why, as Dodgers officials prepared to meet with Ohtani earlier this month, they took a curated approach to wooing the two-time American League most valuable player. The team sent only a small contingent of officials — and, notably, no active players — into its meeting with Ohtani, which occurred at Dodger Stadium on the first day of December.

They leaned into one of the more comedic subplots to the superstar’s free agency, as the Wall Street Journal first reported, by fetching some Dodger-themed dog toys from their gift shop to give to the player’s pup, Decoy (before the dog’s name became public knowledge).

They even dug through their archives for something they’d been saving for six years, from the first time they pursued Ohtani in 2017.

The Dodgers had commissioned a recruiting video from Kobe Bryant to sell the perks of playing in Los Angeles. They never got the chance to show it to Ohtani, stashing it for a second meeting that never came, as Ohtani chose the Angels.

The Dodgers used a 2017 video of Kobe Bryant pitching the team to Shohei Ohtani while recruiting the Japanese baseball superstar as a free agent in December.

When the Dodgers finally played it for him, nearly four years after Bryant’s death, the Lakers star’s face flashed on the screen and his voice filled the room. Multiple people who saw the video believe it captivated Ohtani.

“He was just locked in on it,” one person said.

“It was a special video,” another said.

A week later, Ohtani brought the Dodgers his own surprise.

Even as other teams were preparing $500-million offers featuring significantly less deferred money, according to people with knowledge of the situation but unauthorized to speak publicly, and rival agents were predicting a bidding war to exceed $600 million , the 29-year-old star approached his list of finalists with the same contract offer.

Ten years. $700 million. Almost all of it deferred.

Even with the gaudy total guarantee, Dodgers brass immediately recognized the financial advantages. The team’s ownership — and, in fact, all other suitors except Arte Moreno and the Angels — gave instant approval.

The league calculated the contract’s true worth to be $460 million, since money in the future is less valuable than in the present. The union pegged it even lower, at just $437.8 million, using different accounting methods.

Aaron ran numbers — using a reasonable expected market rate of return, or “discount rate” on the amount of money Ohtani could have made by investing himself —that valued the contract at as little as $233 million.

“I personally think that’s in the ballpark of what he’s getting on a present-value basis,” Aaron said. “The opportunity cost to him is significant, because he could be reinvesting.”

Instead, it is the Dodgers who are best positioned to capitalize. The team has practiced financial restraint in recent years— even as it has paid luxury tax penalties in the last three seasons — but Ohtani’s contract offer came as something of a dream proposition.

There’s never been more pressure on Dodgers manager Dave Roberts to win a championship now that Shohei Ohtani has been signed.

“I wouldn’t have had the guts to propose it,” Andrew Friedman said at Ohtani’s introductory news conference.

A “roller-coaster” of emotions, as the Dodgers’ president of baseball operations described it, followed on Dec. 8, when false reports of Ohtani traveling to Toronto to sign with the Blue Jays circulated on social media. However, Dodgers officials woke up the next morning confident in their chances. That afternoon, Friedman got a call from Ohtani’s agent, Nez Balelo of CAA Sports, informing him of Ohtani’s decision.

The superstar was coming to L.A. And doing it on a relative discount, enabling ample financial possibilities.

“It definitely took some time off my life,” Friedman joked of the process.

The Dodgers’ new reality should more than compensate for it.

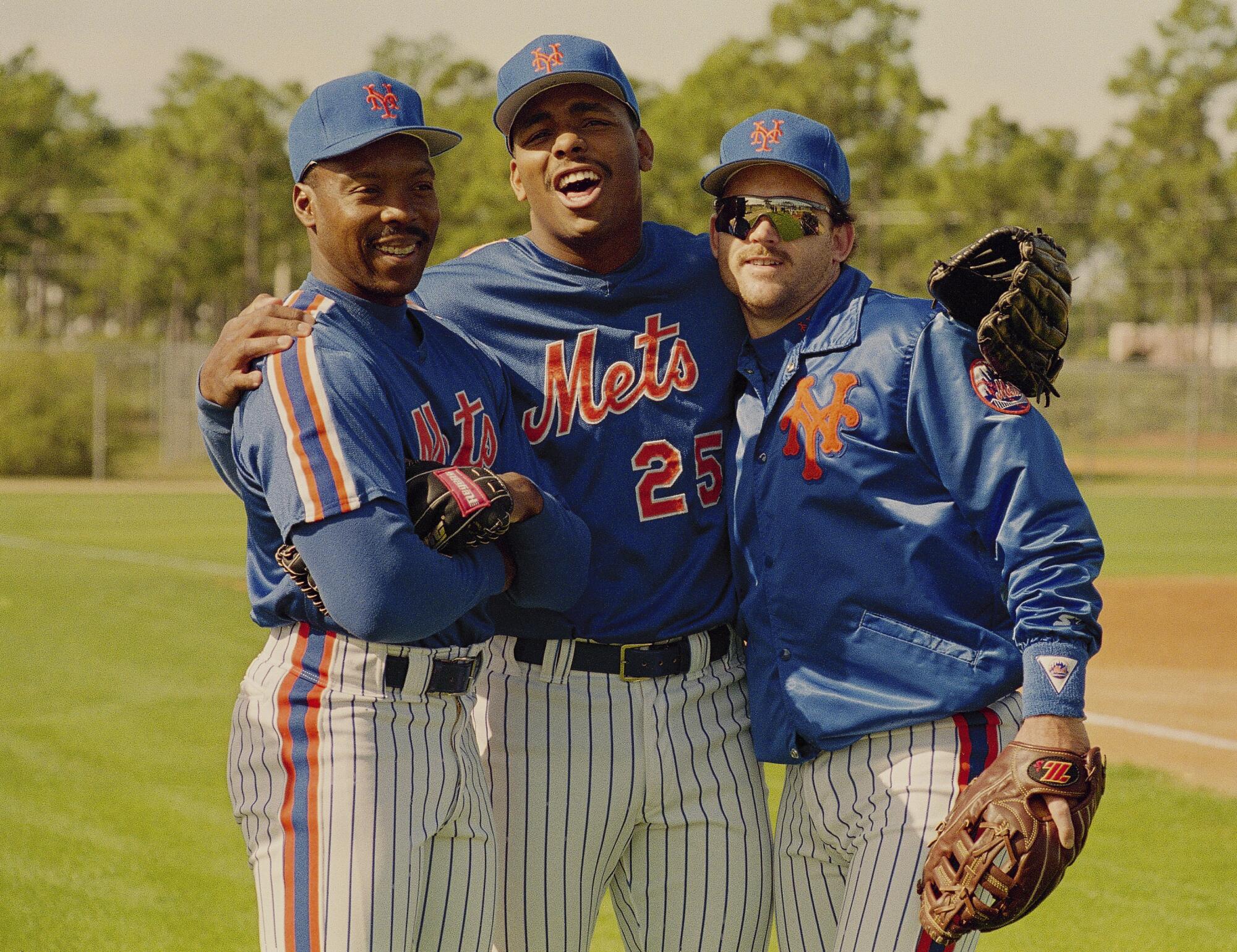

Before this offseason, the most famous deferred contract in baseball history belonged to Bobby Bonilla.

In 2000, the aging slugger was owed $5.9 million by the New York Mets. Rather than pay his salary, the team’s owner, Fred Wilpon, negotiated a buyout with Bonilla’s agent, Dennis Gilbert, that resulted in annual deferral payments of about $1.2 million (which, unlike Ohtani’s deal, included interest of 8%) from 2011 to 2035.

Technically, the Mets were quintupling the amount of money they would pay Bonilla. But, by deferring the payments, Wilpon believed he could make more investing Bonilla’s salary in the interim.

The plan backfired, because Wilpon was investing in Bernie Madoff’s Ponzi scheme.

The logic, however, was reasonable.

And nearly a quarter-century later, the Dodgers might similarly benefit off Ohtani’s deferrals.

Historically, the stock market returns 10% annually on investments. Leading firms like Guggenheim Partners hope to make even more for their clients.

If you take $680 million and compound it by 10% annually over 10 years, then in a decade you’d have roughly $1.7 billion. In the Dodgers’ case, that could mean making more than $1 billion in profits, even after paying out Ohtani’s $680 million.

In the real world, such high finance isn’t so simple, especially in the context of baseball. But it’s almost like Ohtani went to a bank (in this case, the Dodgers), told them they could keep the majority of his paychecks for the next 10 years, and didn’t request any interest when the money eventually is paid to him.

“These guys are going to write him a check every year for $2 million,” Aaron said. “Then they’re going to have the benefit of $680 million.”

In an interview with USA Today, Balelo defended his client for proposing such a contract.

“It is the most incredible act of unselfishness and willingness to win that I’ve ever experienced in my life, or ever will,” Balelo said. “He did not care at all about the present value inflation.”

The contract could provide Ohtani some tax benefits down the road, but the San Francisco Chronicle noted the possibility of the California Franchise Tax Board scrutinizing it for potential loopholes.

At the heart of the deal is an implicit agreement between Ohtani and the Dodgers: That the club use any financial boost to bolster the team during Ohtani’s tenure in L.A. That’s part of the reason Friedman and Walter were included in a “key-man” clause, enabling Ohtani to opt out of the deal if either executive leaves the organization.

Ohtani’s desire to build a winner also is why he has been so involved with the Dodgers’ recruitment of other stars this winter, taking part in a meeting with Japanese free agent Yoshinobu Yamamoto and sending a video to trade acquisition Tyler Glasnow in the last week. He is hoping the Dodgers get even more aggressive when it comes to building a roster.

The question now: Will the team-friendly structure, and new cash flows his presence likely will create, actually change the way the Dodgers operate?

So far, there have been early indications it could.

On Monday, the club introduced Glasnow as their new de facto ace, having signed the talented but injury-prone 30-year-old to a five-year, $136.5 million extension — the most the Dodgers have spent on a pitcher (aside from Ohtani) under Friedman.

The team also is believed to be considering a bid of $250 million to $300 million for Yamamoto, according to a person with knowledge of the plans but unauthorized to speak publicly, a sign of its intention to compete for another free agent attracting plenty of other big-market suitors such as the Mets and New York Yankees.

Whether this is a brief spree in the wake of the Ohtani signing, or a true recalibration of how the team plans to spend, remains to be seen.

If the Dodgers miss out on Yamamoto, it’s more likely they’ll turn back to the trade market — and not another highly-coveted free agent, such as two-time Cy Young Award winner Blake Snell — in their search for additional pitching. Corbin Burnes of the Milwaukee Brewers and Dylan Cease of the Chicago White Sox remain potential targets.

Although the team still could use another right-handed bat , the biggest-name hitter the Dodgers have been linked with is outfielder Teoscar Hernández, and that was back near the start of free agency.

Still, one agent surmised that “there should be a definite retooling” of the Dodgers’ financial approach.

Where they once were conservative with bids on top free agents, they now may afford to be bolder. Where they once were wary to surpass their internal valuations on players, they should be able to take on more risk.

“Anyone who has watched us operate over the years,” Friedman said, “we’re trying to add great players at every turn.”

Adding Ohtani, and his advantageous contract, should only enhance that capability, creating a pathway for one of MLB’s wealthiest franchises to transform, perhaps, into the sport’s predominant financial king.

More to Read

Are you a true-blue fan?

Get our Dodgers Dugout newsletter for insights, news and much more.

You may occasionally receive promotional content from the Los Angeles Times.