Drugmakers are abandoning cheap generics, and now U.S. cancer patients canât get meds

On Nov. 22, three inspectors from the U.S. Food and Drug Administration arrived at the sprawling Intas Pharmaceuticals plant south of Ahmedabad, India, and found hundreds of trash bags full of shredded documents tossed into a garbage truck. Over the next 10 days, the inspectors assessed what looked like a systematic effort to conceal quality problems at the plant, which provided more than half of the U.S. supply of generic cisplatin and carboplatin, two cheap drugs used to treat as many as 500,000 new cancer cases every year.

Seven months later, doctors and their patients are facing the unimaginable: In California, Virginia and everywhere in between, they are being forced into grim contemplation of untested rationing plans for breast, cervical, bladder, ovarian, lung, testicular and other cancers. Their decisions are likely to result in preventable deaths.

Cisplatin and carboplatin are among scores of drugs in shortage, including 12 other cancer drugs, attention-deficit/hyperactivity disorder pills, blood thinners and antibiotics. Supply chain issues left over from the COVID crisis and limited FDA oversight are part of the problem, but the main cause, experts agree, is the underlying weakness of the generic drug industry.

Made mostly overseas, these old but crucial drugs are often sold at a loss or for little profit. Domestic manufacturers have little interest in making them, setting their sights instead on high-priced drugs with plump profit margins.

Adderall, Ozempic, albuterol, antibiotics and lifesaving cancer meds are in short supply. Here are answers to some of the most pressing questions about the situation.

The problem isnât new, and thatâs particularly infuriating to many clinicians. President Biden, whose son Beau died of an aggressive brain cancer, has focused his Cancer Moonshot on discovering cures â undoubtedly expensive ones. Indeed, existing brand-name cancer drugs often cost tens of thousands of dollars a year.

But what about the thousands of patients today who canât get a drug like cisplatin, approved by the FDA in 1978 and costing as little as $6 a dose?

âItâs just insane,â said Dr. Mark Ratain, a cancer doctor and pharmacologist at the University of Chicago. âYour roof is caving in, but you want to build a basketball court in the backyard because your wife is pregnant with twin boys and you want them to be NBA stars when they grow up?â

âItâs just a travesty that this is the level of health care in the United States of America right now,â said Dr. Stephen Divers, an oncologist in Hot Springs, Ark., who in recent weeks has had to delay or change treatment for numerous bladder, breast and ovarian cancer patients because his clinic cannot find enough cisplatin and carboplatin.

Itâs just a travesty that this is the level of health care in the United States of America right now.

— Dr. Stephen Divers, an oncologist grappling with drug shortages

Results from a survey of academic cancer centers released this month found that 93% couldnât find enough carboplatin and 70% had cisplatin shortages.

âAll day, in between patients, we hold staff meetings trying to figure this out,â said Dr. Bonny Moore, an oncologist in Fredericksburg, Va. âItâs the most nauseous Iâve ever felt. Our office stayed open during COVID; we never had to stop treating patients. We got them vaccinated, kept them safe, and now I canât get them a $10 drug.â

The 10 cancer clinicians KFF Health News interviewed for this story said that, given current shortages, they prioritize patients who can be cured over later-stage patients, in whom the drugs generally can only slow the disease, and for whom alternatives â though sometimes less effective and often with more side effects â are available. But some doctors are even rationing doses intended to cure.

Isabella McDonald, then a junior at Utah Valley University, was diagnosed in April with a rare, often fatal bone cancer, whose sole treatment for young adults includes the drug methotrexate. When Isabellaâs second cycle of treatment began June 5, clinicians advised that she would be getting less than the full dose because of a methotrexate shortage, said her father, Brent.

âThey donât think it will have a negative impact on her treatment, but as far as I am aware, there isnât any scientific basis to make that conclusion,â he said. âAs you can imagine, when they gave us such low odds of her beating this cancer, it feels like we want to give it everything we can and not something short of the standard.â

Brent McDonald stressed that he didnât blame the staffers at Intermountain Health who take care of Isabella. The family â his other daughter, Cate, made a TikTok video about her sisterâs plight â were simply stunned at such a basic flaw in the healthcare system.

At Mooreâs practice in Virginia, clinicians gave 60% of the optimal dose of carboplatin to some uterine cancer patients during the week of May 16, then shifted to 80% after a small shipment came in the following week. The doctors had to omit carboplatin from normal combination treatments for patients with recurrent disease, she said.

On June 2, Moore and her colleagues were glued to their drug distributorâs website, as anxious as teenagers waiting for Taylor Swift tickets to go on sale â only with mortal consequences at stake.

She later emailed KFF Health News: âCarboplatin did NOT come back in stock today. Neither did cisplatin.â

Doses remained at 80%, she said. Things hadnât changed 10 days later.

Generics manufacturers are pulling out

The causes of shortages are well established. Everyone wants to pay less, and the middlemen who procure and distribute generics keep driving down wholesale prices. The average net price of generic drugs fell by more than half between 2016 and 2022, according to research by Anthony Sardella, a business professor at Washington University in St. Louis.

As generics manufacturers compete to win sales contracts with the big buyers, including wholesale purchasers Vizient and Premier, their profits sink. Some are going out of business. Akorn, which made 75 common generics, went bankrupt and closed in February.

Israeli generics giant Teva, which has a portfolio of 3,600 medicines, announced May 18 it was shifting to brand-name drugs and âhigh-value generics.â Lannett Co., with about 120 generics, announced a Chapter 11 reorganization amid declining revenue.

Other companies are in trouble too, said David Gaugh, interim chief executive of the Assn. for Accessible Medicines, the leading generics trade group.

The generics industry used to lose money on about a third of the drugs it produced, but now itâs more like half, Gaugh said. So when a company stops making a drug, others do not necessarily step up, he said.

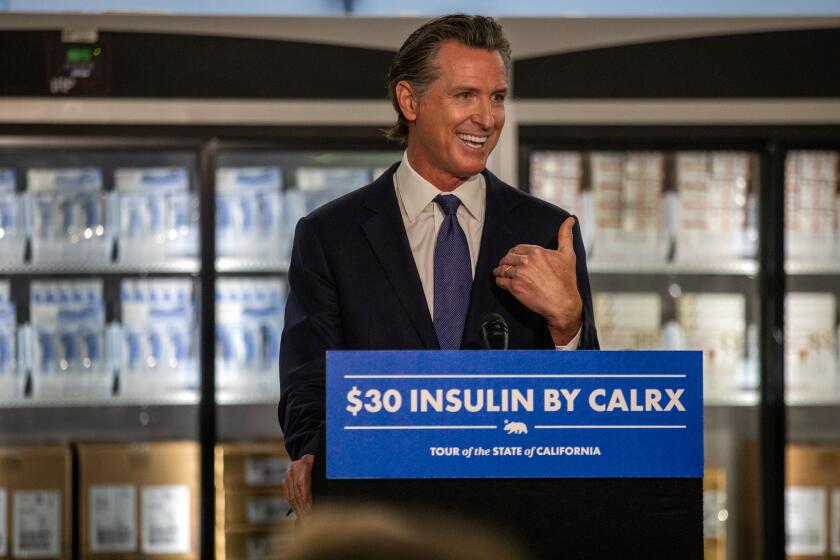

California could become the first state to develop its own line of generic drugs if Gov. Gavin Newsom signs a bill approved by the legislature Monday.

Officials at Fresenius Kabi and Pfizer said they have increased their carboplatin production since March, but not enough to end the shortage. On June 2, FDA Commissioner Robert Califf announced the agency had given emergency authorization for Chinese-made cisplatin to enter the U.S. market, but the impact of the move wasnât immediately clear.

Cisplatin and carboplatin are made in special production lines under sterile conditions, and expanding or changing the lines requires FDA approval. Bargain-basement prices have pushed production overseas, where itâs harder for the FDA to track adherence to quality standards. The Intas plant inspection was a relative rarity in India, where the FDA in 2022 reportedly inspected only 3% of sites that make drugs for the U.S. market.

Sardella, the Washington University professor, testified last month that a quarter of all U.S. drug prescriptions are filled by companies that received FDA warning letters in the past 26 months. And pharmaceutical product recalls are at their highest level in 18 years, reflecting fragile supply conditions.

The FDA listed 137 drugs in shortage as of June 13, including many essential medicines made by few companies.

TikTok has helped fuel a trend of doctors prescribing the drug off label to people for weight loss, leading to a medication shortage for diabetic patients.

Intas voluntarily shut down its Ahmedabad plant after the FDA inspection, and the agency posted its shocking inspection report in January. Accord Healthcare, the U.S. subsidiary of Intas, said in mid-June it had no date for restarting production.

Asked why it waited two months after its inspection to announce the cisplatin shortage, given that Intas supplied more than half the U.S. market for the drug, the FDA said via email that it doesnât list a drug in shortage until it has âconfirmed that overall market demand is not being met.â

Prices for carboplatin, cisplatin, and other drugs have skyrocketed on the so-called gray market, where speculators sell medicines they snapped up in anticipation of shortages. A 600-milligram bottle of carboplatin, normally available for $30, was going for $185 in early May and $345 a week later, said Richard Scanlon, the pharmacist at Mooreâs clinic.

âItâs hard to have these conversations with patients â âI have your dose for this cycle, but not sure about next cycle,ââ said Dr. Mark Einstein, chair of the Department of Obstetrics, Gynecology and Reproductive Health at Rutgers New Jersey Medical School.

Should government step in?

Despite a drug shortage task force and numerous congressional hearings, progress has been slow at best. The 2020 CARES Act gave the FDA the power to require companies to have contingency plans enabling them to respond to shortages, but the agency has not yet implemented guidance to enforce the provisions.

As a result, neither Accord nor other cisplatin makers had a response plan in place when Intasâ plant was shut down, said Soumi Saha, senior vice president of government affairs for Premier, which arranges wholesale drug purchases for more than 4,400 hospitals and health systems.

Premier understood in December that the shutdown endangered the U.S. supply of cisplatin and carboplatin, but it also didnât issue an immediate alarm, she said. âItâs a fine balance,â she said. âYou donât want to create panic. buying or hoarding.â

The contract with the nonprofit generic pharmaceutical manufacturer Civica would make insulin the first generic drug produced and sold under Californiaâs own label next year.

More lasting solutions are under discussion. Sardella and others have proposed government subsidies to get U.S. generics plants running full time. Their capacity is now half-idle. If federal agencies like the Centers for Medicare and Medicaid Services paid more for more safely and efficiently produced drugs, it would promote a more stable supply chain, he said.

âAt a certain point the system needs to recognize thereâs a high cost to low-cost drugs,â said Allan Coukell, senior vice president for public policy at Civica Rx, a nonprofit funded by health systems, foundations and the federal government that provides about 80 drugs to hospitals in its network. Civica is building a $140-million factory near Petersburg, Va., that will produce dozens more, Coukell said.

At a certain point the system needs to recognize thereâs a high cost to low-cost drugs.

— Allan Coukell, senior vice president for public policy at Civica Rx

Ratain and his University of Chicago colleague Dr. Satyajit Kosuri recently called for the creation of a strategic inventory buffer for generic medications, something like the Strategic Petroleum Reserve, set up in 1975 in response to the OPEC oil crisis.

In fact, Ratain reckons, selling a quarter-million barrels of oil would probably generate enough cash to make and store two yearsâ worth of carboplatin and cisplatin.

âIt would almost literally be a drop in the bucket.â

This article was produced by KFF Health News, formerly known as Kaiser Health News, a national newsroom that produces in-depth journalism about health issues.