The road to student loan forgiveness

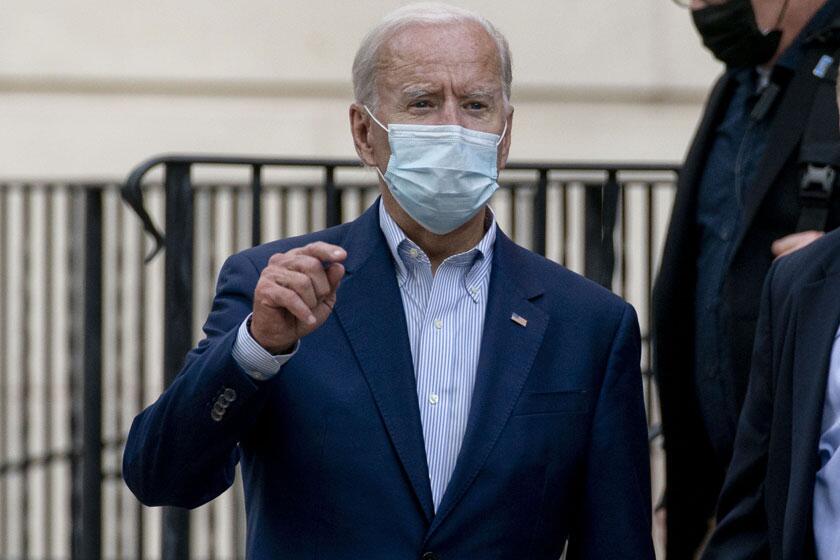

On Wednesday, President Biden announced that $10,000 of student loan debt per borrower will be forgiven for individuals earning less than $125,000 annually.

People who received Pell grants will be eligible for up to $20,000 in loan relief, Biden said in a tweet. The president will also extend a pause on loan repayments for all borrowers through the end of the year.

Pressure from the public ā and fellow Democrats ā to cancel student debt has been constant since Biden took office.

On the campaign trail in 2020, Biden made a pledge to cancel a minimum of $10,000 of student debt per person. At that point, then-President Trump had announced a pause on student loan payments due to the coronavirus pandemic ā the first of many to come.

Last year, President Biden said at a CNN town hall that he questioned whether he had the legal authority to write off the level of debt some Democrats in Congress were pushing for. āIām prepared to write off a $10,000 debt,ā but not $50,000, he said. āBecause I donāt think I have the authority to do it by signing the pen.ā

The president will also institute an income-based repayment cap that will allow borrowers to pay no more than 5% of their monthly income toward their loans as long as they arenāt behind on payments. Some analysts see the change as more significant than the debt forgiveness.

Hereās how we got here.