Trump budget underscores new national priorities: slashing the safety net and taxes

Reporting from Washington â Even President Trump distanced himself from his inaugural budget, literally, as it was released on Tuesday while he was overseas. Republicans in Congress said they will write their own, and Democrats uniformly condemned the $4.1-trillion plan for its proposed mix of big tax cuts for the wealthy and benefits cuts for the poor and working class.

With his budget for the fiscal year starting Oct. 1, Trump has provided fiscal details that could hardly be more at odds with the bold but vague populism of his campaign. It proposes a reordering of the nationâs priorities, ending the decades-old parity between annually appropriated military and domestic spending to favor Defense and slash much else, especially the safety-net programs keeping millions of Americans â including many Trump supporters â out of poverty.

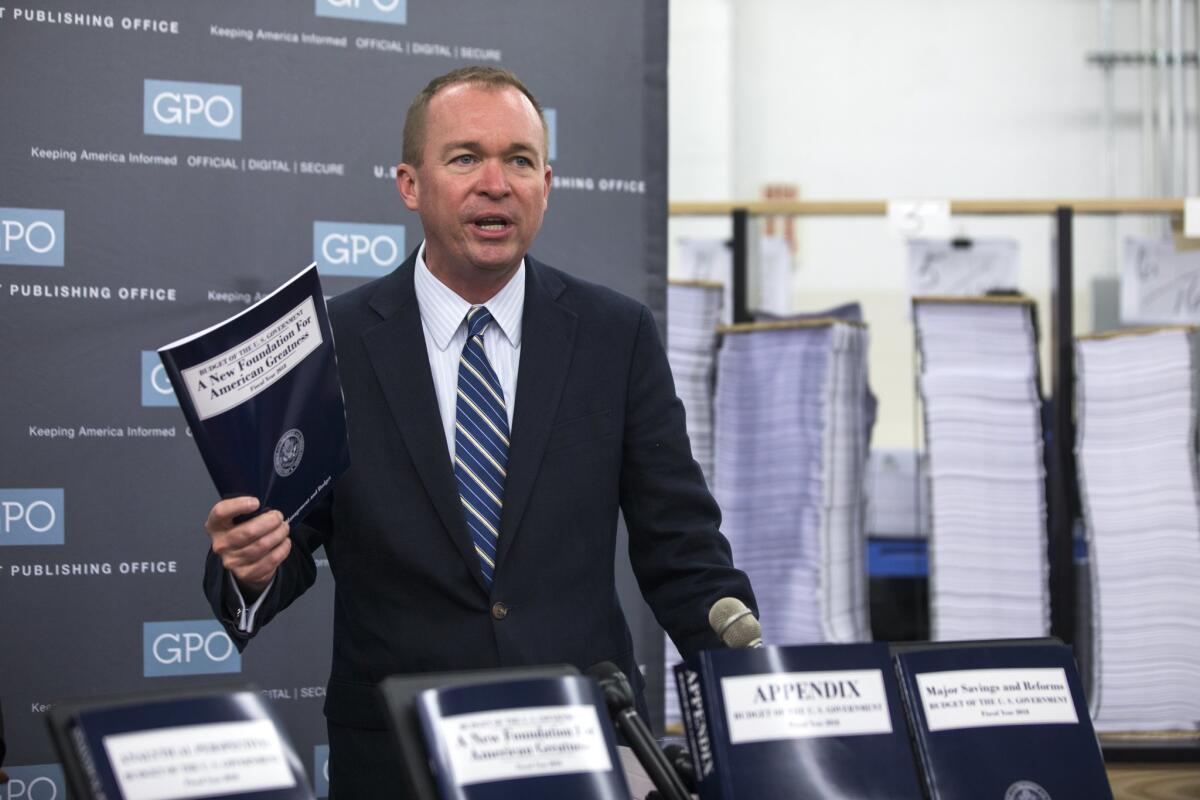

In some ways, Trumpâs budget â titled âA New Foundation for American Greatnessâ â suggests the sort of outrageous opening bid he has boasted of in his real estate deals.

Congress will likely reject the most dramatic spending cuts, as it did his partial âskinny budgetâ for the current fiscal year, along with particulars such as his infrastructure initiative. Still, the broad outlines of the Trump budget could well inform the contours of what a Republican-controlled Congress eventually passes: reduced taxes, increased Pentagon spending and deep cuts in the full range of domestic spending, including Medicaid, nutrition and housing services, medical research, education and air traffic control.

âClearly, Congress will take that budget and then work on our own budget, which is the case every single year,â House Speaker Paul D. Ryan (R-Wis.) said, playing down Republicansâ arms-length reception. âBut at least we now have common objectives.â

Democrats easily were united in opposing a plan that would, among much else, cut $616 billion over 10 years from the Medicaid program for low-income and disabled Americans and the Childrenâs Health Insurance Program. Trump had promised as a candidate to leave Medicaid untouched, along with Medicare and Social Security, though those fast-growing entitlement programs are a main contributor to projections of future federal debt.

The Senate Democratic minority leader, Charles E. Schumer of New York, lambasted the budget as conservative âfantasy.â

âWhat is going on in the White House with this kind of budget?â Schumer asked. âHow many people in America want to cut cancer research? President Trump evidently does.â

But White House budget director Mick Mulvaney, who over two days orchestrated the budgetâs rollout in Trumpâs absence, on Tuesday lashed out at critics who said the budget showed a lack of compassion.

âCompassion needs to be on both sides of that equation,â he said. âYes, you have to have compassion for folks who are receiving the federal funds, but you also have to have compassion for the folks who are paying it.â

That Trump was far from Washington for his inaugural budgetâs unveiling was yet another way in which his presidency is breaking with traditions and norms. Typically, first-year presidents have been prominent in introducing what is their most important statement of national priorities, whatever its fate in Congress.

Even some Republicans did not take seriously the administrationâs claim to reach balance in 10 years, with a small $16-billion surplus by 2027. Critics assailed the budgetâs exceedingly sunny projections for economic growth to be spurred by tax cuts, especially considering that Trump has not yet spelled out his tax plan and â as his Treasury secretary, Steven Mnuchin, acknowledged on Tuesday â it would not get out of Congress this year in any case.

Also, the budget was faulted for being gimmicky in gilding its bottom lines. The administration counts $2.1 trillion in additional revenue over 10 years from a booming economy growing at 3% annually after 2019 â more than a percentage point higher than other government and private forecasters. But missing from the budget baselines are the direct costs in foregone revenues from cutting corporate and individualsâ taxes. Critics, including former Treasury Secretary Lawrence H. Summers, called that double-counting.

âYou canât use the same money twice,â said Marc Goldwein, a senior vice president for the Committee for a Responsible Federal Budget, a nonpartisan group that advocates for fiscal restraint.

Administration officials have said Trumpâs tax overhaul will be ârevenue neutralâ â that is, it will neither add to federal debt nor reduce it. Yet Trump has not identified what tax deductions, credits and other breaks he would repeal to offset the losses from slashing corporate and individual rates.

Reflecting Trumpâs hard-power emphasis over the so-called soft power of diplomacy and foreign assistance, his budget would increase Defense spending 10% in next yearâs budget, or $54 billion, while funding for the State Department and U.S. Agency for International Development would be cut by roughly 30%.

Among the few spending increases proposed are one for Trumpâs infrastructure initiative and down payments for his immigration crackdown and âbeautiful wallâ on the countryâs southern border.

The budget calls for $200 billion to be leveraged to entice private investors to underwrite a total $1 trillion in public works projects. While there is bipartisan support for improving the nationâs roads, airports, waterways, ports and other infrastructure, Trump provided few details of how his plan would work, and the 5-to-1 return on the governmentâs investment is widely seen as overly optimistic.

Democrats were disdainful, though Trump must get votes from some of them to offset opposition from anti-spending Republicans for the initiative.

âItâs a series of words and numbers that are not attached to reality,â said Rep. John Garamendi (D-Walnut Grove), a member of the House Transportation and Infrastructure Committee. What is more, he added, the administration is proposing to cut the agencies that oversee public works, such as the departments of Energy and Agriculture and the Army Corps of Engineers.

For border security, the budget includes $2.6 billion to add ground sensors, cameras and other technology for stopping illegal crossings; to build 74 miles of wall along the 2,000-mile border with Mexico, and to finance studies for further expansions. It also seeks increases to hire 500 Border Patrol agents, 1,000 deportation officers and 450 new attorneys and support workers for the immigration courts, which are now clogged with a backlog of 560,000 cases.

The presidentâs budget arrives on Capitol Hill as Congress is already confronting a fiscal morass given Republicansâ infighting over repealing the Affordable Care Act and overhauling the tax code. Four months out, speculation has started about a government shutdown after Oct. 1, the start of fiscal year 2018, given Republicansâ challenges in passing a budget to maintain operations.

âUltimately,â said Sen. John Cornyn of Texas, a Republican leader, âwe will have to come up with a budget ourselves.â

JoeTanfani and Tracy Wilkinson in Washington contributed to this report.

Twitter: @ByBrianBennett

ALSO

Economists say Trumpâs budget proposal doesnât add up

Winners and losers in Trumpâs budget proposal

Travel leaders say Trumpâs budget would kill program that promotes trips to the U.S.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.