Opinion: Is the FBIâs investigation of Richard Burr political retribution? No. He earned it all by himself

Itâs been a tough 24 hours for Sen. Richard Burr (R-N.C.), but hereâs one bright spot: Apple just recently released a much less expensive version of the iPhone.

Burr needs a new one because the FBI seized his iPhone on Wednesday evening, advancing its investigation into whether the senator illegally used knowledge gleaned from private briefings to make timely stock trades. Burr announced Thursday morning that he would step down as chairman of the Senate Intelligence Committee until the probe was completed.

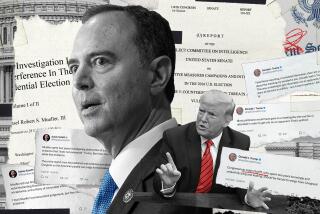

Per federal policy, the FBI could not have sought the warrant to seize evidence from a sitting senator without the approval of top Justice Department officials. Conspiracy theorists quickly tied that fact to another one: Burr is chairman of the Senate Intelligence Committee, which has been working on the fifth and final volume of its lengthy report on Russian meddling in the 2016 presidential election.

The previous volume, which was bipartisan (in sharp contrast to the competing Republican and Democratic analyses by the House Intelligence Committee), defended the U.S. intelligence communityâs work and its conclusion that Russia had attempted to swing the 2016 election in Donald Trumpâs favor. The next one may be even more politically charged; it will contain the committeeâs own counterintelligence findings related to Russian meddling and the Trump campaign.

Burrâs imprimatur on the previous reports undermined Trumpâs argument that the investigation into Russian meddling was the fruit of a Democratic plot. Hence the suspicion that Trumpâs political appointees atop the Justice Department wanted to sideline him.

Call me naive, but I find it impossible to believe that the Justice Departmentâs leadership is corrupt enough to sic the FBI on a senator just because he might issue a report the president wonât like. (OK, I just opened the floodgates with that one.) The committeeâs reports, as weighty as they were, made little more than a ripple in the publicâs consciousness.

The presidentâs new campaign slogan, âTransition to Greatness,â just âcame outâ of him, he says. It should go right back.

Instead, Burrâs problem is his own behavior: He and his wife dumped shares in 21 different companies worth between $628,000 and $1.7 million in mid-February, about a week before the stock market started tanking in response to the COVID-19 pandemic. The move saved Burr from incurring significant losses in his investments, at least on paper. But it reaped a whirlwind of public scorn (and, apparently, an FBI investigation) because, as Times reporters Del Quentin Wilber and Jennifer Haberkorn noted, âBurr and other senators received briefings from U.S. public health officials before the stock sales.â

Burrâs stock sales, which he said were based solely on publicly available news reports, also contrasted with a Feb. 7 op-ed heâd co-written that extolled how ready the United States was to meet the challenge posed by the new coronavirus. âThe public health preparedness and response framework that Congress has put in place and that the Trump administration is actively implementing today is helping to protect Americans,â Burr wrote with Sen. Lamar Alexander (R-Tenn.).

As I argued after Burrâs stock sales were first reported in March, the episode illustrates why it makes no sense for lawmakers to own stocks in individual companies. Several of Burrâs holdings were in hotel and lodging companies threatened directly and severely by the pandemic. He may believe in his heart of hearts that he dumped much of his stock portfolio because of news reports, but the public canât help but suspect that the briefings that he got as Intelligence Committee chairman played a factor. You simply canât avoid the perception problem created by lawmakers trading stocks in individual companies.

Republicans have pointed to stock sales by Richard Blum, Sen. Dianne Feinsteinâs husband, as problematic too; an active trader, Blum sold a total of up to $6 million worth of a pharmaceutical companyâs shares in two installments on Jan. 31 and Feb. 18. Feinsteinâs office told the San Francisco Chronicle on Thursday that federal agents had questioned her about the trades in April, but there had been no follow-up since then. Although those sales, unlike Burrâs, typified Blumâs activity in the market, the reaction illustrates that spousal trading in individual stocks can shake the publicâs faith as well.

Requiring lawmakers to suspend all stock sales and purchases while theyâre in office would solve the problem posed by trades, but not the conflicts caused whenever a lawmaker has to vote on legislation that would have a particularly acute effect on a company he or she is invested in. So a better solution is to require members of Congress either to put their holdings in a blind trust or to invest only in diversified mutual funds, such as index funds.

Lawmakers arenât expected to take a vow of poverty to serve the public. But they are expected to avoid conflicts of interest, real or perceived. Congress needs to give its members a choice: Either convert your individual company stocks into investments that canât pose conflicts, or find another profession.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.