Opinion: The Trump tax cut has amounted to nothing but broken promises for the middle class

- Share via

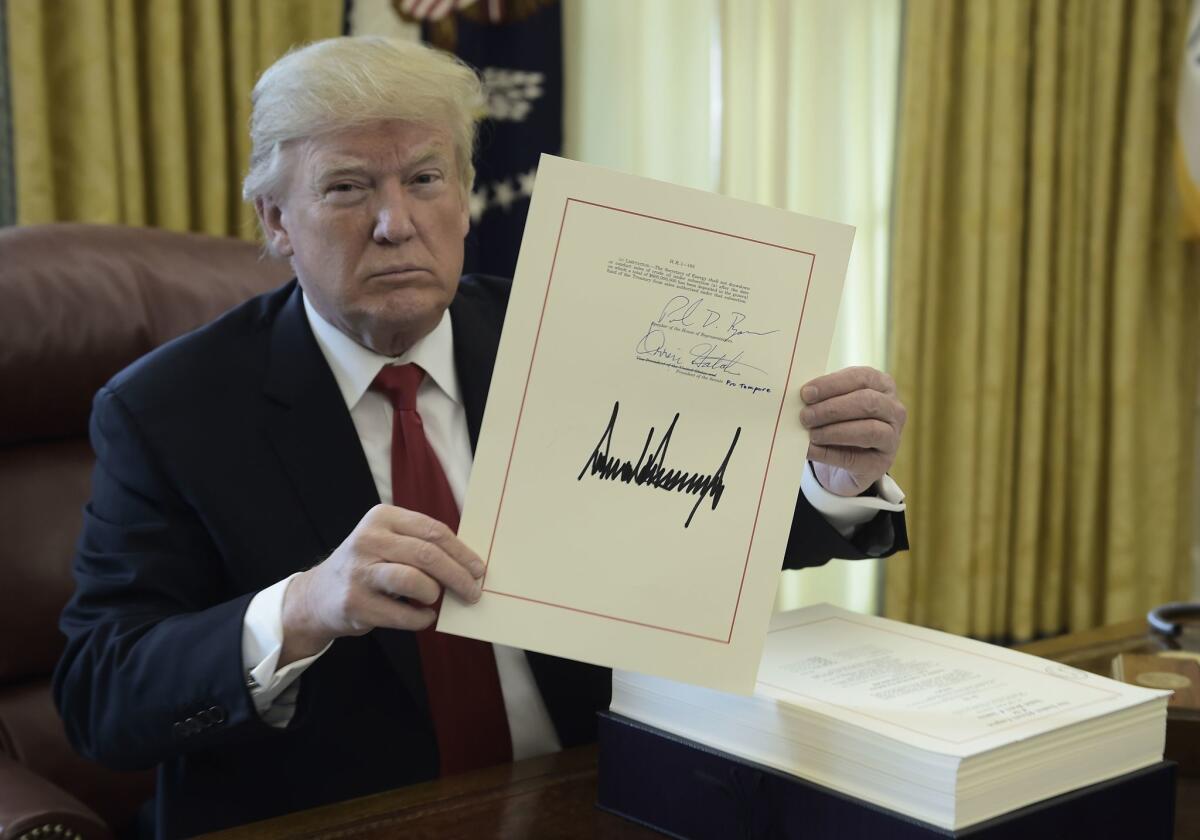

President Trump’s radical Tax Cuts and Jobs Act, which took effect Jan. 1, 2018, has now been around long enough for a fair assessment. The verdict’s not good. The second anniversary is an apt time to review some of the law’s biggest failures — especially since the president is inviting more trouble by considering another tax-cut boondoggle as an election-year ploy.

Rushed through Congress by a Republican majority, the Trump-GOP tax cuts were promoted as a boon for the middle class. Yet in 2020, according to the Institute on Taxation and Economic Policy, the richest 1% of taxpayers will get an average tax cut of around $50,000, 75 times more than the average cut for the bottom 80%.

One big reason the law is so skewed toward the wealthy is that it gives corporations huge tax breaks. It’s primarily the wealthy who own corporations through their stock holdings.

Thanks to loopholes and the cut itself, tax collections from corporations in the first year of the new law collapsed. ITEP found that the effective corporate tax rate for 379 profitable Fortune 500 corporations was just 11.3% last year. That’s about half the rate Trump’s new law established, which slashed the previous rate by 40%. More than 90 corporate titans — including Amazon, Chevron, FedEx, IBM, General Motors and Netflix — paid zero in federal income taxes last year.

The flip side of the phony claim that the tax cuts were targeted at the middle class was the equally false idea that they wouldn’t help rich people such as Trump, who asserted that his law would “cost me a fortune.” But Trump and his family have undoubtedly benefited by millions of dollars from at least five features of the law, ranging from lower top tax rates to a weakened estate tax. Of course, we can’t be sure exactly how much they’ve saved because Trump refuses to release his tax returns.

Trump promised his corporate tax cuts would result in an average pay raise of $4,000 for working families. His top economic advisor more than doubled down on that guarantee, saying the raise could be $9,000 and that higher wages would quickly follow passage of the plan.

Census data show that median family income instead grew by about $500 in the first year after the tax cuts, the smallest annual increase in five years. A close look at Bureau of Labor Statistics figures shows that the growth rate in wages was just 0.4% in the two years since the tax cut. Compare that with wage growth of 0.7% in the last two years of President Obama’s administration.

Just as the wealthy got the biggest share of the individual tax cuts, big firms grabbed the bulk of tax cuts supposedly targeted at small businesses. In 2018, owners of the elite group of non-corporate businesses that earned more than $1 million received nearly half the benefits from the part of the law touted as a small-business tax cut. Enterprises with profits of less than $200,000 a year — the coffee shops and independent web designers most of us picture when we hear “small business” — got less than a quarter of the cuts.

The tax cuts’ overwhelming benefits for the wealthy and multinational corporations might not be so bad if they goosed the economy as promised. But those promises have been broken, too.

Trump predicted the economy — boosted by the “rocket fuel” of his tax cuts — would grow as fast as 6%. Instead, annual growth hasn’t even reached 3% since the tax plan was enacted, a performance in line with the half-dozen years under President Obama before taxes were cut. If the current pace continues, fewer jobs will be created in 2019 than any year since the tail end of the Great Recession.

Business investment, which was supposed to experience a tax-cut-fed boom, has instead gone bust: Government data and stock market indices show that the rate of growth has generally trended down and has recently fallen into negative territory. Instead of investing in job-creating business ventures, corporations used their tax cuts to further enrich top executives and other wealthy shareholders with record stock buybacks — 50% more than the year before the tax cuts.

Republicans assured us their tax cut would “pay for itself” because economic growth would generate higher revenue from lower rates. Instead, federal debt has exploded: This year’s deficit of almost $1 trillion is up by half from the year before the tax cuts and about double the average deficit in Obama’s last three years.

Unless you’re a millionaire, the second birthday of the Trump-GOP tax cuts is nothing to celebrate.

Frank Clemente is executive director of Americans for Tax Fairness. William Rice is the organization’s senior writer.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.