The good reasons behind those Obamacare policy cancellations

- Share via

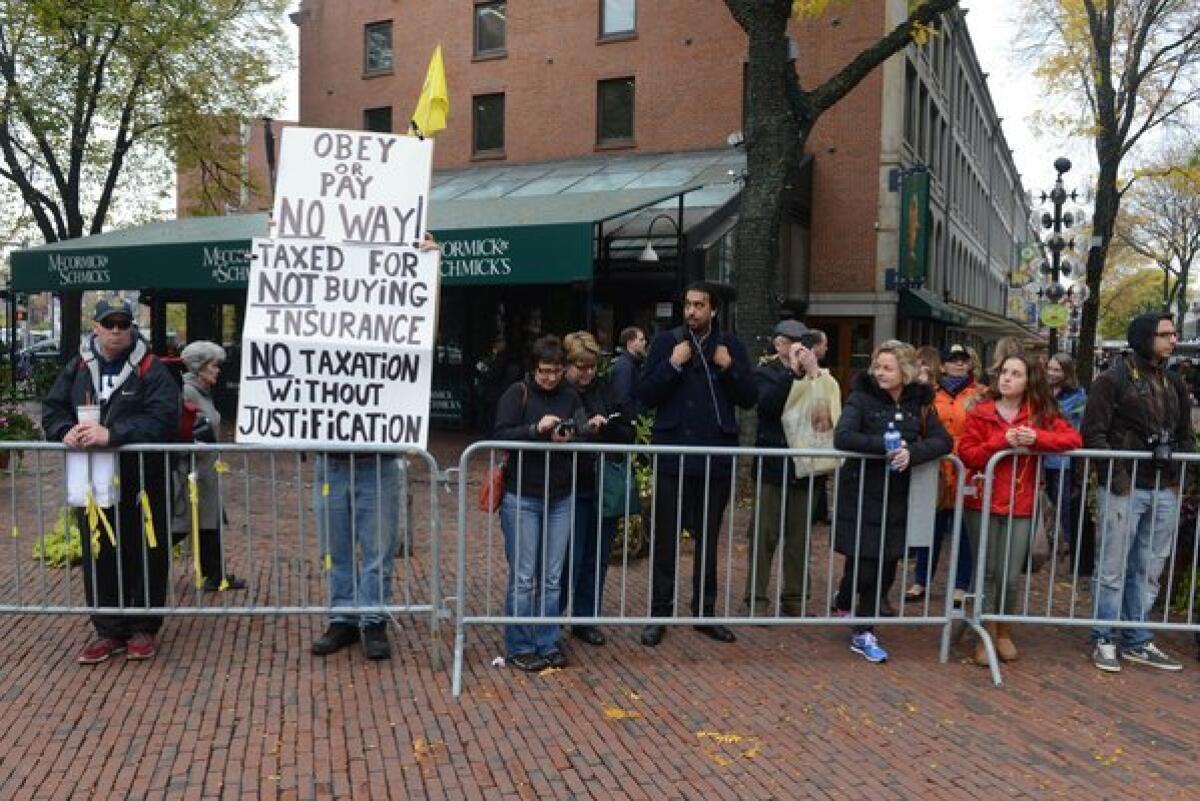

One of the (many) criticisms being leveled at the 2010 healthcare law is that it has caused insurers to cancel the policies covering thousands of Americans. The two main themes here are that President Obama lied when he said people would be able to keep their health plans, and that many insured Americans are being forced to trade low-cost policies for expensive ones.

Little is being said, however, about why those policies are being canceled and whether that’s a good thing.

One of the main reasons, at least in other states, is that the policies don’t include coverage for the 10 essential benefits specified in the Patient Protection and Affordable Care Act, particularly maternity care, drug treatment and mental health services. A survey by the Department of Health and Human Services found that as of the end of 2011, 62% of the people enrolled in individual plans didn’t have coverage for maternity services, 34% for substance abuse and 18% for mental health.

I can hear it now: “But I’m never going to get pregnant, so why should I have to pay for maternity coverage?” For the same reason that someone who doesn’t drink should still contribute to the cost of your hospitalization for cirrhosis of the liver. Insurance is about pooling risk.

Or at least that’s what it should be about. But insurers have worked aggressively to tune their products to exclude risks and avoid costs. That’s why they offer policies that don’t include maternity coverage -- so they won’t enroll women of childbearing age, or if they do, they won’t have to pay for any pregnancy-related costs.

In California, individual plans typically met the essential benefits requirement because state lawmakers had already mandated inclusion of such things as maternity care and mental health services. Which leads us to the second main reason for cancellation: The plans didn’t meet the Affordable Care Act’s requirement to cover 60% of the cost of the services obtained and limit out-of-pocket costs to $6,350 per individual and $12,700 per family.

A study published last year in Health Affairs found that a little more than half of the people had plans that covered, on average, only 52% of their costs. And while the percentage was higher for the families with the highest medical bills, those families had out-of-pocket costs that were 22% to 116% above the limit set by the Affordable Care Act.

In short, these are the sort of plans that can surprise policyholders -- and not in a good way -- when they submit medical bills for payment. Alternatively, they may have sky-high deductibles that force the policyholder to pay for thousands of dollars’ worth of treatment before the benefits kick in. In California, the General Accounting Office found, the median individual plan had an out-of-pocket maximum of $7,500 for a 30-year-old nonsmoker and $15,000 for a 55-year couple. The median plan for a family of four headed by two 40-year-old parents had a deductible of $15,000 and an out-of-pocket limit of $21,000. Those are medians, and none complies with the 2010 law.

Of course, there are plenty of people who have chosen high-deductible policies because they’re willing to assume the risk. In essence, they’re betting on their ability to stay free of major illness or injury. And it rankles them when the nanny state tells them they’re not allowed to make that call.

But there’s a good reason why the law barred anyone over age 30 from signing up for that sort of high-deductible “catastrophic” coverage unless they can’t afford any other type of policy. Catastrophic plans attract the healthiest customers who impose the lowest cost on insurers. If they’re not in the same risk pool as the people who carry comprehensive coverage, that will drive up the latter’s premiums. Insurers, meanwhile, will be tempted to minimize their presence in the market for comprehensive plans and maximize their share in the catastrophic ones.

Nevertheless, the advantage to high-deductible plans is they lead consumers to be more careful shoppers for health services than they are today. When you have to pay the first several thousand dollars’ worth of medical bills, you’re going to be a lot more interested in the differences in the prices charged by various hospitals and medical groups. (For those of you with a conventional health plan, ask yourself when was the last time you asked a healthcare provider how much it would cost to provide the treatment you needed.) You may also be more motivated to stay healthy by avoiding risky behavior.

Democrats have never been fans of high-deductible plans and health savings accounts, so it’s no surprise that they are so strongly disfavored by the 2010 law. And given the interest in pool risks and sharing costs in the individual market, it may have been tough to include such plans in the mix. Nevertheless, as lawmakers work to improve the act -- assuming they stop trying just to kill it -- that’s a change worth exploring.

ALSO:

Jailhouse math: The Conrad Murray case

Democrats scramble to cancel insurance cancellations

Throw out Obamacare? Yes, and give us a single-payer system.

Follow Jon Healey on Twitter @jcahealey and Google+

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.