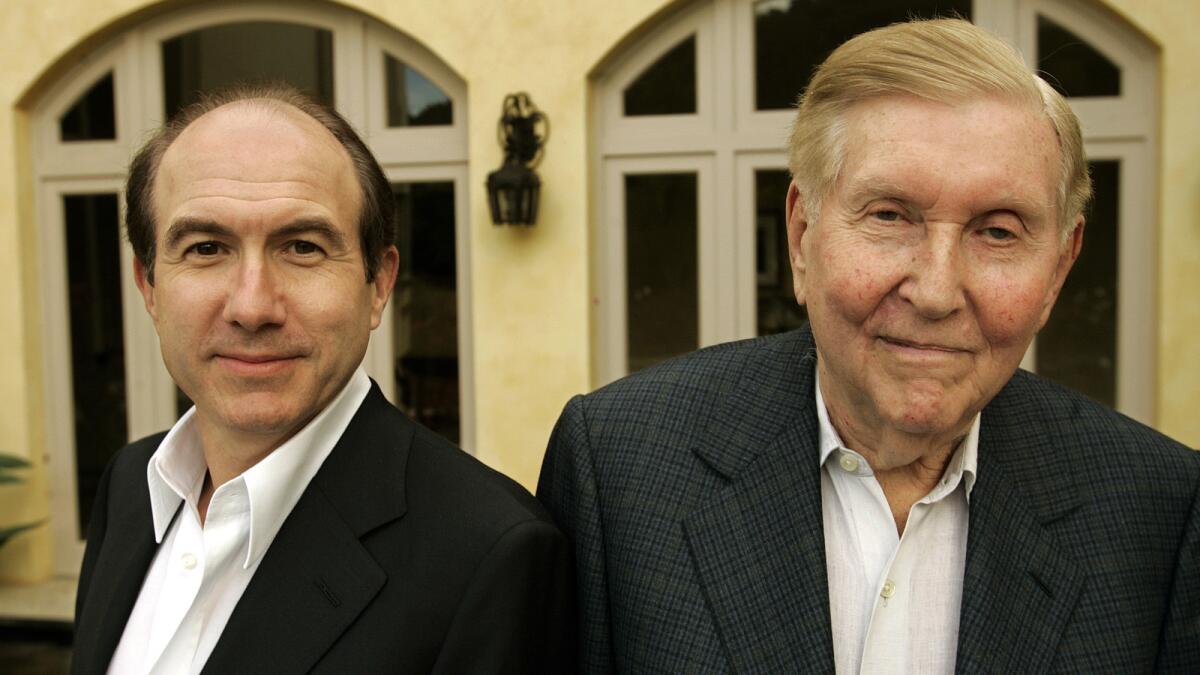

Media mogul Sumner Redstone, whose empire included Viacom and CBS, dies at 97

- Share via

In 1979, Sumner Redstone was trapped in a deadly fire. He fled his third-floor hotel room at Boston’s Copley Plaza by crawling out of a window, then crouching on a narrow ledge as flames seared his flesh.

“The pain was excruciating but I refused to let go,” Redstone would later write.

He suffered third-degree burns over 45% of his body. He endured months in the hospital, numerous skin-grafting surgeries and rehabilitation to learn to walk again. The fire didn’t change him, he would later say, but the recovery proved his grit and determination.

Over the years, Redstone outmaneuvered rivals to assemble one of America’s leading entertainment companies, now called ViacomCBS, which boasts CBS, Comedy Central, MTV, Nickelodeon, BET, Showtime, the Simon & Schuster book publisher and Paramount Pictures movie studio.

“The will to survive is the will to win, too,” he told The Times in 2000.

Redstone died Tuesday at his home in Los Angeles at the age of 97, National Amusements, the Redstone family’s private holding company, announced.

CBS and Viacom finally agreed to reunite, cementing Shari Redstone as one of the most powerful business women in America.

The mogul had been in poor health. His final years and legacy were tarnished by scandals at his companies and tawdry allegations in his personal life. A former girlfriend alleged in a 2015 lawsuit that Redstone had lost his mental capacity and that others were manipulating him for personal gain. The suit, which was dismissed, focused a harsh light on the fierce power struggles, personal slights and insatiable appetite that were hallmarks of the pugnacious billionaire.

His lasting imprint will be his role in accelerating media consolidation and his battles to build, then maintain the empire he constructed over three decades. He ran the family’s Massachusetts regional movie theater chain, National Amusements, until he was in his early 60s. He then embarked on a spectacular buying spree that culminated with control of Viacom, parent of the cable channels, Paramount Pictures and America’s most-watched network, CBS.

Redstone coined the phrase “content is king,” and he firmly believed that companies that produced the most popular movies and TV shows, including “Star Trek,” “60 Minutes,” “NCIS” and “SpongeBob SquarePants,” would always be more valuable than distribution channels.

Unlike contemporaries Rupert Murdoch and Ted Turner, Redstone was not a visionary driven by a passion to influence media or by a fascination with technology. Rather, he was a hard-charging lawyer and iron-willed deal maker who loved the limelight, the stock market and the attention of women. He pursued power and wealth through the accumulation of content companies.

Along the way, he bullied and bulldozed trusted deputies, business rivals, family members and, at times, even his own children.

In recent years, he and his daughter, Shari Redstone, triumphed in bitter boardroom clashes at Viacom and CBS. They ousted entrenched executives and board directors who had long been among Redstone’s closest friends. With those foes gone, Shari Redstone in December achieved her goal of reuniting Viacom and CBS after 13 years of separation.

“My father led an extraordinary life that not only shaped entertainment as we know it today, but created an incredible family legacy,” Shari Redstone said Wednesday in a statement. “Through it all, we shared a great love for one another and he was a wonderful father, grandfather and great-grandfather.”

In the end, Sumner Redstone was a shell of his former self, a virtual prisoner in his Mediterranean-style mansion in the Beverly Park neighborhood that overlooks Beverly Hills. Forbes estimated his worth at $3 billion — less than half what it was just six years ago. He was unable to speak intelligibly because of vocal cord damage, sustained in the fire, a condition that worsened with age.

In his 2001 autobiography, “A Passion to Win,” Redstone wrote that media touches “the hearts and minds” of millions and, in his estimation, no other company could match his “for its effect on lives all over the world.” But his boast did not stand the test of time. ViacomCBS now is a medium-sized player, dwarfed by Walt Disney Co., Comcast, AT&T and technology titans Netflix, Amazon, Google and Facebook.

Sumner Murray Rothstein was born in Boston on May 27, 1923, the first of two sons of Belle Ostrovsky and Max Rothstein. Fear of anti-Semitism drove his father to change the family name to Redstone in 1940, just after Nazi Germany began its march through Europe.

Max Rothstein, who took the name Michael Redstone, sold linoleum out of the back of a truck. Later, he became a restaurant and nightclub owner. With his earnings, he bought land for drive-in movie theaters and opened the first in 1936 on Long Island, N.Y. Soon, this new form of entertainment became more lucrative than nightclubs.

His father was tough, but it was Redstone’s demanding mother who pushed her oldest son to achieve.

“If I was supposed to practice [the piano] for one hour, she would sneak in and put the clock back 30 minutes so that I would actually play for an hour and a half,” Redstone wrote in his book.

The family was known for its caustic relationships. Redstone endeavored to please his mother and would later complain that “nothing was ever good enough for her.”

He excelled academically, earning high grades at the rigorous Boston Latin School, where he was the president of the debate team and graduated at the top of his class.

“There was only one Number One and that had to be me,” Redstone wrote.

His intelligence, tenacity and photographic memory made Redstone a formidable foe. He studied foreign languages at Harvard College and was recruited to join a special intelligence group that worked to break Japan’s military and diplomatic codes during World War II. Redstone graduated from Harvard in 1944 and was admitted to Harvard Law School.

He earned his law degree and married Phyllis Raphael, whom he had met at a temple dance. After stints with the U.S. Court of Appeals and as a special assistant to the U.S. attorney general, Redstone joined a prominent law firm. He once argued a case before the U.S. Supreme Court, and a few years later, the mobster Bugsy Siegel tried to hire him. But Redstone declined.

Redstone would ditch his job as a Washington tax attorney in 1954 to go to work for his father at Northeast Theater Corp., which owned three drive-in theaters.

Redstone tussled with zoning boards, business rivals and suppliers. By the 1960s, the family firm had grown to more than 40 theaters. The company began converting some into indoor complexes, recognizing that it could multiply its revenue by showing several films at the same time on different screens. Redstone even trademarked the word “multiplex.”

When Redstone believed that Hollywood studios were gouging cinemas by charging exorbitant fees for films, he waged a 15-year battle that ultimately changed how movies were parceled out to theaters.

By the early 1980s, Redstone recognized that home videocassettes and cable TV would hurt the theater business. He saw an opportunity to be a major player. In 1986, at the age of 63, he mounted a hostile takeover of Viacom, which owned cable TV systems and cable channels, including Nickelodeon and another upstart, MTV, which played music videos.

He agreed to pay $3.4 billion, borrowing heavily to pull off the 1987 deal, saying, “I bet my life on Viacom.”

The purchase transformed Redstone and his holdings, but he wanted more. In 1993, while lieutenants were negotiating to buy NBC and CNBC from General Electric, they got a call from Redstone. He had just heard Paramount Pictures was in play and, although NBC appeared to be a better deal, Redstone wanted Paramount.

“Paramount was the only studio that gave him the time of day when he was a small theater circuit owner,” the late Frank Biondi, former Viacom chief executive, would later say. “It was like the Yankee bat boy growing up and buying the Yankees.”

For six months, Redstone fought former Paramount executive Barry Diller, who was then running home shopping network QVC, for control of the Melrose Avenue studio. Diller’s company was backed by cable TV mogul John Malone, and the bidding war drove Paramount’s price to nearly $10 billion — $2 billion more than Redstone had initially offered — and far more than analysts said the studio was worth.

To gain the cash flow needed to pull off the deal, Viacom merged with Blockbuster, then the nation’s dominant video store chain.

During the first decade of Redstone’s tenure, Paramount won Academy Awards with “Forrest Gump” and “Saving Private Ryan,” and mined box office gold with “Mission: Impossible” and “Star Trek” films. Viacom approached Paramount films like an investment portfolio, hedging bets on some films by taking on financial partners. Now that strategy is practiced industry-wide.

In 2000, at the age of 77, Redstone capped his empire with the $37-billion takeover of CBS, a fortress of old media that included the CBS broadcast network, cable channels, billboards and one of the nation’s largest chain of TV and radio stations.

He achieved his goal: Viacom ranked as one of the world’s biggest media companies.

But Redstone was known for being extraordinarily fickle. He fired Biondi, Viacom’s longtime chief, in 1996, two years after the Paramount purchase, and took the reins himself. After the merger with CBS, Redstone had agreed to give operational control to CBS head Mel Karmazin. But Redstone soon forced him out.

In 2006, he booted Tom Freston as Viacom CEO less than a year after Freston took the top job. That summer, Redstone publicly dismissed Tom Cruise — one of Paramount’s most bankable stars.

Redstone was irked that Cruise was making more money on Paramount films than the studio was. Then, in 2016, it was Viacom CEO Philippe Dauman — Redstone’s lieutenant for nearly 30 years — who suffered the wrath of the Redstones. He left the company after a volley of lawsuits.

The Redstone family was famously fractured and feuds often wound up in court.

In 2006, Redstone was sued by his nephew Michael Redstone, who alleged that his uncle had cheated him out of his share of the family fortune. But the statute of limitations had expired.

That same year, Redstone was sued by his only son, Brent, who accused his father of using the family’s investment vehicle, National Amusements, as a slush fund. Brent Redstone, in court documents, complained that his father treated his sister with “extreme favoritism.”

Brent Redstone eventually received a $240-million settlement.

As part of Redstone’s 2000 divorce from his wife of 52 years, he promised that his daughter Shari Redstone would eventually be allowed to succeed him as chairman of both public companies. But over the years, the two had squabbles over corporate succession, Viacom’s leadership and plans to expand National Amusements.

Sumner Redstone once sent a letter to Forbes magazine, chastising his daughter.

“It must be remembered that I gave to my children their stock; and it is I, with little or no contribution on their part, who built these great media companies,” Redstone wrote in the 2007 letter.

For months, father and daughter communicated by fax. They came together in 2008, amid the financial crisis, to save their empire by selling assets and restructuring debt.

For more than a decade, Redstone presided over his corporate dominion from his mansion known for its gigantic tanks of exotic fish. He had long left the operations of his companies to lieutenants Dauman and former CBS chief Leslie Moonves. A computer terminal with a stock ticker was placed next to his easy chair so he could monitor his companies’ performance.

Tensions mounted again in 2012 as Redstone’s much-younger female companions took on central roles in his life. Once again, Shari Redstone was shunted aside.

At Viacom’s annual shareholder meeting in Los Angeles in 2014, a makeshift curtain was erected on a Paramount sound stage, obscuring investors’ view of the stage until Redstone had taken his place behind a table. Then, the curtain was pulled back. His distinctive red hair was white, and he struggled to speak and to walk, but he was too proud to be seen using a wheelchair.

When Viacom’s fortunes faltered, the stock price terminal was whisked away.

Then, in late 2015, the elder Redstone kicked two women out of his home. One of them, Manuela Herzer, challenged Redstone’s mental competence in a lawsuit. After the girlfriends were gone, Shari Redstone said that she and her three children, who called their grandfather “Grumpy,” were able to reunite with him and the bond between father and daughter intensified.

But the economics of television was changing. Cable cord-cutting eroded the value of Viacom, which is heavily reliant on advertising and cable TV fees. Shari Redstone first floated a merger in 2016 but retreated. She tried again in 2018 but was rebuffed by then-CBS chief Moonves, who was forced out months later amid a sexual harassment scandal.The boards of Viacom and CBS eventually concluded they needed to reunite to gain scale with Disney and Netflix.

“Sumner Redstone was a brilliant visionary, operator and deal maker, who single-handedly transformed a family-owned drive-in theater company into a global media portfolio,” ViacomCBS Chief Executive Bob Bakish said in a statement. “He was a force of nature and fierce competitor, who leaves behind a profound legacy in both business and philanthropy.”

Redstone contributed more than $150 million to various institutions, universities and causes. Sizable donations were made to Massachusetts General Hospital, USC Keck School of Medicine, Cedars-Sinai Medical Center, Harvard Law School, Cambodian Children’s Fund and the Global Poverty Project, among others. In 2014, he donated $30 million to George Washington University.

He set up a generation-skipping trust to benefit his five grandchildren — Brent’s daughters, Keryn Redstone and Lauren Redstone Ellis; and Shari’s children, Brandon Korff, Kimberlee Ostheimer and Tyler Korff. He intentionally bypassed his two children.

His death will not trigger immediate changes at ViacomCBS. The media company is controlled by National Amusements Inc., which Sumner Redstone owned with an 80% stake. (Shari Redstone owns the remaining 20%.) Succession was outlined in the Sumner M. Redstone National Amusements Trust, which have long held his NAI shares.

Seven trustees, including Shari Redstone and her son Tyler and her daughter Kimberlee, will oversee the controlling stakes in ViacomCBS. Shari Redstone now serves as ViacomCBS chairwoman.

Redstone long kept a tight grip on his affairs, once stating, “I’m in control now, and I’ll be in control after I die.”

More to Read

Start your day right

Sign up for Essential California for the L.A. Times biggest news, features and recommendations in your inbox six days a week.

You may occasionally receive promotional content from the Los Angeles Times.