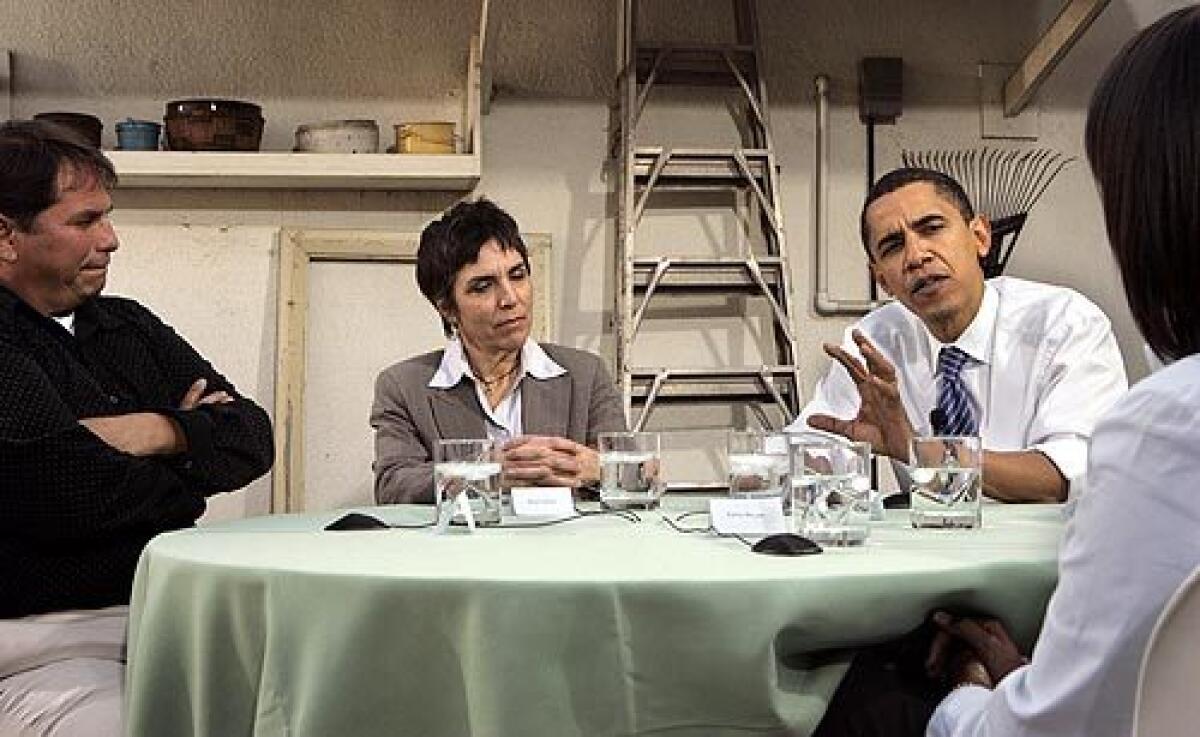

Obama’s backyard economics session

- Share via

Barack Obama sat in registered nurse Mimi Vitello’s sunny backyard in Van Nuys and listened as she and three other local voters talked about their worries over home loans and credit card debt. The presidential hopeful listened intently and said the mortgage and credit card industries were skewed against working Americans.

“The deck has been stacked in favor of the big banks and the big financial companies and not for the consumers and homeowners,” he told the residents.

They sat around a table outside Vitello’s modest home, which she bought with an interest-only loan. Now that loan worries her. “My income is not going to jump ahead, and here comes my interest-only [payment hikes] in a couple years,” Vitello said.

Obama noted that foreclosures could cost California’s economy $23 billion, and he blamed the federal government for not regulating lenders.

“It’s an example of how when the federal government falls down on the job and is listening more to the special interests than it is to ordinary working families that we end up getting into these kinds of crises,” he said.

Obama has proposed creating a $10-billion fund to help prevent foreclosures, eliminate some taxes and fees for families who must sell, and offer counseling to homeowners.

He also proposed changes in the consumer credit card industry. “People are getting caught in a credit card system that is unfair,” he said, faulting “teaser rates” that skyrocket, interest charged on late fees and hidden fees.

His words resonated with Gustavo Lizarde, an auto repair shop owner who has tapped his credit cards to keep the business running. He said teaser rates that went from 0% to 29.9% forced him into a spiral of debt that made him unable to afford health insurance. “Now what I have to do is refinance my home, so I can get out of debt, so I can breathe,” he said.

Obama told the gathering that he no longer had credit card debt, but that was not always the case. “Five years ago, before I had spoken at the convention, before my book sales took off, etc., we were in same situation,” he said.

“My wife and I borrowed to go to college and law school because we don’t come from wealthy families. When I got out of law school and we got married, our combined student loan debt was higher than our mortgage,” Obama said. “And so it took us 10 years to pay that off, which meant that we couldn’t save.”

Obama proposed creating a credit card rating system so that consumers could make more informed choices, and banning companies from raising interest rates without new agreements with borrowers.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.