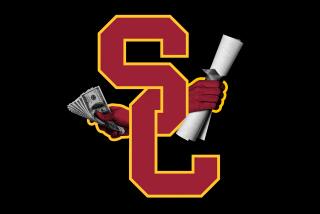

Parents in college-admissions scandal got tax breaks. Outrage sparks calls for change

- Share via

Tax breaks resulting from charitable donations to universities and colleges could be receiving new scrutiny in Washington after the largest admissions cheating scandal in U.S. history.

U.S. Sen. Ron Wyden (D-Ore.), a powerful member of a legislative committee over national tax policy, said he would seek to ban deductions for donations to schools such as USC, UCLA and others that raise private money to fund infrastructure, research and scholarships.

Wyden’s proposed legislation, which would apply only to donations from parents while their children are seeking admission to a school, aims to eliminate what he called a “back door” benefit with inestimable value for the wealthiest families.

“Middle-class families don’t have access to this back door for their children,” Wyden said in a statement. “If the wealthy want to grease the skids, they shouldn’t be able to do so at the expense of American taxpayers.”

His proposal comes after a federal investigation last week revealed a massive admissions scandal involving elite schools such as UCLA, USC, Stanford, Yale and Georgetown. Federal prosecutors allege that wealthy parents — including two Hollywood actresses — paid to help their children cheat on entrance exams or falsify athletics records to help them gain admission.

College admissions scandal snares actresses, CEOs and coaches; alleged mastermind pleads guilty »

The scheme began in 2011 and was propelled by the owner of a for-profit Newport Beach college admissions company.

Some of the parents disguised their alleged bribes as charitable donations to a nonprofit controlled by the man prosecutors say masterminded the scheme. That allowed the donors to then claim deductions on their income taxes, according to the Internal Revenue Service.

It’s unclear whether prosecutors have evidence that university foundations — which would be targeted by Wyden’s suggested legislation — were directly involved in the case, however.

“If the wealthy want to grease the skids, they shouldn’t be able to do so at the expense of American taxpayers.”

— U.S. Sen. Ron Wyden (D-Ore.)

Although some receive public funding, many universities are structured as nonprofits or have associated foundations, allowing their gifts and donations to be classified as charitable under the federal tax code.

The Campaign for USC, for example, is raising billions of dollars in tax-deductible gifts from more than 400,000 donors, according to the university, to fund investments in infrastructure, research and scholarships.

Similarly, the UCLA Foundation is that university’s charitable arm. Its website publishes the foundation’s identification number with the Internal Revenue Service so that donors can seek a deduction.

“The best way for UCLA to preserve our public interest is through private support,” its website reads.

Gov. Gavin Newsom, during a national media tour to defend his decision to ban California death row executions, on Friday decried “legal bribery” in the college admissions process, including favors given to big donors.

Newsom said the college admission system favors all “people of wealth and privilege,” not just those who were indicted in the scandal. That includes influential politicians.

The governor did not propose any new policies to address the issue, saying that “we’ve got to reflect on this in a much deeper way” before taking action.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.