Entertainment deals between China and U.S. to rise, survey says

Dalian Wanda Groupâs $2.6-billion acquisition of theater operator AMC Entertainment last year may be just the beginning of a new wave of deal making between the U.S. and China.

Thatâs one of the key findings from a new survey of American and Chinese investors that predicts an increase in mergers and acquisitions over the next year in the entertainment, advertising and digital media sectors in the U.S. and China.

The report, conducted by the research firm Mergermarket and commissioned by the law firm Manatt, Phelps & Phillips, was based on interviews with more than 100 American and China business executives, investors and analysts.

âAmerica has Wall Street and China has a Great Wall, but the wall on both sides is starting to crack,ââ Lindsay Conner, a partner at Manatt and co-chair of the firmâs entertainment practice, said in an interview with the Los Angeles Times. âI expect entertainment investment on both sides to steadily rise in the years ahead.â

Chinese spending on acquisition of American companies reached a high of $11 billion in 2012, more than triple the value of the previous year. Last yearâs deals included the Dalian Wanda Group/AMC deal, creating the worldâs largest theater operator, and Chinaâs Galloping Horse partnering with Indiaâs Reliance MediaWorks to buy the venerable visual effects company Digital Domain.

During the same period, U.S. investors poured nearly $10 billion into Chinese targets, mostly on smaller deals of less than $250 million. News Corp. took a roughly 20% stake in Bona Film Group, a Chinese film distributor. Walt Disney Studios and DreamWorks Animation also have announced joint venture plans in China.

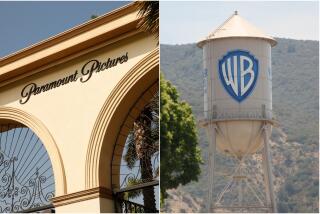

PHOTOS: Hollywood Backlot moments

More than two-thirds of respondents in the survey expected to see an increase in deal making in the entertainment and advertising sectors in the next 12 months. While Chinese investors are eager to take controlling stakes in U.S. companies, Americans are more likely to settle for joint ventures or minority ownership in Chinese businesses because of government restrictions on foreign investment.

The respondents identified movie theaters in China as attractive targets because of a rising middle class and the lack of premium modern theaters. The Motion Picture Assn. of America said it expects the number of cinema screens in China to double by 2015.

U.S. cinemas also were the most attractive target for Chinese investors, along with social media and multimedia production and distribution companies.

âFor U.S-based investors and companies, China provides access to the worldâs largest media consumer market by volume,â the report notes. âIn the U.S., Chinese companies and investors look to gain access to technology in mature markets to expand Chinaâs homegrown entertainment and media industries.â

PHOTOS: Billion-dollar movie club

But the survey also found that business leaders in both countries remain wary about government regulation and intervention, with more than 40% of the respondents in both countries citing that as the chief obstacle to cross-border transactions.

Major studios have been frustrated by foreign quotas and other government restrictions in China. Some Chinese investors also remain apprehensive about the U.S. government, citing concerns about the Committee on Foreign Investment, the report says. The U.S. group that reviews foreign acquisitions recently opposed a Chinese consortiumâs plans to buy an Oregon wind farm.

ALSO:

Produced By Conference: A âgold rushâ out of L.A. for tax credits

âThe Purgeâ trounces âThe Internship.â Cable show kicks off in D.C.

Cable industry to discuss challenges â and hear from Jennifer Lopez

More to Read

From the Oscars to the Emmys.

Get the Envelope newsletter for exclusive awards season coverage, behind-the-scenes stories from the Envelope podcast and columnist Glenn Whippâs must-read analysis.

You may occasionally receive promotional content from the Los Angeles Times.