NBCUniversal parent Comcast tiptoes around strike amid profit gains

Comcast Corp. President Mike Cavanagh on Thursday tiptoed around the twin strikes that have paralyzed Hollywood.

âWe are committed to reaching a fair deal with the guilds as soon as possible,â Cavanagh said Thursday morning during a conference call with analysts to tout Comcastâs strong second-quarter financial results.

âFor all involved in the industry broadly, a prolonged work stoppage, the longer it goes, the worse that it will be,â said Cavanagh, who also oversees the companyâs NBCUniversal media unit â one of the companies that writers and actors have refused to work for since their respective guilds went out on strike.

But Comcastâs earnings underscore how some media companies are doing well, at least in the short term, despite the labor unrest that analysts expect to do lasting damage to the entertainment business. Economists have estimated that the strike could cost the economy as much as $4 billion.

Comcastâs performance â and the sprawling nature of its businesses â illustrate why industry observers expect companies will dig in for a long and bitter fight against the Writers Guild of America and the performersâ union, SAG-AFTRA.

The Philadelphia cable giant beat analyst estimates by generating $30.5 billion in revenue in the second quarter, up 1.7% from the year-earlier period. The bulk of Comcastâs business is in delivering broadband internet, cable TV channels and phone service to more than 30 million customers.

NBCUniversal helped propel Comcastâs earnings. The media unit contributed $10.9 billion in revenue and $2.2 billion in adjusted earnings â a 7.5% increase from the year before. Increased attendance at its Universal Studios theme parks and ticket sales from Universal movies â including âThe Super Mario Bros. Movieâ â delivered in a big way.

Comcast said it generated $3.4 billion in free cash flow companywide during the quarter that ended June 30.

Wall Street applauded Comcastâs results, sending its shares soaring 5.7% to $45.35 a share.

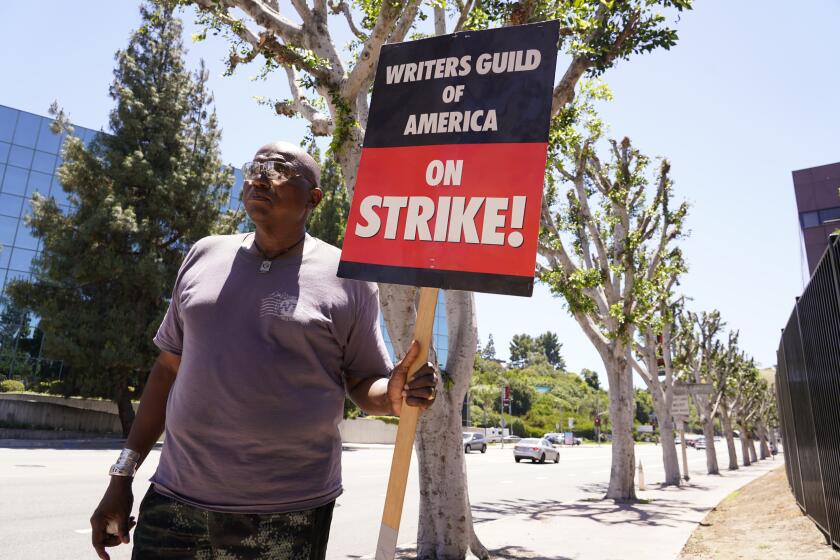

The upbeat earnings from Philadelphia marked a stark contrast to the scene 2,700 miles away in Los Angeles, where writers have been walking picket lines outside the companyâs Universal Studios complex since early May.

Thereâs no end in sight for the strikes against the media companies, which are represented in negotiations by the Alliance of Motion Picture and Television Producers.

SAG-AFTRA leaders and the AMPTP have not held talks since July 12. Similarly, there have been no conversations between the AMPTP and WGA for nearly three months. Large gaps remain over minimum pay, residuals, mandatory staffing for writers rooms, revenue sharing with streaming companies and concerns about the use of artificial intelligence.

The historic strike of Writers Guild of America and SAG-AFTRA has shut down Hollywood and brought widespread uncertainty, but an unlikely flashpoint of the labor unrest has emerged over the trimming of some trees on a block in Universal City.

Analysts anticipate that the labor conflict will boost NBCUniversalâs short term financial results as the company saves millions of dollars that it otherwise would spend producing TV shows and movies.

Cavanagh acknowledged the expected savings but noted that NBCUniversal will spend capital next year to ramp up productions after the strike ends. Because of that, profits are expected to be lower next year, he said.

In addition to the theme parks and Universal film and TV studios, the company owns the NBC broadcast network, Bravo, E!, USA, MSNBC, CNBC and the Spanish-language Telemundo television business.

As SAG-AFTRA members join writers on picket lines, the fallout will disrupt Hollywood film and TV productions worldwide. âThereâs going to be blood in the water,â said one analyst. âThis will not end well.â

The companyâs streaming service, Peacock, added 2 million paying subscribers to reach 24 million customers, about double its total from a year ago.

Peacock generated $820 million in revenue in the quarter but posted a loss of $651 million, swelling from a $437-million loss during the year-earlier period.

Comcast recently announced an increase in Peacockâs subscription fees by as much as $2 a month. Peacockâs premium plan now will cost $5.99 a month, while the ad-free offering will charge $11.99. It was the first price hike for the service that launched three years ago.

Since January 2021, Comcast has lost $5.5 billion on Peacock, according to research firm SVB MoffettNathanson.

The industryâs shift to streaming, which introduced a different set of economics, fueled concerns that helped lead to the strikes.

Media company executives, including Walt Disney Co. Chief Executive Bob Iger, have said the dual strikes are coming at an awful time for studios because they were only beginning to stabilize their businesses after COVID-19 pandemic-related closures. The advertising market also has been soft.

Workers in film and TV, most of whom are pro-union, have been trying to make ends meet amid a dual strike of Hollywood actors and writers.

The traditional companies are reeling from huge losses in streaming in an effort to compete with Netflix and Amazon Prime Video. The entertainment giants are grappling with heavy debt loads due to mergers and acquisitions.

Unlike other media companies, Comcast quickly paid off the more than $30 billion in debt it took on in 2018 to purchase the Sky satellite television operation in Europe that was once owned, in part, by Rupert Murdochâs 21st Century Fox.

Comcast reaps hoards of cash from its broadband internet and phone business. In the second quarter, Comcast used some of its extra cash to spend $2 billion buying back stock and an additional $1.2 billion paid to shareholders in dividends.

For that reason, Comcast has fared better this year on Wall Street than Disney, Paramount Global and Warner Bros. Discovery. Those companies have all seen their shares hammered since the WGA strike began.

Investors are also pleased that Comcast plans to sell its 33% stake in streaming service Hulu to Disney, which will generate another financial windfall for the company.

Comcastâs stock is up more than 25% since the beginning of the year.

Netflix also has seen its shares soar. The streamer last week reported that it had added nearly 6 million subscribers in the second quarter and that it had generated $1.5 billion in profits.

Top NBCUniversal executives Mark Lazarus, Cesar Conde and Mark Woodbury received bigger portfolios. Susan Rovner, who oversaw television programming, is leaving the company.

The quarter opened with an abrupt management shake-up when then-NBCUniversal Chief Executive Jeff Shell exited the company. He resigned under pressure in late April after a sexual harassment complaint was lodged against him by a CNBC international anchor, who has since left the company.

Cavanagh stepped in to oversee the entertainment company.

This month, Cavanagh overhauled the management structure of NBCUniversal, elevating Donna Langley to chief content officer, putting her in charge of television production as well as her longtime role overseeing the film studio.

Cavanagh was sanguine about the companyâs content pipeline for the rest of the year despite the strike, which is expected to hobble the 2024 film slate and efforts to promote upcoming movies.

Universalâs highly anticipated release, Christopher Nolanâs âOppenheimer,â has generated $220 million at the box office worldwide in its six days, according to Box Office Mojo. Those results fold into Comcastâs current quarter.

âWeâve got a lot of strong content coming,â Cavanagh said, mentioning the NFL and Big 10 college football, which will air on NBC and stream on Peacock. âWe feel very good about what we have coming in the second half of the year, content-wise.â

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production â and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.