Disney earnings plummeted in its third quarter. Blame COVID-19

- Share via

Walt Disney Co. suffered a major decline in earnings in its third fiscal quarter, illustrating the severe damage dealt to the world’s most powerful entertainment company by the COVID-19 pandemic, which has kept Disneyland closed, cratered global tourism and delayed movie releases for months.

The Burbank entertainment giant posted a net loss of $4.72 billion for the three months that ended in June, Disney said Tuesday. That’s compared with the $1.43 billion in net income the company reported for the same period in 2019.

However, the media and entertainment titan did better in terms of profit than analysts expected, thanks in part to growth in its TV and streaming businesses. Excluding certain items, Disney posted a profit of 8 cents a share, down 94% from the same period of time a year ago. Analysts polled by FactSet on average had expected a loss of 64 cents a share.

Total revenue for Disney was $11.78 billion, down 42% from a year earlier. Analysts had estimated $12.39 billion in revenue.

Disney stock rose 4% in after-hours trading on Wall Street after the earnings release.

The driving force behind the earnings decline, of course, was the coronavirus. Disney estimated that its parks, experiences and products segment alone suffered a $3.5-billion hit to operating income because of the effects of the pandemic during the quarter.

As COVID-19 rages in Florida and California, what does it mean that Disney World is open while Disneyland remains closed even for its 65th birthday?

Disney closed its domestic parks and Disneyland Paris in mid-March amid growing public health concerns surrounding the coronavirus. The crisis has taken a deep toll on the entertainment and hospitality industries overall, but Disney was particularly vulnerable. Its mighty movie studio primarily makes films designed to be seen in theaters, which remain largely shuttered in the U.S. And Disney’s biggest business — parks and resorts — have suffered from months of closures.

Disneyland remains closed indefinitely as the pandemic continues to grip California. Walt Disney World in Florida — where, despite surges in cases, the government has loosened restrictions on the economy faster than in many other states — reopened last month with limited capacity and strict protocols to limit the risk of spreading the coronavirus.

Shanghai Disneyland was the first Disney resort to reopen, welcoming back guests starting May 11 with pandemic-driven restrictions and rules, including masks for employees and patrons. The company’s parks in Paris and Tokyo have also begun phased reopenings. Hong Kong Disneyland reopened in June, but shut down again last month because of a rise in coronavirus cases.

Revenue for parks, experiences and products, normally a powerhouse for the company, collapsed 85% to $983 million in the quarter. The division’s operating loss was $1.96 billion, compared with a profit of $1.72 billion during the prior-year third quarter.

“Simply put, the parks are bleeding cash, with no end in sight,” said LightShed Partners analyst Richard Greenfield in a blog post ahead of the earnings release.

Tuna Amobi, an analyst with CFRA Research who has a “buy” rating on Disney’s stock, is more optimistic about the company‘s prospects once the pandemic subsides.

Praise Baby Yoda, Disney+ breakout Star Wars hit ‘The Mandalorian’ nabbed an Emmy nomination for drama series (and 14 more).

“While the surge in COVID-19 cases gives us some pause, Disney seems well poised to gradually tap into pent-up demand amid a phased reopening of parks, and a gradual return of live sports events,” Amobi wrote in a note to clients.

With no new theatrical releases, the company’s film studio generated $668 million in operating income, down 16% year over year. Revenue was $1.74 billion, down 55%. The studio’s highly anticipated “Mulan” remake has been delayed multiple times because of theater closures.

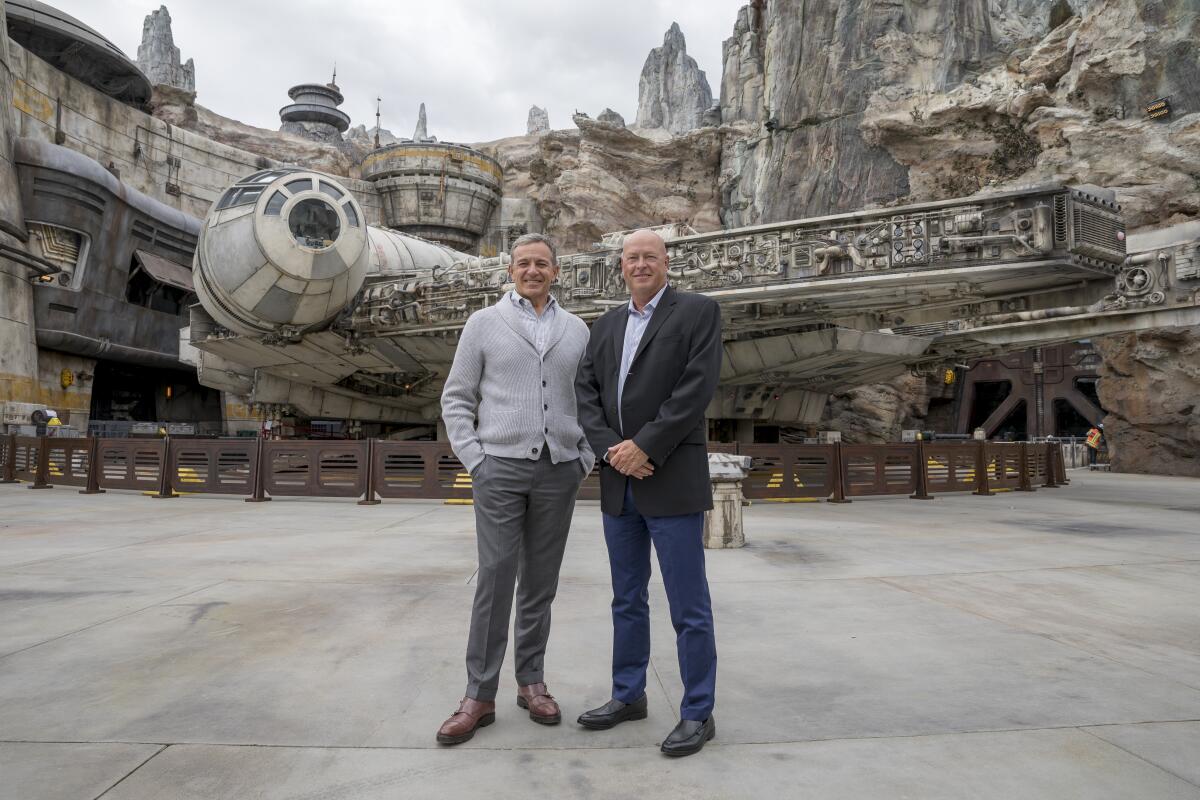

Disney on Tuesday announced a new plan for the release of “Mulan” that is sure to irk theaters. The company will offer the film for a $29.99 video-on-demand release on its streaming service Disney+ starting Sept. 4. The company will also release the film in theaters that are open in territories where Disney+ is not available. However, Disney Chief Executive Bob Chapek said the move is not a sign that Disney plans to pursue similar releases as a new business model.

“We’re very pleased to be able to bring ‘Mulan’ to our consumer base that has been waiting for it for a long, long time,” Chapek said. “But we’re looking at ‘Mulan’ as a one-off.”

On the bright side, Disney+ has surged during the public health debacle as viewers flock to streaming services amid limited entertainment options. The company scored a coup when it brought the filmed version of the Broadway smash “Hamilton” to its service during the July 4 weekend, which drove a rise in downloads of the app. Disney also recently launched “Muppets Now” on Disney+ and the Beyoncé visual album “Black is King.”

Disney+ now has 60.5 million subscribers, the company said. In May, the service had 54.5 million paying customers. A Disney+ subscription costs $7 a month on its own, and $13 a month when bundled with Disney’s other digital offerings, Hulu and ESPN+. The company’s streaming offerings have passed a major marker of 100 million paid subscribers combined, including about 35 million Hulu subscribers, Chapek said.

“Despite the ongoing challenges of the pandemic, we’ve continued to build on the incredible success of Disney+ as we grow our global direct-to-consumer businesses,” Chapek said in a statement. “The global reach of our full portfolio of direct-to-consumer services now exceeds an astounding 100 million paid subscriptions — a significant milestone and a reaffirmation of our DTC strategy, which we view as key to the future growth of our company.”

The Disneyland closure is part of Hong Kong’s effort to contain a resurgent coronavirus outbreak.

However, Disney’s direct-to-consumer and international segment — composed of Disney+, Hulu and other units — continued to lose money. The direct-to-consumer businesses lost $706 million, compared with $562 million in the prior-year quarter. Streaming and international revenue rose to $3.97 billion a year earlier, up 2%.

Though Disney+ has proved a clearly formidable competitor to Netflix, analysts worry that the service will suffer from a lack of fresh content after the coronavirus hobbled production of new shows and movies. Marvel’s “Falcon and the Winter Soldier,” for example, was delayed. However, Disney+ will get a boost in October when its hit “The Mandalorian” returns for a second season, which was filmed before COVID-19 roiled the industry.

Disney’s TV segment — which includes ABC, ESPN, Freeform and Disney Channel networks — gave the company a boost. Operating income was $3.15 billion, up 48%, thanks in part to an increase in profit from ESPN. The sports cable channel’s costs decreased dramatically because of the deferral of rights costs for Major League Baseball and National Basketball Assn. games as both leagues postponed their seasons. ABC also benefited from lower programming costs.

The NBA and MLB recently restarted, albeit with severely altered seasons. The NBA is playing all its games at Disney’s own ESPN Wide World of Sports complex in Florida. The MLB is continuing with traveling games, though the cancellation of some games due to coronavirus outbreaks has spurred speculation about how long it will last.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.