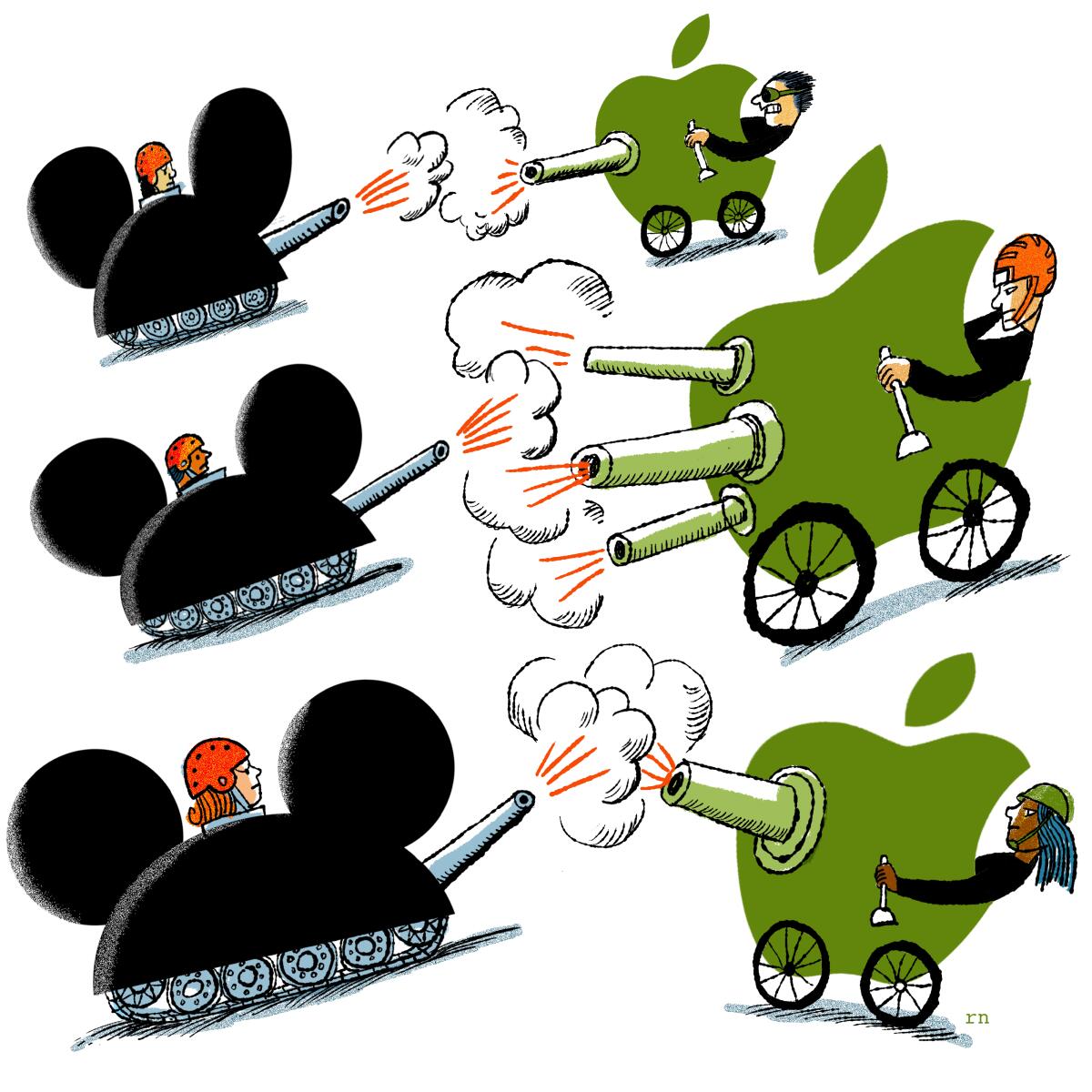

Who will win the streaming wars?

This story is part of a Times series on the great streaming wars of 2019. Click here to read the rest of our coverage of Disney +, Apple TV +, HBOMax and more.

An epic battle is brewing in the entertainment industry. In the coming months, most of the biggest media conglomerates will launch their own streaming services in a high-stakes effort to remain relevant by selling movies, TV programming and short-form videos directly to viewers.

While the much-anticipated slugfest between the Walt Disney Co. and Netflix Inc. is sure to garner the most attention, AT&T Inc.âs HBO Max and Comcast Corp.âs Peacock also are getting ready to enter the fray, as are Apple Inc.âs Apple TV+ and Jeffrey Katzenberg and Meg Whitmanâs Quibi.

The competition for subscription and advertising dollars has already led to disruption and anxiety. Studios are spending heavily to lock up prolific showrunners and popular older shows that they hope will get viewers to subscribe. Recently, tensions flared as Disney began rejecting Netflix ads on its TV channels.

âItâs really setting up to where all these massive media organizations are looking to keep their content within their own ecosystems,â said Kevin Crotty, co-president of Century City-based talent agency ICM Partners.

Not every service will be able to thrive in this crowded market, and several companies have clear advantages. But itâs far too early to declare winners and losers, said Tom K. Ara, a Los Angeles-based entertainment industry attorney at the law firm DLA Piper.

âAnyone who says they know how itâs going to play out is foolish,â Ara said.

Disney vs. Netflix

If any company can claim âfavoriteâ status in the streaming race, itâs probably Disney, which launches its subscription service, Disney+, on Nov. 12.

Disney Chief Executive Bob Iger has been clear about his intentions for Disney+, calling it âthe most important product that the company has launchedâ during his 14-year tenure. Itâs not just a product but a shift in Disneyâs business model. The companyâs stock surged after Disney executives presented their plans at an April investor event at the companyâs Burbank headquarters, where they projected attracting 60 million to 90 million subscribers by 2024.

The Mouse House has several key advantages: namely its deep library and slate of originals from the industryâs most enviable collection of brands, including Marvel, Pixar and âStar Wars.â New productions exclusive to Disney+ include a live-action Lucasfilm series, âThe Mandalorian,â several Marvel shows including âWandaVision,â and Disney Channel reboots such as âHigh School Musical: The Musical: The Series.â

âThink about the range of subscribers theyâll be able to attract, from children to adults, from âStar Warsâ fans to Homer Simpson fans to National Geographic fans,â said Ric Kay, head of MUFGâs Media, Telecom & Sports Finance practice.

Another huge factor will be its low price of $6.99 a month, or a discounted $70 a year, compared to Netflixâs basic offering of $8.99 a month. The company also offered a significant three-year discount for D23 members. It will bundle Disney+ with Hulu, which will host more of the companyâs non-Disney-branded content, and sports service ESPN+, for $12.99 a month.

The rise of Disney could leave frontrunner Netflix in a vulnerable position.

Netflix, which has long relied on content it licenses from studios as well as its originals, must cope with efforts by suppliers-turned-rivals to claw back the rights to stream programs such as âThe Office.â Shares plunged after the company in July reported losing nearly 130,000 U.S. customers in one quarter, and observers were split on whether the stumble was a blip or a trend.

âNetflix has hit a road bump because theyâve reached a saturation point,â said Gene Del Vecchio, an entertainment marketing expert at USCâs Marshall School of Business.

Netflix will now have to rely more on addictive original content, including âDead to Meâ and âQueer Eye,â to maintain its status as a must-have for viewers. Its movies strategy is also poised for a major test when âThe Irishman,â a 3 1/2-hr epic from Martin Scorsese, hits theaters Nov. 1 before streaming Nov. 27.

But Bernstein analyst Todd Juenger argues that both Netflix and Disney+ will offer distinct programming. âDisney+ should not hurt Netflix,â he said in a recent report. âIt is not a substitute, it is a complement.â

Phone folks and cable guys

Unlike Disney+, which is focused on family-friendly entertainment, AT&T Inc.âs WarnerMedia will offer something for every demographic. The companyâs HBO Max, coming spring 2020, promises originals from its namesake channel, as well as the 96-year-old Warner Bros. studio, Looney Tunes and Cartoon Network.

Fortunately for the Dallas phone company, HBOâs brand is associated with quality. Original shows such as âDune: The Sisterhoodâ and a recently announced revival of animated satire âThe Boondocksâ should help convince people to sign up. In an appeal to families, the company recently announced âSesame Streetâ would be moving to HBO Max for new seasons.

âThe quality, curation and marquee aspects of HBO form the foundation of our offering and give us an immediate head-start with consumers,â said Bob Greenblatt, chairman of WarnerMedia Entertainment and Direct-to-Consumer.

But pricing, which has not been announced, could be a hurdle, as Max is expected to be the most expensive on the market. HBOâs existing streaming option, HBO Now, already costs about $15 a month. HBO Max may initially charge a price similar to HBO Nowâs, said people familiar with the matter who were not authorized to comment. WarnerMedia is expected to reveal details at an Oct. 29 investor event in Burbank.

Some analysts think the relatively high price may limit how many people sign up for the new service, even with exclusive content and older material including âFriendsâ and âThe Big Bang Theory.â Some in the industry also question whether HBO will continue its dominance following the high level exodus of top executives at the premium channel, including Richard Plepler, the architect of much of HBOâs success under previous Time Warner management.

Meanwhile, Comcast Corp.âs Peacock will be playing catch-up when it launches in April. Peacock promises new seasons of such shows as âA.P. Bio,â reboots of âBattlestar Galacticaâ and âSaved by the Bell,â and old seasons of favorites including â30 Rockâ and âParks & Recreation.â NBCUniversal is sure to give Peacock a robust promotional push during its presentation of the Tokyo summer Olympics.

But Peacock is taking a different approach to the market, by relying largely on an ad-supported model. The advertising-based version of Peacock will be available for free for NBCUniversal pay-TV subscribers, while an ad-free version will be offered for a yet-undisclosed fee. Cord cutters will have to pay a subscription for the service.

Unlike some companies, the Philadelphia cable colossus is not willing to cannibalize its legacy business for the sake of streaming. âWe looked at it and said, letâs do something different than the very, increasingly crowded field,â said Comcast chairman and chief executive Brian Roberts at a recent investor summit.

Peacock still appears to be working out the kinks. In a leadership shakeup announced Monday, Comcast Cable executive Matt Strauss was named chairman of the streaming platform, taking over direct-to-consumer duties from Bonnie Hammer, who has been shifted to a new position overseeing NBCUniversalâs television studios.

Wild cards

Appleâs much-anticipated efforts in the entertainment space have long faced skepticism, despite the iPhone makerâs enormous cash reserves and fan base. However, the Cupertino, Calif. tech titanâs strategy for Apple TV+ has gradually become clearer.

The new app, launching Nov. 1, costs significantly less than the competition, at $4.99 a month (new Apple device buyers receive a free yearlong subscription). That price should be low enough for many consumers to check out original series, including Jennifer Aniston and Reese Witherspoonâs âThe Morning Showâ and the Jason Momoa sci-fi epic, âSee.â

The company still has to prove it can make quality content, and Apple has previously pulled the plug on significant endeavors when there are early signs of trouble. Still, with vast resources and a global mobile phone network, Apple canât be counted out.

âI think people underestimate Apple,â said Dan Rayburn, a digital media analyst at consulting firm Frost & Sullivan. âApple doesnât have to have 10,000 hours of content at launch, they just have to have really great content.â

Rival Amazon.com is already entrenched in the streaming space, though its approach to content has evolved under Amazon Studiosâ head Jennifer Salke, who took over in early 2018. The company, which uses original shows to entice subscribers to its Amazon Prime delivery service, has proven it can generate interest with niche shows such as the Emmy-winning âFleabag.â But Amazon is also trying to appeal to a wider, more global audience with big shows, including a pricey âLord of the Ringsâ series.

One of the riskiest plays is probably Quibi, the Los Angeles-based start up that aims to provide short-form series specifically designed for mobile devices. The executives behind Quibi, which will charge about $5 a month with ads and $8 without ads, think they can get millennials to watch shows in bite-sized âchaptersâ lasting 7 to 10 minutes. The company has already raised $1 billion to support its efforts, and it seems every producer in Hollywood is making a show for Quibi. In a deal with CBS News, for example, the nascent company recently announced a six-minute program from the producers of â60 Minutes.â

Talent race

Some media executives used to scoff at the amount of money Netflix would spend on original content. But the companyâs willingness to throw money at talent has increasingly become the norm in Hollywood.

Top-tier showrunners have scored massive, exclusive deals from studios in the last couple of years. Netflix shook up the entertainment world by giving nine-figure pacts to Shonda Rhimes and Ryan Murphy. WarnerMedia has responded by locking up the likes of Greg Berlanti and J.J. Abrams with their own mega-deals. In recent weeks, Amazon has secured âFleabagâ creator Phoebe Waller-Bridge, while Netflix signed âStranger Thingsâ producers the Duffer Brothers.

âWith the proliferation of over-the-top services, the truly independent producers believe thereâs a real opportunity,â said Bryan LaCour, managing director and head of entertainment finance at MUFG Union Bank. âWhile a lot of deals with creators have closed, the streaming services require additional content beyond the level the exclusive creators can generate and thatâs an opportunity for the independent producers.â

On the other hand, some entertainment financiers and studio executives worry that the increased spending on content has the makings of a bubble. They note that past success does not necessarily predict future success. It will be several years before the studios know whether their deals paid off, but studios may feel they donât have a choice over whether to pay up. âThe numbers have gotten higher, because the stakes have gotten so much higher,â said one film financier.

The streaming race has also changed the economics of production deals, often limiting the upside for creators. Netflix is famous for buying out talentâs backend participation with big guarantees, a practice that is starting to creep into the legacy media business. The Times reported in September that Disney is pressing TV producers and other profit participants in its shows to accept a new formula offering profits sooner in exchange for control of future licensing revenue.

Another concern is that the deal frenzy is widening the divide between the haves and the have-nots in the film and TV business, insiders said.

âFor brand-name showrunners and creators, the marketplace is great,â said ICMâs Crotty. âEveryone else needs someone to fight for their deals.â

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production â and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.