Wide Shot: The streaming splurge is changing how Hollywood deals are valued

Welcome to the Aug. 10, 2021, edition of the Wide Shot, your weekly dose of entertainment business news. If youâre not receiving it already, please sign up here to get it in your inbox.

The epic streaming-fueled quest for more content has produced some truly staggering valuations for companies that make movies and TV shows.

First came the game-changing $8.45-billion sale of MGM to Amazon (pending regulatory approval), followed by a deal for Reese Witherspoonâs Hello Sunshine valued at $900 million.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production â and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

Just last week, ViacomCBS made a $900-million deal to get more âSouth Parkâ episodes on Comedy Central and a bunch of straight-to-streaming âSouth Parkâ movies for Paramount+ (more on that later). Variety previously cited anonymous sources saying A24 had been holding sale talks with an asking price of up to a staggering $3 billion.

Healthy skepticism over that A24 number aside, itâs a sellerâs market, to put it mildly.

One of the biggest potential acquisition targets is Legendary Entertainment, which I wrote about this week. The company has had its ups and downs, to be sure, but itâs currently on an upswing with pandemic release âGodzilla vs. Kong.â

People familiar with its finances say Legendary is worth upward of $2 billion and is on track to generate $100 million in profit this year, doubling its 2020 net income. Itâs not clear who would be the buyer. Kevin Mayerâs and Tom Staggsâ Blackstone-backed media company (the buyer of Hello Sunshine) kicked the tires, though talks didnât proceed, sources said.

In 2016, Chinese property and entertainment giant Dalian Wanda Group bought Legendary Entertainment for $3.5 billion including debt, a number that struck many an analyst as too rich at the time.

I asked Legendary CEO Josh Grode, a deal attorney who advised Wanda on its Legendary purchase, about how deal talks were proceeding, and he answered in the way you might expect from an attorney.

âWe get multiple inbound calls on a weekly basis, both from the actual parties and from bankers,â Grode said. âWe always listen to what people have to say. My job running the company is to maximize value for my shareholder, which is Wanda, and thatâs what I will always look to do.â

Legendary is perennially speculated about as a potential acquisition, though rumors have heated up in recent weeks. Bloomberg in April reported that LionTree LLC was working with the company to explore options, including going public through a special purpose acquisition company, or SPAC.

SPACs were the new kids on the financial block this year, but itâs not obvious that being subject to the public market makes sense for a small studio, financial experts told me. The stock market likes stability. The film business is a lot of things, but itâs not stable.

In any event, Grode argues the company is in good financial health and in an increasingly rare position to supply content to voracious streamers.

The price tags for these companies raise a broader question in the entertainment business: How should studios and production companies be valued amid the Hollywood streaming surge?

A couple years ago, much of the value of an entertainment company came from its library, which would not only generate cash but give the studio the ability to do remakes and reboots. In some sense, this is still true, with Amazon citing MGMâs 4,000-film catalog as a primary attraction.

But Hello Sunshineâs valuation doesnât come from a deep library. Neither does the floated $750-million value of LeBron Jamesâ SpringHill Entertainment, which produces HBO talk show âThe Shopâ and, of course, was one of the production companies on Warner Bros.â âSpace Jam: A New Legacy.â Legendaryâs library isnât MGMâs by any stretch. And MGMâs library comes with complications, as much of the catalog has previously been exploited.

Instead, valuations increasingly are based on having a prestigious brand and a management team with an ability to produce the next big thing.

If youâre Reese Witherspoon, and youâve proven you can produce hits like âBig Little Liesâ and keep people hooked on your book club, youâre in a good position, even if you donât own 200 film titles like Spyglass (which just sold the bulk of its former Weinstein Co. titles to Lionsgate) did.

Media companiesâ stock prices are based on how many people are signing up for their streaming services, more than on traditional metrics like profitability.

Legendary is hoping its sci-fi epic âDuneâ is a hot property when it hits theaters and HBO Max in October. Film Twitter is very excited about âDune.â That much was clear after Warner Bros. released the trailer for the star-studded film based on the notoriously difficult-to-adapt Frank Herbert series.

TimothĂŠe Chalamet. The desert vistas. The epic scale.

Some of the same folks who were tweeting so fervently about seeing âDuneâ couched their enthusiasm in concerns over whether the ambitious film would be a box-office hit. âCan Warner Bros. pull off a movie marketing miracle?â went a Forbes headline.

Film Twitter appears to have learned the first rule of Film Twitter: Donât listen to Film Twitter. Excitement among a very dedicated group of online fans doesnât always translate into commercial success. Look at the returns for the very well-reviewed âThe Suicide Squadâ as the most recent example.

Stuff we wrote

â Great read from Meredith Blake: How HBOâs âThe White Lotusâ turned a $9,000-a-night resort into the âhotel from hell.â

â Get that shot, or else! CNN fired three staffers for working at its New York headquarters without a COVID-19 vaccination.

â âA positive step forwardâ for the Golden Globes group, says NBC. Several months after the HFPA pledged âtransformational change,â the vast majority of its 84 members voted for a slate of proposed bylaws intended to overhaul the organization, expand membership with a focus on diversity and restore its credibility with the entertainment industry.

â El Rey Network finds an afterlife in streaming. Robert Rodriguezâs Latino-focused cable channel went dark at the end of last year after falling victim to cord-cutting. Now the brand is moving to the crowded space of free, ad-supported streaming through a deal with Cinedigm.

â The latest in our Explaining Hollywood series: How to get a job in practical special effects.

â Sports are great. The Tokyo Olympics ratings were very bad for NBC.

Number of the week

The content buying spree seems to come straight out of the Underpants Gnomes School of Economics. Yes, that is a âSouth Parkâ reference. In a classic Season 2 episode, a team of gnomes pilfers a characterâs drawers in service of a nonsensical business plan, which goes as follows:

Phase 1: Collect underpants.

Phase 2: ?

Phase 3: Profit.

In the streaming wars, content is underpants.

Back in 2019, WarnerMedia won a bidding war for exclusive rights to stream âSouth Parkâ on HBO Max, paying upward of $500 million.

That deal made creators Trey Parker and Matt Stone even richer than they already were, following a previous licensing pact with Hulu. It also set up an awkward situation for Viacom and CBS, which were in the process of merging and would soon rebrand the CBS All Access streaming service as Paramount+. One of Viacomâs signature shows, the one that made Comedy Central a force in basic cable, had become fuel for a rivalâs streaming ambitions.

Last week, ViacomCBS sought to cure its âSouth Parkâ streaming envy by paying Parker and Stone $900 million over the next six years for new episodes of the animated satire on Comedy Central and to produce 14 âSouth Parkâ made-for-streaming movies to run on subscription service Paramount+.

In 1997, when âSouth Parkâ debuted, the casual viewer may not have expected much financial aptitude from the guys behind âMr. Hankey, the Christmas Poo.â But the history of âSouth Parkâ reveals some foresight (or luck) almost on the level of George Lucas keeping the âStar Warsâ merchandise rights.

Bloombergâs writeup contains a fascinating detail about Parker and Stoneâs 2007 deal with Viacom, which also resulted in the creation of the website South Park Studios, where fans could watch episode of the show for free.

âAs part of that arrangement, negotiated by their longtime lawyer Kevin Morris, Parker and Stone secured a 50% stake in all future online deals for the show,â Bloombergâs Lucas Shaw writes. âTheir stake, once worth pennies, is the basis of Park Country, a company which they own outright, that is now valued at more than $1 billion.â

Whatâs going on with STXâs parent company?

In July 2020, movie studio STX, best known for âBad Momsâ and âHustlers,â merged with Eros International, a Mumbai, India-based firm with a huge Bollywood library and a streaming service. STX founder Robert Simonds became CEO of the combined company, which is publicly traded on the New York Stock Exchange.

Last week, we reported the company is looking to generate cash from the 46-film STX library to pay off more than $150 million in maturing debt. The company âhas entered into an exclusive negotiation period with a third party to monetize the revenue from 46 films in its library.â

The details are murky and Eros STX didnât identify the third party. But it looks like Eros STXâs bigger issues are in India. The company said it could not deliver its annual report on time because of âa formal internal review of certain accounting practices and internal controls related to its Eros subsidiaries.â The exact nature of the audit wasnât clear, but Erosâ accounting issues predate the STX merger.

Investors were displeased by last weekâs announcement, sending the stock down 40% over two days. As Deadline noted, Eros STX shares are now trading below $1 a share. Eros STX declined to comment.

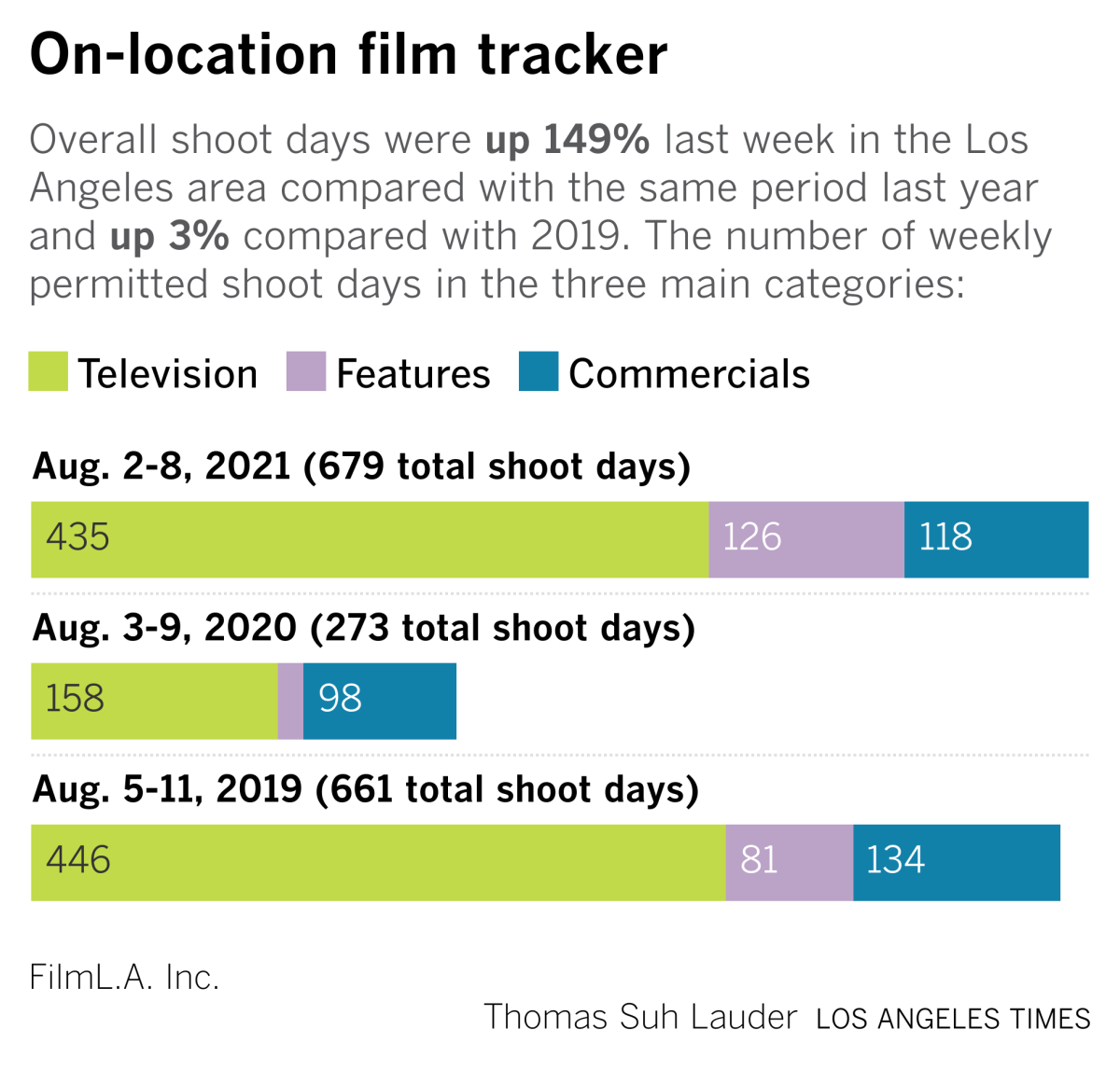

Hollywood production

On-location production is reaching pre-pandemic levels in Greater Los Angeles. Hereâs the latest chart on weekly shoot days.

More stories from the week

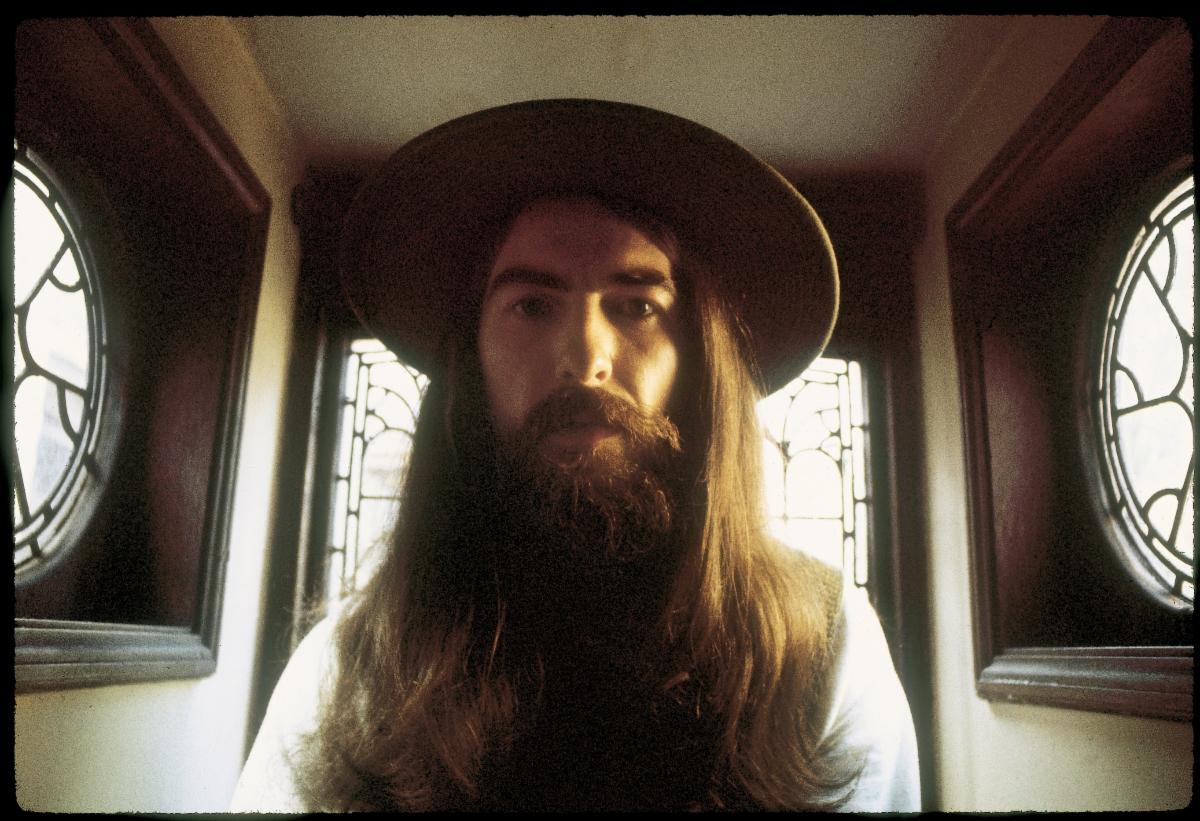

â âAll things must pass, but George Harrison is forever.â Thatâs the lead from Tim Greivingâs piece, featuring interviews with the Beatleâs widow and son on the legacy of his landmark solo album.

â The next big thing in media and entertainment is voice technology, writes media consultant Donald Buckley over at Variety VIP+.

â Kareem Abdul-Jabbar: Bravo to Bravo for keeping the spirit of Black Lives Matter alive. After other media turned elsewhere, the networkâs âReal Housewives of NYCâ and âMarried to Medicineâ have maintained focus on the movement. (THR)

â WarnerMedia studios and networks boss Ann Sarnoff is getting out in front of the press as the Discovery merger looms. (CNBC)

Final shot...

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production â and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.