The Wide Shot: Five big questions for Hollywood in 2021

Welcome to the inaugural edition of the Wide Shot, a new weekly newsletter about the future of Hollywood.

Where do we even start? The entertainment business would love to put the problems of 2020 behind it, with box office down 80%, theaters on the brink of insolvency and productions still touch-and-go.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production â and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

But the chaos isnât over yet. In the short term, many studios have paused production amid ballooning COVID-19 cases and an ICU capacity crunch in Southern California. As my colleague Anousha Sakoui reported late last week, a lot of folks want to keep working through the surge. The Grammys were postponed from January until March just weeks before they were scheduled to go on, in an indication of how fragile the return to work will be until vaccination is widespread.

Meanwhile, the timeline for long-term changes weâve expected for a half-decade or more â premium early rentals, direct-to-streaming movies â was compressed into a few wild months. Thereâs still something jarring about firing up âSoulâ or âSound of Metalâ on a laptop when you know the filmmakers intended them for the big screen.

The effects of the pandemic are proof that, as in the natural world, evolution in business isnât always gradual; it can be sudden, violent and catastrophic, like a comet strike of the type that sent Gerard Butler scrambling for the bunkers in âGreenland.â And thereâs little doubt 2021 will be an equally transformative year as studios, media companies and tech giants figure out what the postpandemic entertainment industry will look like.

Five burning questions for 2021

What happens to theaters?

A handful of day-and-date releases and Oscar-bait titles notwithstanding, traditional moviegoing is mostly on hold until vaccination reaches critical mass. Any comeback will take time. âItâs not a flick of the switch, itâs a ramp-up,â National Assn. of Theatre Owners CEO John Fithian told me last week.

I wonder how many theaters will be able to turn the lights on at all six months from now. The $15-billion Save Our Stages program gave a lifeline to small and midsize theaters and music venues. But AMC and other large chains â which represent the bulk of the nationâs screen count â are not eligible for it.

So what does the theatrical world look like after COVID-19? Some executives predict the remaining theaters will increasingly bet on luxurious amenities and a film lineup dominated by four-quadrant blockbusters. That will surely be more expensive for consumers.

Much will depend on whether WarnerMediaâs direct-to-HBO Max plan is a temporary adaptation or a sign of whatâs to come. Warner Bros. has signaled that it believes multiplexes will remain important, recently announcing theatrical movies for 2023, including the âMad Max: Fury Roadâ prequel âFuriosa,â with no mention of HBO Max. Still, few believe that AT&T brass and WarnerMedia CEO Jason Kilar see their plan as simply a short-term response.

Will small fry survive the streaming wars?

In the battle for streaming audiences, there are the brawling kaiju, and thereâs everybody else. A little more than a year after its launch, Disney+ has emerged as a clear frontrunner among the newer streamers, with its success emboldening a major revamp of the companyâs structure and a dramatic increase in programming plans. Netflix, in its effort to maintain its position as library content migrates from its app, will look for more homegrown hits Ă la âThe Queenâs Gambitâ and Shonda Rhimesâ âBridgerton.â

Apple and Amazon have an advantage in that they donât really need Hollywood; they can afford to lose money on streaming for as long as they choose. HBO Max, a high-stakes bet by AT&T, is trying to recover from its messy launch by gambling with a yearâs worth of Warner Bros. movies and stunt reboots such as the just-announced Samantha-less âSex and the Cityâ series.

That leaves the smaller players to make inroads where they can. Paramount+ (rebranded from CBS All Access), Peacock and Discovery+ will have to figure out where they fit into a crowded market when peopleâs entertainment budgets are already stretched by subscriptions. None of those three seem to be make-or-break priorities for their parent companies, which could increase the risk that they become also-rans.

Who will buy a studio?

With Metro-Goldwyn-Mayer Studios being shopped to potential buyers a decade after its bankruptcy, M&A talk has returned to the entertainment industry. The question is, whoâs buying? Itâs an opportunity for the usual suspects, including international media and tech firms such as Apple and Amazon. The sellers are keeping their options open for a possible acquisition by a deep-pocketed company or private equity firm.

The conventional wisdom holds that one acquisition leads to others. If MGM or another studio sells to a tech player, the conversation will turn to what deals come next, though a bigger catalyst would be something like a combination of WarnerMedia and NBCUniversal, which Wall Street analysts at MoffettNathanson have floated.

Lionsgate is a constant potential target for a tech giant or a media company looking to bulk up. Sony Corp. has long seemed resistant to the idea of selling its Culver City studio, but that could change as Silicon Valley companies circle the industry in search of something that can give them an edge in the content space. Of course, a company the size of Google, Apple or Amazon might decide that an asset like MGM, Lionsgate or even Sony isnât big enough to put it over the edge competitively. What if one of them decides to go after something bigger?

Will Washington hobble Big Tech?

The tech world, meanwhile, has its own issues to deal with in Washington, where antitrust sentiment against Silicon Valley has been brewing. With Trumpâs banishment from mainstream social media platforms and Parlerâs exile from app stores, the antitech criticism has lately been most visible on the right.

But concern over the internet companiesâ influence is bipartisan. Facebook, which also has toyed with the content business, could take additional political heat over its role in fomenting the kind of collective delusion that inspired the mob invasion of the U.S. Capitol last week. The government has already launched a case against Google over its dominance of search, and Apple and Amazon have come under scrutiny for how they wield the power of their platforms.

Big Techâs forays into entertainment probably arenât a main focus of regulators. However, intensified scrutiny could make it less likely that one of the so-called FAANG companies (Facebook, Amazon, Apple, Netflix and Google) makes the kind of splashy media company purchase that becomes a natural bullâs-eye for lawmakers and regulators.

Will the push for diversity deliver results?

Following the death of George Floyd by a Minneapolis police officer, media companies were all over the airwaves and social media proclaiming their support for racial justice. The corporate hashtags were met with the expected eyerolls.

Where was the true action? Internally, there were inclusion workshops and Zoom seminars, all acknowledging the work that needs to be done to diversify the overwhelmingly white C-suites at the studios and networks. While audience demand for greater onscreen representation has resulted in more inclusive storytelling , progress in terms of people of color getting decision-making power remains slow.

Some are doing the necessary work, including Michael B. Jordan and Ava DuVernay. As my colleague Yvonne Villarreal wrote, DuVernay and former Warner Bros. TV head Peter Roth have teamed for a plan to diversify production crews, which seems like a step toward real change. MGM promised to relaunch a whole film label, Orion Pictures, with a new mission to elevate diverse stories and storytellers.

As for the broader industry, weâve heard promises too many times to enumerate them all here. Weâll be watching to see if the familiar patterns return.

Support our journalism

Subscribe to the Los Angeles Times.

Number of the week

San Joseâs Roku on Friday paid âless than $100 millionâ for more than 75 shows, including â#FreeRayshawn,â from defunct streaming service Quibi, The Times and others reported. Based on what weâve heard, the words âless thanâ are doing a lot of work here.

Quibi raised $1.75 billion before launch. The Jeffrey Katzenberg-created app had $350 million to return to investors once it collapsed, meaning it spent about $1.4 billion before going bust. Even if the company expended only half of that cash on content, getting less than $100 million for it â and maybe a lot less â represents a tiny return.

How Roku will use a built-for-mobile film and TV library for its traditional flat-screen customers remains to be seen. As Wendy Lee noted, the shows were designed for mobile viewing. But given the bargain-basement price, itâs no wonder Rokuâs shareholders are pleased.

The pitch: Netflixâs sizzle reel

Netflix is sticking with the volume game with its movie lineup in 2021, if its new promotional video is any indication. This morning, the Los Gatos, Calif., company released its slate of film titles for the next year, totaling 70 movies. That includes 52 English-language live-action titles, as well as 10 non-English and eight animated pictures.

The streamer announced the slate with a promotional video promising, with its ambitious slogan, ânew movies, every week.â The sizzle reel shows clips from âRed Noticeâ and Lin-Manuel Mirandaâs âtick, tick ⌠BOOM!â Some filmmakers have privately complained that itâs easy for Netflix titles to get lost in its vast, ever-growing catalog as the company emphasizes the quantity of its films and shows. But the production pipeline is clearly not slowing down.

Iâll take âInternet controversiesâ for $400

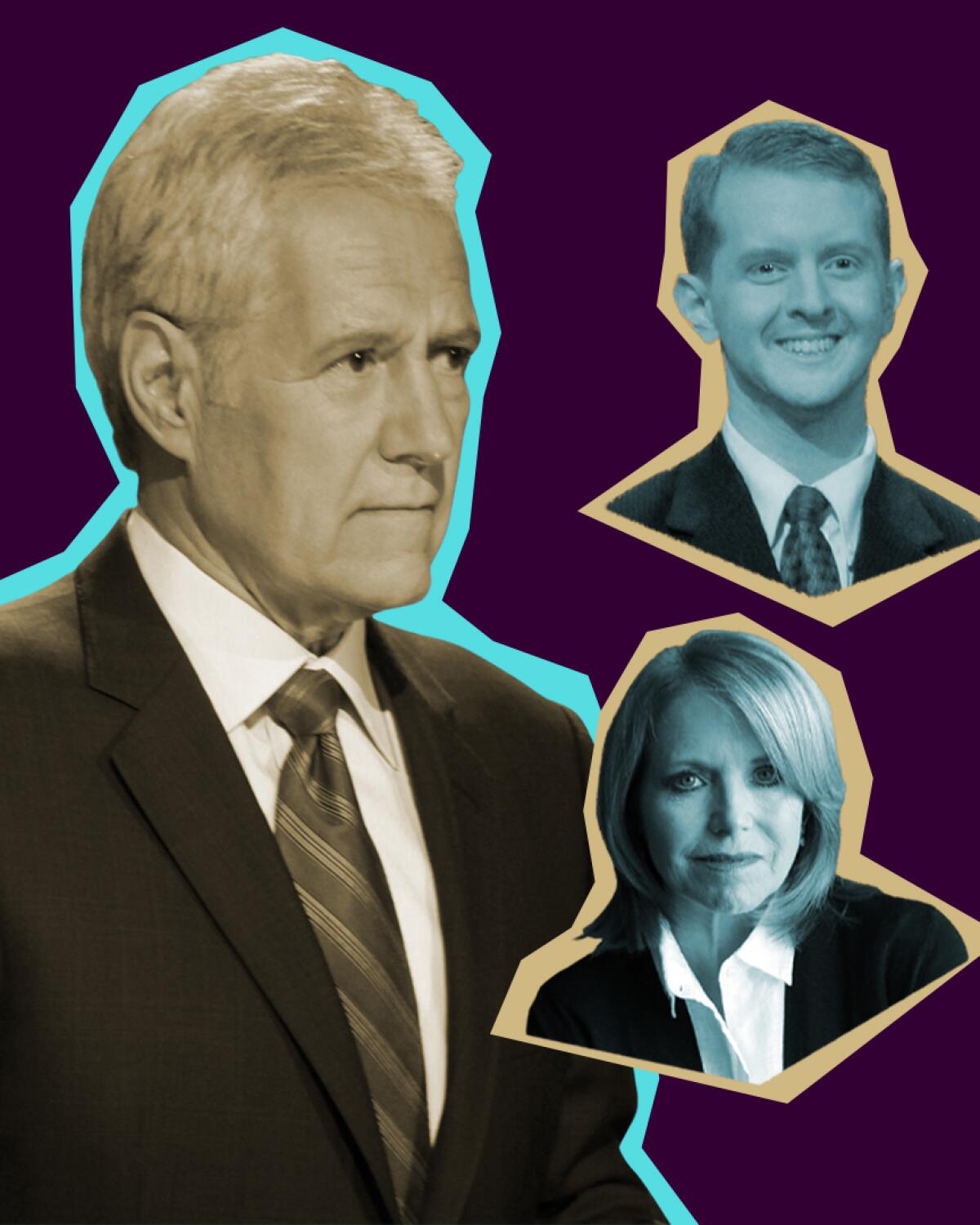

Who will succeed the late Alex Trebek as âJeopardy!â host? Stephen Battaglio looked into the factors at play as Sony Pictures Television considers its options for the face of its beloved quiz show. Those with potential include Steve Kornacki, Katie Couric and, of course, Ken Jennings, the one âJeopardy!â champion to rule them all.

According to Battaglioâs sources, agencies were surprised at the bake-off scenario because they assumed Jennings was being groomed for the role. Apparently Sony is looking for someone with A-list appeal. Itâs hard to think of a bigger star among âJeopardy!â fans than Jennings. But, like so many people whoâve had their dream jobs in their sights, heâs stepped in it on social media, most recently with the #Beandad social media drama.

More top stories

â Wendy Lee profiled Kelly Merryman, whose work at YouTube has helped turn the Google unit from an enemy of Hollywood to a partner.

â For Vulture, Jackson McHenry dug into the output so far from Ryan Murphyâs lucrative Netflix deal. The story gets into the dynamics of what happens when a person who built a reputation as an outsider gets the seat of power.

â Two years ago, Pixarâs Pete Docter got the unenviable task of leading the company as its chief creative officer after the departure of John Lasseter. Rebecca Keegan of the Hollywood Reporter wrote an in-depth profile of the veteran animator, whose latest directorial effort, âSoul,â is streaming on Disney+.

â Lastly, the first sentence of Brooks Barnesâ profile of Louise Linton, film producer and wife of Steven Mnuchin, certainly got my attention...

On the calendar

CES began Monday (virtually) and runs through Thursday.

Focus Featuresâ âPromising Young Womanâ hits PVOD Friday.

Liam Neesonâs latest actioner, âThe Marksman,â hits whatever theaters are open, courtesy of Open Road.

Finally ... a recommendation

Over the holidays, I finally caught up with the Ringer podcast âBoom/Bust: The Rise and Fall of HQ Trivia,â about the trivia game that promised to be the future of television. Itâs a worthwhile listen for media pros and anyone who remembers that brief moment when an app managed to create essential appointment viewing. Hearing how it all went wrong is pretty spectacular.

Thanks for reading the Wide Shot.

Follow me on Twitter (@rfaughnder), and if you want to send me a tip or any feedback, hit me at [email protected] or direct message me for Signal info.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production â and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.