Is there a market solution to L.A. homeless housing?

When the pastor of the South Los Angeles church unfurled his plans to build homeless housing, the council member assumed the visit was about money.

âItâs nice, but where are we going to come up with the cash?â Councilman Marqueece Harris-Dawson recalled asking.

Shortly after that meeting, Los Angeles voters passed Proposition HHH, a $1.2-billion bond measure to build homeless housing. Harris-Dawson called the pastor with the good news. âThereâs money. Come by my office,â he said.

But Pastor Kelvin T. Calloway brushed the offer off. âThatâs OK,â he told the councilman. âWe got this.â

What Calloway had was $11.7 million in private sector capital that would allow Bethel AME Church to build 53 permanent housing units for homeless people on its property at 79th Street and Western Avenue.

The money came from SDS Capital Group, one of a handful of mission-driven for-profit companies and nonprofits that finance and build housing for people with special needs â those who are chronically homeless or mentally or physically disabled â without government subsidies.

Collectively, they are producing affordable housing with private sector financing on a scale that rivals the developers who rely on a smorgasbord of tax credits, HHH and other government subsidies.

Without the bottlenecks and restrictions of public money, private sector developers can tap underutilized financing such as foundation investment funds and even crowd-sourcing to build faster and at lower cost.

SDS has raised $190 million in social impact capital to finance 2,500 or more units of permanent housing for homeless people over the next decade. Its president and chief executive, Deborah La Franchi, expects to complete the Bethel project in less than two years at about $250,000 per unit.

That would be less than half the cost of the typical project that has received HHH funding. And the time frame would be much shorter than the three to five years many of those projects usually take simply to build what is called a âcapital stackâ from multiple public sources before they can apply for tax credits, which make up the majority of the funding.

Advocates argue that the privately funded development is the only realistic path to building on the scale necessary to solve the regionâs affordable housing crisis.

The more zealous see the Low Income Housing Tax Credit system, commonly known by its acronym LIHTC, as a relic that bogs projects in bureaucracy and drives costs up.

âThe way LIHTC has been implemented over the years has caused a lot of taxpayers to become disillusioned with government-financed development,â said Bill OâNeil, director of capital markets at SoLa Impact, a for-profit developer that has completed 400 units for low-income and formerly homeless people in the last 12 months and has more than 4,000 more in various stages of development. In his view, the tax credit process, which pays developer fees based in proportion to the total cost of a project, creates an incentive to spend more.

The incentive works the opposite way for SoLa.

âWe have to answer to our investors, which drives accountability and cost-efficiency,â OâNeil said. âIf they donât like what weâre doing we donât have jobs.â

Housing researchers have taken notice, and see potential â within limits.

âItâs very encouraging to see so many people trying to solve this affordability problem through non-traditional means,â said David Garcia, policy director for the Terner Center for Housing Innovation at UC Berkeley.

Economist Jason Ward, associate director of the Rand Center on Housing and Homelessness in Los Angeles, sees private funding as a way to unlock the advantages of streamlined production.

âYou can produce housing MUCH more quickly and affordably if you can avoid all the (well-intentioned) constraints placed on housing production by various public funding sources,â Ward wrote in an email reply to The Times. âIf managed right, large-enough funds can be turned into a revolving account to finance this kind of quicker and less expensive production in an ongoing manner.â

Neither see private investment as the sole solution to homelessness.

âI will say I do think there will always be a need for the traditional affordable housing development structures, the LIHTC type projectsâ to provide affordability that âeven innovate private market approaches are just not going to serve,â Garcia said.

âIf you are trying to serve a population that is acutely low income, trying to build permanent supportive housing, that needs specific sources of subsidy,â he said. âYouâre always going to need having that structure in place to provide that type of housing.â

Such housing relies on long-term rental subsidies and services for a resident population with a high proportion of physical and mental health disabilities, and comes with commitments to keep their rents affordable for decades. Private sector developers are not required to make the same commitments.

Among the wide array of actors seeking a social impact solution to homeless housing, there is no single âprivate sectorâ model.

Some envision the public and private sectors working together, with land acquisition, loan guarantees or other boosts from government supplementing private capital.

After decades building LIHTC housing, Christian Ahumada, executive director of nonprofit developer Holos Communities, has fielded an innovation team to pursue imaginative, even fanciful, new housing models.

Ahumada, for example, imagines a special department in the city that acquires land, conducts community outreach and entitles a housing project, then hands the package over, âlike a relay race â by the time that goes to the developer, the developer is just, âGo, go.â â

For now, what Ahumada calls Housing 2.0 is still unproven. Holos is expecting to break ground by early next year on two projects financed through Californiaâs Multifamily Housing Program, a less onerous source than LIHTC funding, but still government money.

âWeâre continuing to dream bigger though and are working on models that donât require any public funding,â said Aaron Perry-Zucker, Holosâ director of marking and communication.

Capital for social impact development comes from many sources. SoLa has financed its construction, all in South Los Angeles, with opportunity zone investments that give tax breaks for money pumped into low-income neighborhoods. Others build their funds from social impact investors and credit institutions that are willing to accept less than market returns to see their money contribute to their social mission. SDS Capital Group, for example, received $50 million from Kaiser Permanente.

What distinguishes them all from the prevailing model of government-subsidized housing is that the money comes first.

The typical subsidized project begins with a building site. Then the developer goes after subsidies, often grants or loans from up to five different government programs, leading to an application for the tax credits, the last hurdle in a steeplechase that can take years.

Private sector developers may spend years building their capital pools, but when they identify a project, they can fund it quickly.

âWeâre here to put money in the ground and build units,â SoLaâs OâNeil said. âTime counts. Itâs really critical.â

At least seven low-income housing developments funded by the state have eclipsed more than $1 million per apartment to build in the last two years.

Former journalist and foster youth advocate Daniel Heimpel hopes to tap several hundred million dollars from private foundations to produce housing for 2,000 young adults leaving the foster care system.

His multifaceted concept would provide different living arrangements including shared living in single-family homes and private units in apartment buildings with tenants of all ages. The nontraditional accommodations would not qualify for tax credits.

In a study commissioned by several foundations, the community lending institution Genesis LA found that the money could be raised by a combination of foundation grants and investments returning 8% interest, about half the expected rate for conventional private sector funds. Heimpel is now in discussion with a potential fund manager.

Creative financing is also key to unleashing the inventiveness of small-scale developers who lack the financial heft and expertise to navigate the byzantine public financing system.

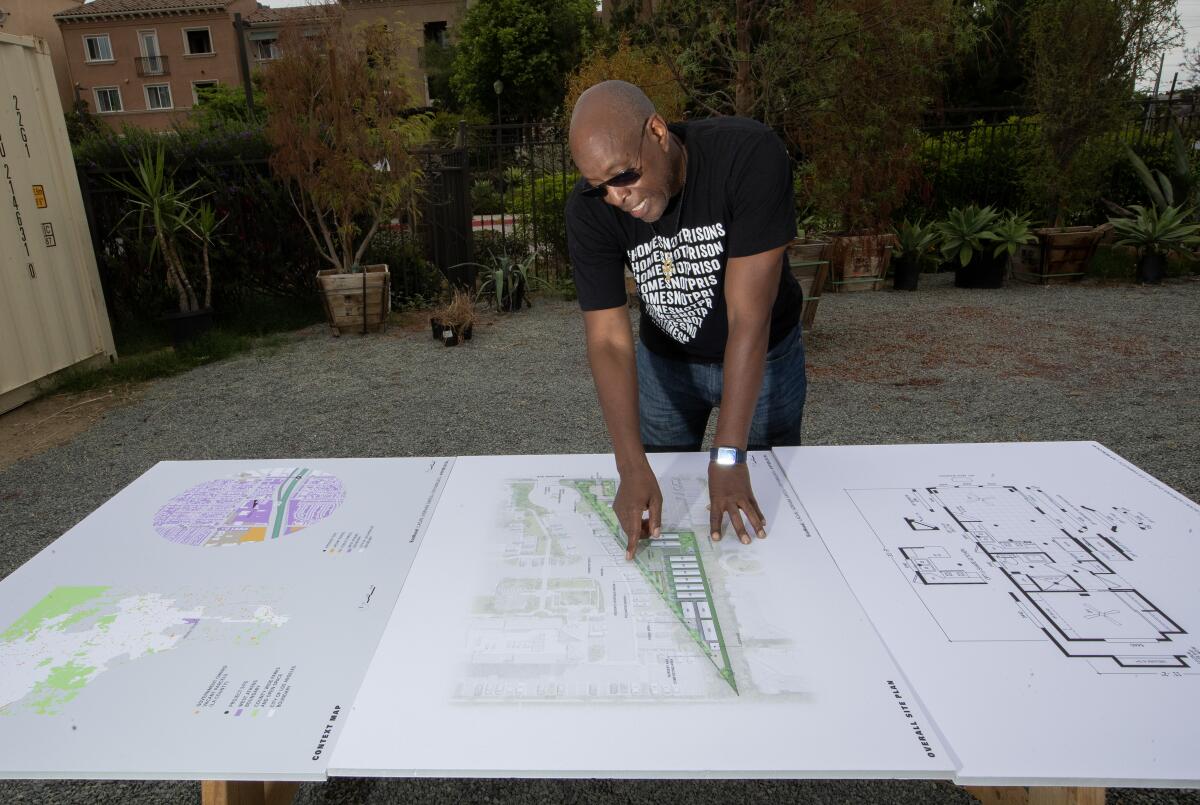

Pete White, president and founder of the homeless advocacy nonprofit LA CAN, had no development experience when he received a donation of âunusableâ land between Imperial Highway and the 105 Freeway. The half-acre lot, in the shape of a chefâs knife, was carved out of a large affordable housing project because it was too close to the freeway to qualify for tax-credit financing.

The restriction, meant to protect residents from high concentrations of air pollutants near freeways, can conflict with the goal of housing people who live outdoors, often on freeway embankments and underpasses, White said.

White raised $250,000 from Black Lives Matter and crowd-sourcing, and commissioned an architectural plan that arranged 11 free-standing structures in the blade portion of the lot, leaving room for a community garden on the handle â an amenity that will be open to anyone in the neighborhood.

âWe wanted to erase this idea that this land canât be used and these plans donât pencil out,â White said. âWe wanted to show what a project could cost when we kept the city as far away from it as possible.â

After his first idea â 3D printing the homes â didnât pan out, White settled on a mobile home manufactured by Champion Homes Center in Lindsay, Calif. The wood-frame structures, each with a kitchen and bath, are delivered on wheels and licensed by the DMV, a big reduction in red tape by avoiding city building approvals and inspections.

Once the city clears him to install them, heâll have 11 permanent homes at an average cost of $50,000.

âI see the project as being common sense, not revolutionary,â White said. âCan this be the antidote to houselessness? No. Is this the way to begin to move forward to use properties that are empty? I would say yes.â

Whiteâs goal is to keep rent low enough that residents can pay their own way with their Social Security or other benefits, thus entirely removing additional public subsidies from his project.

More commonly, though, projects built with social impact investments rely on government rental subsidies to sustain their operation. When SoLa or SDS Capital finances a building, their cash flow projections depend on rental subsidies, either federal or local, to pay off debt and provide a return to their investors.

::

In the race to provide homes for the thousands living on the streets â and potentially tens of thousands facing rental insecurity â the challenge is scale: How much affordable housing can be produced in what period of time?

There are limiting factors.

Ward, of Randâs Center on Housing and Homelessness, sees a barrier in the capacity of the services systems to keep pace.

âI have heard troubling anecdotal evidence of chronically homeless individuals being placed in permanent supportive housing and left without meaningful support leading to poor outcomes, destroyed units, etc.,â Ward said.

âItâs not clear that there is some private financing mechanism to address this issue,â he said. âBut itâs probably where a lot of thought should be going among these folks who are enthusiastic about the production side of this space.â

Ward said that complication makes the social impact model more appropriate for rent-subsidized affordable housing rather than service-dependent permanent supportive housing.

That matches SoLaâs stated mission to provide housing for low-income residents of South Los Angeles. La Franchi, on the other hand, is committed to homelessness as a defining social mission.

Both groups have forged relationships with service providers such as Homeless Healthcare LA and Homeless Outreach Program Integrated Care System to lease buildings and provide services.

In the long term, shortages in either the supply of capital or rental subsidies could squeeze production.

âIn order to have a functioning affordable housing market, to deliver the volume of housing we need at the middle and low income levels, you need a steady supply of funding,â said Helmi Hisserich, a former official in the defunct Los Angeles Redevelopment Agency and the L.A. Housing Department who now works with a nonprofit researching global challenges including housing affordability. âItâs got to be predictable, itâs got to be a significant supply of capital that can be invested into the market.â

So far, SDS Capital and SoLa have not faced a shortage of capital. After closing several deals quickly, La Franchi returned to investors to add $40 million to her initial $150-million fund. SoLaâs most recent fund, called its Black Capital Fund, has raised its total investments to more than $1 billion.

In the last year, La Franchi said, sheâs seen progress in her most troublesome obstacle, development restrictions and City Hall bureaucracy requiring multiple plan checks from multiple departments.

âWe need the Disneyland Fast Pass,â La Franchi said in an interview last year. âYou want to help us? We donât need your money. We just need to get through the process in a reasonable amount of time.â

To get the most out of her investment fund, La Franchi needs to recycle the money at least once by using completed projects as collateral for long-term commercial financing. Cutting six months off the time projects are locked up in city review would enable her to build more projects â as many as 3,500 units â before the money has to return to investors.

La Franchi, who was on Mayor Karen Bassâ transition team, said sheâs seen improvement since the new mayor ordered city departments to streamline the processing of affordable housing projects. The Legislature has helped too.

The Bethel project, conceived by Pastor Calloway in 2016, only broke ground last year, and almost fell apart because of a three-story height limit and parking requirements.

âThe numbers werenât working,â La Franchi said.

It was rescued by two bills easing zoning and parking restrictions for affordable housing on church property.

âThis is a perfect example of how state and local policy changes make a huge difference in making projects pencil instead of being completely underwater and not viable,â La Franchi said.

The foundation is in, and the walls are rising. Opening is scheduled next year.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.