Regulators and law enforcement crack down on crypto’s bad actors. Congress has yet to act

- Share via

WASHINGTON — The scandals in the cryptocurrency industry seem to never end, but Washington policymakers appear to have little interest in pushing through legislation to codify the structure of the industry.

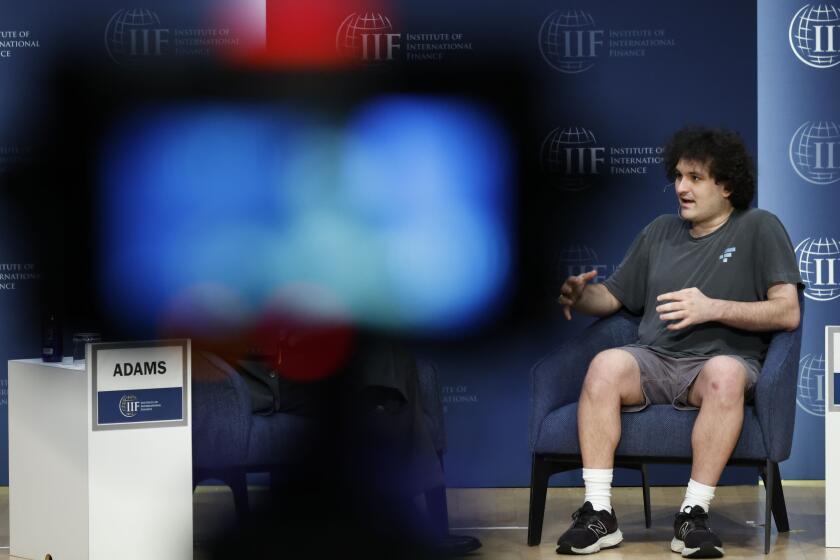

The latest shoe to drop was Binance’s multibillion-dollar settlement with U.S. authorities and the resignation of its chief executive last week. Before that came the conviction of FTX founder Sam Bankman-Fried for stealing billions from customers and the implosion of smaller crypto companies that cost investors large sums of money.

When cryptocurrencies collapsed and a number of companies failed last year, Congress considered multiple approaches for how to regulate the industry in the future. But most of those efforts have gone nowhere, especially in this chaotic year that has been dominated by geopolitical tensions, inflation and the upcoming 2024 election.

In fact, the appetite for new rules seems more diminished than ever.

At a news conference last week announcing the $4-billion settlement with Binance, U.S. Treasury Secretary Janet L. Yellen said existing regulations already apply to cryptocurrency: “I think today’s actions show that we are serious about enforcing strong regulations that are already in place to make sure that illegal transactions are not fostered by cryptocurrency entities,” she said.

“In cases like this, where there are violations of a truly egregious nature,” she said, “of course we want to make sure our tools stay up to date and are adjusted so that we can address emerging threats. We believe we have strong tools and we have been increasingly deploying them to counter this type of abuse.”

As cryptocurrencies and NFTs gain popularity, addiction specialists are hearing from people whose compulsive trading resembles full-blown dependency.

And a group of more than 100 mostly Democratic lawmakers in October said the responsibility for preventing the use of crypto to finance terrorism belongs to the White House, calling for the Biden administration to act.

Changpeng Zhao, the CEO of Binance, pleaded guilty last week to a felony related to his failure to prevent money laundering on the platform. Zhao stepped down and Binance admitted to violations of the Bank Secrecy Act and apparent violations of sanctions programs, including its failure to implement reporting programs for suspicious transactions.

As part of the settlement agreement, the U.S. Treasury said Binance will be subject to five years of monitoring and “significant compliance undertakings, including to ensure Binance’s complete exit from the United States.” Binance is a Cayman Islands limited liability company.

U.S. Atty. Gen. Merrick Garland called the settlement one of the largest corporate penalties in the nation’s history.

Now the largest entities in crypto over the last couple of years — Binance, Coinbase and FTX — either are in severe legal trouble, are under investigation or have collapsed altogether.

Without Congress, federal regulators such as the Securities and Exchange Commission have stepped in to take their own enforcement actions against the industry, including the filing of lawsuits against Coinbase, Binance and Kraken, three of the biggest cryptocurrency exchanges. Kraken was charged by the SEC last week with operating its crypto trading platform as an unregistered securities exchange.

The ridiculous story of Sam Bankman-Fried, FTX and cryptocurrency generally is aired in two new books, but only one is worth reading and it’s not by bestselling author Michael Lewis.

Additionally, PayPal received a subpoena from the SEC related to its PayPal USD stablecoin, the company said in a filing with securities regulators this month. The firm says its cooperating with authorities.

Some members of Congress have opposed the SEC’s actions on crypto, arguing that the SEC needs congressional approval to justify going after bad actors, or that crypto should be regulated more like a commodity, which would be under the jurisdiction of the Commodity Futures Trading Commission. One or both of those arguments have been made by legislators in both major political parties.

Sens. Debbie Stabenow (D-Mich.) and John Boozman (R-Ark.) proposed last year to hand over the regulatory authority over cryptocurrencies such as bitcoin and ether to the CFTC. Stabenow and Boozman lead the Senate Agriculture Committee, which has authority over that regulator.

So although Congress has made proposals, it has yet to act. Part of the reluctance to act stems from lawmakers’ inability to coalesce around what crypto is in the first place, and further, the opposition to crypto altogether from some powerful members of Congress.

One of those members opposed is Sen. Sherrod Brown (D-Ohio), chair of the Senate Banking Committee.

Brown has been highly skeptical of cryptocurrencies as a concept and he’s been generally reluctant to put Congress’ blessing on them through legislation. He’s held several committee hearings over cryptocurrency issues, ranging from the negative impact on consumers to use of the currencies to fund illicit activities, but has not advanced any legislation out of his committee.

“Americans continue to lose money every day in crypto scams and frauds,” Brown said in a statement after Bankman-Fried was convicted. “We need to crack down on abuses and can’t let the crypto industry write its own rulebook.”

In the House, a bill that would put regulatory guardrails around stablecoins — cryptocurrencies that are supposed to be backed by hard assets such as the U.S. dollar — passed out of the Financial Services Committee this summer. But that bill has gotten zero interest from the White House and the Senate.

Consumer advocates are skeptical about the need for new rules, or the usefulness of crypto itself.

“The lawlessness if not criminal activities of crypto will continue and increase until all prosecutors, regulators and elected officials force the industry to act like all other law-abiding people and firms in the financial industry,” said Dennis Kelleher, president of Better Markets, a nonprofit that works to “build a more secure financial system for all Americans,” according to its website.

But some analysts say the fraud trials, settlements and criminal charges signal a new era for crypto development.

Yiannis Giokas, senior director of digital assets at Moody’s Analytics, said the settlement agreement between U.S. authorities and Binance “marks the end of an era.”

“With digital currencies becoming more mainstream and institutional players entering the space, regulations and enforcement will become stricter to ensure compliance and consumer protection. Yesterday’s development marks the same inflection point that we saw earlier at the intersection of the .com and post-.com eras.”