Everything we donât know about Elon Muskâs latest about-face on Twitter

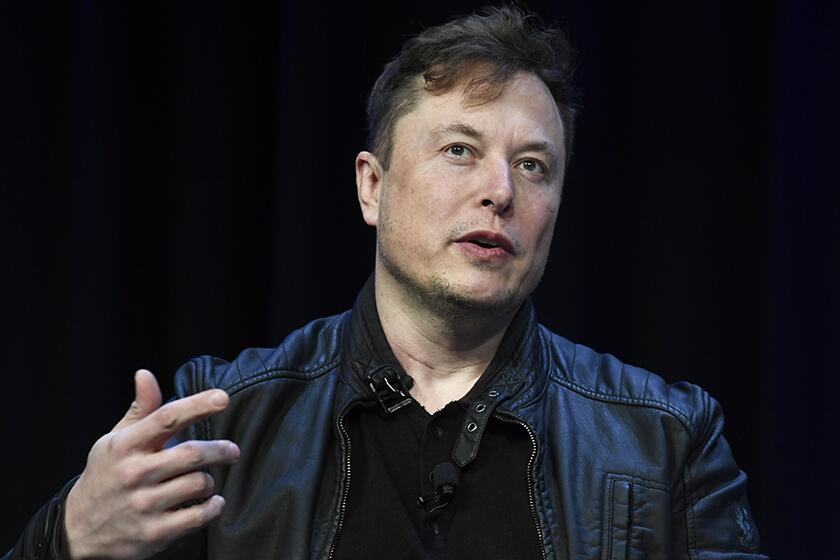

Elon Musk wants to buy Twitter for $54.20 a share: A headline from April, yes, but also breaking news, with the on-again, off-again Silicon Valley saga looping back around on itself to end up, on the eve of a courtroom showdown, exactly where it started.

With a trial over the stalled merger set to begin Oct. 17, the Tesla billionaire proposed Monday evening to consummate his courtship of the social media platform at the original price he agreed to pay in April.

A sharp downturn in the stock market quickly made the $44-billion purchase price seem high, and it wasnât long before Musk sought to back out, saying Twitter had too many bot accounts and was not transparent about the issue.

Although many Twitter employees were leery of Musk, who openly disparaged them as lazy activists, the companyâs management had little choice but to take him to court or risk the wrath of its own shareholders.

The latest development suggests Musk has come to agree with the many observers who saw a Twitter victory as all but assured. âBuying Twitter is an accelerant to creating X, the everything app,â he tweeted Tuesday.

But what changed his mind? Could he still see a way out of the deal? And what happens next for Twitter, either way?

Hereâs what we still donât know.

Will the deal go through?

After the events of the last six months, it may be hard to take Muskâs latest proposal at face value.

Musk initially purchased a stake in Twitter without the necessary public disclosures, then agreed to join its board of directors, only to walk away from that agreement to pursue the acquisition he would soon be trying to halt. He has publicly criticized Twitterâs executives, suggested they misled him and investors about the platformâs problem with bots, or automated accounts, and mused that the service may be dying.

Wary of another reversal, Twitter has reportedly asked the Delaware Court of Chancery to superintend the closing.

Could Musk still find a way out?

Itâs conceivable. A letter from Muskâs lawyers declared his intent to close the deal as originally agreed to in April, âpending receipt of the proceeds of the debt financing.â

That phrase could be significant. Muskâs $44-billion offer included $13 billion of debt financing from banks, including Morgan Stanley, Bank of America and Barclays. Under the terms of the merger agreement, Musk could escape the deal by paying a $1-billion breakup fee if the bank financing falls through, said Ann Lipton, a law professor at Tulane University.

But thereâs a catch: Thatâs only true as long as Musk is not determined to have sabotaged the financing or influenced the banks himself, Lipton said.

The billionaire leader of Tesla and SpaceX says Twitter must go private to fulfill its âsocietal imperative.â But the way he went about offering to buy it left Wall Street doubting his seriousness.

The banks could have their own motives for preferring to see the deal fail. They have struggled to offload buyout debt to investors in recent months and are facing huge potential losses from the Twitter deal, as well as many others.

On the other hand, the banks face both legal obligations and reputational pressure to follow through on their commitments, however expensive. If they bail, the chancery court could require Musk to hold them to their lending commitments, even if that involves Musk suing them to complete the financing, Lipton said.

The chances of a bank pullout âare pretty slim but not impossible,â said Eric Talley, a professor at Columbia Law School.

Did bad publicity for Musk and his billionaire friends play a role?

Itâs a theory. The discovery phase of the case had already yielded a trove of internal emails and text messages between Musk and other Silicon Valley whales and even, for some reason, Joe Rogan.

Some of the texts have shown Musk appearing unprepared or uninformed. Offered an introduction to crypto billionaire Sam Bankman-Fried, Musk did not seem to know who he was. In talking to Twitter Chief Executive Parag Agrawal, he wrote, âI kinda donât think I should be the boss of anyone.â

On the other side of the exchanges, Muskâs friends came across in some cases as sycophantic, careless or both.

Oracle founder Larry Ellison and venture capitalist Marc Andreessen both offered giant sums of money to back the deal with no apparent intention of performing any due diligence. Angel investor Jason Calacanis offered himself up as a candidate for Twitter CEO â âPut me in the game coach!â he texted â and managed to annoy Musk by trying to raise outside funds for the deal without Muskâs permission.

The messages also showed Muskâs deepening ties to the political right. Joe Lonsdale, a conservative venture capitalist, texted Musk that Florida Gov. Ron DeSantis was in support of him.

Mathias Dopfner, CEO of media conglomerate Axel Springer, texted him: âWhy donât you buy Twitter? We run it for you.â Dopfner once asked executives at his company to pray for Trumpâs reelection.

Others reached out to simply celebrate the news.

âYou are the hero Gotham needs â hell Fâing yes!â Riot Games founder Marc Merrill texted to Musk.

âAre you going to liberate Twitter from the censorship happy mob?â Rogan texted him.

Musk was also due to be questioned under oath later this week.

What happens to Twitter now?

Although the messages released in discovery shed light on Muskâs vision for Twitter as a free speech haven, his plans for the company are still unclear. In a meeting with employees in June, Musk said he wanted to reach 1 billion daily active users and make the company profitable.

To do this and pay down the debt heâs taking on in this deal, Musk has a tough task ahead of him. In the June meeting, Musk implied layoffs were likely in order to bring down Twitterâs costs, which currently exceed revenue. Some of his allies have suggested he lay off a large fraction of Twitterâs 8,000 employees.

Whether in anticipation of those cuts or of Twitter becoming something they would find politically unpalatable, employees have already been leaving the company in droves, Business Insider reported in August.

Times staff writers Russ Mitchell and Michael Hiltzik contributed to this report.