Since its IPO, Snap Inc. did exactly what it said it would, so why is its stock struggling?

- Share via

The Los Angeles tech company behind

In its first four months as a publicly traded company, Snap Inc. has kept its part of the bargain. It has debuted a new mapping tool that reveals the location of friends and trending events, launched several short video series and made it easier for any advertiser to buy commercial time on Snapchat. The firm also caught up to rival Instagram by matching options for replaying messages.

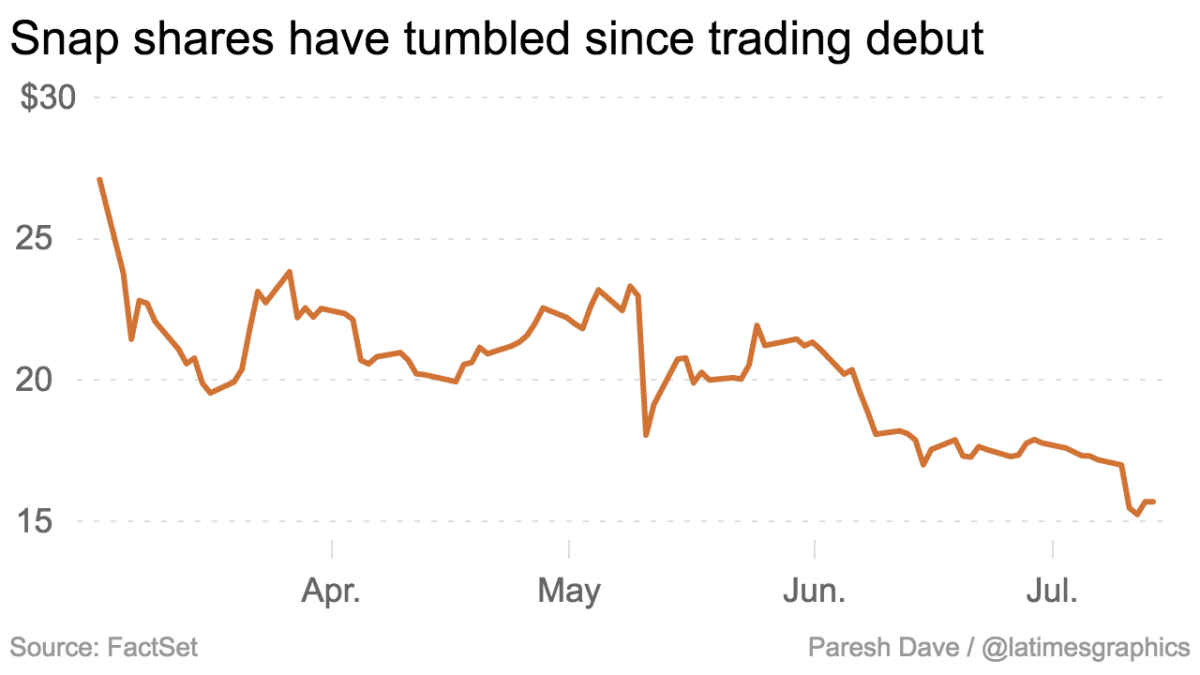

Yet, despite the changes, investors don’t consider Snap any more valuable than when it went public. In fact, Snap shares have fallen below their $17 opening price in March to $15.27 on Friday. The company’s market capitalization of around $18 billion sits right about where it did in the months leading up to Southern California’s biggest initial public stock offering.

What gives?

There’s no shortage of concerns swirling around Snap, which is scheduled to reveal its second-quarter financial results Aug. 10. But chief among them, investors remain unsure whether or how Snap will generate a profit someday. Snap declined to comment.

Financial analysts estimate the company will lose $3.3 billion this year, according to a tally by investment research aggregator FactSet. Much of Snap’s expenses is stock compensation to employees.

Questions about making money dogged Snap before its IPO too. Investors and analysts say what has led the stock to drop is a creeping sense among investors that no matter how many creative features it launches, Snapchat just may be too small a player in the app economy to command a high valuation. That has investors wondering when shares might settle at a comfortable price.

At the moment, as Snap stares “down the face of very pronounced head winds, we’d rather fish in better waters,” said Christopher Versace, chief investment officer at Tematica Research, which provides guidance to individual investors.

Advertiser reactions are mixed

Snap generates its revenue by selling ads that appear inside Snapchat. Varieties include 10-second commercials bought by the likes of Adidas, Spotify and Emirates in addition to small decorative graphics that anyone, including regular users, can buy to celebrate an event.

But it remains a work in progress for many big-budget advertisers to figure out whether the spots they’re buying are worthwhile. Snap in recent months introduced more sophisticated measures to help retailers track whether ads lead to in-store visits and purchases.

Morgan Stanley stock analyst Brian Nowak reportedly said this week that the initiatives have been underwhelming, and he lowered estimates for Snap’s ad sales growth. Others have voiced concerns about users skipping past ads on Snapchat and the special effort required to design commercials for the app.

Martin Sorrell, chief executive of ad agency giant WPP, gave unenthusiastic mentions of Snap in TV interviews in recent days. He said Facebook — which has duplicated many of Snapchat’s best-known features in its Instagram and Messenger apps — had “successfully” countered Snap.

WPP spends about $2 billion annually buying ads on Facebook for clients such as Ford and Procter & Gamble. Its spending on Snapchat ads could double to $200 million this year.

Versace, the investment research analyst, said Snap also could take a hit if companies lower their growth forecasts after initially thinking the economy would grow faster under

“This coming earnings season, there’s a high probability we see companies dialing back expectations for the second half of the year,” he said. “I wouldn’t be surprised if we see Snap doing the same.”

Credit Suisse stock analyst Stephen Ju said this week that he's had encouraging conversations with advertisers about Snap being on the right track. But he still lowered second-quarter sales assumptions.

“While we were hoping for Snap to exhibit a more comfortable growth path, we are reminded that nascent companies sometimes grow in fits and starts,” Ju wrote.

Analysts estimate Snap picked up $190 million in revenue during the second quarter, with a full-year estimate of $980 million.

“The big concern is you have a company that’s not profitable and doesn’t show a clear path to how it’s going to become profitable,” said Steven Dudash of IHT Wealth Management.

User growth remains difficult to predict

One of Snap’s biggest priorities for the year has been loading up the app with a daily batch of short, scripted videos about sports, celebrity life, food and even dating. But analysts are getting mixed data on whether shows and other features are roping in new users or getting existing Snapchatters to spend more time on the app. More users and more time spent increases the opportunities Snap has to display an ad.

Snap’s moves to increase usage may be cutting both ways. For instance, its new location-sharing feature has unleashed a wave of privacy concerns that could see parents more closely monitor or restrict their children’s app usage. On Wednesday, Arkansas Atty. Gen. Leslie Rutledge joined numerous schools and public officials in alerting consumers to be cautious about Snap Map.

Scott Devitt at Stifel, Nicolaus & Co. said in a note to investors Thursday that stock buyers should give Snapchat a try — and that becoming a user might assuage some of their skepticism.

“Many of these individuals don’t use or understand Snap (yet), leading to a negative bias despite healthy underlying growth,” Devitt said.

Snap Chief Executive

An increase in stock supply looms

The 200 million Snap shares available are expected to turn into 1.2 billion by the end of the summer as trading bans lift on employees, advisors and top investors. Increased supply tends to dampen prices.

How many shareholders will actually start selling their newly freed stakes “is a wildcard,” Versace said.

Veteran tech and media executives who took pay cuts to work at Snap may be interested in cashing in sooner rather than later, while co-founders Evan Spiegel and

Spiegel and Murphy, who already control most of the company's voting power, may decide to even add shares to their holdings in the coming weeks. Such a move would be a strong signal of their faith in their long-term plan.

Snap's biggest venture capital investors, Benchmark and Lightspeed Venture Partners, didn’t respond to requests to comment on their plans for their soon-to-be unrestricted Snap shares. Before its shares of Twitter became unrestricted three years ago, Benchmark forewarned that it wouldn’t be an immediate seller.

Stock indexes could keep Snap out

Snap also could automatically lose potential buyers in the coming months. Operators of stock indexes such as FTSE Russell, Standard & Poor’s and MSCI are considering, and perhaps leaning toward, leaving out companies that don’t offer investors voting power. An exclusion policy would be bad for Snap, whose publicly traded shares carry no votes, because several major investment funds maintain portfolios that match indexes.

The issue adds to the defense of people who are not only betting on Snap shares to fall, but also paying one of the market’s highest options fees to make that wager.

There is a limit to how far skeptics think shares will sink, and some think it’s near. Paul Schatz, chief investment officer at Heritage Capital, said Snap is “close to a low” as it moves into “the typical four- to six-month-after-IPO zone where a bottom is likely to appear.”

He had called the shares "garbage” in March when Snap traded in the $20s. At $16 months later, he says, “I am a lot less negative.”

UPDATES:

5:22 p.m.: This article was updated with Snap's closing stock price for Friday.

This article was originally published at 3 a.m.