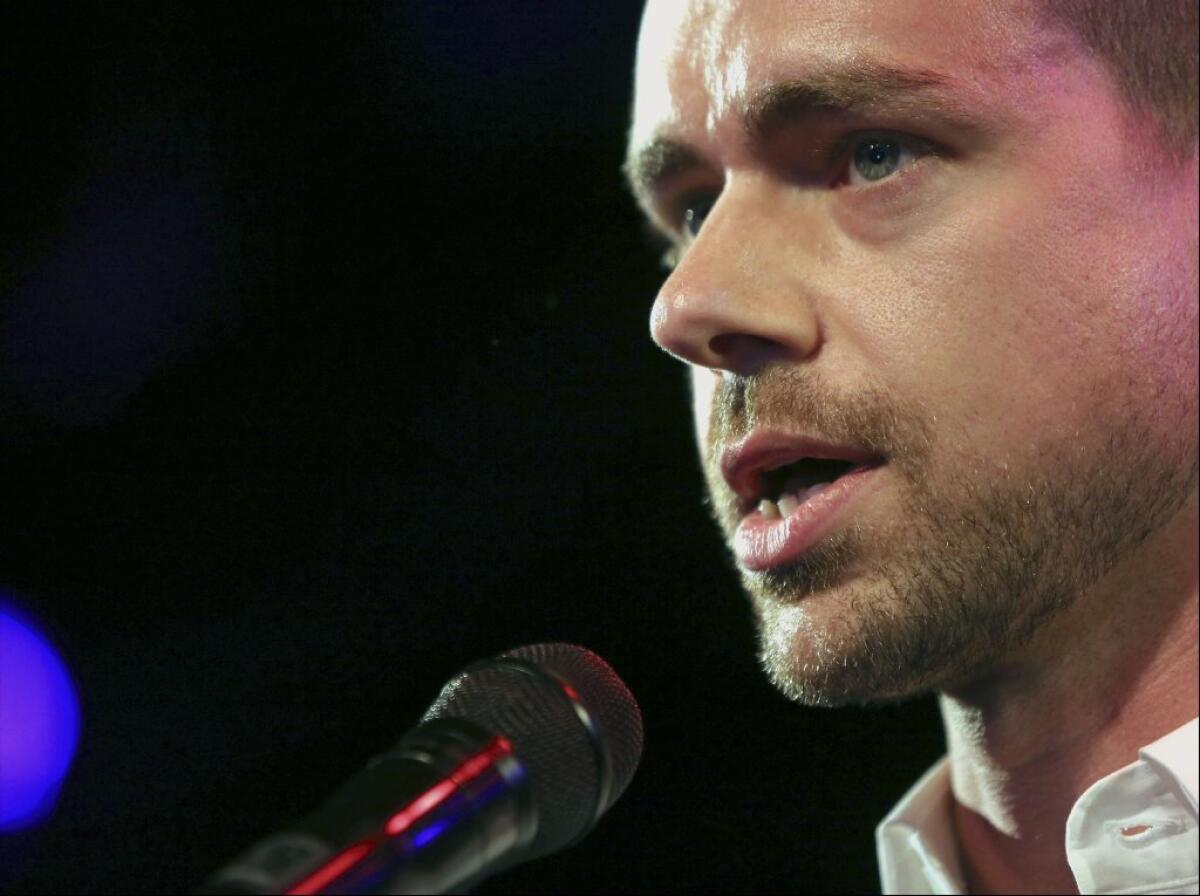

Jack DorseyŌĆÖs other company, Square, could do IPO as early as 2014

Jack Dorsey co-founded Square in 2009 after being given his walking papers as TwitterŌĆÖs chief executive.

SAN FRANCISCO -- Square, the payments company run by Twitter co-founder Jack Dorsey, could hold an initial public offering as soon as next year.

News of the timing came as DorseyŌĆÖs other company, Twitter, settled on the final price for its IPO. It is set to be valued at $18 billion when it begins trading on the New York Stock Exchange on Thursday.

Last week, The Times reported that Square had taken a step toward an IPO with the addition of former Goldman Sachs Chief Financial Officer David Viniar to its board. The Wall Street Journal reported on Wednesday that Square is in discussions with investment banks.

Aaron Zamost, a Square spokesman, declined to comment.

Viniar lends Square credibility on Wall Street as it prepares for an IPO. At the time he retired from Goldman Sachs last January, Viniar was one of the highest-profile and best-compensated executives in the financial industry. Goldman Sachs is also the lead bank for the Twitter IPO.

Dorsey, who co-founded Square in 2009 after being given his walking papers as TwitterŌĆÖs chief executive, has said that Square is planning on an IPO as a ŌĆ£milestone.ŌĆØ

It has raised $340 million, including $200 million last year in a venture capital funding round that valued the company at $3.25 billion.

ALSO:

For Twitter, itŌĆÖs an ideal IPO market

ItŌĆÖs official: $26 a share as Twitter prices IPO

Former Goldman Sachs CFO David Viniar joins Square board