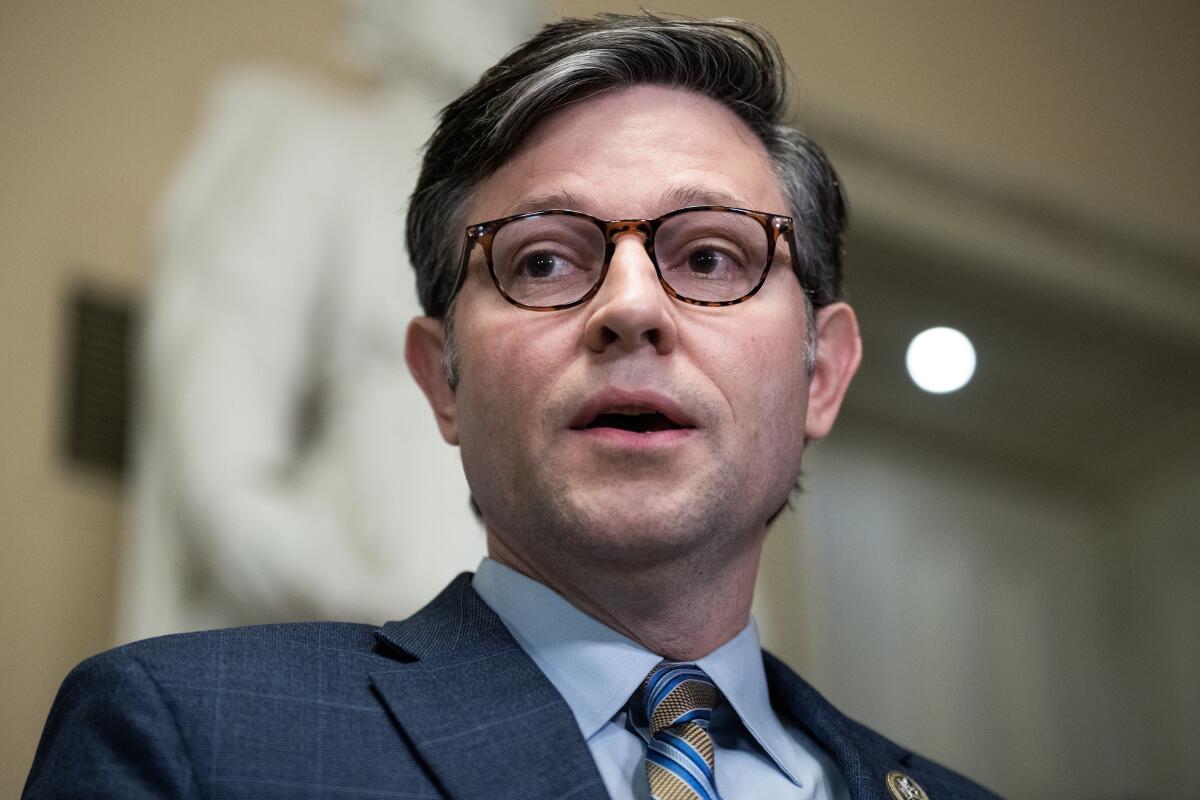

Column: The budget lie at the heart of House Speaker Johnson’s Israel aid proposal

- Share via

Scarcely a week into the tenure of House Speaker Mike Johnson (R-La.), and his view of American voters and the press as dimwits to be gulled is becoming clearer with every day. Case in point: His proposal to advance $14.3 billion in aid to Israel by “offsetting” it with a $14.3-billion cut in the budget of the Internal Revenue Service.

The truth, as anyone with the merest understanding of the IRS funding knows, that cut in the agency’s budget will open a vastly larger hole in the federal budget.

The Congressional Budget Office wasn’t fooled one bit. In its scoring of Johnson’s proposal, it estimated that the $14.3-billion IRS cut would reduce federal revenues by $26.8 billion over 10 years.

Only in Washington when you cut spending do they call it an increase in the deficit.

— House Speaker Mike Johnson tries to fool all of the people all of the time

The reason is that most of the money is earmarked for “enforcement and related activities,” the CBO observed — that is, hounding wealthier American taxpayers for the money they owe but don’t pay, the so-called tax gap.

Questioned about this finding, Johnson doubled down. “Only in Washington when you cut spending do they call it an increase in the deficit,” he said.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

We’ll do Johnson the (undeserved) favor of calling his comment “disingenuous.” Closer to the mark is the description by Alex Shephard of the New Republic that it’s a “trollish, stupid ploy.”

Late Thursday, a majority of House members bought into Johnson’s approach, passing his Israel aid measure, which included the IRS cut, on a mostly party-line vote. Senate leaders said they won’t bring the measure up for a vote, and President Biden said that even if it were to pass, he’d veto it.

A couple of threads came together in Johnson’s ploy. One is the GOP’s enduring effort to cast itself as the party of sound budgetary thinking. That’s a self-portrait that has long been fatuous in the extreme.

That image has been expressed in recent years by the GOP’s periodic grandstanding about the federal debt ceiling, which looks like a spending cap until you dig under the surface, when it becomes clear that it has nothing to do with limiting government spending — that’s entirely under the control of Congress, which spends whatever it wants under Democratic and Republican majorities alike.

The other thread is the party’s supine deference to its rich and corporate patrons. That’s been manifested in its hostility to the IRS. It should be recalled that when Congress passed the Inflation Reduction Act in April 2022, Republicans mischaracterized the $80 billion in additional IRS funding provided by the measure into a plan to create a horde of jackbooted government thugs empowered to rip the bread out of middle-class infants’ mouths.

America’s retirement system is already among the worst in the developed world. If new House Speaker Mike Johnson were to get his way, it would be far worse.

Of course it was nothing of the kind. The goal was to give the IRS the resources to enforce the law against those most prone to cheat on their taxes — the rich. As a team of IRS analysts and academic economists reported in 2021, the 1% were able to conceal as much as 21% of their taxable income from tax collectors, largely because pursuing them required enforcement resources the IRS didn’t have.

As I reported last year, anti-tax conservatives in Congress have systematically impoverished the IRS for decades, with the unmistakable goal of undermining its ability to do its job, not to mention its public reputation.

In 1991, the agency employed more than 114,600 full-time staff to serve a population of 254 million and collect about $1.1 trillion in revenue.

By 2020, full-time employment had dwindled to less than 75,800, serving more than 330 million Americans and collecting $3.5 trillion. Just over the previous decade, the agency’s budget had declined by 20% in inflation-adjusted terms.

For Republicans in Congress, that amounts to “mission accomplished.”

Johnson’s ploy demonstrates that the mission is still alive and well. What’s especially disturbing about it is that not a few Washington political reporters and political newsletters opted to take it at face value. Judd Legum of the indispensable Popular Information blog put it at the center of a post titled “Why reporters play dumb.”

Legum’s main target was Jake Sherman of PunchBowl News, a fledgling D.C. information sheet that has tried to make its name by sedulously cultivating access to congressional insiders and marketing it to Washington insiders like lobbyists.

As Legum documented, Sherman initially regurgitated Johnson’s description of the IRS cut as an “offset” in a tweet and treated the unlikelihood of its passage as a product of Democratic Party opposition. Sherman followed up two days later describing the CBO projection as “breaking” news.

Why does the IRS focus its enforcement capabilities on the poorest families?

Sherman must have known the truth all along because he had covered the debt limit negotiations in April 2022, when the CBO had scored the GOP’s proposal for IRS cuts as adding to the deficit.

But Sherman wasn’t alone. Per Legum, Bloomberg, the Guardian, CBS News and others parroted the GOP spin of the IRS cut as an “offset,” barely mentioning its deficit implications or leaving those out entirely.

This is how misinformation gets injected into the bloodstream of American political discourse.

The ingrained habit of political reporters is to parrot lawmakers’ points of view as if they’re neutral observers of nature, and then (if ever) to circle around and correct the record — typically after the initial lie has already become embedded in the public mind.

As we’ve learned, that no longer serves the public. It’s what allowed Donald Trump to trample reality during his four years in the White House — and what allowed him to continue doing so in recent interviews with CNN and NBC News. Johnson appears eager to exploit the same phenomenon.

His effort didn’t work very well this time around, mostly because the CBO was ready with a nearly instant refutation of his claim. But it was a near-miss.

The betting here is that if the CBO hadn’t issued its analysis so quickly, the trope that Johnson was “offsetting” Israel aid with the IRS budget cut would have become rooted in the public mind to the point where it was impossible to dislodge. And that’s scary.

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.