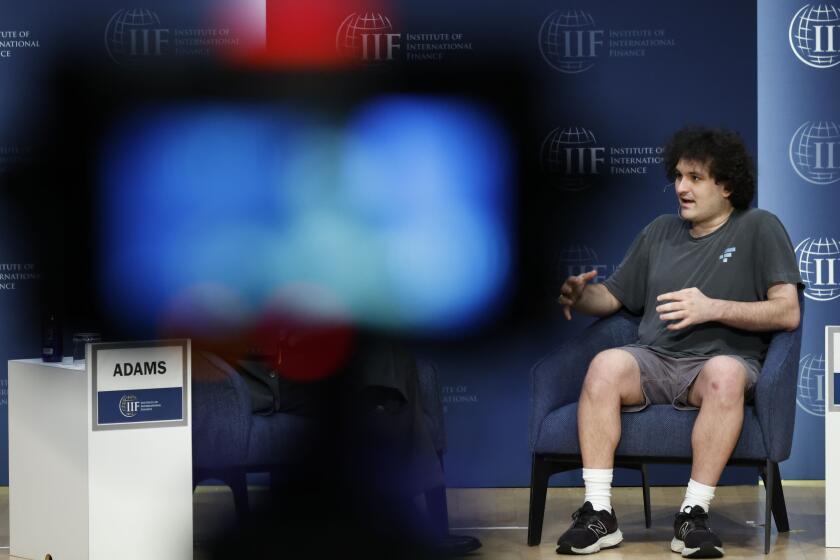

Column: Sam Bankman-Fried’s seven guilty verdicts expose crypto as a swindle through and through

- Share via

It took a federal court jury barely four hours Thursday to find crypto scam artist Sam Bankman-Fried guilty of seven counts of fraud and conspiracy.

He was undone partly by a crack team of federal prosecutors who laid out a clear, simple paint-by-numbers picture of his crimes for the jurors, but mostly by his own greed and arrogance. And also by the deceit fundamental to the cryptocurrency market itself.

The prosecutors strove to keep the jury focused on what Bankman-Fried had in common with fraudsters throughout history — the promise to marks that they will acquire riches beyond compare if they just ride along — rather than on the peculiarities of the crypto market.

The cryptocurrency industry might be new; the players like Sam Bankman-Fried might be new, but this kind of fraud, this kind of corruption, is as old as time.

— U.S. Attorney Damian Williams

”This is not about complicated issues of cryptocurrency,” assistant U.S. Atty. Nicolas Roos said in his closing argument to the jurors Wednesday. “It’s about deception. It’s about lies. It’s about stealing. It’s about greed.”

U.S. Atty. Damian Williams reiterated that point to reporters in a brief appearance outside the Manhattan courthouse after the verdicts. “The cryptocurrency industry might be new; the players like Sam Bankman-Fried might be new, but this kind of fraud, this kind of corruption, is as old as time,” he said.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

But those statements risk doing a great disservice to investors who might yet be tempted to take a plunge into the crypto market. Crypto promoters will paint Bankman-Fried as merely a single rotten apple.

That argument may work when fraud occurs in a market that is otherwise real, such as stocks, bonds or precious metals. It doesn’t work in this case, where the market itself is fraudulent.

The value of cryptocurrencies can be placed anywhere. They don’t produce income like bonds, and their prices can’t be pegged to liquid markets like those of public company securities. To this day, no one has ever explained what cryptocurrencies are useful for, other than paying ransom to crooks holding databases or computer systems hostage.

As I reported in the past, even Bankman-Fried acknowledged that claims for the usefulness of crypto involved “a lot of hand-waving.”

The ridiculous story of Sam Bankman-Fried, FTX and cryptocurrency generally is aired in two new books, but only one is worth reading and it’s not by bestselling author Michael Lewis.

Bankman-Fried exploited the vacuity of crypto as an asset by slathering it over with what sounded like profundities but were vacuous at their core. He could not have done so if there actually was anything genuine about crypto — his claims would have been weighed against market realities.

But since there is nothing real about crypto, there was nothing to weigh them against. His marks had to take him at his word. The harvest: They’ve lost as much as $10 billion, and Bankman-Fried is facing a prison term as long as 110 years.

What is amazing about this case is how many people got snowed, including leading investment firms such as Sequoia Capital. That Silicon Valley venture firm put $150 million into Bankman-Fried’s company, FTX, and followed that up by posting a slavishly adoring article about Bankman-Fried on its website.

The article reported that Sequoia’s partners decided to make their investment after a single “last-minute” Zoom call with Bankman-Fried. Its author, Adam Fisher, related that after his first interview with Bankman-Fried, “I was convinced: I was talking to a future trillionaire.”

Sequoia later scrubbed the article from its website (I retrieved it from the Internet Archive). The firm assured its clients that its FTX investment was the product of “extensive research” and “a rigorous diligence process.” That must have been some Zoom call! Anyway, Sequoia wrote down its FTX stake to zero.

Of the author Michael Lewis and his credulous book about Bankman-Fried, “Going Infinite,” not much more remains to be said. His reputation for perspicacity in matters financial lies in tatters.

He said that he had spent 100 hours with Bankman-Fried in researching the book, yet he didn’t see what 12 jurors came to understand after four weeks of testimony. In an interview broadcast on “60 Minutes” on Oct. 1, just before Bankman-Fried’s trial began, Lewis was still asserting that FTX was “a great real business. If no one had ever cast aspersions on the business, if there hadn’t been a run on customer deposits, they’d still be sitting there making tons of money.”

Lewis isn’t alone in displaying such childlike faith in the real-ness of crypto. “Even if Bankman-Fried appeals the verdict,” wrote Reuters columnist Anita Ramaswamy after the verdicts, “his swift conviction should cause a collective sigh of relief from firms using blockchain technology to solve real problems like streamlining cross-border payments and remittances.”

The lesson of Theranos and the conviction of Elizabeth Holmes is that even big-name investors can be fooled.

The truth is that no one seems to have found blockchain technology (the foundation on which crypto is built) necessary, or even useful, for “solving real problems.”

Who else got taken in? Politicians who were misled by Bankman-Fried’s blather, but more by his lavish political donations, into thinking that all the crypto field needed to complete its quest for legitimacy were a few judicious, but not especially burdensome financial regulations.

Bankman-Fried testified to Congress in February 2022 about what those might be. Put briefly, he advocated rules that resembled practices that he said FTX already had put in place. His firm, he said, offered customers and investors rigorous risk-management practices.

“FTX platforms have built a reputation as being highly performant and reliable exchanges,” he told the Senate Committee on Agriculture, Nutrition and Forestry, which oversees commodities regulation. “Even during bouts of high volatility in the overall digital-asset markets, the FTX.com exchange has experienced negligible downtime and technological performance issues when compared to its main competitors.”

He added, “FTX has aimed to combine the best practices of the traditional financial system with the best from the digital-asset ecosystem.”

What may have gotten lost in the commentary about Bankman-Fried’s criminal trial is that all of this was a lie. He painted FTX as a well-oiled machine designed to minimize risk in the crypto markets, but that structure and those safeguards simply didn’t exist — they were all part of the scam. That’s what gives the lie to his defense case that everything would have continued working perfectly if he hadn’t been momentarily distracted here and there.

Sam Bankman-Fried’s $16-billion fortune was always a myth. The mystery is why venture firms and the financial press thought it existed.

The facts were laid out last November by John J. Ray III, the corporate restructuring expert installed as FTX’s CEO after it filed for bankruptcy.

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here,” Ray told the bankruptcy court. “From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.”

Ray was the guy who managed the Enron bankruptcy, so it means something for him to say FTX was worse.

After Elizabeth Holmes, the mastermind behind the Theranos medical device scam, was convicted of fraud in January 2022, I predicted that the verdict in her case wouldn’t stop even sophisticated investors from pouring money into the next big fraud. The Bankman-Fried case allows me to say, “I told you so.”

Will this case keep investors from plunging into the next fraud? Don’t bet on it. The quest for easy pickings, FOMO — the “fear of missing out” — is too powerful a magnet for capital. Even as I write, the next scams are bulking large on the horizon. Keep your eyes on artificial intelligence and self-driving cars.

And keep your eyes peeled for the Next Big Thing. It will come along soon enough, and the reckoning won’t be made until billions of dollars are lost and the next swindler with a clever story goes to jail.

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.