Anxious about your student loan debt? Beware of offers that are too good to be true

- Share via

The current state of student loans is confusing.

Some loan payments are still on hold due to pandemic-era policies; some (private student loans) never stopped requiring payment.

Many are watching with bated breath as the Supreme Court deliberates the fate of the trillions of dollars of federal student loan debt. Will a large amount of it be forgiven, as President Biden promised? And when will repayments begin for whatever balances remain?

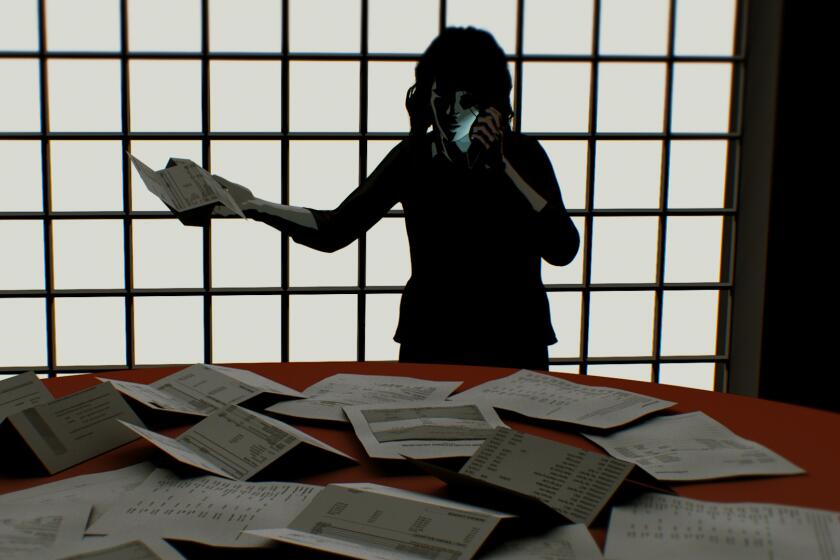

Where borrowers face uncertainty and worry, others see opportunity — enter student loan scammers.

These swindlers seize upon fears about the mountains of debt that millions of Americans face by dressing up scams as quick and easy fixes.

“People have been stressed out about paying their bills, and that creates a captive audience,” said Suzanne Martindale, senior deputy commissioner of California’s Department of Financial Protection and Innovation, which regulates banks, credit unions and other financial service providers operating in the state.

The problem is that spotting scams — or even legal offerings that may be less advantageous than they seem for a borrower — can be tougher than dismissing emails from allegedly deep-pocketed “royalty” from faraway countries. The deceptions are usually shrouded in official-seeming web design and enough finance-speak and legalese to make it all seem promising.

“So-called debt relief companies claim that they can help you navigate your debt, lower your payments. Sometimes they make it sound like they can negotiate on your behalf and save you all this money,” Martindale said. “If it sounds too good to be true, it probably is, and one should always be wary of companies that promise a quick fix that’s going to save you a ton of money.”

With the high court expressing skepticism about Biden’s debt forgiveness, student loan borrowers are on notice that relief may not materialize.

Who is most at risk from student loan scams?

In short, anyone with student loan debt.

And there’s a ton of student loan debt out there — spread across all ages, races, nationalities and income brackets. According to educationdata.org, Californians in the 35-to-49 age group hold the largest percentage of debt, with borrowers owing an average of about $48,000 each for a total of $56.4 billion. Those from 25 to 34 owe an average of nearly $34,000; for 50- to 61-year-olds, it’s more than $46,000. People 24 and younger hold the least amount of debt, averaging about $13,000, while people over 62 on average owe about $44,000.

Although more than half of all student loans are held by white borrowers, Black, Latino, Asian and Native American borrowers owe more, on average, than their white counterparts.

Scams are an equal-opportunity business in theory. But as with most anything, those in difficult financial situations are most at risk. Additionally, people who aren’t particularly internet savvy might make easier targets.

Biden’s plan to forgive up to $20,000 in student loans is held up in the courts. But the administration has already canceled billions in debt.

What does a scam look like?

Look for grammatical mistakes in emails and physical mail from outfits claiming to provide relief. Government agencies and other legitimate organizations have teams of editors to ensure clean text.

Be wary of organizations that reach out by text message, phone or email and claim they require immediate responses.

If you see an ad for student loan relief services on social media, don’t trust it. Companies pay good money to have favorable ad placement — that location on your timeline has nothing to do with a company’s legitimacy.

Other red flags?

“First of all, [federal student loan providers] are going to correspond via email, so no one will ever call you asking for fast cash, saying that they can provide you with immediate and guaranteed debt forgiveness or cancellation,” said Amy Czulada, an outreach and advocacy manager at the Student Borrower Protection Center, a nonprofit that fights predatory student loan practices. “If you’re asked to provide your password for the Federal Student Aid, that’s something that the Department of Education wouldn’t even do, and so definitely don’t give out your password to anyone.”

Watch for emails and other communications that use logos and language that give the impression of a partnership with a government agency.

“That’s how they seek to establish legitimacy, and so it’s important to look very carefully at the materials,” Martindale said.

Do some digging on the companies offering relief, but don’t just look at their websites — they may be filled with fabricated positive reviews. Use websites like Trustpilot and the Better Business Bureau, which also offers a scam tracker, to suss out real reviews and see if the company is accredited.

“It’s not enough to avoid sites that have a bad reputation,” said Kevin Roundy, senior technical director of the cybersecurity company Norton. “You want to make sure that you’re going into business with a site that has a good reputation.”

The federal government plans to forgive up to $20,000 in student loan debt for millions of Americans. Here’s everything you need to know.

What about things that aren’t exactly scams?

Some outfits function in legal but deceptive ways, Roundy notes.

That includes some groups that want to move your federally held student debt into a privately held loan.

“In some situations, you wouldn’t call these outright scams necessarily,” Roundy said, “because they are offering something like a legal service. But the fees are often very high and disproportionate to the value, and often they may be obscuring the disadvantages to moving from a public loan to a private loan.”

Sometimes consolidating your loans through a private lender can be advantageous in the immediate term but will have detrimental effects in the long term, said Jaylon Herbin, director of federal campaigns at the Center for Responsible Lending, a nonprofit focused on consumer financial protection.

The pitch might begin with, “Hey, we can get you low payments right now,” Herbin said. “That may be true, but on the back end, you have to look at what is the interest rate that is coming along with that. If you miss a payment and you get put into default, how long will it take you to get out of default? How long will it be on your credit that you have been in default or that you are in forbearance? What is the delinquency path and can you get back on the right track?”

Czulada emphasized that legitimate programs that help with federal student loans are free.

“Knowing that right up front is really helpful because if someone’s calling you to ask you to pay $50 up front to get immediate loan forgiveness — that’s a red flag,” she said.

One other important note: Even if you do find a legitimate private lender, know that your federal loans that are moved into private loans will no longer be eligible for forgiveness if the Biden administration’s plan for loan relief survives legal challenge. They will also be shut out from federal income-based repayment plans and debt forgiveness programs for people who hold public service jobs.

A stolen wallet precipitates a reporter’s years-long fight against identity thieves — and a system that doesn’t care and won’t help.

Is everyone trying to trick you?

No!

It can definitely feel that way, but there are loan servicers that can help people manage their financial burden.

“There are a handful of loan servicers that are affiliated with the federal government to administer people’s student loan payments, and if you don’t know who your servicer is and you have a federal student loan, then you go to studentaid.gov,” Martindale said. “There you can determine who your official loan servicer is, and that is the one and only third party that the federal government has in place to help you manage your loans.”

The Department of Education does not contract or affiliate with debt relief companies. The department contracts only with loan servicers, who handle billing and can help set up repayment plans. Servicers also can put a defaulted loan into collection, at which point the Treasury could withhold money from your wages or tax refund.

Just say no to anyone offering to help you obtain the $10,000 to $20,000 in student loan debt forgiveness. You don’t need them.

Whom can you actually trust regarding student loans?

Experts agree that the preferred first stop for borrowers is to consult your lender directly.

People with federal student debt can go through studentaid.gov to monitor the status and balance of their loans and contact representatives who can help with payment options.

If you have private student debt, you can’t rely on the Education Department for that information. So be sure to know which company or companies are servicing your loans and how much you owe.

Someone tried to scam you. Can you stop them from targeting others?

File a complaint or report fraud through the Department of Education, the federal Consumer Financial Protection Bureau, the Federal Trade Commission, the California Department of Financial Protection and Innovation, and the Better Business Bureau scam tracker.

With this eight-week newsletter course from the Los Angeles Times, assistant editor Jessica Roy will help you get a handle on your money stuff.

More to Read

Totally Worth It

Be your money's boss! Learn how to make a budget and take control of your finances with this eight-week newsletter course.

You may occasionally receive promotional content from the Los Angeles Times.