Wall Street ends higher as company earnings season kicks off

Stocks closed higher on Wall Street on Friday to give the Standard & Poor’s 500 its best week in two months, as earnings reporting season gets underway and chief executives begin to show how well or poorly they’re navigating high inflation and a slowing economy.

The year has begun on Wall Street with optimism that cooling inflation trends could get the Federal Reserve to ease off soon on its sharp hikes to interest rates. Such increases can drive down inflation, but they do so by slowing the economy and risk causing a recession. They also hurt investment prices.

The S&P 500 rose 15.92 points, or 0.4%, to 3,999.09 on Friday. It is up 4.2% so far this year after a dismal 2022. The Dow Jones industrial average rose 112.64 points, or 0.3%, to 34,302.61. The Nasdaq composite rose 78.05 points, or 0.7%, to 11,079.16.

Slowing chunks of the economy and still-high inflation are dragging on profits for companies, which are one of the main levers that set stock prices. Friday marked the first big day for companies in the S&P 500 to show how they fared during the final three months of 2022, with a bevy of banks at the head of the line.

JPMorgan Chase rose 2.5% after beating analysts’ expectations for earnings and revenue. Bank of America also shook off a morning stumble to rise 2.2% after reporting better-than-expected results. Bank of New York Mellon rose 1.8% after its earnings release and announcement of a program to buy back as much as $5 billion of its stock.

Inflation has slowed sharply, so why is the Federal Reserve still intent on killing jobs and economic growth?

Several big banks said that a recession is probably on the horizon but will probably be mild, and that consumers remain healthy. That has added to hopes that the Fed could achieve its goal of taming inflation without inflicting too much damage on the economy.

“Banks are telling the story of the broader economy and giving us a sense of where the economy is and where it may be headed,” said Quincy Krosby, chief global strategist for LPL Financial.

On the losing end was Delta Air Lines, which sank 3.5% after it gave a forecast that thudded onto Wall Street. Despite stronger results for the end of 2022 than expected, its forecast for profit this quarter fell short of analysts’ expectations.

A drop for Tesla’s stock also weighed on Wall Street. It fell 0.9% after the company slashed prices dramatically on several versions of its electric vehicles. The move could drum up more sales but could also cut into its overall revenue.

One big worry on Wall Street is that S&P 500 companies will report a drop in profits for the fourth quarter from a year earlier. It would be the first such decline since 2020, when the pandemic was crushing the economy. Perhaps more important, the fear is that such weakness could be just the beginning.

“That will suggest whether this market has to recalibrate,” Krosby said. “That’s why guidance from companies next week is going to be essential.”

If the economy does fall into a recession, as many investors expect, sharper drops for profits may be set for 2023. That’s why the forecasts for upcoming earnings that CEOs give this reporting season may be even more important than their latest results.

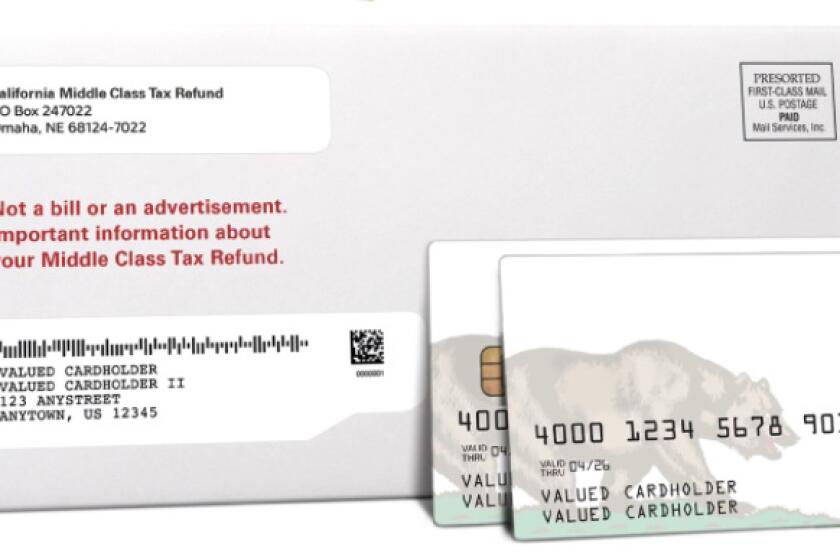

Debit card recipients whose California addresses have changed since filing their 2020 tax return could have their inflation relief debit cards sent out between Jan. 30 and Feb. 14.

“We expect earnings to take the center stage going forward, where reactions to earnings have been getting bigger” and reactions in markets to inflation data and the Fed have been waning, equity strategist Savita Subramanian wrote in a BofA Global Research report.

She expects cuts to estimates for corporate earnings to accelerate in coming months, which would pressure stocks.

Treasury yields rose. The yield on the 10-year Treasury climbed to 3.50% from 3.45% late Thursday. That yield helps set rates for mortgages and other loans that are crucial for wide swaths of the economy. The two-year yield, which tends to move more on expectations for the Fed, rose to 4.21% from 4.15%.

A report released Friday morning showed U.S. consumers downshifted their expectations for inflation in the coming year, down to 4%, which is the lowest reading since April 2021. Long-run expectations for inflation, meanwhile, remained stuck in the narrow range of 2.9% to 3.1% that they’ve been in for 17 of the last 18 months, according to the University of Michigan.

The Federal Reserve has been intent on such numbers staying low. Otherwise, it could cause a vicious cycle that only worsens inflation. Consumers could start accelerating their purchases in hopes of getting ahead of higher prices, for example, which would push prices even higher.

AP business writer Elaine Kurtenbach contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.