- Share via

From the peaceful vantage point of Angels Gate Park, high above San Pedro Bay, a huge floating traffic jam of cargo ships was clearly visible when it reached its peak of 109 vessels in January, stranding toys, clothing, semiconductors, cars and a long list of items headed to stores, factories and online shoppers’ doorsteps.

The backup that began early in 2020 is gone now, but big problems remain for the ports of Los Angeles and Long Beach, and by extension, the tens of thousands of Southern California workers whose jobs are dependent on the twin harbors and the international trade that flows through them.

That’s because U.S. retailers and manufacturers — hurt by the logjam and worried about a potential dockworkers strike — figured out workarounds that sent their cargo containers to ports on the East and Gulf coasts, which have been investing heavily for years to grab shipping business away from Southern California.

The lost freight represents a serious blow to the Southern California economy if that business doesn’t return. And experts say some is gone forever.

“The ports have a huge impact on the regional economy with longshore jobs at the docks, trucking jobs and warehouse and distribution employment that extends far out into the Inland Empire. And that’s just the direct effect,” said John Husing, an economist specializing in Riverside and San Bernardino counties.

Follow a container of board games from China to St. Louis to see all the delays it encounters along the way.

“The secondary effect is that those wages are being spent into the local economy,” producing income for a broad range of local businesses, he said.

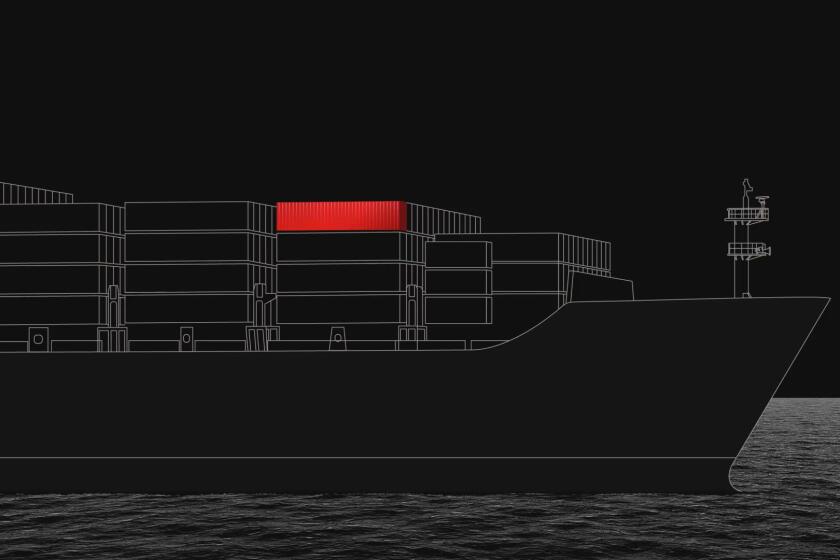

The L.A. and Long Beach ports combine to handle nearly 40% of U.S. imports from Asia that arrive in giant metal containers aboard vessels that stretch to nearly the length of the Empire State Building. But goods movement has fallen sharply in recent months, allowing the combined ports of New York and New Jersey to intermittently grab No. 1 bragging rights away from Los Angeles.

The local downward trend is worrisome not just to officials at the twin ports but also for 175,000 Southern California workers — employed at the harbors themselves as well as in related businesses — moving freight valued at $469 billion a year, port data show. At stake are jobs all along this supply chain, operating like a line of people passing water buckets to the person putting out a fire.

These types of jobs have been crucial for the region, said Gigi Moreno, chief economist for the Southern California Assn. of Governments, particularly for Riverside and San Bernardino counties, home to many vast warehouse and fulfillment centers.

“The labor force in the Inland Empire is now slightly above the size that it was before the pandemic,” Moreno said. “A lot of that was elevated by the logistics sector,” thanks to an explosion of online buying that overwhelmed the entire supply chain for a time.

Logistics is the word used to describe the movement of raw materials, parts and goods from factories to ships to trains and trucks to their final destination, which might be a retailer’s shelf, an automobile factory or an online shopper’s closet.

The logjam at the ports and larger supply chain disruptions have led to record-setting profits for big companies in the logistics business.

At the docks, people load and unload ships, stacking and organizing cargo containers before moving them on trucks or rail cars. Warehouse workers and those who work in fulfillment centers take on the next set of jobs.

Ports provide some of the region’s few high-wage blue-collar jobs. At the other end of the pay spectrum are people who work in distribution and warehousing where workers earn low wages and struggle to support their families with inflation near a 40-year high.

Among them are port truckers, many of whom are independent contractors. Cargo diversion could be the thing that puts them out of business, said Matt Schrap, Harbor Trucking Assn. chief executive.

Trucker David Alvarado loved seeing a huge backlog of ships offshore because “it meant that there was going to be a lot of work.”

Alvarado, 38, is the sole supporter for his wife, two sons and a daughter. In a good year, he will clear as much as $80,000 hauling freight from Long Beach on short runs throughout Southern California.

“Now, it’s really bad. I’d say my jobs are down 50%, and I know some other drivers who haven’t worked in two weeks,” Alvarado said.

Supply strains, while still afflicting many consumers and businesses, are becoming more mundane than menacing.

“Before, when there was a lot of demand, it could be $1,000 for a job,” he said. “Now, it’s ridiculous at like $300 or $400.

“It’s like a spit in the face for a trucker.”

Although he’s hanging on and hoping for the best, Alvarado said that some port drivers are already giving up.

“Other guys out there, I’m serious, they’re already dragging. They’re selling their trucks already,” Alvarado said.

Through November, traffic at the L.A. port is down 7% from a record 2021. Container movement at the neighboring Long Beach port has been uncharacteristically flat through the same period. New York-New Jersey has handled 9.4% more containers through October compared with the year earlier.

Experts predict that some of the lost business will never return, partly because retailers and manufacturers have spent on new facilities or otherwise altered their shipping practices to favor other ports as a way to hedge their bets against future calamity in the West.

West Coast ports could lose up to 10% of ocean cargo to the Atlantic coast, according to an analysis by New York investment firm Cowan.

Big winners have been the fast-growing Savannah, Ga., port, fourth in cargo container traffic, and Houston, which holds the sixth spot.

But the biggest challenger to Los Angeles and Long Beach’s longtime dominance as the nation’s busiest seaport complex has been the New York-New Jersey complex, a collection of berths across two states. Long Beach first took the title away from New York-New Jersey in 1995, and Los Angeles moved ahead of both in 2000.

Caveats abound. In some of those “we’re No. 1” months, more than a third of New York-New Jersey’s containers were empty, meaning the port complex wasn’t first in the number of containers that actually carried freight.

What’s more, month-to-month data can be volatile. So most trade experts don’t bother with monthly who’s-in-first banter, preferring calendar year totals as the measuring stick.

By the end of 2022, it’s possible that the Port of Long Beach will be third, behind New York-New Jersey, which will be challenging the Port of Los Angeles for first place. Combined, Los Angeles and Long Beach will remain, by far, the nation’s largest Asian gateway for trade.

Any level of diversion has consequences. Vessels are so huge today that missing out on a single one can mean the loss of enough cargo to fill a five-mile-long freight train.

The ILWU, the union representing dockworkers across the West Coast, is at the bargaining table with the PMA, the group representing shipping companies. The current contract expires on July 1.

Two factors contributed to the shift, experts say.

Some shippers switched to other ports because of fears over protracted labor negotiations between the 22,000-member West Coast ports International Longshore and Warehouse Union and the Pacific Maritime Assn., representing 70 employers at the 29-port West Coast seaports.

Negotiations began in May, and the union has worked without a contract since July 1. Neither side responded to requests for comment on the status of contract talks.

The other factor was the backlog of more than 100 ships off the ports of Los Angeles and Long Beach earlier this year, waiting to unload cargo.

The supply chain mess started with factories in China and was exacerbated by a shortage of truck drivers and miles-long railroad backups. East and Gulf coast ports also had ships waiting outside their docks, but that drew far less publicity.

The twin ports’ top officials, noting that the backlog has since disappeared, say they have a fight on their hands that they can win.

“We’ve got to get this cargo back from the East and Gulf coast,” said Gene Seroka, executive director of the Port of Los Angeles. “We may have to do some more marketing. We may have to do some more things on pricing, but more cargo means more jobs. And that is absolutely sacrosanct here in Los Angeles.”

Mario Cordero, executive director of the neighboring Port of Long Beach, acknowledged that “my colleagues in other parts of the U.S. are doing a very good job in investing in their own infrastructure to better their ports. American shippers have more choices.

“But we’ve been here before with a loss of cargo,” he said, adding that he would do all he could to see that Southern California “will continue to be the nation’s most significant strategic gateway” for Asian trade.

The San Pedro Bay Ports Complex is planning marketing and pricing moves and strengthening its position through more capital projects.

Work on the West Harbor entertainment complex in San Pedro will begin immediately and finish in 2024, an official said.

Pre-pandemic, Seroka had spent 60% of his time traveling to Asia and Europe, pushing the benefits of working with Los Angeles for cargo movement. He said he’s gradually building up to that level again, having gotten all of his COVID booster shots.

“East Coast ports have benefited by getting more cargo during our labor negotiations. By the first quarter of next year, we’ll have that labor contract in place and by next summer, the East Coast longshore union will be negotiating its contract,” Seroka said.

“As history has shown during my career, there will be some East Coast cargo coming our way next summer because of that. So we’ve got to have our work in order, our processes in place, and we have to be ready for the cargo next summer.”

In Long Beach, investment includes a $1.6-billion high-tech overhaul of the Pier B rail yard to increase cargo-handling ability and speed.

“We feel very good that at the end of this decade, it’s going to be a game changer,” Cordero said.

In addition, BNSF Railway said in October that it will build the $1.5-billion, 4,500-acre Barstow International Gateway Project to “help reduce highway congestion, transform the regional economy, and unlock critical efficiencies to meet our nation’s supply chain demands.”

Although other ports have done a good job building up their cargo infrastructure, certain advantages will always play out in Southern California’s favor, some experts said.

Even after the 2016 completion of the Panama Canal expansion, the key transit point allowing bigger ships from Asia to travel to the Gulf Coast and East Coast, those ports still cannot accommodate the biggest container ships coming out of Asia, said Jerry Nickelsburg, director of the UCLA Anderson Forecast and professor of economics at the UCLA Anderson School of Management.

Also, the shorter Asia-West Coast route combined with rail travel remains the fastest way to move cargo across the U.S., Nickelsburg said. Going east by ship, the cargo requires much more travel time by water “because you’re going down to the Panama Canal and up to or past the Gulf of Mexico. So that could be an additional week to two weeks.”

Weather also plays a role, with hurricanes and other serious storms in the Atlantic tending to happen during peak shipping times, he said.

For workers, life has become more difficult as consumers retrench amid high inflation and fears of recession. The fallout may leave even more truckers and warehouse workers vying for jobs that cargo diversion has taken away.

Some companies were riding high and expanding during the short pandemic boom and were unprepared for the retrenching.

United Furniture Industries was one of several businesses that took advantage of brisk furniture sales to people stuck at home during the pandemic.

Just days before Thanksgiving, United Furniture abruptly shut down and laid off its 261 employees, who suddenly were without pay and health insurance. The Victorville company was a victim of the port slowdown, the housing slowdown and its own bad guess that the pandemic online buying frenzy would continue.

Mario Gonzalez, once the company’s director of operations, said he’s been working without salary to find new jobs for the people who worked for him.

“The guys in transportation, the truckers, I’ve been able to place 32 of them already, and I have a bunch more going to interviews and driving tests and all that, trying to get them placed as well,” he said. “I seem to be working more for the company now than I was when it was still open.”

Dominick Alcantara, a long-haul trucker for United Furniture, was asleep in his rig, somewhere in the Pacific Northwest, waiting for a load of lumber, when his phone beeped with the news that he didn’t have a job anymore.

“I was shocked,” Alcantara said. He tried applying for a job with a local trucking company but was turned down amid the slowdown in hiring.

Now, he thinks he will have to turn to “hot shotting,” using a car trailer on his truck, moving confiscated cars from Southern California to a big auction site in Albuquerque.

“There can be good money in it. It will take a while to get established. ... It’s not ideal,” Alcantara said. “The timing could not have been worse for me.”

L.A. Reads

L.A. Guides

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.