Chip stocks sink to lowest since 2020 as U.S. expands China curbs

Shares of semiconductor companies fell Monday, with the industry selling off globally after fresh U.S. curbs on Chinaâs access to American technology added to a disappointing start to the earnings season, stoking concern that the industryâs downturn is far from over.

The Philadelphia Stock Exchangeâs semiconductor index fell 3.5%, closing at its lowest level since November 2020. The index dropped nearly 10% over the last three trading days and is now down more than 40% so far this year. Semiconductor capital equipment companies led the dayâs declines, with Applied Materials Inc. tumbling 4.1%, Lam Research Corp. off 6.4% and KLA Corp. down 4.7%. Advanced Micro Devices Inc. dropped 1.1%, ending at its lowest since July 2020, while Marvell Technology Inc. shed 4.8%.

U.S.-listed shares of chip-equipment maker ASML Holding sank 2.9%, and Chinese bellwether Semiconductor Manufacturing International Corp. fell 4% in Hong Kong, the most in five weeks. Declines were steeper in smaller stocks.

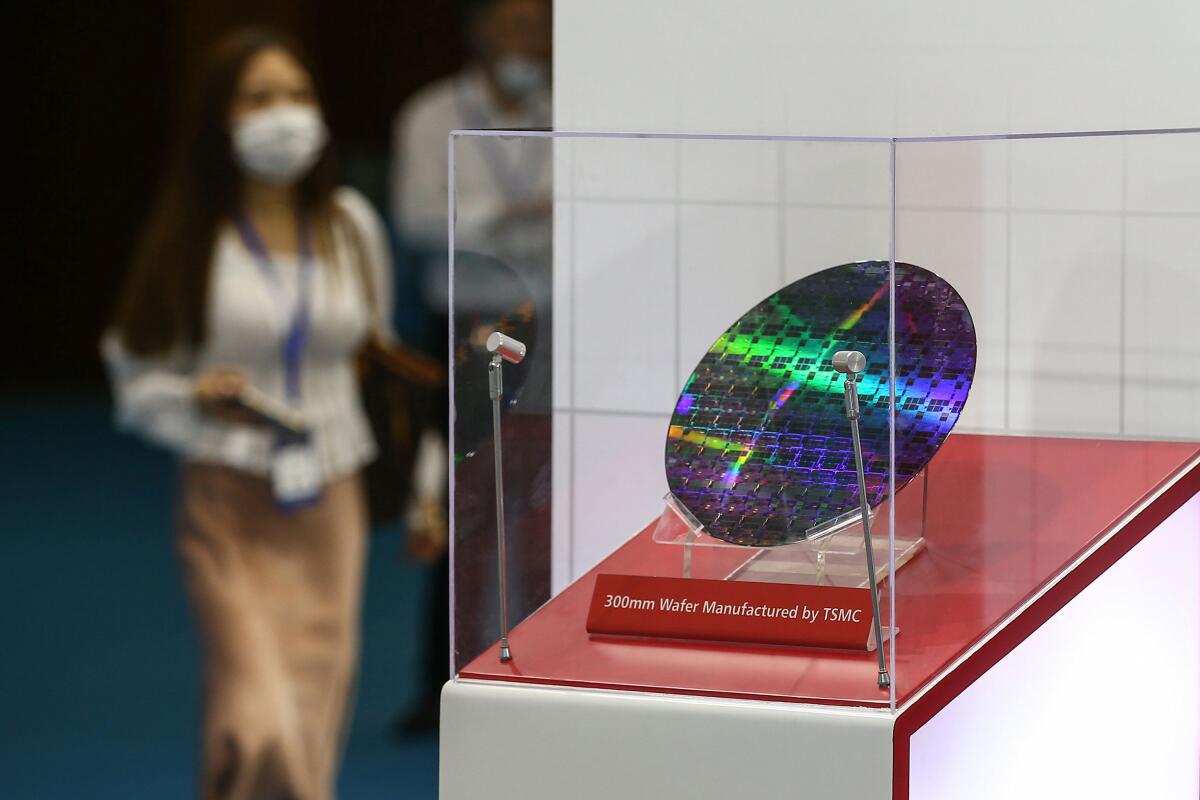

The U.S. measures include restrictions on the export of some types of chips used in artificial intelligence and supercomputing, and also tighter rules on the sale of semiconductor equipment to any Chinese company. Separately, the U.S. added more Chinese firms to a list of companies that it regards as âunverified,â which means U.S. suppliers will face new hurdles in selling technologies to those entities.

âThe changes represent a further escalation, and we do not know what China might do in response,â wrote Stacy Rasgon, an analyst at Bernstein. âPotential retaliation remains a risk.â

The new strategy suggests that Washington aims to âfreeze inâ China at its current level, enabling the U.S. to increase its lead, said Gabriel Wildau, an analyst at advisory firm Teneo Holdings.

Chinese Foreign Ministry spokesperson Mao Ning said Saturday that the measures, which are set to take effect this month, are unfair and will âalso hurt the interests of U.S. companies.â They âdeal a blow to global industrial and supply chains and world economic recovery,â she said.

Robbi Jade Lew invited me to a jeweler in an effort to prove her ruby ring didnât help her win the Texas Hold âEm hand that has rocked the poker world.

The new U.S. rules come at a time when the chip industry is already grappling with an ominous start to the earnings season and has gone from a worldwide shortage of chips to a glut in a matter of months due to the boom-and-bust nature of semiconductor demand.

Samsung Electronics Co., the worldâs largest memory-chip maker, and PC-processor maker AMD reported results last week that suggested a deeper-than-feared slowdown ahead.

Among smaller chip-related companies, equipment maker ACM Research Inc. plunged 27% in New York trading Monday, while its Shanghai-listed subsidiary, ACM Research Shanghai Inc., sank 20%. In Hong Kong, Hua Hong Semiconductor Ltd. fell 9.4% and Shanghai Fudan Microelectronics Group Co. plummeted 20%, the most since July 2020. Chinaâs Will Semiconductor Co. and Maxscend Microelectronics Co. dropped more than 6% each.

The curbs are a âbig setback to Chinaâ and âbad newsâ for global semiconductors, Nomura Holdings Inc. analyst David Wong wrote in a note. Chinaâs localization efforts may also be âat risk as it may not be able to use advanced foundries in Taiwan and Korea,â he wrote.

The U.S. Commerce Department has added Beijing Naura Magnetoelectric Technology Co., a subsidiary of Naura Technology Group Co., to its Unverified List, Naura Technology said in a filing. Naura Technology plunged by the daily limit of 10% in China.

To be sure, the intensifying Sino-American tensions could spur Beijing to step up support for homegrown companies in a bid to achieve its goal of becoming an independent chip powerhouse.

The fall in Chinese chip stocks may cast a pall over the sector globally. Markets in Japan, South Korea, Taiwan and Malaysia will get a chance to react Tuesday as they were closed Monday.

âThis will not only be negative to the Chinese semiconductor industry but also indirectly impact global semiconductor makersâ business opportunities longer term,â Citigroup analysts including Laura Chen wrote in a note.

The broader Chinese equity market also saw declines Monday after returning from the Golden Week holiday, hurt by a global equities sell-off and bleak holiday-spending data that deepened concerns about an economic recovery.

Bloomberg writers Debby Wu, Henry Ren, Divya Balji and Phil Serafino contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production â and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.