Column: Amazon’s acquisition of a medical firm may not disrupt healthcare, but could disrupt your life

- Share via

In announcing its newest foray into the healthcare field last month — the $3.9-billion acquisition of the primary care firm One Medical — Amazon explained its interest in the industry this way:

“We think health care is high on the list of experiences that need reinvention.”

There are two ways to think about that statement. For one thing, it’s indisputable. For another, when you hear Amazon talking about reinventing how you get medical treatment, you should be afraid. Very afraid.

What data does Amazon want to collect and how can they be thinking about monetizing it? That’s not exactly what you want your healthcare provider to be thinking about.

— Caitlin Seeley George, Fight for the Future

That’s because of what we know about Amazon’s corporate expertise. The giant company doesn’t know much about delivering healthcare — that’s obvious from the checkered record of its previous healthcare ventures.

What Amazon does know about is how to snarf up personal data from its customers and exploit it for profit.

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.

Information from buyers of books and other merchandise on its website, including from users of its Kindle ebooks and its Echo home devices (those objects you activate by summoning “Alexa”), all gets used by Amazon to sell users more merchandise, more subscription services, more TV shows and movies.

“Amazon is a data company,” says Caitlin Seeley George, managing director of Fight for the Future, a tech policy advocacy group. “Everyone should be asking how Amazon is looking at this from that mind-set. What data does Amazon want to collect and how can they be thinking about monetizing it? That’s not exactly what you want your healthcare provider to be thinking about.”

Amazon has issued assurances that it will adhere to the privacy mandates set forth in the federal Health Insurance Portability and Accountability Act, or HIPAA, which prohibits healthcare providers from sharing personal medical information without a patient’s permission.

“As required by law, Amazon will never share One Medical customers’ personal health information outside of One Medical for advertising or marketing purposes of other Amazon products and services without clear permission from the customer,” the company says. “Should the deal close, One Medical customers’ HIPAA Protected Health Information will be handled separately from all other Amazon businesses, as required by law.”

Warren Buffett, Jeff Bezos, and Jamie Dimon thought they could solve healthcare. They never had a chance.

But pledging to comply with the law is not much of a concession, as the consumer advocacy group Public Citizen observed in a letter urging the Federal Trade Commission and other agencies to closely scrutinize the proposed deal, which is subject to regulatory approval.

“There is very good reason to worry that HIPAA protections will be inadequate to prevent Amazon from vacuuming up One Medical patients’ data,” Public Citizen observed. “Amazon will be well positioned to secure privacy waivers from One Medical patients,” perhaps by offering discounts on its Prime service or other blandishments.

“Such waivers may be intentional — but consumers may have little awareness of what they are sacrificing for modest price discounts,” Public Citizen adds. “It would be a mistake to underestimate the corporation’s ability to navigate around the law creatively” via “legal maneuvering, discount offers, online trickery or otherwise.”

The recent case in which Nebraska authorities relied on Facebook chat messages between a mother and daughter to charge them in connection with an allegedly illegal abortion illustrates how much ostensibly private health-related information is in the hands of social media companies, with no privacy guarantees.

As an inveterate collector of customer data, Amazon routinely ends up with mounds of information related to users’ health, but not subject to HIPAA protection. Amazon’s access to information about One Medical members could heighten the danger of its spillover, to the members’ disadvantage.

Amazon plainly believes that there is profit to be made from the business model of One Medical (that’s the company’s brand name — its formal corporate moniker is 1Life Healthcare). The purchase price works out to about $18 per share, or roughly a 77% premium over the company’s stock price just prior to the announcement.

One Medical aims its services, which amount to providing faster appointments, “wellness” services and “routine and preventive care,” at a relatively affluent market segment. It does so partially by charging an annual fee of $199. That’s a discretionary charge that instantly discourages families that may have difficulty scraping together their insurance plan premiums and copays, which members must pay for separately.

Then there’s the firm’s practice of geographical segregation. One Medical says it places its offices in “locations convenient to where consumers work, shop and live,” but that depends on how you define your consumers.

In the Los Angeles area, for example, One Medical lists six offices in the affluent Westside — in Beverly Hills, Century City, Culver City, Santa Monica, West Hollywood and Brentwood/West L.A. — but none in East L.A., South L.A. or other lower-income neighborhoods.

In New York City, the firm lists no offices in Manhattan uptown of West 81st Street. It has locations in the pricey Brooklyn neighborhoods of Brooklyn Heights and Park Slope, but none in the lower-income Bronx or working-class Queens.

This works to One Medical’s advantage by “limiting its exposure to uninsured, poor, and costly patients,” David Blumenthal and Lovisa Gustafsson of the Commonwealth Fund, a healthcare-oriented think tank, wrote after the Amazon announcement.

But to remake the U.S. healthcare system, as Amazon says is its goal, “new models have to be comfortable with all comers, including the sickest, most complex, and most expensive,” Blumenthal and Gustafsson wrote.

Amazon’s ambition, Neil Lindsay, the head of its health services division, said in the deal announcement, is to “help more people get better care, when and how they need it.” But it’s probably wise to see the One Medical acquisition as a straight business deal rather than a blow for healthcare reform.

There were a couple of endearingly all-American aspects to Tuesday’s announcement of a joint venture by Jeff Bezos of Amazon, Warren Buffett of Berkshire Hathaway and Jamie Dimon of JPMorgan Chase to reduce healthcare costs.

“Amazon may be able to make this a viable business venture that returns a significant profit to their investors,” Blumenthal, a primary care physician who is the Commonwealth Fund’s president, told me. But “unless they substantially change the model this will just be another selective deal serving a part of the population that is already favored by the current healthcare system.”

So what does One Medical offer in the way of healthcare innovation? Spoiler: Not much. The firm’s model is essentially a variation on concierge medicine, in which customers pay a fee, separate from insurance premiums and copays, for prompt personal access to medical providers instead of waiting for an appointment. One Medical is a supplement to, not a substitute for, health insurance.

Office decor and ambience of its offices are big selling points for One Medical. “We are focused on providing kind and attentive in-person care in aesthetically pleasing offices with contemporary interior designs,” the company says in its annual report. “Members enter into first-name relationships with providers who greet them upon arrival and walk them out upon appointment completion.”

Although the company’s main focus is on primary care, it claims to offer access to specialists, chiefly through referrals. Its “value proposition” for employers, who it seeks to recruit as clients, is that by offering same-day or next-day primary care appointments to members, it keeps them from having to receive high-cost treatment at emergency rooms.

This is all well and good, to the extent that One Medical can deliver on its boasts. Whether it can move the needle on the cost and efficacy of American healthcare is another issue entirely.

Certainly One Medical has been unable to exploit its model for profit. Its losses have been growing and margins shrinking: One Medical reported a loss of $254.6 million, or 40% of its revenue of $623.3 million last year, compared with a loss of $88.7 million, or 23% of its revenue of $380.2 million in 2020.

For the first half of this year, One Medical’s loss came to $184.7 million on revenue of about $510 million.

An effort to be the first billionaire in space is the biggest vanity project in history.

That may not be surprising, because the aspects of healthcare delivery that One Medical focuses on aren’t what drive American healthcare costs higher. There isn’t much evidence that the decor of waiting rooms or the lack of first-name relationships with doctors are governing factors in Americans’ feelings about healthcare.

“Most of health care spending is on sick patients and can’t be easily reduced,” Amitabh Chandra, a healthcare expert at Harvard Business School, said in an interview on the school’s website after the Amazon announcement.

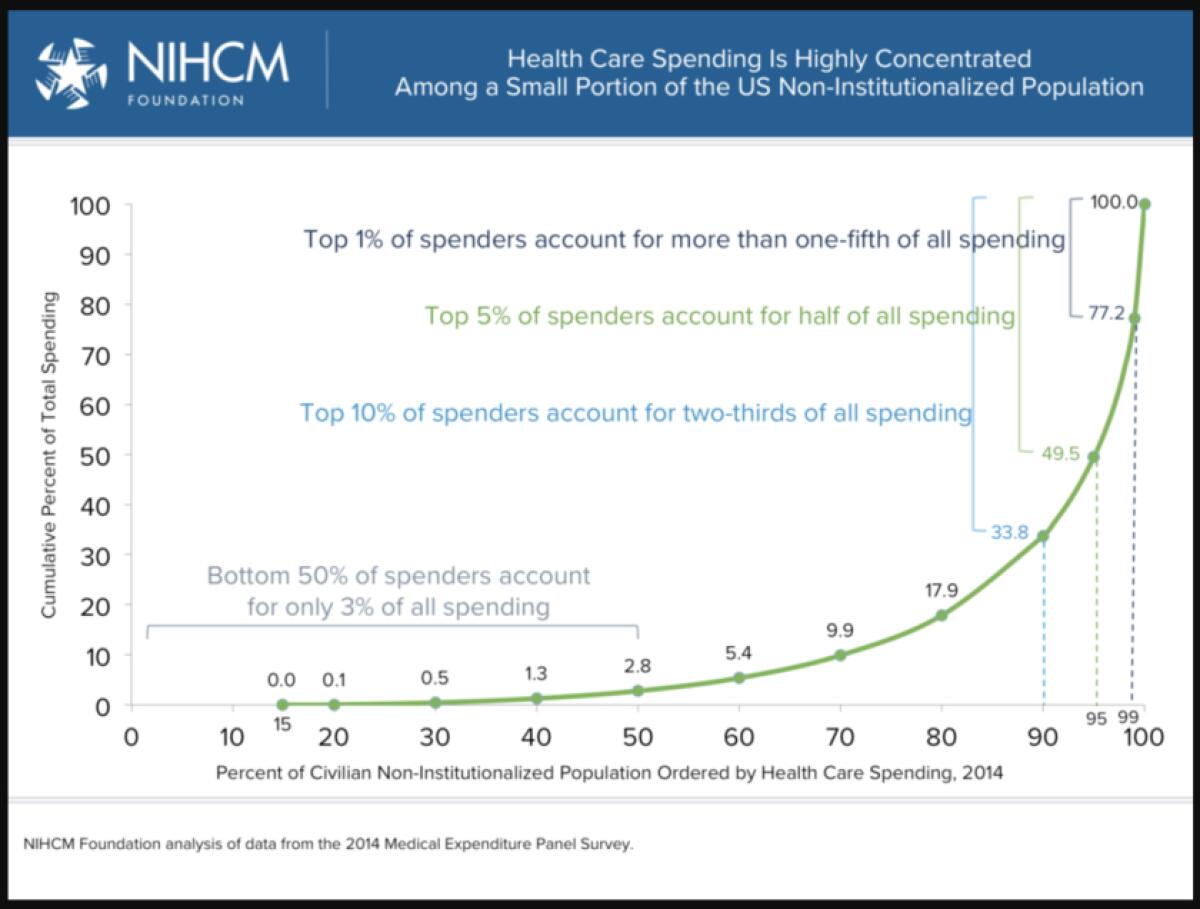

He’s right about that. Healthcare spending follows a classic Pareto distribution, in that it tends to be concentrated among a small number of patients: About 5% of patients account for half of all spending, and the top 1% account for more than one-fifth of spending. The bottom 50% — those needing little but routine care or no care at all, or One Medical’s target market — account for only about 3% of all spending.

Amazon’s experience in the healthcare field doesn’t inspire much confidence that it can “reinvent” the field through the acquisition of One Medical. Amazon has been rolling out a virtual treatment system known as Amazon Care nationally, but telehealth — conferring with doctors remotely — is still a small, albeit growing, variety of healthcare delivery, with obvious limitations.

The company bought the online pharmacy PillPack in 2018 for about $750 million, but there aren’t many signs that it has made a dent in the country’s established pharmaceutical distribution system.

Amazon’s high-profile misstep was Haven, a joint venture with Jamie Dimon’s JPMorgan Chase & Co. and Warren Buffett’s Berkshire Hathaway, launched in a blare of publicity in 2018 and humiliatingly shut down in 2021.

Twelve red states still haven’t taken advantage of Obamacare’s economic benefits.

Haven aimed to reduce American healthcare costs by focusing on “technology solutions,” but the Bezos/Dimon/Buffett triumvirate didn’t understand what healthcare economist Uwe Reinhardt and colleagues identified in 2003 as the main reason for high healthcare costs in America, with an article titled “It’s the Prices, Stupid.”

Americans spent more on healthcare despite having fewer hospital admissions per capita and shorter stays per admission than residents of other developed countries, the authors noted, but paid more per admission and per day. The same went for pharmaceutical prices — the U.S. paid the highest prices, by far, for drugs. Haven didn’t do anything about pricing, and so it failed.

One Medical’s business model works against the goal of bringing down costs. Leaving aside that most healthcare spending is incurred in treating the very sick or at the end of life, improving the primary care patient experience — well-upholstered office furniture, smiling doctors and nurses, same-day primary care appointments, etc., etc. — “is not going to save money on health care,” Chandra asserted. “Improving the experience makes it easier to access health care and that increases spending.”

Absent the price controls imposed in other developed countries such as France, Switzerland and Britain, Americans’ preference for unlimited choice of healthcare providers is a formula for unconstrained spending.

Amazon could bring down costs of care for its consumers by limiting choices through narrow provider networks, as many insurers do, but that would run counter to its goal of being seen as “Earth’s most customer-centric company.”

“Constraining choice,” Blumenthal and Gustafsson observed, “is unlikely to be viewed as ‘consumer centric.’”

The key flaw in the American healthcare system is the encroachment of business principles into what used to be regarded as a public service, back when Blue Cross and Blue Shield were nonprofit insurers and most hospitals were nonprofit providers.

The structure that would be most likely to bring universal healthcare to Americans at an affordable price would be a single-payer system with the government as the payer. But even Medicare, which was once the quintessential single-payer program, has been moving away from that principle, thanks to the spread of private Medicare Advantage plans.

The appetite of Amazon, one of the richest private corporations in America, to get a piece of healthcare profits won’t make the creation of a system that works for everyone any easier.

More to Read

Get the latest from Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

You may occasionally receive promotional content from the Los Angeles Times.