GE says it will split into three different public companies

- Share via

General Electric, one of the most storied names in U.S. business, will divide itself into three public companies focused on aviation, healthcare and energy.

The company, founded in 1892, has refashioned itself in recent years from the sprawling conglomerate created by Jack Welch in the 1980s into a much smaller and more focused entity. It was heavily damaged by the financial crisis.

With its announcement Tuesday that it would spin off its healthcare business in early 2023 and its energy segment — including renewable energy, power and digital operations — in early 2024, General Electric may have signaled the end of the conglomerate era.

“By creating three industry-leading, global public companies, each can benefit from greater focus, tailored capital allocation, and strategic flexibility to drive long-term growth and value for customers, investors, and employees,” Chairman and Chief Executive Lawrence Culp Jr. said in a prepared statement.

The healthcare business is the company’s third-largest segment, producing diagnostic imaging systems including magnetic resonance, X-ray, digital mammography and nuclear imaging.

GE will maintain a 19.9% stake in the healthcare unit.

The struggling company is involved in 19 coal power plants in 17 countries, including many with lower environmental standards than the U.S.

Culp will become nonexecutive chairman of the healthcare company. Peter Arduini will serve as president and CEO of GE Healthcare effective Jan. 1. Scott Strazik will become CEO of the combined renewable energy, power and digital business. Culp will lead the aviation business along with John Slattery, who will remain its CEO.

Aviation is the most profitable part of GE’s business. The company produces jet engines, aerospace systems and replacement parts and provides maintenance services for commercial, executive and military aircraft, including fighters, bombers, tankers and helicopters.

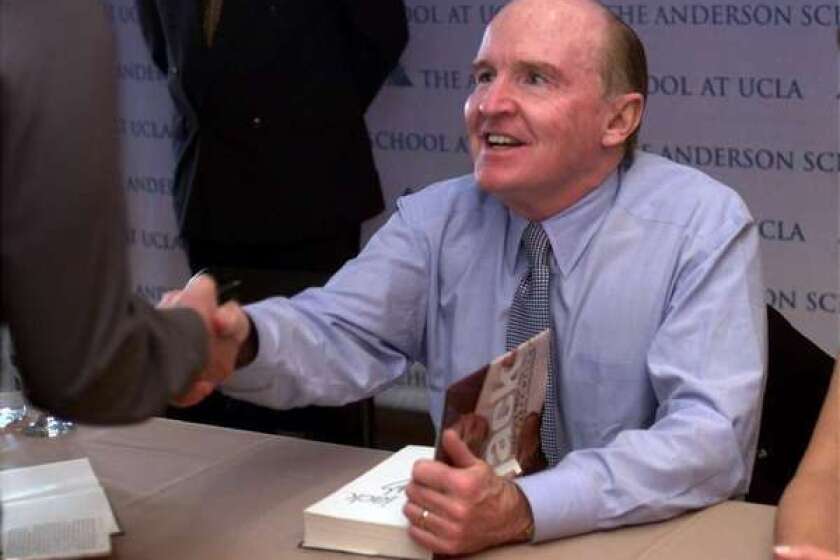

The company has spent years undoing its massive transformation under Jack Welch, an era of unbridled growth that gave birth to a sprawling conglomerate in the 1980s and 1990s. General Electric had a hand in lightbulbs, appliances, healthcare, financial services and other sectors.

During the late-1990s boom, GE’s soaring stock price made it the most valuable company in the world. GE’s revenue grew nearly fivefold during Welch’s tenure, and the firm’s market capitalization increased thirtyfold.

The former GE chairman and chief executive mentored people who went on to run some of the world’s best-known companies.

However, the financial crisis of 2007-08 revealed how exposed GE was to risk, particularly through its financial division.

In 2015, GE announced a radical transformation of the company, vowing to shed billions in assets to better focus on the company’s industrial core, namely power, aviation, renewable energy and healthcare. That led to some tumult in leadership.

CEO Jeff Immelt was replaced in 2017 by John Flannery, who was ousted just a year later, with Culp taking over and vowing a massive corporate transformation.

The company expects one-time separation, transition and operational costs of about $2 billion related to the split, which will require board approval.

GE, based in Boston, also announced that it expects to lower its debt by more than $75 billion by the end of the year.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.