Trumpâs payroll tax deferral is in limbo as employers await IRS guidance

The U.S. Treasury Department still has yet to tell companies how to handle President Trumpâs order delaying the due date for employee payroll taxes, leaving major employers such as Walmart Inc. in the lurch.

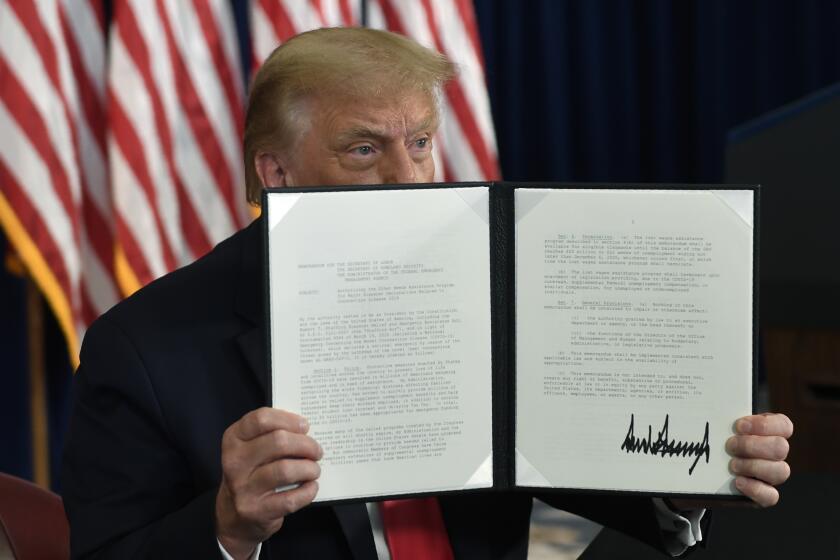

Itâs been two weeks since Trump issued his directive deferring the deadline to pay workerâs portions of Social Security taxes from Sept. 1 to the end of the year. But employers, which are responsible for submitting those payments to the Internal Revenue Service, are waiting to hear from the agency on how any tax bill would be handled when it comes due later.

âI donât think there is a bloody chance that, at this point, anybody is implementing anything before Labor Day,â said Adam Markowitz, an enrolled agent and vice president at Howard L Markowitz PA CPA.

The Treasury and IRS didnât respond to requests for comment on when the guidance would be published.

Trumpâs payroll tax deferral is a mortal threat to Social Security.

Some companies have already shied away from the payroll tax deferral, which Trump touted as a boost for workers as the economy reels from the COVID-19 pandemic, because the taxes would ultimately have to be paid unless Congress forgives the liability.

Large employers â including Walmart, Macyâs Inc. and Procter & Gamble Co. â have said they need more details from the IRS. They didnât immediately respond to a request to comment on whether they would implement the deferral if the IRS didnât issue any rules by the Sept. 1 start date. The U.S. Office of Personnel Management didnât respond to a question about whether it plans to defer taxes for federal employees.

âCompanies cannot do anything until there is guidance,â said Veena Murthy, a principal at accounting firm Crowe. The order ârequires Treasury and IRS to provide some way it can be done. In this case particularly, there really are no answers.â

Payroll software providers need time to update their systems, and they canât do that without guidance from the IRS and Treasury, Markowitz said. And companies have learned the hard way about claiming benefits before having sufficient guidance, he said.

After the enactment of the last coronavirus stimulus legislation in March, some businesses quickly took advantage of loans under the Paycheck Protection Program but later found, after guidance was issued, that it might have been in their best interest to ditch the loans in favor other tax credits or grants, he said.

The U.S. Chamber of Commerce has said that many companies are unlikely to implement the deferral, even with the IRS guidance, because it forces a large tax bill on employees in the future and would be very difficult for employers to administer.

âFurther, the lack of concrete guidance on the most basic of implementation issues presents an untenable situation, making it basically impossible for employers to implement this [executive order] and leaving little choice but for those employers to continue remitting payroll taxes to the Treasury,â Caroline Harris, the chamberâs chief tax policy counsel, said in a statement.

Treasury Secretary Steven T. Mnuchin has said that he canât force companies to implement the deferral but that he hopes many companies will participate. Trump has said he would forgive the tax bills if heâs elected to a second term, but that would require participation from a Congress that has been hesitant to cut the funding source for Social Security.

The onus is now on employers to provide explanations to their workers about why the company isnât implementing the deferral, and they should prepare to face a potential backlash from employees, Markowitz said.

The average employee isnât going to understand or care that there isnât any IRS or Treasury guidance, he said. âTheyâre just going to say, âHey, Trump said I should have 6.2% more in my paycheck every week, and I donât.ââ

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production â and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.