Column: Another strike against Trump’s coronavirus tax cut — most of it would go to the rich

- Share via

Decision makers in Washington have come together on the idea of a major cash infusion to household pocketbooks to counter the economic impact of the coronavirus crisis, with the debate now focused chiefly on how much to deliver and who gets the money.

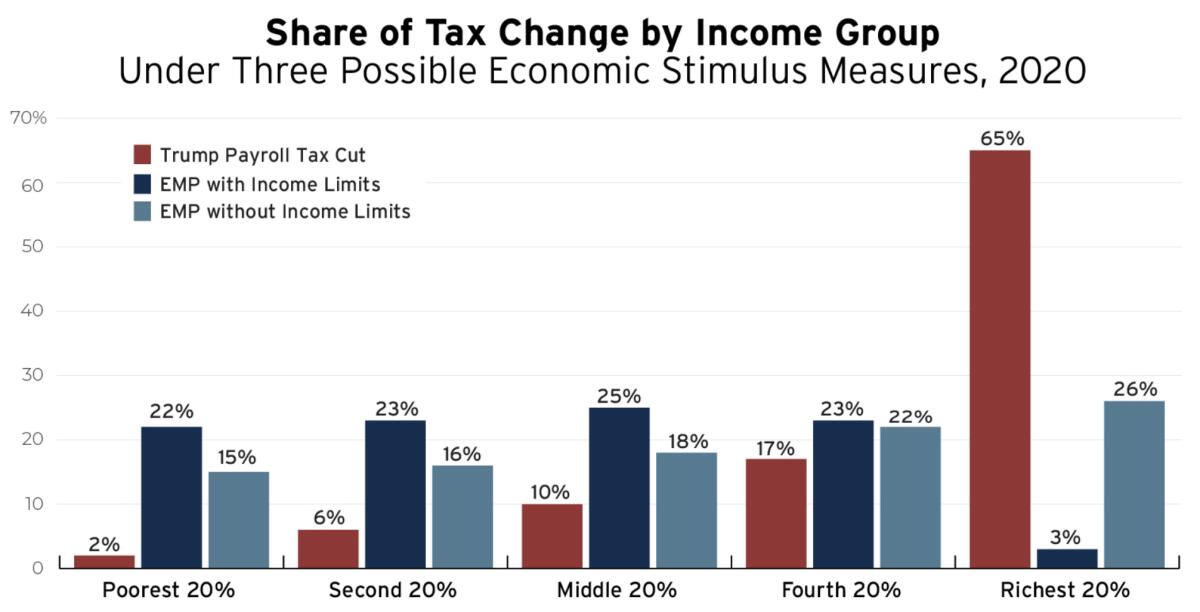

Still on the table, though fading, is the notion of providing the assistance by eliminating the payroll tax, possibly through the end of the year. If this idea has any life at all, it’s because it’s been a hobby horse of President Trump. But a new study showing that two-thirds of the benefit would go to the richest Americans should kill it for good.

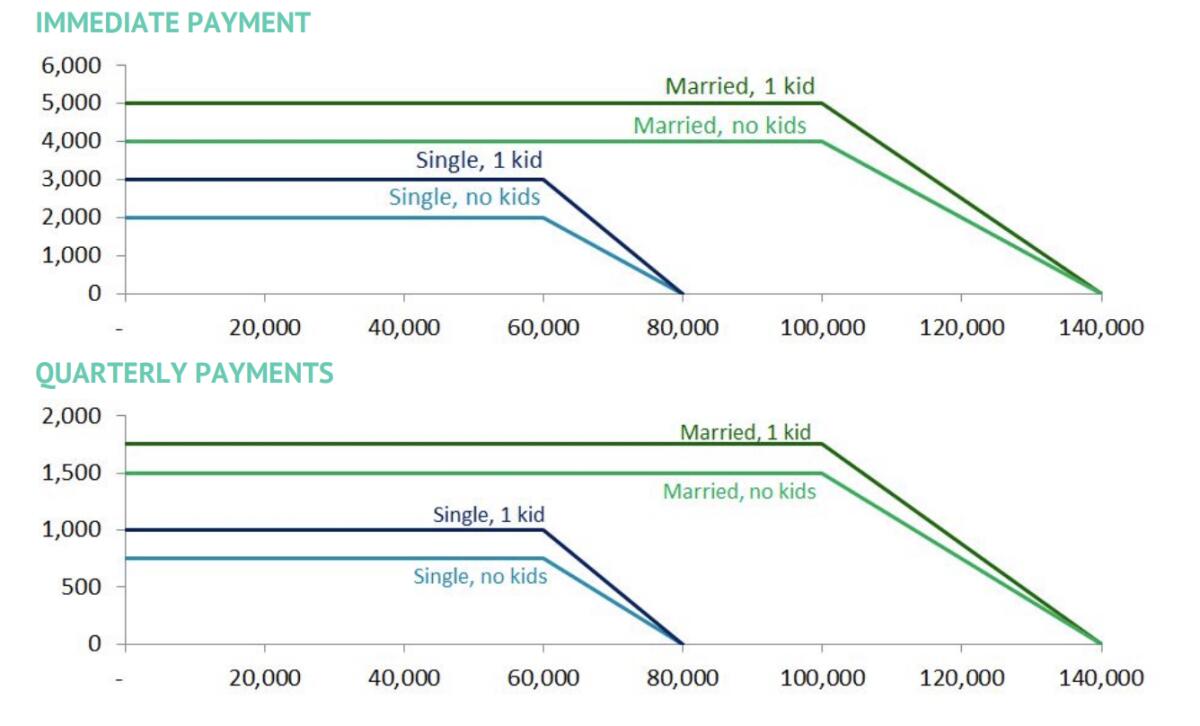

The statistical analysis is offered by the Institute on Taxation and Economic Policy, a nonprofit think tank that tracks how taxes and tax breaks are distributed along the income spectrum. ITEP compared the distributional effects of the payroll tax cut to those of a proposal for an immediate cash payout of up to $2,000 per adult and $1,000 per child, phased out for households earning $140,000 or more.

Sending checks to every household would ... immediately put money in the hands of everyone who would likely spend it right away, pumping it back into the economy.

— Institute on Taxation and Economic Policy

The proposal, dubbed Emergency Money to the People, was developed by the Economic Security Project, which was created in 2016 by Facebook cofounder Chris Hughes and other activists to promote the idea of a universal basic income. The Emergency Money program would continue to pay $750 per adult and $250 per child quarterly, until the unemployment rate fell below 5.5%.

ITEP’s calculations show that in a straightforward reduction of the payroll tax, 65% of the benefit would go to the top 20% of earners — those making $118,700 or more a year. Fully 25% of the benefit would go to the top 1%. That group collects income of $643,700 or more, with an average income of $2 million.

The poorest 20%, with income below $24,200, would receive only 2% of the benefit. The next poorest 20% would receive 6% of the benefit.

A payroll tax cut was a bad idea in President Obama’s time, and even worse now.

This finding is important because it is becoming increasingly clear that the chief victims of the crisis will be low-income service workers who can’t do their jobs from home, whose workplaces — restaurants, bars and so on — are being closed by government order, and who have virtually no financial cushion. The imperative, therefore, is to get cash into their hands, now.

Those who would receive the bulk of the payroll tax cut are at the other end of the scale. Many can work from home, their jobs are still in place, and they have financial resources to help them ride out the national lockdown.

“A payroll tax cut would help those lucky enough to keep their job and would provide a bigger break to those with more earnings,” ITEP reported. “Sending checks to every household would be a far more effective economic stimulus because it would immediately put money in the hands of everyone who would likely spend it right away, pumping it back into the economy.”

ITEP’s finding that a payroll tax cut would be regressive isn’t surprising. The payroll tax, which funds Social Security and part of Medicare, is highly regressive, meaning it falls more heavily on the middle- and working-class than the rich.

That’s because the Social Security portion of the tax, which totals 12.4% shared equally by workers and employers, is applied only to wage income of $137,700 (this year). Wage income above that ceiling, and nonwage income such as capital gains and dividends, isn’t taxed at all.

With income limits applied, ITEP found that 45% of the benefit from Emergency Money to the People would go to the bottom 40% of income earners, and 70% of the benefit would go to the bottom 60% (everyone earning $69,800 or less).

Even with no income limits, the bottom 40% would still receive roughly one-third of the total benefit. The richest 1% would still receive 1% of the benefit.

The Emergency Money proposal, with income limits in place, would cost less than the payroll tax cut Trump envisions — $648 billion for Emergency Money vs. $843 billion for the payroll tax cut through the end of the year. So the tax cut would be more expensive and less effective, making it penny unwise and just plain foolish.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.