Amazon takes the low road

Greed, we are told by the moral philosophers, brings out the worst in human beings. As Amazon.com is about to prove, the same rule applies to big corporations.

Last week, the giant online retailer announced that it was backing a ballot referendum to overturn a new state law mandating that it collect the sales tax due on purchases by its California customers.

That law, which was signed by Gov. Jerry Brown at the end of June, was designed to eliminate the price advantage enjoyed by Amazon, and many other online retailers, over brick-and-mortar stores. The advantage arises because the latter charge customers sales tax at the register, and Amazon does not â making for a difference of 7.25% to 9.75% of the purchase price, depending on the city and county youâre in.

That makes it seem as if youâre saving a bundle by shopping at Amazon, even though youâre not, really. You owe the tax even if the seller doesnât collect it, a fact that most Californians wink at, with Amazon winking right along with them. Whatâs at stake, according to California tax authorities, is more than $1 billion a year in unpaid tax. If you need evidence that the only effective way to collect sales tax is to have the retailer do it at the time of sale, consider that in 2008, when the California tax return included a line allowing taxpayers to declare tax owed for online purchases, only $9 million was paid, less than 1% of what the state thinks was owed.

Amazon and other online retailers have avoided collecting sales tax in many states by relying on a 1992 Supreme Court decision that said a state canât impose its will on a retailer that doesnât have a formal presence within the state. California trumped the court by defining that presence to include Amazonâs relationship with its âassociates.â These are website owners and bloggers who post an Amazon link on their sites and collect a piece of the action, typically 4%, if one of their visitors clicks on the link and makes a purchase. Under the new state law, Amazonâs network of tens of thousands of California-based associates gives the company a presence in the state, ending the free ride on sales tax.

In response to the law, Amazon made two moves.

It cut loose all its California associates, putting many of them out of business.

Then it filed the referendum, claiming that the new law will put people out of work.

This is known as shedding crocodile tears over your own actions.

The new California law resembles measures passed in other states, notably New York and Illinois. There Amazonâs strategy is to challenge the lawsâ constitutionality in court. (In Illinois, the lawsuit is being handled by the Performance Marketing Assn., which promotes itself as a trade group for associates of online retailers.) In New York, the company has kept its associates on board and is collecting sales tax while its lawsuit proceeds.

But those states donât make it as easy as California to circumvent the courts and the legislature by launching a ballot campaign. In court, Amazon would have to painstakingly muster credible legal arguments and present them to a judge who, more often than not, is no fool. In a California ballot campaign, one can try to mislead voters by deploying half-truths, outright lies and flagrant deceit. Lie to a judge, and you might end up with a stiff fine for contempt and maybe jail. Lie to the California electorate, and you might win an election. Amazon hasnât ruled out challenging the California law in court, and it might do so if the referendum fails. But is there any mystery why it preferred to start with a ballot measure?

I write these words more in sadness than anger. As a frequent Amazon purchaser and fan of its Kindle e-reader, I can attest that itâs the only company with which I have had more positive customer service encounters than negative ones. So itâs depressing to see Amazon slogging around in the fetid swamp of corporate cynicism arm in arm with such previous promoters of self-interested ballot measures as Pacific Gas & Electric, Mercury Insurance and the oil industry â all paragons of the public-be-damned school.

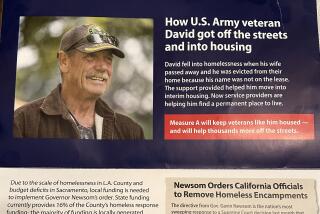

Although most of the recent ballot measures promoted by those other companies failed, Amazon plainly has made close study of their campaign methods. The deceit and misrepresentation and lying has already started. In claiming that its referendum was all about jobs, for example, it managed to gloss over the fact that the only people whose jobs were threatened were those it voluntarily cut off. The company also failed to mention the thousands of people whose jobs are threatened by the fake price advantage it enjoys, along with many other online merchants: the employees of its brick-and-mortar competitors, ranging from mom-and-pop bookstores to national department stores.

Indeed, the big joke in retailing today is that once-dominant chains like Best Buy have been reduced to showrooms where customers can try out a product before placing their (tax-free) orders online. Best Buyâs counter-strategy is to downsize its standard store by about a fifth, which obviously will require fewer employees.

Amazon has also suggested that tracking the sales tax rates of many thousands of cities and counties so it knows how much to charge customers is a big burden. Its chairman, Jeff Bezos, told Consumer Reports in May that Amazon had been âinsistingâ for 10 years that the national sales tax system be simplified. He endorsed something called the âstreamlined sales tax initiative,â which calls for compliant states to levy a single statewide rate.

Itâs hard to know how to react to Bezosâ statement other than to say: He has some nerve. Itâs not as though he committed his company to collecting sales tax for states that implement the streamlined code. Quite the contrary â he said Amazon would continue to refuse to collect tax except where state law leaves it no choice.

Moreover, for Amazon to claim itâs hard to keep track of sales tax rates unless theyâre âstreamlinedâ is ludicrous. California has 539 towns, cities and counties that can set their own rates, though most choose among three or four options. Is that a big deal? This is a company that tracks the prices of the millions of products it offers with nary a glitch, maintains a database of orders from what are reportedly more than 80 million customers (I can look up my purchases on Amazon.com going back to 1997), and didnât have any problem keeping straight what it owed its tens of thousands of California associates.

The truth is that Amazon wonât be able to put its referendum over except by lying. It canât claim the tax itâs being told to collect is a new tax, because itâs existed since 1935. It canât say the law requires it to charge customers money they donât owe, because they do owe it. It canât claim the new law will cost Californians jobs, because it effectively fired its associates all by itself. It canât claim the law is unconstitutional, because if it believed that, then there would have been no reason to fire the associates to evade its provisions.

If Amazon is not lying, then it has to admit that its opposition to the law is all about protecting a price advantage that it doesnât deserve and is, legally, a fiction. The company even admits this in its most recent annual report, where it declares that if âone or more statesâ successfully mandate that it collect sales tax, that could âdecrease our ability to compete with traditional retailers.â No kidding.

In the meantime, Amazon has deprived thousands of Californians of income they had come to rely on, and has geared up to defile the California ballot process. This is a company that got where it is today by offering a new service and doing it exceptionally well. It sacrificed profitability for years, until it got its business model right. Now that itâs learned how to make money, is it about to teach us how low it can sink?

Michael Hiltzikâs column appears Sundays and Wednesdays. Reach him at [email protected], read past columns at latimes.com/hiltzik, check out facebook.com/hiltzik and follow @latimeshiltzik on Twitter.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production â and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.