Businesses arenât spending. Can tax reform change that?

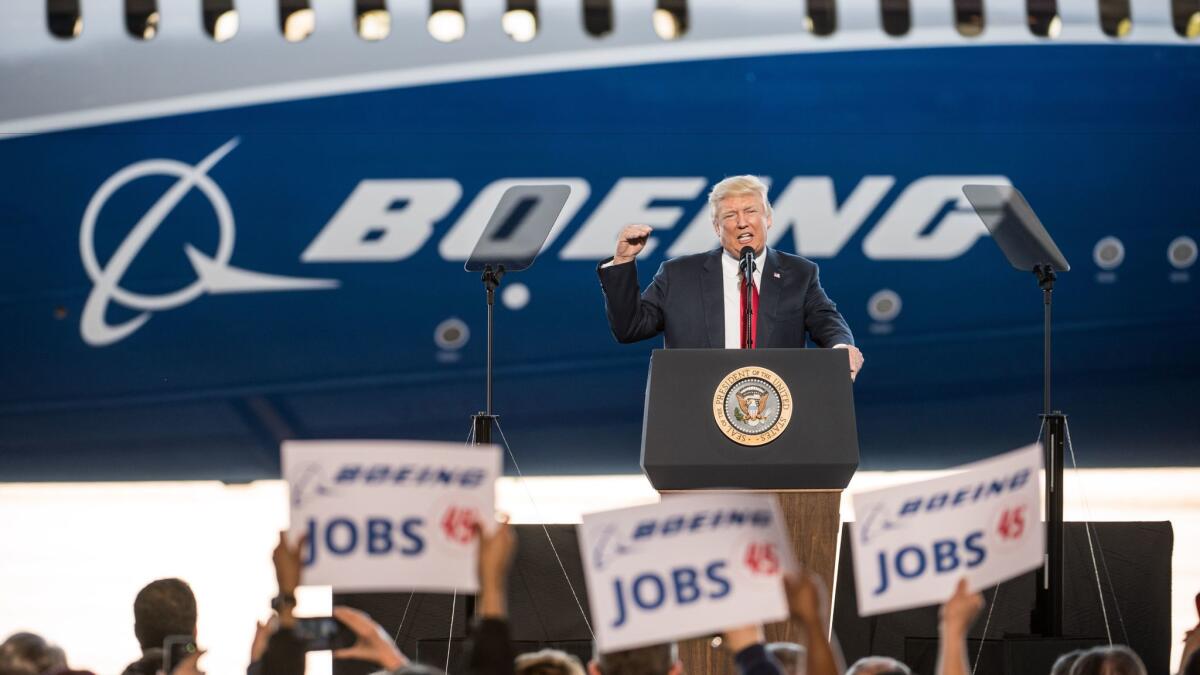

The sweeping tax overhaul plans from

By investing more in factories, stores, equipment and new employees, companies could provide a sorely-needed boost to the lackluster U.S. economy.

But many business owners have been hesitant to open their wallets. They are wary of another downturn, and some sectors are struggling against low oil prices and a rising dollar that makes exports more expensive.

Business investment has been weak for the last couple of years, dragging down economic growth.

âWeâve seen resurgence in business sentiment more recently, but you still see a lot of people running companies who are somewhat scarred from the Great Recession, so thereâs still a lot of caution out there,â said Sarah House, an economist at

Major tax changes â such as slashing the corporate rate, changing how companies deduct capital expenditures and luring billions of dollars of foreign earnings back to the United States â could spur businesses to spend more here, analysts and business executives said.

But the issue is complex. And aside from the difficult politics of enacting a major tax overhaul, the proposed changes might not be enough to get hesitant businesses to open their wallets.

The spending problem

Any business investment is a bet on the future â sales growth that will justify a new factory, or increasingly productive workers utilizing new technology.

As of three years ago, businesses seemed to be slowly regaining their investment confidence. Spending by businesses was approaching pre-recession levels. Then worldwide oil prices cratered and the dollar began rising as some key global economies struggled.

The low oil prices hit the mining sector hard, causing investment in new wells and exploration to decline sharply. The stronger dollar hurt companies that sell their products abroad and exports fell.

The double-whammy caused overall spending by U.S. businesses to start declining again as a share of overall economic output. Business investment jumped in the first quarter of this year, apparently driven by an increase in oil and gas drilling as energy prices have rebounded.

But there also appeared to be other forces depressing business spending. Asked about it last fall, Federal Reserve Chairwoman

âIt's not clear to my mind why it is that investment spending has been as weak as it is,â she said when pressed at a hearing of Congressâ Joint Economic Committee.

Coming out of the Great Recession, the economy had âa lot of excess capacityâ â factories not operating at full tilt, equipment sitting idle â and businesses didnât see enough demand to justify investing in more of it, she said.

âMore recently, with the economy moving toward full employment, you would expect to see investment spending pick up and it's not obvious exactly why it hasn't picked up,â Yellen said.

One answer lurked abroad â much lower tax rates in other countries.

A foreign cash stash

Over the last couple of decades, Ireland and many other countries have cut their tax rates sharply to try to lure companies there. That left the United States with the highest corporate tax rate among the major developed economies in the Organization for Economic Cooperation and Development.

Corporate tax rates among developed nations

Lowest

- Switzerland (8.5%)

- Hungary (9%)

- Ireland (12.5%)

- Poland (15%)

- Latvia (15%)

- Canada (15%)

Many companies donât actually pay the 35% rate; they use deductions and loopholes to reduce their tax bill. Last year, the effective tax rate for U.S. corporations was 26%, according to Wells Fargo Securities.

But effective tax rates vary widely by sector because companies in some industries make greater use of tax breaks, such as depreciation. Utilities had the lowest effective rate â 10% â from 2007-11, according to the Treasury Department. Construction firms, retailers and wholesale companies paid the highest rate at 27%.

The United States also is one of the few nations that taxes income no matter where itâs earned. Such a worldwide system requires companies to pay U.S. taxes on foreign income when it is brought back, or repatriated, to this country â minus the corporate taxes paid in the nation where the money was earned.

Most other countries have a territorial system that exempts foreign income, meaning itâs only taxed where it was earned.

Thereâs broad consensus that the combination of a high corporate tax rate and the way foreign earnings are taxed puts the United States at a global disadvantage. That has helped fuel the trend in so-called inversions, in which U.S. companies move their headquarters abroad to reduce their tax bills.

The tax system also has led companies to keep offshore earnings sitting abroad â invested in foreign subsidiaries â to avoid paying U.S. taxes on them.

As of 2015, U.S. companies had about $2.4 trillion in indefinitely reinvested foreign earnings, according to research firm Audit Analytics. The figure has more than doubled since 2008.

A failed attempt to boost spending, jobs

In 2004, Congress sought to tap the foreign earnings held by U.S. corporations to give a temporary jolt to the economy.

The Homeland Investment Act was a one-time tax holiday for money repatriated to the United States in 2005, slashing the tax rate to 5.25%. Companies were required to invest the money in the United States and lawmakers hoped the additional spending would create 500,000 jobs.

The holiday lured more than $300 billion back to the United States, a huge increase that amounted to about a third of all the U.S. corporate cash held abroad, according to the nonpartisan Congressional Research Service.

But a 2009 study published by the National Bureau of Economic Research found that the money âdid not lead to an increase in domestic investment, employmentâ or research and development.

Instead, most of the money was returned to shareholders through stock buybacks or dividend payments, which provide a much smaller stimulus to the economy.

A 2011 review of the repatriation holiday by the Senateâs Permanent Subcommittee on Investigations found that the impact on job creation was nearly nonexistent. Ten of the top 15 companies that brought money back to the United States had job losses from 2004-07, the subcommittee said.

New efforts to get businesses to spend

House Republicans and the Trump administration believe that a major overhaul of the tax code that includes a much lower corporate rate and an end to U.S. taxation of foreign earnings could unlock business spending.

âOur objective is to make U.S. businesses the most competitive in the world,â Treasury Secretary Steven T. Mnuchin said Wednesday in unveiling the administrationâs one-page list of principles for tax reform.

Trump wants to reduce the corporate tax rate to 15% and provide the same rate for so-called pass-through businesses that funnel their income through the individual tax code.

House Republican leaders have called for a 20% corporate tax rate, still a major reduction.

Both plans call for changing the way foreign earnings are taxed by switching to a territorial system, which would mean companies would pay taxes only where the income is made.

Both also want to lure back the approximately $2.4 trillion that U.S. companies have abroad by offering a sharply reduced rate for a limited time.

The House Republican plan calls for an 8.75% rate on cash and 3.5% on other investments. Trump administration officials havenât specified their rate, but Mnuchin said it would be âa very competitive rate that will bring back trillions of dollars.â

The House Republican plan also calls for allowing companies to deduct the full cost of capital expenditures immediately instead of depreciating the expense over time.

âWe can buy some new equipmentâ

Maxine Turner said she would love to upgrade the aging building that houses her Salt Lake City catering business, buy a couple of new stoves, replace some delivery vans and increase pay for her 120 workers.

But in a tight economic environment, she hasnât been able to do that.

A cut in the tax rate for her and her three Cuisine Unlimited partners â her husband and their two sons â would enable them to make those investments, Turner said.

âWe can buy some new equipment. That would really help us,â said Turner, who chairs the U.S. Chamber of Commerceâs Small Business Council.

Ideally, the tax rate would be cut to somewhere between 15% and 20% for corporations and down to at least 25% for so-called pass-through businesses that pay through the individual tax code, if not lower, said Caroline Harris, chief tax counsel for the U.S. Chamber of Commerce.

âWe donât have a magic number, but certainly where we are makes us a tremendous outlier,â she said of the 35% U.S. rate.

Eliminating U.S. taxes on foreign earnings also would provide a boost to spending by removing the tax incentive for keeping money offshore, said Marc Gerson, vice chair of the tax department at the Miller & Chevalier law firm.

âIt drastically increases the competitiveness of U.S. business on a global basis and I think that necessarily leads to greater economic activity and job creation in the U.S.,â he said.

But House, the Wells Fargo economist, doesnât think the return of money stashed abroad will be a major economic stimulus because corporate profit margins are pretty good now.

âIt might help in times when companies get financially stressed,â she said. âWithout that, I donât think itâs going to change the overall investment decisions here at home.â

Some companies already have indicated they would use that money for stock buybacks, which House said would largely just benefit more affluent Americans who own shares by bidding up the prices.

A CNBC survey of chief financial officers in December found that just 12.5% planned to use the money for hiring.

With the 2005 experience in mind, there has been talk in Washington of limiting how executives could use the repatriated cash.

Larry Fink, chief executive of money management giant BlackRock Inc., thinks businesses need to think more about how theyâre going to grow and compete.

âWhile we certainly support returning excess capital to shareholders, we believe companies must balance those practices with investment in future growth,â Fink wrote to the chief executives of major companies in his annual letter this year.

Twitter: @JimPuzzanghera

UPDATES:

6 a.m.: This article was updated to clarify that the U.S. Chamber of Commerce would like to see a maximum tax rate of 25% for so-called pass-through businesses and a corporate tax rate of 15% to 20%.

This article originally was published at 5 a.m.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production â and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.