A new wave of satellites in orbit: Cheap and tiny, with short life spans

- Share via

Reporting from San Francisco — It’s one of the most recognizable images in aerospace: Highly specialized workers clad in gowns, hair nets and shoe coverings crawl over a one-of-a-kind satellite the size of a school bus. The months-long process is so delicate that even workers’ metal rings must be covered with a translucent tape to prevent static transfer.

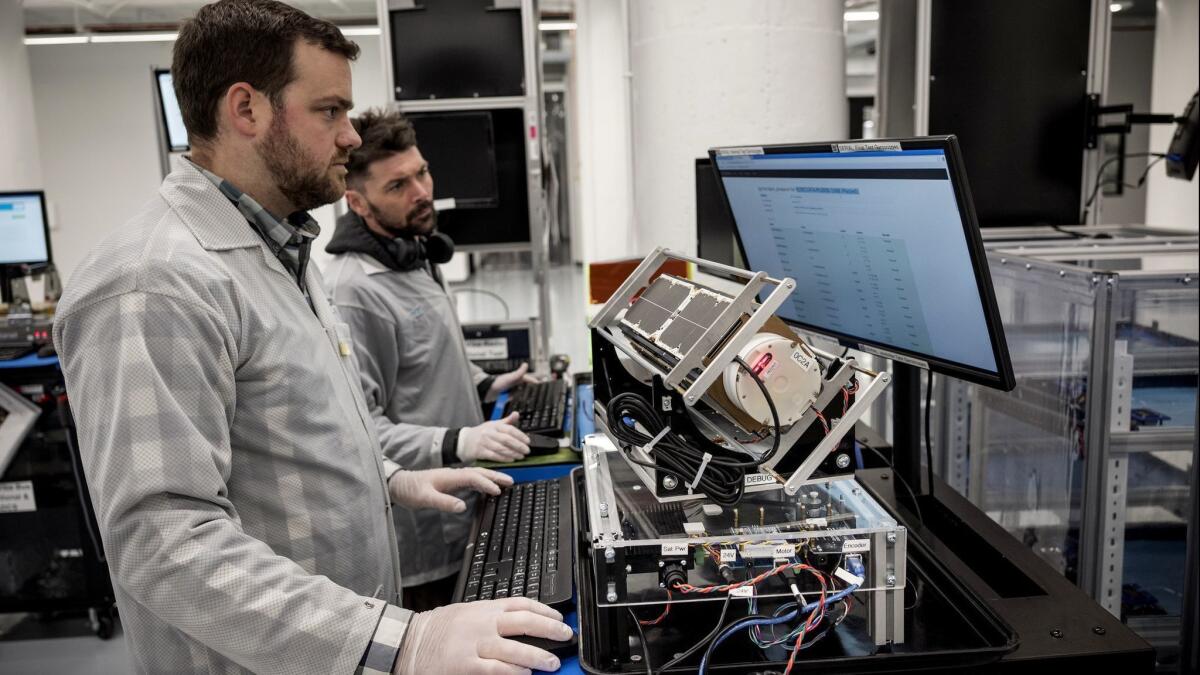

Contrast that with how things are done at Planet Labs Inc. in San Francisco’s South of Market neighborhood. Satellites no bigger than a loaf of bread are propped on work benches, tended by technicians wearing simple rubber gloves and light lab coats. Largely using commercially available tech components, they can crank out and test 25 of these pint-sized satellites in a week.

Befitting its location, the Earth-imaging company’s approach is more akin to that of a tech start-up than a traditional aerospace firm. Giant satellites might cost north of $1 billion and last for a decade or more. Planet churns out satellites that cost a tiny fraction of that — how much, it won’t say — with a life span of just two to three years.

Like Apple and Google do with their smartphones, Planet plans constant upgrades by beaming software updates to orbiting satellites and sending up new ones as needed.

“From the beginning, we had the notion that we didn’t have to do space the same way it had been done before,” said Mike Safyan, Planet’s vice president of launch and global ground station networks.

Small satellites are revolutionizing Earth imaging and communications, as well as the launch business. No fewer than three dozen rockets have been developed or are in the works to serve the anticipated boom in launch demand. Even the Pentagon is pondering how to incorporate tiny spacecraft into national security plans.

Planet was ahead of the curve when a trio of former NASA scientists — Will Marshall, Robbie Schingler and Chris Boshuizen — founded the company in 2010. They set up shop in a Cupertino, Calif., house, clearing out excess equipment from the Burning Man festival and camping trips to make room for satellite components.

The outfit moved to a San Francisco office and added a greenhouse tent with a HEPA filter, recalls Safyan, a former NASA Ames Research Center aerospace engineer who joined in 2011. Planet launched its first Dove satellite in 2013. Two years later, it took over a 3,000-square-foot former textile manufacturing building on 9th Street in San Francisco.

In 2017, Planet launched 88 tiny Doves aboard the Indian Space Research Organization’s PSLV rocket, followed five months later by 48 Doves on a Russian Soyuz. The company also acquired Google’s Terra Bella small-satellite unit and its 7 SkySat satellites.

Planet sells the images taken by its satellite constellation to governments and companies in agriculture, finance and insurance. Farms can use the data to monitor crop health; oil and gas firms might want to keep an eye on new wells.

“We felt the data we would be generating from these satellites has immense value,” Safyan said. “Now that we have the fleet in orbit, for a long time, we’ve been talking about what we can do with this data.”

On a Thursday morning in July, some of the 23 members of the satellite manufacturing team clustered around test stands and other equipment in the company’s new SoMa facility to check that all the equipment, networks and other processes were accurately calibrated.

Satellite parts arrive just as they’re needed, starting with printed circuit boards. Workers piece together and test sub-assemblies, such as antenna flaps. Parts are loaded onto baker’s racks, organized by plastic labels. Technicians follow instructions from iPads.

Parts for an entire satellite can fit on just one or two racks.

“All of that will be the right size to match the amount that we’re building or the maturity of the technology that we’re building,” said Chester Gillmore, Planet’s vice president of manufacturing, decked out in his customary bowtie. “None of this is built in stone.”

There are reminders that the end user isn’t your typical consumer. In an adjoining room, accessible only with a keycard, satellites go through a variety of tests to ensure they will survive the harsh environment of space, including shock tests with a large, clanging metallic piece of equipment Gillmore calls “Thor’s hammer.”

Even parts that are off-the-shelf — such as the solid-state storage drives that are similar to what you’d find in a computer — go through rigorous qualification processes.

The company’s recent shift toward data analysis resulted in a round of layoffs. Planet said that reflected a restructuring — to focus on “developing commercial products and building a successful business” instead of “meeting big technical challenges” — rather than business problems. Though the company doesn’t report financial results, it said sales last year were double those of 2016. It has raised more than $180 million in venture capital. Google became an investor last year.

A report from trade publication Space News said 38 jobs were cut. Planet wouldn’t confirm that, but said the layoffs affected less than 10% of its global employee count. A source with knowledge of the situation said the company now has 450 employees.

The boom in small-satellite development has softened demand for some big birds, but isn’t killing them off entirely. Larger satellites can beam back images with finer details of objects on the ground or in space because their cameras have larger apertures, said Mason Peck, associate professor in the mechanical and aerospace engineering department at Cornell University and former NASA chief technologist. They can also communicate data from farther away, in geostationary orbits, because they have more power.

NOAA’s GOES-S next-generation weather satellite, for example, was launched to geostationary orbit in March and will be used to track wildfires and storm systems near the western U.S. The satellite, which weighs more than 11,000 pounds, arrived for launch in Florida aboard a C-5M cargo transport plane.

Planet’s Safyan said different missions dictate different requirements. Larger satellites often need to survive for 10 to 15 years in space, meaning they need more radiation protection, redundant systems and capabilities — all of which are less crucial to Planet’s missions, he said.

“Really, we’re optimizing for different things,” Safyan said. “It’s not like this way’s better than that way.”

Twitter: @smasunaga

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.