U.S. household debt tops 2008 peak, but this time Americans’ finances are better

- Share via

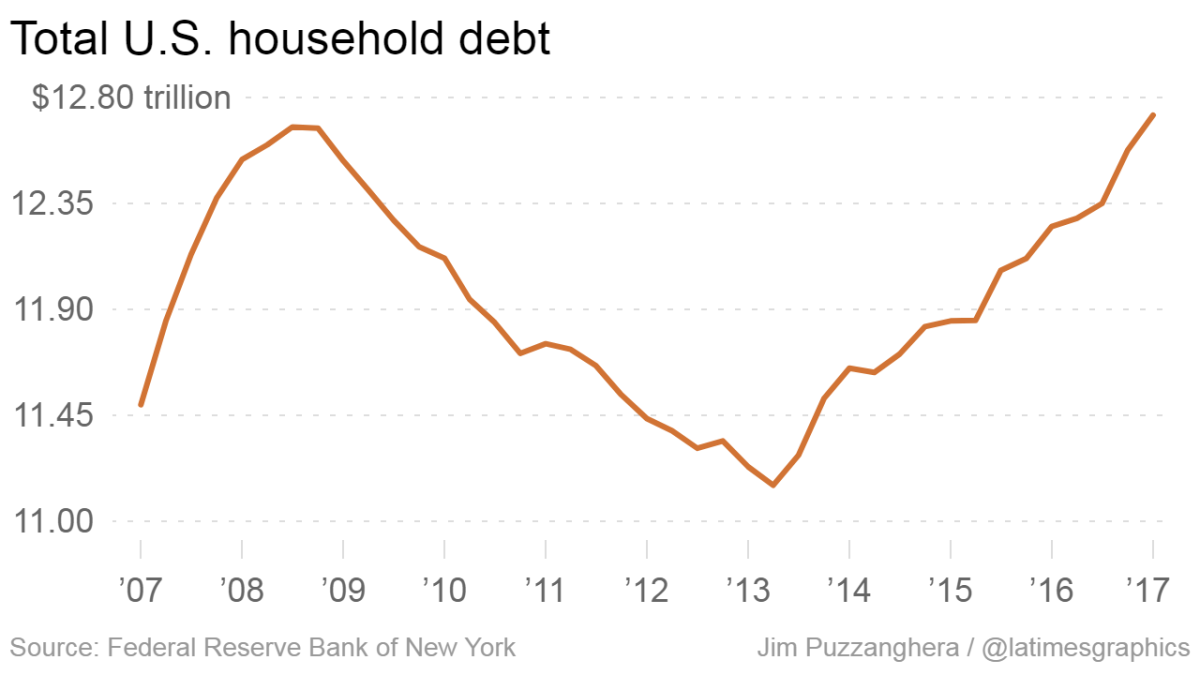

The recovery from the Great Recession has hit a milestone: Total household debt climbed to $12.73 trillion in the first quarter to top the peak reached in 2008 before the housing market crash and severe economic downturn led to a historic reduction, according to government data released Wednesday.

But this time, Americans are doing much better handling their mortgages, credit cards, auto loans and other borrowing, the data from the

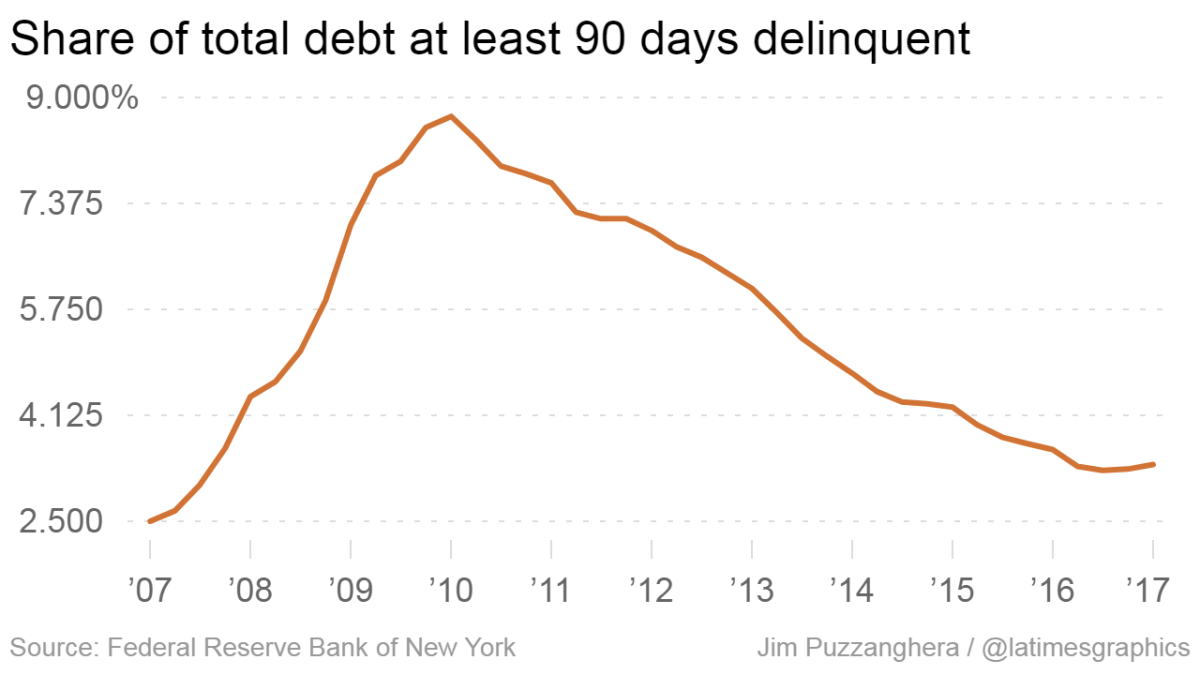

Consumers were delinquent on 4.8% of total debt, a marked improvement from the 11.9% of debt that was at least 30 days late at the end of 2009.

Rising household debt — up from $12.58 trillion in the fourth quarter of last year — can indicate that Americans are confident in their jobs and the overall economy.

But, as it did in the years leading up to the Great Recession, the increased borrowing also could signal lower loan standards, predatory lending and eager consumers getting overextended.

“This record debt level is neither a reason to celebrate nor a cause for alarm,” said Donghoon Lee, research officer at the New York Fed.

“Borrowers look quite different today,” he said — older and more creditworthy than a decade ago.

But there are some potential warning signs in the latest data. Auto loan and credit card delinquencies have started trending up in recent months, and student loans delinquency rates “remain stubbornly high.”

Here are the key takeaways from the Fed’s quarterly report on household debt and credit.

A long climb back

In the fourth quarter of 2008, total household debt hit $12.68 trillion. It took “an unusually long time from a historical perspective” for debt to get back to that level, Fed researchers said.

The data are not adjusted for inflation or population growth, so it generally had been rising since officials began tracking it in the 1940s.

But borrowing increased sharply during the real estate boom in the mid-2000s. When the housing market crashed, leading to the Great Recession and the 2008 financial crisis, total debt fell off dramatically.

Some of the decline was involuntary as a wave of foreclosures and other loan defaults hit unemployed and overextended consumers. But some of it was voluntary as Americans tried to adjust to the struggling economy by reducing their borrowing.

From the peak in 2008, household debt sank 12% to its low point in the second quarter of 2013.

Since then, debt has risen 14% as the economy slowly recovered.

Growth in new mortgages slowed in the first quarter with origination balances of $491 billion, down from $617 billion in last year’s fourth quarter, the report said.

After a record year for auto loans in 2016, growth in that category slowed as well in the first quarter. The $132 billion in originations was down from the fourth quarter but up from the same period a year earlier.

Mortgages are a smaller share of debt

Mortgages now are a much smaller percentage of total household debt than in 2008, the Fed said.

At the previous peak, mortgage debt accounted for 73% of the total. The figure now is down to 68%, in part because of tougher lending standards mandated by federal regulators.

At the same time, auto and student loans have increased their shares while credit cards have remained about the same.

In the first quarter, student loans accounted for 10.6% of household debt, more than double the 2008 figure. Auto loans accounted for 9.2%, up from 6.4%.

Delinquency rates are low for most debt

Household debt has been increasingly shifting toward older and more creditworthy borrowers, Fed researchers said.

The Fed said changing borrowing patterns have led to very low delinquency rates for most debt.

One measure, debt at least 90 days past due, was 3.4% in the first quarter of the year. That was up slightly from the fourth quarter of last year but still down significantly from the recent high of 8.7% in the first quarter of 2010.

“While most delinquency flows have improved markedly since the Great Recession and remain low overall, there are divergent trends among debt types,” Lee said.

Delinquency measures for auto loans and credit cards are trending up, he said. Student loan delinquencies remain high.

The report also broke down data for the largest states and those hit hardest by the Great Recession, including California, Arizona, Nevada and Florida.

California is doing the best of those states, with just 2.3% of debt at least 90 days delinquent. That is lower than the national figure.

Florida is doing the worst, with 4.8% of debt at least 90 days delinquent. Nevada’s figure was 3.8% in the first quarter, and Arizona’s was 3.4%.

Twitter: @JimPuzzanghera

MORE BUSINESS NEWS

The share of Americans without health insurance stops shrinking

Trump-related jitters push stocks down

Ford reportedly plans to cut 10% of its workers

Forget about steel, car parts and manufactured goods: Service exports are key to U.S. trade future

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.