Trump is pressuring the Fed to keep interest rates low. Nixon actually did it — and damaged the economy

- Share via

Reporting from Washington — The Federal Reserve was raising interest rates and the president wasn’t happy about it.

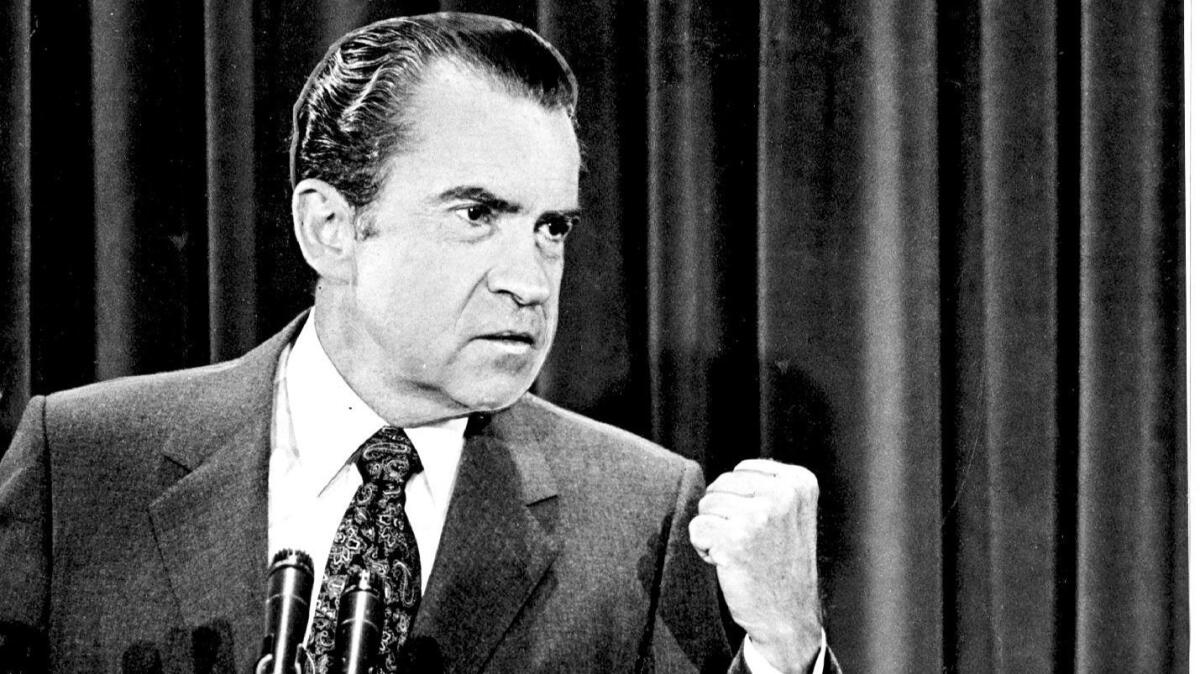

No, it wasn’t President Trump, who has repeatedly taken the unusual step of publicly criticizing the independent central bank. It was another volatile president — Richard Nixon — and the experience presents a cautionary tale.

The U.S. had just emerged from a nearly yearlong recession in 1971 after the independent central bank slashed its key short-term interest rate by more than half.

Fed Chairman Arthur Burns was worried that continuing the low rates and expansionary monetary policy with the economy growing again could lead to what he called “awful problems” down the line.

Nixon was more worried about his reelection in 1972.

“We’ve really got to think of goosing it … late summer and fall of this year and next year,” Nixon told Burns on March 19, 1971, according to White House audio recordings released years later.

It was one of several conversations with Burns by Nixon and his top deputies that succeeded in getting the Fed chairman to reverse the interest rate hikes in the fall of 1971 — only to lead to a decade of economic damage from high inflation.

It has become a case study for the dangers of jawboning the Fed on interest rates.

“There is a very short-run political motivation to get results before the next election and I think Donald Trump … doesn’t want to see interest rates start spiking now,” Burton Abrams, a University of Delaware economist who has studied political pressure on the Fed, said in July, the month Trump’s public criticisms of the central bank began.

“A lot of the public might say, ‘That’s right. They can’t be raising interest rates and slow the economy. We want a booming economy,” Abrams said, “without understanding the longer-run ramifications.”

The Fed, like other major central banks around the world, has independence in making monetary policy so it can look out for the longer-term health of the economy instead of making decisions based on short-term political calculations.

That’s what happened in the 1970s. And that’s what some economists are worried could happen now because of Trump’s public pressure.

“I’m not thrilled,” Trump told CNBC in an interview July 19 about the Fed’s recent interest hikes. “Because we go up and every time you go up they want to raise rates again. I don’t really — I am not happy about it. But at the same time, I’m letting them do what they feel is best.”

Trump has doubled down on that criticism in October, including saying Wednesday that Fed officials are “making a mistake” and have “gone crazy.”

Trump has said he had “put a very good man” into the Fed chairman’s job: Jerome H. Powell, who took office Feb. 5. The Fed has raised its short-term federal funds rate three times — by 0.25 of a percentage point each time — since Powell took office in a process known as monetary policy tightening.

The Fed now has raised the federal funds rate by 0.25 of a percentage point eight times since December 2015 after holding the rate at an unprecedented level of near zero for seven years in an attempt to fight the Great Recession and the financial crisis.

With the U.S. economy improving, another hike is expected this year to try to stave off the high inflation that can come when there are low borrowing costs in a growing economy.

The day after the July CNBC interview, Trump wrote on Twitter that the Fed rate hikes were “taking away our big competitive edge” with China and the European Union.

“The United States should not be penalized because we are doing so well. Tightening now hurts all that we have done,” Trump tweeted. “Debt coming due & we are raising rates — Really?”

Trump was the first sitting U.S. president to publicly criticize the Fed’s monetary policy since George H.W. Bush in 1992.

Then, in the midst of a tough reelection battle after a recession, Bush told the New York Times, “I’d like to see another lowering of interest rates.… I can understand people worrying about inflation. But I don’t think that’s the big problem now.”

The Fed, under chairman Alan Greenspan, cut the rate twice over the next few months. But Bush lost his reelection bid anyway.

For years, presidential pressure on the Fed wasn’t unusual.

From its creation in 1913 until 1935, the Treasury secretary served as Fed chairman, giving the president direct influence over the central bank’s policy. Congress changed that arrangement during the Great Depression, increasing the central bank’s independence by removing the Treasury secretary from the Fed’s board and providing for a chairman appointed by the president who could not be removed for political reasons.

A dispute over interest rates on government debt during the Korean War led to a formal accord between the Treasury Department and the Fed giving the central bank the full freedom to set monetary policy as it saw fit.

But presidents continued to pressure the Fed in other ways.

In 1965, Fed Chairman William McChesney Martin Jr. warned his board colleagues that they risked an overhaul of the Fed when they narrowly voted to raise interest rates in 1965 over the objections of President Johnson.

But it was the secret White House taping system used by Nixon that provided the most detailed example of presidential pressure on the Fed — and its long-term ramifications for the economy.

Nixon appointed Burns to replace Martin as Fed chairman in early 1970. The Fed was in the midst of lowering its key short-term interest rate from nearly 9% to about 3.7% to fight a recession.

The recession ended in November 1970. But the labor market generally lags in recovery and Nixon was worried in early 1971 that the unemployment rate remained high, at about 6%.

“I’d be delighted to be the first president in 25 years to take the Fed on if it becomes necessary,” Nixon told Treasury Secretary John Connally on March 5, 1971, according to White House audio recordings quoted by Abrams in a 2011 research paper.

The tapes show Burns, though a Republican loyal to Nixon, initially resisted the pressure.

“To drive interest rates lower would run the risk of accelerating an international monetary crisis,” Burns told Nixon on March 19, 1971, in response to the suggestion about “goosing” economic growth.

But Nixon kept at it.

In July, he told aides to leak a story that he was considering pushing to expand the size of the Fed’s board, which would weaken Burns’ influence.

Even a personal warning from legendary economist Milton Friedman didn’t dissuade Nixon from continuing to push for lower interest rates.

“If you let the inflationary pressure build up over us, we might be able to hold it down at least through the election,” Friedman advised Nixon on Sept. 24, 1971. “After this, you’ll have a great upsurge in inflation.”

On Oct. 10, 1971, Nixon told Burns that concerns about too much liquidity in the financial system are “just bullshit” and worried his will be “the last conservative administration in Washington.”

Burns finally relented in the weeks afterward and the Fed started lowering interest rates that fall.

“He was the expert on business cycles and inflation and he knew that monetary policy was the primary cause of inflation,” said Abrams.

“It’s not clear what straw broke the camel’s back and why he wound up reversing himself rather dramatically,” Abrams said. “I think he thought he was going to lose control of the Fed.”

Nixon easily won reelection as the economy boomed and the unemployment rate declined to 5.3% in November 1972 from 6% the previous December. Inflation declined as well, mostly because of temporary wage and price controls that Nixon instituted in mid-1971.

But the economic troubles that Burns and Friedman hand warned about soon arrived.

The U.S. fell into another recession in November 1973. In an unusual economic occurrence, inflation also skyrocketed, to 12% by the end of 1974. So-called stagflation — high prices combined with a stagnant economy — would remain a major problem into the early 1980s, when Fed Chairman Paul Volcker tamed it through high interest rates despite initial opposition from the Reagan administration.

“The political pressure is always going to be to juice up the economy before an election,” said Princeton economist Alan Blinder, a former Fed vice chairman.

“You can get what are called political business cycles,” he said. “You get a boom before the election and then a bust after the election. That’s not good for anyone except for the incumbent president who helps himself get reelected.”

The high inflation of the 1970s and early 1980s helped changed that equation, said Fed Vice Chairman Stanley Fischer in a 2015 speech on central bank independence.

He cited that experience as “one of the primary motivations for the broadening and deepening of monetary policy independence worldwide.”

But the view that Trump’s actions are out of line are not shared by all economists.

Thomas Cargill, an economics professor at the University of Nevada in Reno, said in July that Trump was being unfairly criticized for doing publicly what other presidents have done behind the scenes through pressure and appointments to the Fed’s seven-member board.

Trump has appointed three of the Fed’s four sitting board members and has three more awaiting Senate confirmation.

“There’s a long history of political interference with the Federal Reserve,” said Cargill, who has studied the issue. “This whole idea of independence is something that is more myth than reality.”

Powell pledged at his confirmation hearing and has publicly stated that he intended to be independent. Asked about Trump’s criticism at a September news conference, Powell defended the Fed.

“We’ve been given a really important job to do on behalf of the American people by Congress, and we’ve been given the tools to do it, and my colleagues and I are focused exclusively on carrying out that mission,” Powell said.

“We don’t consider political factors or things like that,” he continued. “So that’s who we are, that’s what we do, and that’s just the way it’s always going to be for us.”

Blinder predicted this summer that Trump’s criticism was likely to strengthen the resolve of Powell and other Fed officials to continue on a path of gradual interest rate hikes. But Blinder acknowledged that could lead to more presidential criticism, “so this is not over.”

Twitter: @JimPuzzanghera

UPDATES:

Oct. 11, 9:10 a.m.: This article was updated to reflect developments since the original publication, including recent criticism by President Trump, comments by Fed Chairman Jerome Powell, an additional rate hike and changes to the Fed board.

This article was originally published July 27.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.