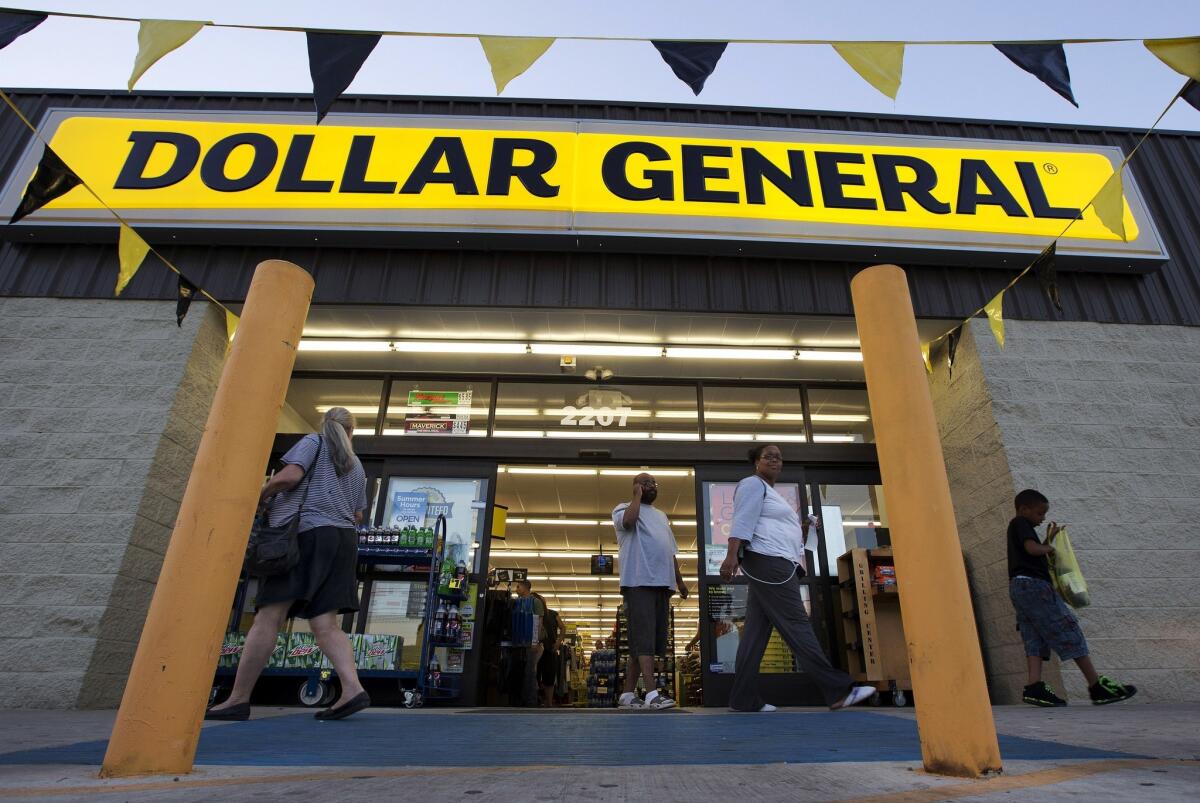

Dollar General goes hostile in bid for Family Dollar

Dollar General Corp. is going hostile with its $9.1-billion bid for Family Dollar Stores Inc. after its rival repeatedly rejected previous offers.

The discount chain has commenced an open offering to Family Dollar shareholders for $80 per share in cash. That offer was rejected last week by Family Dollar’s board, which has already accepted a deal with another discounter, Dollar Tree Inc.

Family Dollar, based in Matthews, N.C., has voiced concerns about Dollar General’s deal passing antitrust review. In response, Dollar General has said that it is willing to divest as many as 1,500 stores if the Federal Trade Commission requires it. The company also is offering to pay a $500-million reverse breakup fee if antitrust hurdles get in the way.

Dollar General’s offer makes for a compelling financial argument, Sterne Agee analyst Chuck Grom wrote. He expects the Goodlettsville, Tenn., company to ultimately win the dollar store war.

Family Dollar has been exploring a sale amid considerable financial stress and it has closed some of its stores and cut prices in an attempt to increase foot traffic. In June, activist investor Carl Icahn urged the company to put itself up for sale.

Family Dollar accepted an $8.5-billion offer from Dollar Tree a month later. The competing bid includes $59.60 in cash and the equivalent of $14.90 in shares of Dollar Tree for a total of $74.50 for each share held. Family Dollar has backed the bid, saying regulators are less likely to interfere.

There are more similarities, however, between Family Dollar and Dollar General, which stock their shelves with goods that sell for a range of prices. Everything sold at Dollar Tree costs a buck.

Appealing directly to Family Dollar shareholders, Dollar General Chairman and Chief Executive Rick Dreiling said that a sale to his company would provide them with “immediate and certain liquidity for their shares.”

“By taking this step, we are providing all Family Dollar shareholders a voice in this process, and we urge them to tender into our offer,” Dreiling said in a statement.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.