City National critics want ‘bank to the stars’ to ‘cater to the poor’

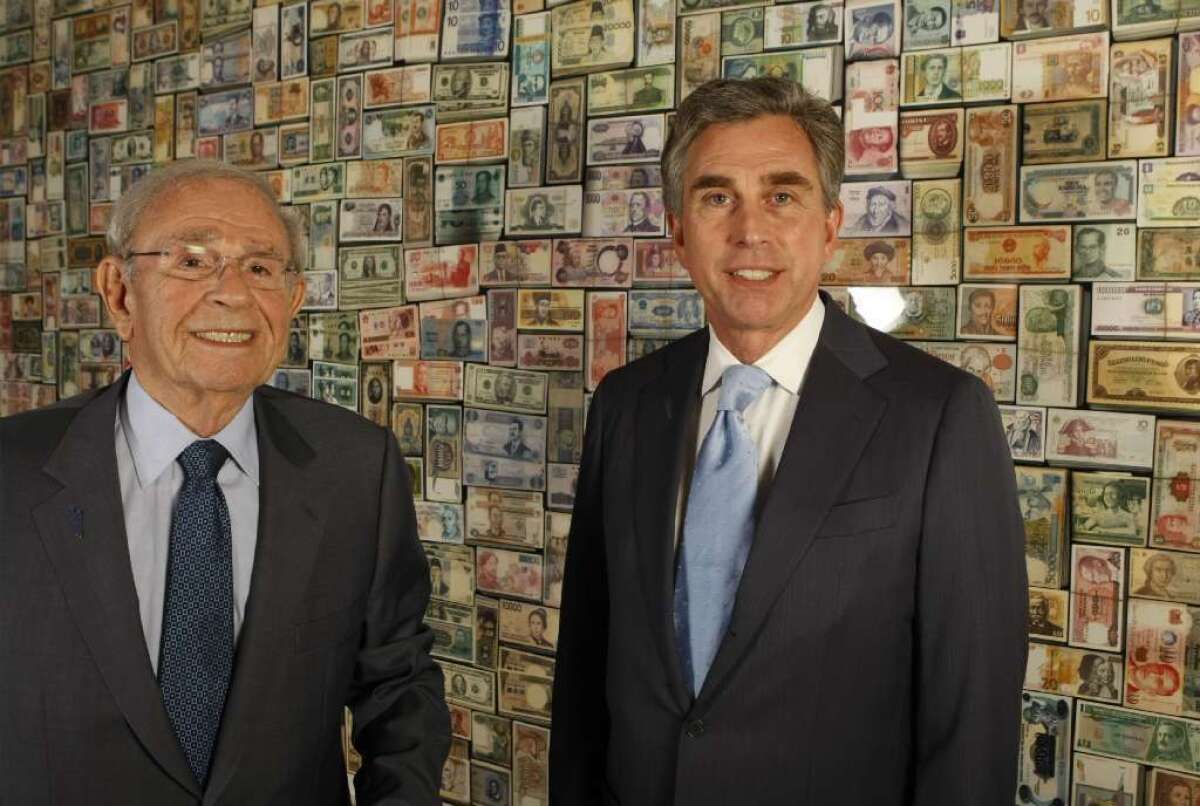

Some advocates for the poor are challenging City National Corp.’s sale to Royal Bank of Canada, saying L.A.’s biggest bank should do more to help low-income areas. Above right, City National Chairman Russell Goldsmith with former Chairman Bram Goldsmith in 2012.

Demands by advocates for low- and moderate-income banking customers are complicating the approval of a second major acquisition this year — Royal Bank of Canada’s proposed $5.4-billion takeover of City National Corp. in Los Angeles.

Community and minority groups want the Federal Reserve to hold a public hearing on the benefits that a merger should be able to provide to residents in such areas as East Los Angeles.

City National, sometimes called the “bank to the stars” because of its deep Hollywood ties, specializes in managing money for wealthy clients, the key line of business that the Canadian bank seeks.

Gilbert R. Vasquez, chairman of the Los Angeles Latino Chamber of Commerce, thinks the bank should be doing more under the 1977 Community Reinvestment Act, which requires banks to serve poorer customers in their metro areas.

“City National is a tale of two cities,” Vasquez said. “Huge investments among the wealthy in West L.A. and virtually nothing in East L.A, the entrepreneurial center for future Latino growth.”

Vasquez is one of a number of advocates who want the Fed to require bigger commitments to minority lending and other banking services before it approves the acquisition.

Early this year, two prominent advocacy groups persuaded the Fed to hold a public-benefits hearing on the planned $3.4-billion purchase of OneWest Bank in Pasadena by CIT Group Inc. in New York. That hearing, in February, has strung out the timeline for approving the deal, which is still pending.

In approving deals, the Fed must consider the banks’ performance and pledges under the Community Reinvestment Act in addition to scrutinizing the expected safety and soundness of the combined entities.

Eric Kollig, a Fed spokesman, declined to comment on the prospects for a City National hearing or the timing of a decision on the planned mergers.

The community and minority groups have taken mixed views of mergers.

The California Reinvestment Coalition in San Francisco, which objected to the sale of OneWest, supports the City National deal.

City National said last week that it would commit $11 billion over five years to help poor neighborhoods and small businesses. That’s roughly twice OneWest’s pledge of $5 billion over four years, said Paulina Gonzalez, the coalition’s executive director.

However, Berkeley’s Greenlining Institute, which also objected to the OneWest deal, withheld support for City National, calling for a hearing even as it continued discussions with the bank this week. Greenlining officials also said they hoped to meet with RBC’s chief executive, David I. McKay.

RBC spokesman Wojtek Dabrowski said senior executives of the Toronto bank already have discussed the City National deal with several community groups.

“We have been very pleased with the open and transparent tone of these discussions,” Dabrowski said, “and our CEO remains open to additional dialogue in the future.”

Opposing the City National transaction is National Diversity Coalition, a Daly City amalgam of community, ethnic and church groups. It said City National had rejected its suggestion that the bank overhaul its focus to begin operating in low-income areas as well as in pockets of wealth.

Like many banks with few branches in depressed neighborhoods, City National has funneled much of its CRA lending, investments and philanthropy through community groups and community development financial institutions, which are smaller banks, credit unions and non-bank lenders focused on low- and moderate-income areas.

Adding City National’s $33 billion in assets to Royal Bank of Canada’s $800 billion in assets would give the greater Los Angeles area access to one of North America’s biggest banks. That size alone, said Filipino-American advocate Faith Bautista, means the combined operation should be doing business with all of California’s economic sectors.

“This is a mega-merger,” Bautista said. “Banks should cater to the poor.”

City National’s record in meeting CRA requirements was rated satisfactory in the latest review, in 2012, by the Office of the Comptroller of the Currency, which regulates national banks. The agency said the bank’s considerable small-business lending offset the fact that its mortgage business focused entirely on jumbo loans for business owners and other affluent homeowners.

City National said its latest pledge would replace a 10-year, $17-billion CRA commitment made in 2007. Chief Executive Russell Goldsmith said the current plan was “on track ... notwithstanding the challenges of the recent recession.”

The new $11-billion commitment over five years includes a promise that City National would purchase and keep on its books $700 million in home mortgages funded for minority borrowers.

The bank also said that it would make $4.2 billion in small-business loans of $1 million or less; $4.4 billion in qualified CRA community development loans; $1.6 billion in qualified CRA investments; more than $80 million in supplier expenditures with minority- and women-owned businesses; and $30 million in charitable contributions.

“We’re gratified to have received the support of the California Reinvestment Coalition and look forward to actively working with all of our community partners to build upon our great progress with qualified CRA lending,” said Goldsmith, whose family has been the bank’s controlling shareholder for decades.

Meanwhile, in the OneWest deal, CIT Chief Executive John Thain told analysts Tuesday that he still expected to complete the purchase of OneWest “in the middle of this year.”

Proposed mergers often provide community groups a chance to lobby banks for higher pledges of CRA assistance, a process that former U.S. Sen. Phil Gramm (R-Texas) compared to extortion when he was chairman of the Senate Banking Committee.

The Fed had been swamped by mass emails from backers and detractors of the OneWest deal before it called the unusual open hearing in February to discuss what benefits low-income people might expect from CIT’s proposed takeover.

Thain and OneWest’s chief executive, Joseph Otting, testified that poor neighborhoods would benefit as the bank sought to increase its CRA rating from “satisfactory” to “outstanding.”

In opposing the deal, the California Reinvestment Coalition pointed out that CIT and the billionaire private investors who own OneWest had received extraordinary bailout favors during the financial crisis and now are creating another “too big to fail” bank.

Follow @ScottReckard for news about banks and home loans.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.