News Corp. to buy parent of Realtor.com for $950 million

The battle for house-hunting eyeballs is heating up.

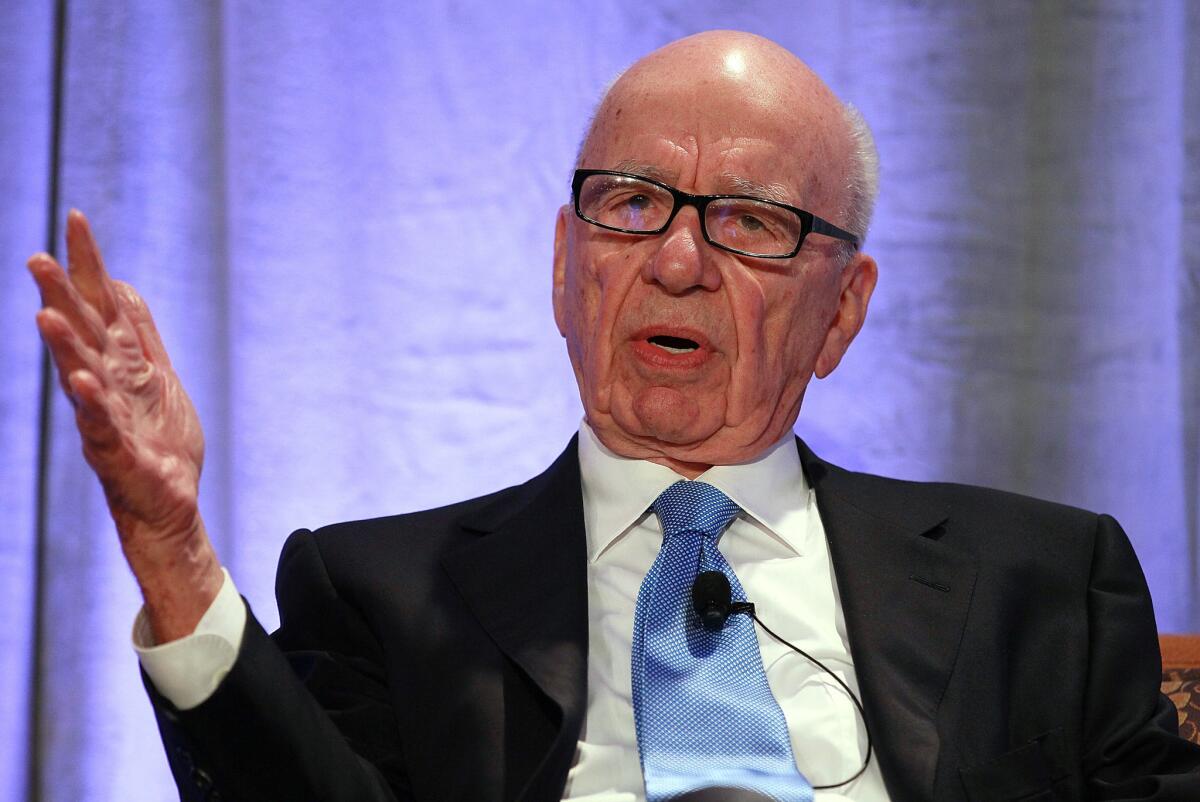

Rupert Murdoch’s News Corp. announced Tuesday a $950-million agreement to buy the nation’s third-largest online real estate listing company, Move Inc., marrying the parent company of the Wall Street Journal with the Realtor.com website, which drew 26 million would-be home buyers last month.

It’s a bid to help Murdoch’s publishing company diversify in the wake of its split from 21st Century Fox. It’s also a bid to create a viable competitor to online real estate giants Zillow and Trulia, which are themselves merging.

The online real estate business is growing fast as agents and brokers shift ever greater chunks of their $14 billion in annual advertising dollars away from print and into data-rich digital and mobile platforms. That spending, though, is scattered across hundreds of local and national sites, and if big portals like Move’s Realtor.com can consolidate it, there’s profit to be made, News Corp. Chief Executive Robert Thomson told analysts Tuesday.

“We believe there is a massive market opportunity in the U.S. for online real estate revenue,” he said. “This market is in the early stages of development.”

The same thinking is driving Zillow and Trulia, which in July announced plans for a $3.5-billion merger designed to give them a big slice of the advertising pie. Both sites long ago surpassed Realtor.com in traffic, and combined drew nearly four times as many unique visitors last month as Move’s network, according to online data service ComScore.

But Move’s Realtor.com is still the third-busiest site by far, and it has a big asset in its long partnership with the National Assn. of Realtors. The industry’s biggest trade group gives it up-to-the-minute access to nearly all of the country’s multiple listing services — providing for more accurate listings, says Move Chief Executive Steve Berkowitz — and a strong brand name to boot.

The deal with News Corp. will provide back-office support and the expertise of News Corp.-owned REA Group, the leading property website in Australia. It will also give Realtor.com a broad marketing platform on the Wall Street Journal’s digital network, which averages 500 million page views a month.

“We intend to use our media platforms and compelling content to turbo-charge traffic growth and create the most successful real estate website in the U.S.,” Thomson said. “We certainly expect this deal to amount to far more than the sum of its parts.”

It will be a tall order for the News Corp.-Move tie-up to match Zillow and Trulia in the marketplace, said Brian Boero, who tracks the online listing business at consulting firm 1000Watt in Oakland. But the company is expected to be strong enough to survive as a viable competitor.

The real success of the deal will come down to how well News Corp. is able to manage the agreement with the National Assn. of Realtors, which provides Move with its competitive advantage but has at times also blocked innovations — such as the home value estimate that powered Zillow to its early prominence.

“[The partnership] is their greatest advantage and their greatest weakness in the same breath,” Boero said.

For its part, the Realtors Assn., which has voiced concerns about the Zillow-Trulia merger, said Tuesday that it supported the News Corp.-Move deal.

It ought to, said Steve Murray, president of Real Trends, a real estate research and consulting firm in Castle Rock, Colo. Teaming up with one of the biggest names in business media should help broaden the reach of Realtor.com, he said, and give agents some leverage should the combined Zillow and Trulia try to flex their marketing muscle.

“This will increase and enhance competition,” he said. “That’s a very positive thing.”

Twitter: @bytimlogan

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.