UnitedHealth starts pulling out of Obamacare, but will anybody notice — or care?

The giant health insurance company UnitedHealth inspired lots of hand-wringing and hyperventilation last year when it announced that it had lost hundreds of millions of dollars on Affordable Care Act exchanges and was considering withdrawing from the market in 2017.

Although that news prompted numerous Obamacare critics to declare the impending death of the program, we were skeptical. United, which makes most of its money in the large-group (employer) market, always was a reluctant participant in the individual exchanges, and was largely inept at pricing and managing those products.

Its unlikely that United's departure from the [Georgia] exchange will have a significant impact on plan availability or consumer choices.

— Louise Norris, healthinsurance.org

Now the company has started to make good on its threat, pulling out of the exchange markets in Arkansas and Georgia. Its announcements prove our point. United was a very small player in both states, and plainly had been out-competed by Blue Cross Blue Shield plans and by large rivals such as Aetna.

Its withdrawals aren't likely to materially reduce competition in those states. As Charles Gaba observes, four other carriers are staying on in Arkansas, and eight in Georgia. Whether United will withdraw from other states where it sold plans in 2016 is still unknown, as the last deadline nationwide for submitting proposals for 2017 plans isn't until May 11.

Here's how small a factor United has been:

In Georgia in 2015, United had 9,933 HMO enrollees, or a market share of 4.47%. UnitedHealthcare Life Insurance had an additional 825 members. The big players were Aetna, Anthem Blue Cross Blue Shield and Humana, which had more than 200,000 customers, or more than 90% of the market, altogether. United, which hadn't even joined the Georgia ACA market until 2015, had sought a rate increase of 18.64% for 2016 but had to settle for 13.2%. Georgia was one of the states in which United canceled broker commissions for ACA insurance plans, which was a way to reduce its presence in the market even further.

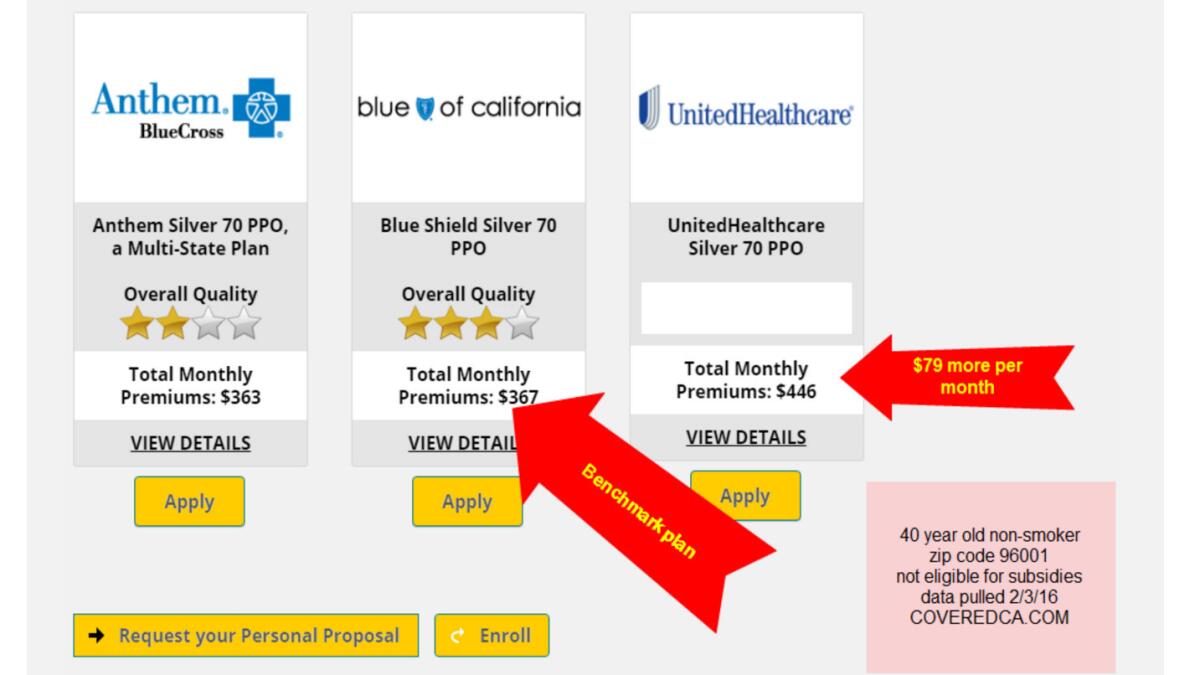

Detailed figures aren't available for Arkansas, but indications are that it was trying to build its book of business from a very small base. The company had offered only off-exchange individual plans in 2015, when it signed up all of its 521 customers. The company sought a rate increase of nearly 20% for those customers in 2016, so its competitiveness was probably not very high. The biggest player in the Arkansas exchange, by far, is Arkansas Blue Cross Blue Shield, an independent Blue plan with nearly 80% of the market and a rate increase request for 2016 that came in at 7.15%. See how competition works?

United's experience in the individual health insurance market may eventually reign as a business school case study in how not to do things. According to a joint analysis by the Robert Wood Johnson Foundation and the Urban Institute, the company entered some of the least populous exchange markets and failed to establish itself among the lowest-priced choices in most of them.

"United seems to be more aggressively participating in less populous and less-competitive markets," the report says. The results don't suggest that this was a formula for building a strong presence in the market. They also suggest that United's departure won't send rates higher in those markets.

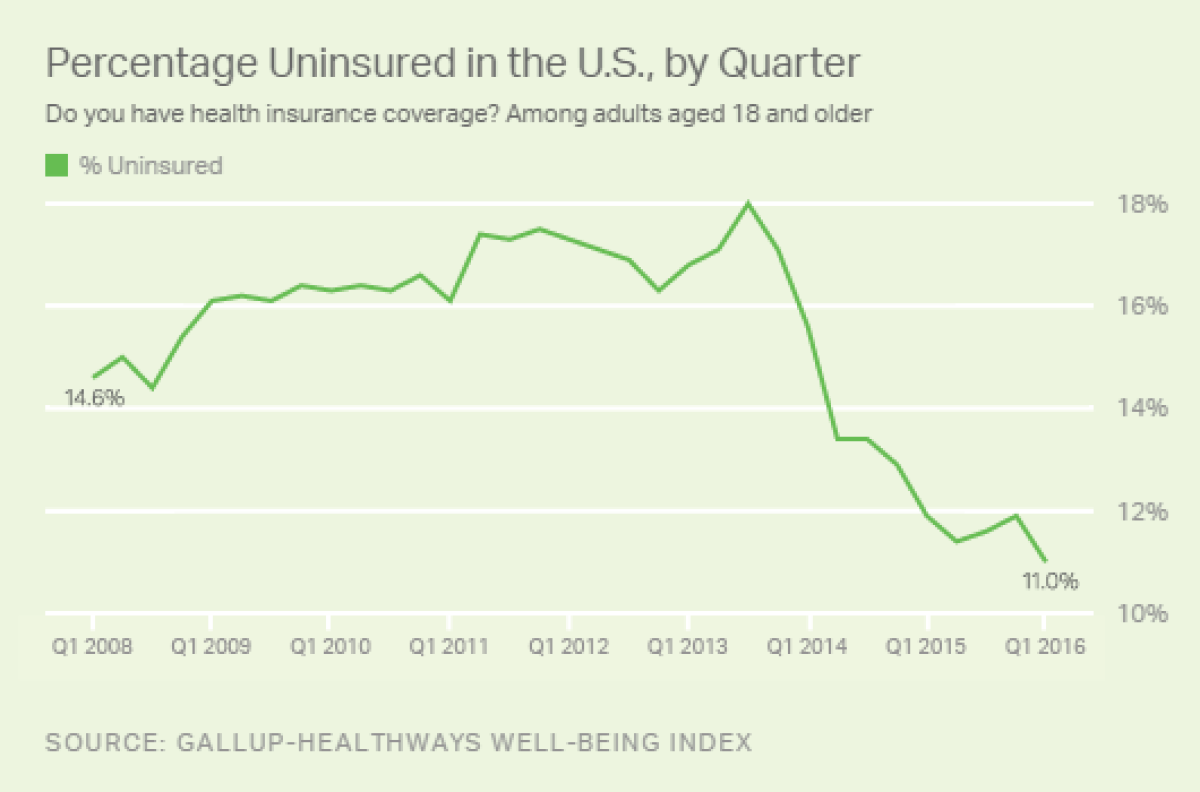

What's interesting about United's announcements in Arkansas and Georgia is that they come as new evidence arrives that the Affordable Care Act is doing its job. The Gallup organization reported Thursday that the U.S. uninsured rate had fallen to 11% in the first quarter of 2016, the lowest in eight years and nearly a full percentage point from the rate three months earlier. As the Obamacare train continues chuffing along, UnitedHealth will be left at the station.

Keep up to date with Michael Hiltzik. Follow @hiltzikm on Twitter, see his Facebook page, or email [email protected].