Column: Senate GOP’s Obamacare repeal bill will cost lives, but fatten the wallets of millionaires

- Share via

Senate Republicans finally revealed on Thursday why they’ve been crafting their Affordable Care Act repeal in secret. As the newly released draft shows, it’s a rollback of health coverage for millions of Americans that could cost the lives of tens of thousands a year.

But make no mistake: This is not a healthcare bill. It’s a tax cut for the wealthiest Americans, paid for by a reduction in government funding for healthcare. The measure would constitute one of the largest single transfers of wealth to the rich from the middle class and poor in American history.

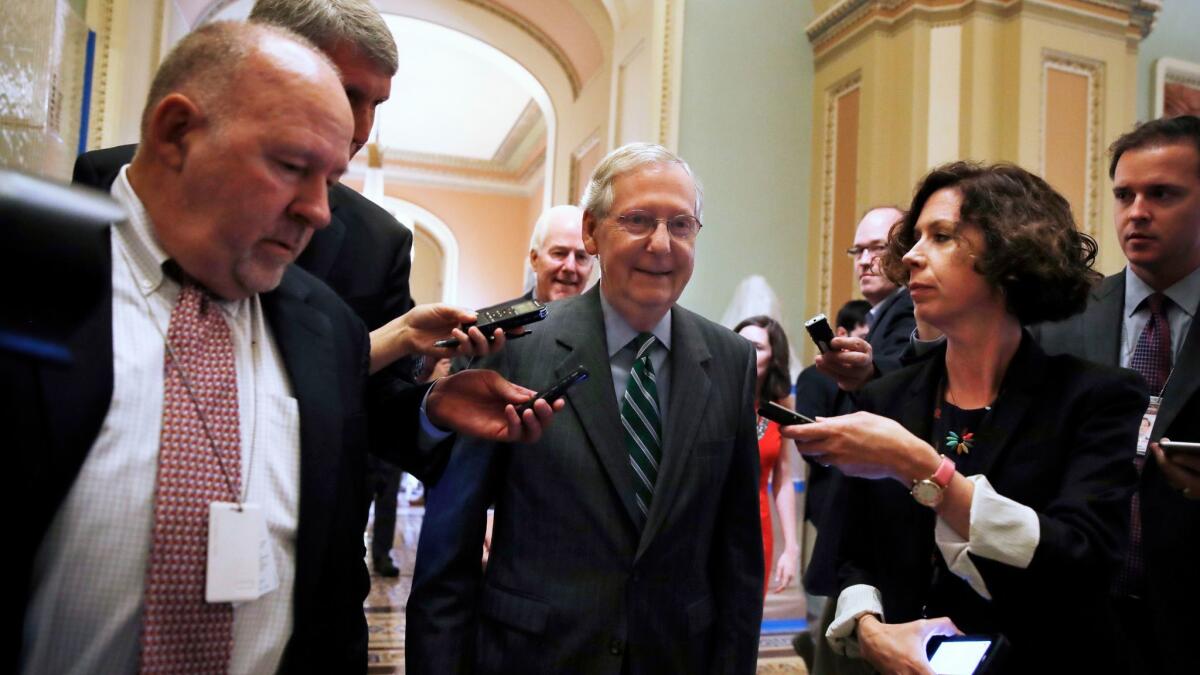

Senate Majority Leader Mitch McConnell, the ringmaster of this circus, says the bill will be scheduled for a vote next week.

Stakeholders and experts in healthcare have been bracing for the details of the Senate GOP draft for weeks, or ever since a small group of Republican senators began working on it behind closed doors. The Senate has scheduled no hearings on the draft. As my colleagues Noam Levey and Lisa Mascaro reported last week, they shut out not only their own Republican colleagues, but “major physician groups, hospitals, consumer advocates and organizations representing millions of patients with cancer, diabetes, heart disease and other serious illnesses.”

Under the Senate bill, low-income people would pay higher premiums for bigger deductibles.

— Larry Levitt, Kaiser Family Foundation

That didn’t keep some advocates from pounding on the door. CEOs of 10 health insurance companies, including Blue Shield of California, pleaded Tuesday in a letter to McConnell to protect Medicaid. The cuts being contemplated in that program would place an insupportable burden on the states, which share the program’s costs. States would have no options other than to blow up their budgets, throw thousands of residents off Medicaid, or drastically cut benefits.

“Reducing the federal government’s share of Medicaid,” they wrote, “is not meaningful reform …. It is simply an enormous cost shift to the states.” Among the programs bound to be undermined, they said, are state responses to the opioid addiction crisis, of which as much as 41% of the cost has been covered by Medicaid.

McConnell plainly wasn’t listening.

The Congressional Budget Office projected that the repeal bill passed by the House in May would cost 23 million Americans their health coverage by 2026. The Senate bill isn’t likely to change that calculation by much.

Here are some key provisions in the Senate bill.

—An enormous cut to Medicaid. The measure reduces Medicaid, which is the nation’s largest single healthcare program and the one aimed most directly at its most vulnerable population, to a rattling skeleton. Some reports on the Senate bill note that the measure would slow the pace of Medicaid cuts compared with the House bill. That’s a minuscule improvement to what otherwise is a devastating cut. It’s a reminder that Republicans have had the knives out for Medicaid for decades, for reasons that make no sense other than as expressions of disdain for and indifference to the nation’s neediest residents.

As we reported earlier this week, like the House measure, the Senate’s would convert Medicaid to a system of block grants to states. But it would tie growth of the grants to an inflation index that rises more slowly than the index of medical costs used by the House. The House version would produce a cut in Medicaid of more than $800 billion over 10 years compared with current law; the Senate would add more than $200 billion to that cut.

—Premium subsidies become stingier, and deductible and co-pay subsidies disappear. One key to making insurance affordable under the ACA is its system of subsidies for premium and, for some lower-income households, for deductibles and co-pays. The Senate bill cuts back premium assistance and eliminates co-insurance subsidies entirely as of 2020.

Under the ACA, premium assistance is provided on a sliding scale to households earning up to 400% of the federal poverty line. The Senate GOP lowers the cut-off to 350% of the poverty line. For a family of four, the cut-off is lowered from $98,400 to $86,100. This change will be particularly damaging to older Americans in high-premium areas. Larry Levitt of the Kaiser Family Foundation observes that the ACA provides an average premium subsidy of $5,151 a year to 60-year-olds at 351% of the poverty level; under the Senate GOP bill, they would receive nothing.

Moreover, the Senate bill would change the benchmark plan on which premium subsidies are calculated from the second-cheapest silver plan in each jurisdiction to a bronze plan, which offers less protection from medical costs and higher deductibles. Bronze plans would be permitted to be even stingier than the ACA allows. Those changes alone would produce a “15% across-the-board cut” in premium subsidies, Levitt tweeted.

—The individual mandate is repealed. The mandate, which required all Americans to have health coverage, is a linchpin of the ACA. It’s designed to ensure that even younger and healthier Americans who might otherwise feel comfortable going without coverage would be part of the insurance pool. If there’s a flaw in the ACA’s mandate, it’s that the penalties for skipping coverage aren’t strong enough. Eliminating the mandate, Levitt judges, will make the insurance pool sicker and therefore riskier for insurers, which will drive up premiums and discourage even more people from buying health plans.

—Households earning $250,000 or more get a healthy tax cut. The Senate bill, like the House version, would eliminate almost all the tax increases enacted in 2010 to fund the ACA’s subsidies and other provisions. We’ve previously reported that repeal of the Affordable Care Act’s tax provisions would provide America’s wealthiest taxpayers with an immediate tax cut totaling $346 billion over 10 years. Every cent of that would go to taxpayers earning more than $200,000 a year ($250,000 for couples).

The key taxes being eliminated are a 0.9% increase in the Medicare tax on wage and self-employment income over $200,000 for individuals and $250,000 for couples, and a 3.8% surcharge on capital gains and dividends for those in the same bracket; for them, the top rate on investment income was raised from 20% to 23.8%. Put together, these two provisions were estimated to bring in $346 billion over 10 years. That’s the money being funneled to the wealthy by eviscerating healthcare for the middle class and working class.

—Planned Parenthood loses its funding and abortion rights are eroded. The Senate bill retains a House provision that would forbid the use of premium subsidies to buy health plans that cover abortions, other than those necessary to save the life of a mother or to end births caused by rape or incest. That provision would place the repeal in direct conflict with laws in states such as California and New York that require all health plans to include that coverage. The Senate also retains a provision that withdraws funding for Planned Parenthood for a year, with the expectation that the defunding would be reenacted every year the Republicans hold the reins of government.

By reducing the availability of insurance coverage, the Senate bill puts the health of millions of Americans at risk. A new survey published in the New England Journal of Medicine calculates from an analysis of Medicaid that one life is saved for every 239 to 316 adults gaining coverage. This implies that the loss of coverage for 23 million would cost from 72,700 to 96,200 lives. The survey also found that care of chronic diseases and overall well-being are vastly improved by health insurance.

Against that, weigh the powerful desire of Republicans in the House and Senate to deliver an immense tax cut to the wealthy. Once again, the question is raised: Who are these people working for?

Keep up to date with Michael Hiltzik. Follow @hiltzikm on Twitter, see his Facebook page, or email [email protected].

Return to Michael Hiltzik’s blog.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.