Thrown a curve by health networks

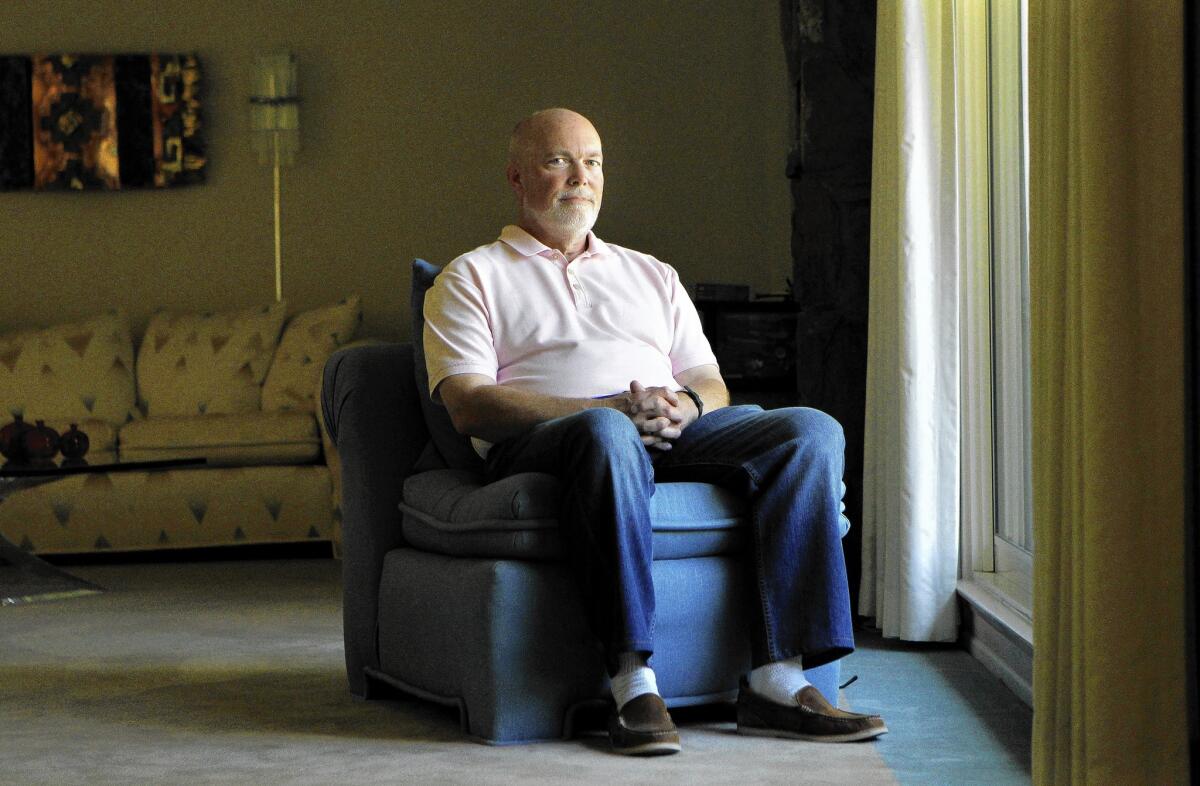

In December, Chuck Richmond switched to a new health plan that complies with the Affordable Care Act. But when the 63-year-old accountant from Tustin went to see his dermatologist last month, he was surprised to learn that the skin doctor wasnât in his planâs provider network.

When he selected the plan, he recalls, âthey led me to believe that the only change I was making was to a plan that complied with the Affordable Care Act.â He soon learned that more than half of his physicians â some of whom heâd been seeing for more than 20 years â are excluded from the network.

âI thought I was getting a better health plan than what I had before because it was ACA-compliant and had lower deductibles. That is why I paid the higher premium. If I knew half my doctors werenât in the network, I might have gone for something cheaper,â he says.

The problem involves not just consumers who are discovering their doctors are not covered by their plans. Some doctors have themselves been confused about whether they participate in various networks, making it difficult for them to instruct their patients. Other providers are dropping out of networks, leaving patients in the lurch.

Because the new plan Richmond bought was with the same insurer that had been covering him for years, he says he had no reason to believe his doctors would no longer participate.

âJust because a provider took a Blueâs plan before and you are still enrolled in a Blueâs plan, you assume that the provider would be in-network even with a different product, and thatâs not necessarily the case. Itâs very product-specific,â says JoAnn Volk, senior research fellow with the Georgetown University Health Policy Institute.

According to the California Department of Managed Health Care, about 200 complaints related to patients having difficulty getting access to a healthcare provider have been filed since January.

Patients arenât the only ones complaining about how hard it can be to find a doctor. In a recent survey, an arm of the California Medical Assn. found that 55% of physicians say they have had trouble finding in-network providers to whom they can refer their patients.

âItâs a real issue,â says Anthony Wright, executive director of Health Access, a California consumer healthcare organization. But, he says, âitâs a problem that existed before the ACA.â

With open enrollment now closed, most people are locked into their current policy until next year. There are, however, consumer protections in place, and a few options if your doctor drops out of your planâs network. Here are tips.

Check the adequacy of your planâs network. Health plans have to offer an adequate network of healthcare providers. By law, plans must provide policyholders access to a primary care physician within 15 miles or 30 minutes of their homes. (Insurers have more flexibility in rural areas.)

Companies also must meet the stateâs requirements for the time it takes to see a doctor or other providers.

For example, you have to be able to get an appointment with a primary care doctor within 10 business days for non-urgent care and within 15 business days if you need an appointment with a specialist.

If you canât find a doctor in your area to offer you an appointment within those timelines, you have cause to complain and demand help from your insurer to find someone who can see you.

If your network does not include the type of specialist you need to treat a condition, your insurer is obligated to find one and cover those services as it would for an in-network provider, says Rodger Butler, a spokesman for the California Department of Managed Care.

If you are in the middle of treatment and your doctor drops out of your planâs network, you may have the right to continue care with that doctor for a period of time.

âThis is not the longtime relationship for managing your cholesterol. This is if youâre in the middle of a round of treatment,â Wright says.

For example, women who are pregnant may be allowed to continue care with their obstetrician until and immediately following their babyâs delivery; someone with a chronic condition such as diabetes may be allowed to continue with their doctor for up to 12 months.

Youâll need to check with your health plan to learn whether you qualify for continuity of care. Also, this is all contingent upon your doctor agreeing to your planâs reimbursement rate.

Check your network again. Physician networks constantly change, and in recent months, some insurers have added more providers to their networks. It may be worth taking another look at your planâs provider directory to see whether your doctors now participate.

Anthem Blue Cross, for example, just reported that 3,800 physicians have been added to its network since January. Health Net increased the number of doctors in its network 68% since the start of the year. And Blue Shield says that 64% of physicians practicing and 82% of hospitals throughout the state participate in its individual market network.

File an appeal with your insurer. Youâre entitled by law to file an appeal to continue care with your current healthcare providers. There are at least two levels: an internal appeal with your insurer, and a review by an independent third party.

Just be ready for a fight, says Sam Smith, an Encino insurance broker and president of the California Assn. of Health Underwriters. âThere has to be an overriding reason why the patientâs health would be adversely affected by cutting ties with their doctor,â he says. âItâs a hard-fought battle, and you really have to pull out all of the stops.â

File a complaint with regulators. You can also file a complaint with the Department of Managed Health Care, which is the regulatory agency that oversees most health plans in the state.

Plans are required to maintain an adequate network of doctors and hospitals, and to provide lists of their contracted providers. âThat is why we want enrollees who are having trouble finding a provider to contact the DMHC,â Butler says. In addition, if your plan is an HMO and intends to terminate your doctor from its network, it has to give you at least 60 daysâ notice of the termination date.

Richmond, the Tustin accountant whose doctors turned out not to participate in his plan, says heâll shop for a new plan during the next open enrollment period. But at this point, he says heâs not too optimistic about finding one that includes all his doctors. With just a year and a half until he qualifies for Medicare, he says, âIâm going to tread water until I turn 65.â

Resources and links

For help filing insurance appeals, complaints and general consumer assistance: California Department of Managed Care: (888) 466-2219 or healthhelp.ca.gov.

For help with plans purchased through Covered California: 1-800-300-1506 or coveredca.com.

Zamosky is the author of âHealthcare, Insurance, and You: The Savvy Consumerâs Guide.â

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production â and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.