Tesla in line for $15 million in California job creation tax credits

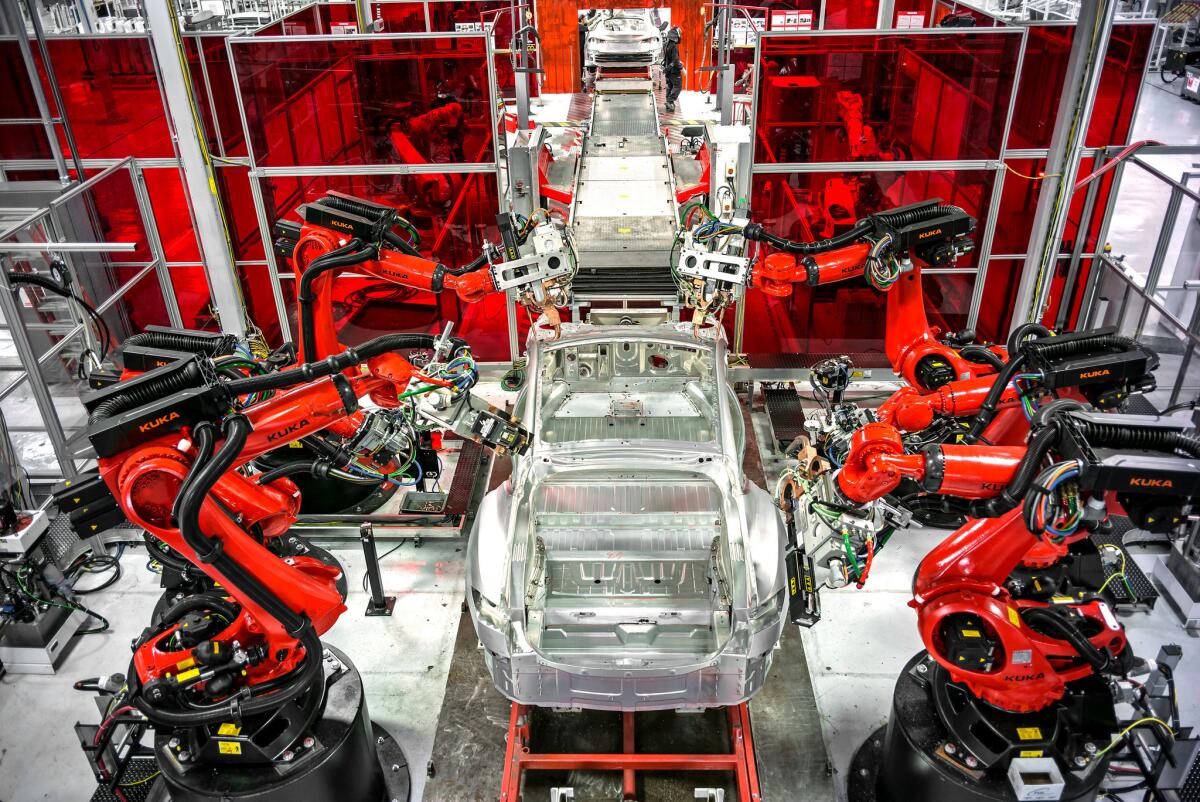

Robots help assemble a car at the Tesla factory in Fremont, Calif.

Tesla Motors is positioned to get the largest tax credit grant of dozens of companies from a special California economic development program.

California officials are recommending that the Palo Alto electric car manufacturer receive $15 million of the $49.5 million in tax credits planned in the latest disbursement.

A vote on the deal by the stateâs GO-Biz California Competes tax credit committee is scheduled for June 18.

Tesla has been a major contributor to the state economy, said Tesla spokesman Ricardo Reyes, and accounted for $50 million in state tax revenue last year.

âThis award reflects our commitment to create even more jobs and investment in the state,â Reyes said.

Tesla and its chief executive, Elon Musk, have become adept at tapping into local, state and federal sources of money to grow the business.

A recent L.A. Times analysis of subsidies for all three companies headed by Musk -- Tesla, SolarCity SpaceX -- found that the company has received or secured commitments for $4.9 billion in government support. The figure underscored Muskâs strategy of incubating high-risk, high-tech companies with public money. Tesla accounted for almost half of the total.

The figure compiled by The Times comprises a variety of government incentives, including grants, tax breaks, factory construction, discounted loans and environmental credits that Tesla can sell. It also includes tax credits and rebates to buyers of solar panels and electric cars.

This latest tax credit considered by California is tied to job creation. Companies can draw down the specific award amounts only after they hit employment milestones.

Tesla would get the full amount by creating 4,426 positions by 2019. The jobs must have a minimum annual salary of $35,000 and an average salary of at least $55,000. The contract calls for Tesla to collect $10.5 million of the incentives in 2019, after it has hired most of the workers.

The company has already made most of the hires, according to Tesla. The state is measuring from a base of about 6,500 jobs, but the automaker said Tuesday that figure is already out of date. It now has more than 9,000 workers in California.

That makes Tesla the stateâs largest manufacturing employer, Reyes said.

The automaker is growing rapidly and is hiring workers at several locations in California, including its auto factory in Fremont, where it plans to add a second model to its assembly line later this year and at its design studio in Hawthorne.

Although the Tesla credits would be the largest award from the latest round of funding by the committee, they amount to only a small portion of the $650 million that the state has allocated in targeted tax credits over the next four years.

The Tesla deal amounts to $3,300 per job. The GO-Biz program evaluates applications based on total jobs created, total investment, average wage and economic impact. Companies are exempted from paying state income taxes in the amount awarded.

Tesla has previously tapped California for tax credits and other economic benefits.

The state ponied up $90 million from the California Alternative Energy and Advanced Transportation Financing Authority. It is providing Tesla with another $126 million from the California Self-Generation Incentive Program to help launch the companyâs battery-based energy storage business.

Itâs also paid $39 million to underwrite the price of Teslaâs Model S for California buyers. The car has an average price of $100,000 before the state chips in with a $2,500 rebate to subsidize the price of Teslaâs Model S sedan.

Follow me on Twitter (@LATimesJerry), Facebook and Google+.