HALO AND GOOD BUY

- Share via

BIRMINGHAM, Ala. — The photograph comes from another time, an unthinkable place, but Donald Watkins believes its subjects speak to him.

They are his mother’s ancestors, slaves who belonged to an Irish family in Clinton, Miss. The owners taught them and their children to read and documented their existence in that 1857 photo, which Watkins keeps in a place of pride in his bedroom.

Every day, before he goes to work and before he goes to sleep, he asks them if he has made them proud.

It is for them and his 85-year-old mother, Lillian, that Watkins wants to buy the Angels from Disney and become the first African American to own a majority stake of a major league baseball team. It is for a family that was rooted in slavery but whose last five generations, he said, have attended college.

Watkins, 53, is an Alabama businessman who privately puts his net worth at $1.5 billion, a figure that has been widely questioned but not disproved. He would spend about $250 million to buy the Angels, but what dollar value can be placed on closing the circle from slavery to ownership of a team in the most American of pastimes?

“It’s the completion of a journey that started in the 1800s,” he said. “It’s very special to me and my family, and I want to get it soon.”

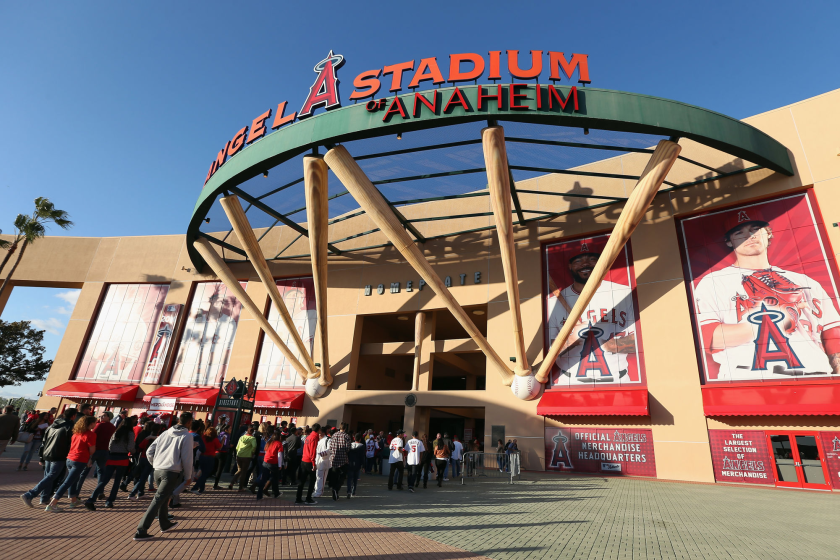

By the end of the year, he hopes to close the proposed purchase and win approval from Major League Baseball. Disney hasn’t given him exclusive negotiating rights, but while company executive Paul Pressler said people have “come through and kicked the tires,” Watkins is the only confirmed suitor.

“I like my chances,” he said, crediting baseball Commissioner Bud Selig and influential Chicago White Sox chairman Jerry Reinsdorf with shepherding him through the process. “I think I want it more than anyone else, and determination is not capable of objective measurement. I won’t let anybody outwork me for this opportunity. I will hit all of the benchmarks I have to hit to make it happen.”

Selig declined to comment on Watkins’ chances and was guarded when asked if Watkins is a legitimate buyer. “We haven’t gotten into that kind of detail, but he’s a man who’s spent a lot of time talking to a lot of people, including me,” Selig said. “So I think he’s quite serious about this.”

A former Montgomery, Ala., city councilman and civil rights attorney, Watkins envisions the Angels as the cornerstone of a Southern California business empire that would include a broadcast media outlet for sports and entertainment programming, a bank and a life insurance company.

He believes the Angels, winless in three American League Championship Series appearances, can enhance the value of those businesses. He believes the market can support a well-run, well-promoted team.

Although many owners--including Disney--claim to lose money, he thinks he can make a profit “if we do it right.” And while he believes baseball must “get a handle on salaries,” he said his offer isn’t contingent on owners and players agreeing on a new labor contract.

He envisions the Angels assembling a roster of humble, team-oriented, fan-friendly players who will become World Series champions. “I think we can get there in three years,” he said during recent conversations in Birmingham and Los Angeles. “The [Arizona] Diamondbacks did it, and they were an expansion team. They did it in what, four years? We ought to be able to do it in three....

“The Dodgers won’t be the dominant team in this market for much longer. I’m focused on the right team. I’m going to make the Angels a national team. A lot of people will be wearing Angel paraphernalia all over in Atlanta, New Orleans, Latin America. Wearing a uniform will be special. It will be something that major league players aspire to.”

Unquestionably, Watkins dreams big.

Or is he fantasizing?

A highly placed baseball official told The Times no one knows if Watkins has the money to make this deal because most of his assets are in privately held companies and are difficult to verify. However, Watkins has said he has a credit agreement letter for $200 million in financing as well as liquidation agreements on his assets that will give him $50 million to put in at closing.

According to Watkins, the credit agreement letter is from an investment firm that acts as a middleman between him and banks that work with Major League Baseball. He’s not fronting for anyone, he said, and he’s not seeking investors because he wants total operating control.

Repeated scrutiny of his finances hasn’t produced a clear picture.

Forbes magazine this year didn’t rank Watkins among its richest 400 Americans, a ladder with a lowest rung of $600 million. Forbes couldn’t quantify his non-publicly held assets and reporter Monte Burke said of Watkins’ purported $1.5-billion net worth, “we have reason to doubt the number.”

Watkins said he doesn’t need Forbes to certify his wealth.

“I have never sought inclusion on any list Forbes compiles, nor have I asked the magazine to confirm my net worth,” he said in a letter to Forbes’ editor. “It is my goal, however, to be listed as one of 30 Major League Baseball owners. Major League Baseball has a comprehensive and detailed description of my financial assets. I must persuade the League, and not Mr. Burke, that I have the financial strength to buy and operate a baseball team.”

Those in Watkins’ inner circle are confident he would be a dynamic and innovative owner.

“I believe and know that any team he would acquire, he would have the focus and the resources to be able to be very, very successful,” said Milton Davis, a Tuskegee, Ala., attorney and sometime business partner.

“I have great confidence that Donald Watkins would be to baseball what Tiger Woods is to golf.”

Most questions about Watkins stem from his refusal to detail his private holdings and his insistence his finances are too complex for all but a few experts to comprehend.

He says he made extensive investments in energy-related businesses, and once valued them at $500 million to $600 million--a figure he later revised downward. He also owns some oil wells. He is a co-founder of Alamerica Bank, a Birmingham commercial bank with about $40 million in assets. That’s modest, but he said the 2-year-old bank was profitable enough for him to begin the process of acquiring compatible institutions late last year.

One of his companies has a small interest in Masada Energy Resources, which focuses on turning waste into ethanol. He is a director of eChapman, a Baltimore-based investment banking and brokerage firm. He also owns and publishes Voter News Network, a political newsletter. A political independent, he plans to bring Voter News Network to California and become politically active.

Despite his varied businesses, he does not network or make the social scene in Birmingham. Judy Haise, society columnist for the Birmingham News, said she has never seen him at a party, charity event or social function there, although she has been told he has funded scholarships for deserving students.

Public records show Watkins has modest mortgages on a residence he owns in Birmingham, where he does most of his business, and another in Montgomery, where his family lives.

Natalie Springfield, a spokeswoman for the Birmingham Chamber of Commerce, called him the city’s unknown billionaire.

“He does nothing with the Chamber or the local business community,” she said. “When [his offer for the Angels] was in the paper, it was news to us he had the money to do it. We don’t know anything about how he got that much money.... People that have lived here for years and years know nothing about him.”

Watkins, a neat but casual dresser who wears no jewelry other than a watch, doesn’t mind being relatively anonymous. Nor does he mind questions about his wealth.

“The real question is, are you going to have your money at closing? And I’m satisfied that I’ve carried my burden on that,” he said. “I’ve never failed to have my money at closing in any business transaction in 30 years.”

Watkins and his five siblings were reared in Montgomery. His late father, Levi, was president of Alabama State University, where Donald was later a trustee. A brother, Levi Jr., is a heart surgeon at Johns Hopkins University.

After graduating from Southern Illinois University, he got his law degree at Alabama and practiced law in Montgomery. Among his most prominent cases was helping get a pardon in 1976 for Clarence Norris, the last survivor of the Scottsboro Boys, nine African American men who were unjustly convicted of raping two white women in 1931.

His work caught the eye of Birmingham Mayor Richard Arrington Jr., who had known Watkins’ father. Arrington hired Watkins as his legal counsel, a job that reportedly paid Watkins $8 million to $10 million by the time Arrington left office in 1999.

“In the courtroom, he’s a very aggressive but highly successful attorney,” Arrington said. “Uncharacteristic of most attorneys, he speaks openly about his cases, and the fact he won so many might have made him some enemies.”

He undoubtedly made enemies when he represented Auburn football player Eric Ramsey in a 1991 case that led to the resignation of Coach Pat Dye and the school’s placement on probation by the NCAA. Ramsey had tapes of coaches and boosters offering him money and a loan, and Watkins did a masterful job of gaining media attention for the case.

“Some people will probably never forgive him for that,” Arrington said.

Watkins also received attention for his plan to raise Alabama State to Division I-A status. He talked of building a stadium and museum by raising $90 million, some of it from the sultan of Brunei and the king of Tonga. The money never materialized, and he resigned from the board of trustees last year.

Watkins was more successful with Alamerica, which was profitable within five months of opening its doors in January 2000. Lawrence Tate, a bank co-founder and acquaintance of 25 years, said Watkins is particularly skilled at generating cash flow and is capable of buying and operating a major league team.

“I think he has received more speculation than perhaps others would. I don’t know why,” Tate said. “He’s an extraordinary individual who is quite bright, persistent, determined and successful.”

Except, so far, at buying a team.

Watkins began his pursuit a year ago by inquiring about the Tampa Bay Devil Rays, expecting to spend about $150 million. When the club came off the market, he looked at the Minnesota Twins, attracted by e-mails from fans beseeching him to rescue the cash-strapped team from the clutches of owner Carl Pohlad.

Watkins said he’d pay $125 million to $150 million and privately finance a new stadium to save the Twins from contraction, and he spent the Saturday before Christmas at the Mall of America meeting fans. His efforts were stymied when Pohlad said he preferred to sell to a local buyer, even though none has appeared.

Watkins’ finances came into question again a few weeks ago, when Twin President Jerry Bell said in a letter to Minnesota legislators no interested party “with adequate resources to consummate a transaction” had emerged. If Watkins had proven his net worth, Bell said, “I can unequivocally assure you that he would have every opportunity to become the owner of the team.”

Watkins said neither Bell nor Pohlad asked him for a clarification.

“I’ve never been in a situation like that, where you submit an expression of interest and there’s absolutely no questions regarding your expression of interest,” Watkins said. By contrast, he described his dealings with Disney as “very professional.... They have a lot of class as a company.”

He turned his focus to the Angels this winter. Initially reluctant to spend more than $150 million, he decided to make a financial leap after making enough baseball contacts and learning about the sport’s economics. He wouldn’t say if Disney had countered his original offer or disclose other details of their negotiations.

Friends and business associates believe he can pull it off, and with panache.

“A lot of people say, ‘Show me the money,’ and he knows that,” said William Parker, a member of the Alabama House and a Watkins confidant. “There are skeptics in everything that’s successful, and I think he has proven them wrong....

“His bank is successful. He’s practiced law and been successful. People need to stop underestimating him and start looking at his track record. I think he’d be a great fit with Anaheim and he’d be a hands-on owner, like Mark Cuban with the Dallas Mavericks, Jerry Jones with the Cowboys and George Steinbrenner with the Yankees.

“This is not his largest venture, but it’s something he really wants.”

Davis scoffed at suggestions from critics who say Watkins is after publicity.

“His name has been in the paper for 25 years for significant matters,” Davis said. “He has excelled in all of his endeavors.”

As the Angels’ owner, Watkins said he will sit in the stands, buy food from Edison Field concessions and use public rest rooms “because that’s the ultimate quality control check.” He will put some of his kids to work--he has four sons and a daughter, ages 6 to 29--at jobs that would teach them the business from the bottom up.

He also said he has some front-office candidates in mind, though he wouldn’t identify them, and he will consider keeping current employees who share his goals. “To go from the Disney Channel to the Watkins Channel, that should be fine-tuning,” he said.

Like Disney, Watkins says he loves the synergy of owning companies with interests that seem to mesh. But unlike Disney, whose movie and TV magic didn’t make its baseball and hockey operations profitable, he believes he can make it work.

“The Angels is a small unit in a huge global corporation [to Disney],” he said, “and in my world, the Angels is a cherished family prize, to be treated as such and to be passed on to generations. It’s not a simple business transaction.”

More to Read

Go beyond the scoreboard

Get the latest on L.A.'s teams in the daily Sports Report newsletter.

You may occasionally receive promotional content from the Los Angeles Times.